Stock Market Update: House Passes Tax Bill, Impact On Bonds And Stocks

Table of Contents

Immediate Market Reactions to the House Tax Bill

The immediate market response to the House tax bill's passage was mixed, reflecting the complexities of the legislation and the diverse opinions among investors. The initial reactions provided a glimpse into the potential short-term implications for both stocks and bonds.

-

Stock market indices showed a relatively muted response in the hours following the vote. While the Dow Jones Industrial Average experienced a slight uptick, the S&P 500 and Nasdaq Composite exhibited more modest changes, indicating a degree of investor caution. This suggests that the market was already anticipating some aspects of the bill.

-

Treasury yields, a key indicator of the bond market, showed a slight increase in the immediate aftermath. This reflects the market's expectation of potential inflationary pressures stemming from increased government spending or corporate investment fueled by the tax cuts. Other bond market indicators followed suit, reflecting a similar sentiment.

-

Investor sentiment, as gauged from various news sources and market analyses, revealed a mixture of optimism and concern. While some analysts welcomed the potential for increased corporate profits and economic growth, others voiced concerns about the bill's long-term fiscal implications and potential impact on the national debt.

-

Sector-specific reactions were noticeable. The technology sector, often sensitive to changes in corporate tax rates, saw a relatively positive reaction, while the healthcare sector, facing potential changes to its regulatory environment, exhibited more cautious behavior.

Potential Long-Term Effects on Stock Market Sectors

The long-term effects of the House tax bill on various stock market sectors will depend on how companies respond to the changes and the overall impact on economic growth. Here's a breakdown of the potential long-term implications:

-

Impact on corporate profits and subsequent stock valuations: Lower corporate tax rates are projected to boost corporate profits, potentially leading to higher stock valuations. However, this effect might vary across sectors, with some industries benefiting more significantly than others.

-

Effect on capital investment and economic growth: The tax bill aims to stimulate economic growth by encouraging increased capital investment. However, the extent of this effect will depend on various factors, including consumer spending, global economic conditions, and the overall business environment.

-

Analysis of specific sectors: The real estate sector may experience increased activity due to potential tax benefits for real estate investment. Conversely, sectors reliant on government spending might see reduced growth if budget cuts are implemented to offset the tax cuts. The manufacturing sector could see a boost from repatriation of overseas profits.

-

Changes in merger and acquisition activity: Lower corporate tax rates could potentially encourage increased merger and acquisition activity as companies seek to consolidate and expand their operations.

Tax Bill's Influence on Corporate Tax Rates and Dividend Policies

A central element of the House tax bill is the reduction in corporate tax rates. This change will significantly influence corporate profitability and, consequently, dividend payout decisions.

-

Explanation of the new corporate tax rates: The reduction in the corporate tax rate from [Previous Rate]% to [New Rate]% will directly impact earnings per share (EPS) for many companies. This increase in after-tax earnings could lead to higher stock prices.

-

Analysis of how companies might adjust their dividend policies: Companies may choose to increase dividends to shareholders, reinvest profits in business expansion, or a combination of both. This will depend on their individual strategies and growth prospects.

-

Potential effects on investor income and portfolio returns: Higher dividends translate to increased income for investors, positively affecting portfolio returns. However, the reinvestment of profits could lead to longer-term growth, albeit with a delay in immediate dividend income.

The Impact on the Bond Market

The House tax bill’s passage is likely to influence interest rates and, subsequently, the bond market. Understanding this relationship is critical for investors.

-

Relationship between interest rates and bond prices: Generally, rising interest rates lead to falling bond prices, and vice-versa. The tax bill's impact on interest rates will, therefore, directly affect bond prices.

-

Prediction of potential changes in Treasury yields: Increased government borrowing to finance tax cuts could potentially push Treasury yields higher. This depends on the overall demand for bonds in the market.

-

Attractiveness of bonds compared to stocks: With potentially higher interest rates, bonds may become relatively more attractive to some investors seeking fixed income, especially those seeking to mitigate risk in a potentially volatile stock market.

-

Impact on different types of bonds: The impact may vary across different bond types, with corporate bonds and municipal bonds experiencing different levels of sensitivity to changes in interest rates.

Strategies for Investors in the Current Market Environment

The changing market landscape requires investors to adapt their strategies to account for the implications of the new tax law.

-

Portfolio diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk and capitalize on potential opportunities across different sectors.

-

Rebalancing investment portfolios: Regularly rebalancing your portfolio to maintain your desired asset allocation is vital to ensure that you're not overly exposed to any single sector or asset class.

-

Tax implications in investment decisions: Investors should consider the tax implications of various investment decisions, including capital gains taxes, dividend taxes, and interest income taxes.

-

Staying informed and monitoring market developments: Continuous monitoring of market developments and economic news is essential to make informed investment choices.

Conclusion

The House tax bill’s passage will undoubtedly influence both the stock and bond markets. While lower corporate tax rates are expected to boost corporate profits and potentially stock valuations, the long-term impact remains subject to many variables. Investors should be aware of the potential for increased interest rates and their effect on bond prices. It is crucial to analyze your portfolio, diversify holdings, and adapt your investment strategy accordingly.

Call to Action: Stay informed on this evolving situation. Monitor our regular stock market updates for further analysis and insights into how the new tax bill and other economic factors continue to affect the market. Make informed decisions about your investment portfolio based on the latest information concerning the stock market impact of this legislation. Remember to consult with a financial advisor before making any significant investment changes.

Featured Posts

-

Escape To The Country Top Locations And Considerations

May 24, 2025

Escape To The Country Top Locations And Considerations

May 24, 2025 -

Naujas Porsche Elektromobiliu Ikrovimo Centras Europoje Patogumas Ir Greitis

May 24, 2025

Naujas Porsche Elektromobiliu Ikrovimo Centras Europoje Patogumas Ir Greitis

May 24, 2025 -

Borse In Calo A Causa Dei Dazi La Reazione Dell Ue

May 24, 2025

Borse In Calo A Causa Dei Dazi La Reazione Dell Ue

May 24, 2025 -

Kyle Walker And Annie Kilner New Ring Sparks Engagement Speculation

May 24, 2025

Kyle Walker And Annie Kilner New Ring Sparks Engagement Speculation

May 24, 2025 -

Your Escape To The Country Choosing The Right Location And Lifestyle

May 24, 2025

Your Escape To The Country Choosing The Right Location And Lifestyle

May 24, 2025

Latest Posts

-

Joe Jonas Surprise Concert At The Fort Worth Stockyards A Fans Delight

May 24, 2025

Joe Jonas Surprise Concert At The Fort Worth Stockyards A Fans Delight

May 24, 2025 -

Review Neal Mc Donough In The Last Rodeo

May 24, 2025

Review Neal Mc Donough In The Last Rodeo

May 24, 2025 -

The Last Rodeo Neal Mc Donoughs Powerful Portrayal

May 24, 2025

The Last Rodeo Neal Mc Donoughs Powerful Portrayal

May 24, 2025 -

Dc Legends Of Tomorrow How To Watch And Where To Stream

May 24, 2025

Dc Legends Of Tomorrow How To Watch And Where To Stream

May 24, 2025 -

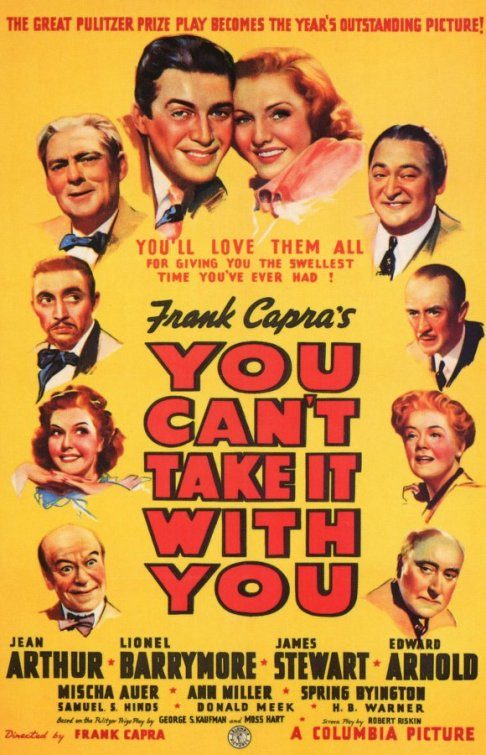

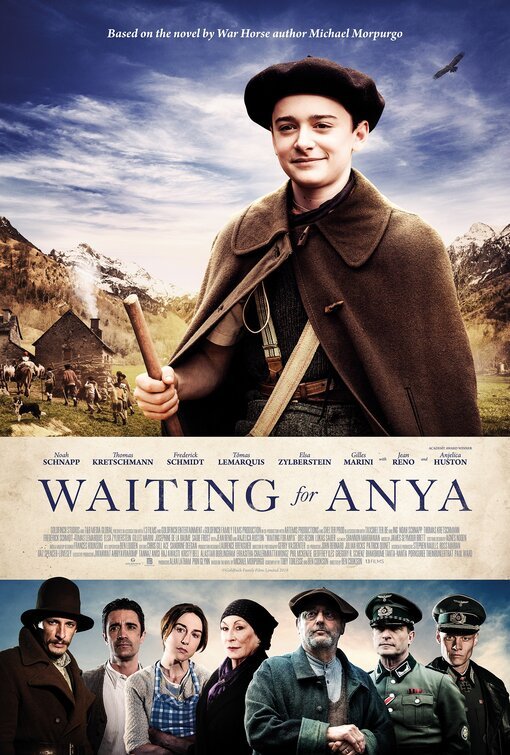

Free Movies And Stars The Usa Film Festival Comes To Dallas

May 24, 2025

Free Movies And Stars The Usa Film Festival Comes To Dallas

May 24, 2025