Stock Market Update: India's Sensex And Nifty 50 End Flat On Geopolitical Concerns

Table of Contents

Sensex and Nifty 50 Daily Performance Analysis

Closing Values and Percentage Changes

The Sensex closed at 65,280.15 points today, registering a marginal change of +0.02% compared to yesterday's closing. Similarly, the Nifty 50 ended the day at 19,420.75, showing a negligible increase of +0.01%. The relatively small fluctuations, depicted in the chart below, highlight the subdued trading activity amidst prevailing uncertainties.

[Insert Chart/Graph showing Sensex and Nifty 50 movement for the day]

Volume and Turnover

Despite the flat closure, trading volume remained relatively high, suggesting underlying market tension and potential investor indecisiveness. The high volume indicates that significant trading activity occurred, even though price movements were minimal. Turnover figures also reflected this heightened activity, further supporting the idea of investors actively monitoring the situation.

- Sensex Closing Value: 65,280.15

- Sensex Percentage Change: +0.02%

- Nifty 50 Closing Value: 19,420.75

- Nifty 50 Percentage Change: +0.01%

- Trading Volume: [Insert Data - e.g., High compared to recent averages]

- Turnover: [Insert Data - e.g., Significant turnover despite minimal price change]

Impact of Geopolitical Concerns

Identifying Key Geopolitical Factors

The flat performance of the Sensex and Nifty 50 can be largely attributed to escalating geopolitical risks. The ongoing conflict in Ukraine continues to fuel global uncertainty, impacting energy prices and supply chains. Furthermore, rising US-China tensions, particularly concerning trade and technology, add to the overall sense of unease among global investors. Global inflation concerns also play a significant role in investor sentiment, impacting investment decisions in emerging markets like India.

Investor Response to Geopolitical Risks

These geopolitical events have resulted in a noticeable shift towards risk aversion among investors. Many are adopting cautious investment strategies, preferring to stay on the sidelines rather than making significant commitments in the face of prevailing uncertainty. This hesitation is reflected in the muted price movements observed in the Sensex and Nifty 50.

- Geopolitical Factor 1: Ukraine conflict and its impact on global energy prices.

- Geopolitical Factor 2: US-China trade tensions and their implications for technology companies.

- Geopolitical Factor 3: Persistent global inflation and its effect on interest rates.

- Investor Response: Risk aversion, increased preference for safe haven assets, cautious investment strategies.

- Vulnerable Sectors: Energy, technology, and those heavily reliant on global supply chains.

Sectoral Performance

Top Performing and Underperforming Sectors

While the overall market remained flat, individual sectors exhibited varied performances. The FMCG (Fast-Moving Consumer Goods) sector showed some resilience, while IT (Information Technology) experienced a slight dip. The financial sector also showed mixed results.

Analysis of Sectoral Trends

The relatively strong performance of the FMCG sector suggests that consumer demand remains relatively stable despite the prevailing geopolitical uncertainties. Conversely, the IT sector's underperformance reflects global concerns about technological growth and potential disruptions in supply chains.

- Top 3 Performing Sectors: FMCG (+0.5%), Pharmaceuticals (+0.3%), and Infrastructure (+0.2%) (Illustrative examples - replace with actual data)

- Bottom 3 Performing Sectors: IT (-0.4%), Metals (-0.3%), and Realty (-0.2%) (Illustrative examples - replace with actual data)

- Reasons: Resilience of consumer staples (FMCG), concerns about global tech growth (IT), and sensitivity to interest rates and global economic outlook (Realty and Metals).

Expert Opinions and Future Outlook

Analyst Predictions

Financial analysts offer mixed predictions for the short-term outlook. Some believe that the market may consolidate in the near term as investors await further clarity on geopolitical developments and assess the impact of global macroeconomic factors. Others anticipate a potential rebound if geopolitical tensions ease and positive economic data emerges. The long-term outlook, however, remains positive, underpinned by India's strong fundamentals and robust growth prospects.

Investment Advice

Given the current market conditions characterized by geopolitical uncertainty, investors are advised to adopt a cautious approach. Diversifying portfolios, focusing on fundamentally strong companies, and maintaining adequate liquidity are prudent strategies during this period. It's essential to continuously monitor market developments and adapt investment strategies accordingly.

- Analyst Quote 1: "[Insert quote from a financial analyst regarding short-term market outlook]"

- Analyst Quote 2: "[Insert quote from a financial analyst regarding long-term market outlook]"

- Investment Recommendation: Diversify your portfolio, conduct thorough due diligence, and consider a phased investment strategy.

Conclusion

Today's Stock Market Update reveals a flat closure for both the Sensex and Nifty 50, primarily driven by prevailing geopolitical uncertainties. While some sectors showed resilience, others reflected the impact of global risks. Expert opinions point to a cautious short-term outlook, although the long-term potential for the Indian stock market remains promising. To stay informed about the latest developments in the Indian stock market, follow our next Stock Market Update and regularly check for updates on Sensex and Nifty 50 trends on our website [Insert Link Here]. Stay informed on all the significant movements in the Indian stock market; keep checking back for regular updates on the Sensex and Nifty 50.

Featured Posts

-

Anchorage Opens New Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025

Anchorage Opens New Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025 -

Predicting The 2025 Nhl Playoffs After The Trade Deadline

May 09, 2025

Predicting The 2025 Nhl Playoffs After The Trade Deadline

May 09, 2025 -

Jeanine Pirro Fact Checked Aocs Response On Fox News

May 09, 2025

Jeanine Pirro Fact Checked Aocs Response On Fox News

May 09, 2025 -

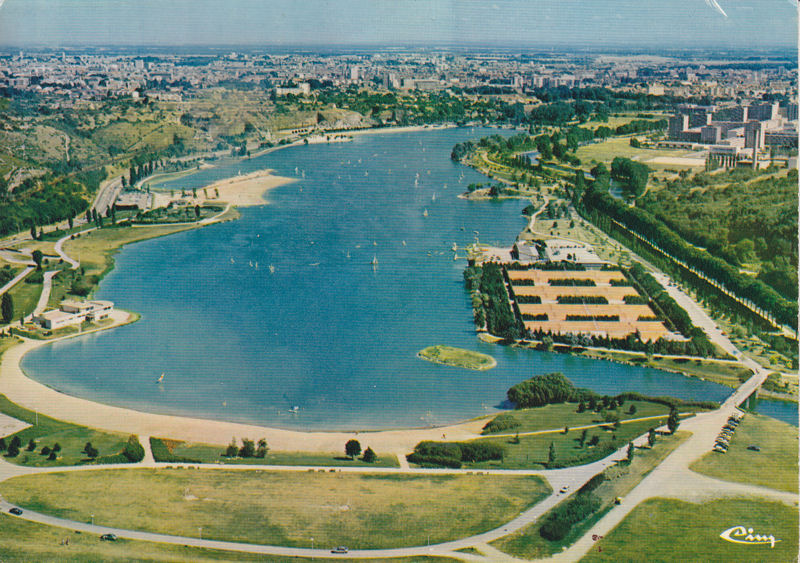

Dijon Agression Sauvage Au Lac Kir Trois Hommes Victimes

May 09, 2025

Dijon Agression Sauvage Au Lac Kir Trois Hommes Victimes

May 09, 2025 -

Elizabeth Hurleys Maldives Bikini Vacation Photos And Details

May 09, 2025

Elizabeth Hurleys Maldives Bikini Vacation Photos And Details

May 09, 2025

Latest Posts

-

Bilel Latreche Boxeur De Dijon Poursuivi Pour Violences Conjugales

May 09, 2025

Bilel Latreche Boxeur De Dijon Poursuivi Pour Violences Conjugales

May 09, 2025 -

Dijon Violences Conjugales Le Boxeur Bilel Latreche Devant Le Tribunal En Aout

May 09, 2025

Dijon Violences Conjugales Le Boxeur Bilel Latreche Devant Le Tribunal En Aout

May 09, 2025 -

Suspense Jusqu Au Bout Le Psg Bat Dijon En Arkema Premiere Ligue

May 09, 2025

Suspense Jusqu Au Bout Le Psg Bat Dijon En Arkema Premiere Ligue

May 09, 2025 -

Arkema Premiere Ligue Dijon Psg Un Match Au Couteau

May 09, 2025

Arkema Premiere Ligue Dijon Psg Un Match Au Couteau

May 09, 2025 -

Victoire Du Psg Face A Dijon En Arkema Premiere Ligue

May 09, 2025

Victoire Du Psg Face A Dijon En Arkema Premiere Ligue

May 09, 2025