Stock Market Valuation Concerns? BofA Offers A Reason For Calm

Table of Contents

BofA's Core Argument: Earnings Growth Outpacing Valuation Concerns

BofA's central argument rests on the premise that robust corporate earnings growth is outpacing concerns about elevated stock market valuations. They contend that while some valuations appear high based on historical price-to-earnings ratio (P/E) metrics and traditional market capitalization analyses, the projected future earnings growth justifies these levels. This perspective emphasizes a forward-looking approach, rather than relying solely on past performance to assess current value.

The P/E ratio, a key metric in stock market valuation, represents the price of a stock relative to its earnings per share. A high P/E ratio can suggest a stock is overvalued, while a low P/E ratio might indicate undervaluation. However, BofA's analysis considers future earnings projections, arguing that anticipated growth will bring the P/E ratio down to more acceptable levels over time. While specific data points from BofA's internal reports may not be publicly available, their analysis is supported by general market trends.

- Stronger-than-expected Q3 earnings reports across multiple sectors. Many companies have exceeded analysts' expectations, demonstrating resilience and underlying strength.

- Positive outlook for future earnings based on economic forecasts. Positive economic indicators suggest continued growth and expansion, bolstering future earnings projections.

- Analysis of specific sectors showing robust earnings growth. Sectors such as technology and healthcare consistently show strong earnings growth, supporting the overall bullish outlook.

Addressing Specific Valuation Concerns: Sector-Specific Analysis

BofA's calming perspective isn't a blanket statement; rather, it's a nuanced analysis considering different market sectors. They provide a breakdown of valuations across various sectors, acknowledging that some might be overvalued while others represent attractive investment opportunities. This sector-specific analysis is crucial for building a well-diversified portfolio.

For instance, the technology sector, known for its high growth potential, might exhibit higher valuations than more mature sectors like utilities. BofA likely acknowledges this but emphasizes the long-term growth prospects of leading tech companies, justifying their valuations. Conversely, they might highlight undervalued sectors with strong fundamentals and consistent growth potential, suggesting opportunities for strategic investment.

- Analysis of technology sector valuations and growth prospects. BofA likely factors in factors like innovation, market share, and future technological advancements when assessing tech valuations.

- Assessment of the financial sector’s resilience and profitability. The financial sector's performance is often closely tied to macroeconomic conditions, so BofA's analysis considers interest rate environments and economic growth projections.

- Evaluation of the healthcare sector and its long-term growth potential. Demographics and advancements in medical technology contribute to the ongoing demand for healthcare services, leading to consistently strong growth in this sector.

BofA's Recommendations for Investors: Navigating Market Uncertainty

BofA likely advises investors to adopt a long-term perspective, focusing on fundamental analysis rather than reacting to short-term market fluctuations. Their recommendations emphasize strategic approaches to mitigate risk and capitalize on growth opportunities.

They likely suggest a diversified investment strategy, spreading investments across multiple sectors and asset classes to reduce portfolio volatility. Focusing on companies with strong fundamentals, consistent earnings growth, and a proven track record is another key piece of advice. While specific stock recommendations might be found in BofA's proprietary research reports, their public statements emphasize a balanced and diversified approach.

- Maintain a diversified portfolio across various asset classes. This approach helps to mitigate risks associated with market volatility and sector-specific downturns.

- Focus on companies with strong fundamentals and consistent earnings growth. Investing in financially sound companies reduces the risk of significant losses during market corrections.

- Consider a long-term investment horizon to weather market fluctuations. Short-term market movements are less impactful on long-term investment goals.

- Consult a financial advisor for personalized guidance. A financial advisor can help tailor an investment strategy to an individual's specific financial goals and risk tolerance.

Conclusion

While concerns regarding stock market valuations are understandable given recent volatility, BofA's analysis suggests a more optimistic outlook. Their focus on strong earnings growth and sector-specific analysis provides a counterpoint to anxieties. By understanding the nuances of current valuations and incorporating BofA's insights—particularly their emphasis on strong corporate earnings growth and long-term investment strategies—investors can make more informed decisions.

Don't let stock market valuation concerns paralyze your investment strategy. Understand BofA's perspective and develop a well-informed approach to navigate the market effectively. Learn more about BofA's stock market analysis and gain a clearer understanding of your investment opportunities. Understanding stock market valuation is crucial for effective investing, and BofA’s insights offer valuable guidance in this complex landscape.

Featured Posts

-

Movies Leaving Hulu This Month Your Complete Guide

May 23, 2025

Movies Leaving Hulu This Month Your Complete Guide

May 23, 2025 -

Naybilshi Finansovi Kompaniyi Ukrayini U 2024 Rotsi Oglyad Lideriv Rinku

May 23, 2025

Naybilshi Finansovi Kompaniyi Ukrayini U 2024 Rotsi Oglyad Lideriv Rinku

May 23, 2025 -

Ftc Launches Probe Of Open Ai Implications For Ai Development

May 23, 2025

Ftc Launches Probe Of Open Ai Implications For Ai Development

May 23, 2025 -

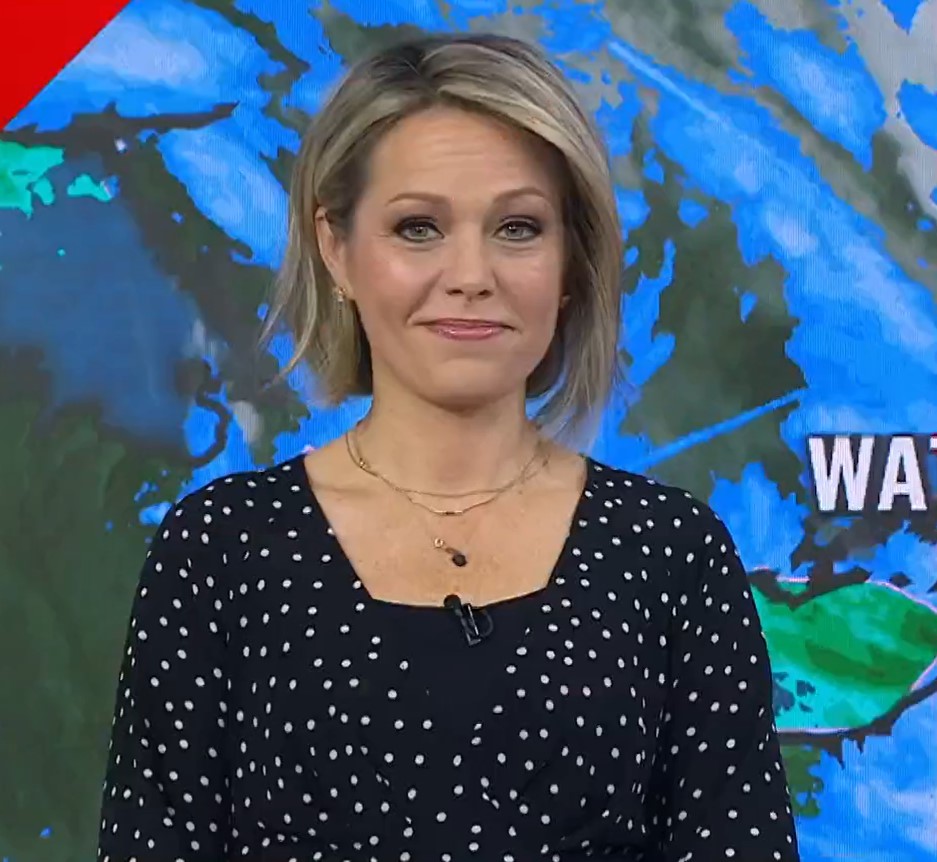

Dylan Dreyers Today Show Mishap Leads To Separation From Co Stars

May 23, 2025

Dylan Dreyers Today Show Mishap Leads To Separation From Co Stars

May 23, 2025 -

Sheinelle Jones Unexpected Absence Prompts Concern From Today Show Colleagues

May 23, 2025

Sheinelle Jones Unexpected Absence Prompts Concern From Today Show Colleagues

May 23, 2025

Latest Posts

-

Jonathan Groffs Just In Time Broadway Performance A Tony Awards Contender

May 23, 2025

Jonathan Groffs Just In Time Broadway Performance A Tony Awards Contender

May 23, 2025 -

Jonathan Groffs Just In Time Opening Night Lea Michele Daniel Radcliffe And More Celebrate

May 23, 2025

Jonathan Groffs Just In Time Opening Night Lea Michele Daniel Radcliffe And More Celebrate

May 23, 2025 -

Jonathan Groffs Just In Time A Night Of Broadway Stars And Support

May 23, 2025

Jonathan Groffs Just In Time A Night Of Broadway Stars And Support

May 23, 2025 -

Jonathan Groffs Broadway Opening Lea Michele And Friends Show Support

May 23, 2025

Jonathan Groffs Broadway Opening Lea Michele And Friends Show Support

May 23, 2025 -

Jonathan Groff Could Just In Time Lead To A Historic Tony Award

May 23, 2025

Jonathan Groff Could Just In Time Lead To A Historic Tony Award

May 23, 2025