Stock Market Valuations: BofA Assures Investors There's No Need To Worry

Table of Contents

Recent market volatility, fueled by high inflation and rising interest rates, has left many investors questioning stock market valuations. Concerns about overvaluation are widespread, leading to uncertainty and apprehension. However, Bank of America (BofA) recently released an analysis suggesting that investors shouldn't panic. This article examines BofA's arguments and assesses whether their reassurance is justified, providing a comprehensive look at current stock market valuations.

BofA's Key Arguments for a Healthy Stock Market

BofA's optimistic outlook on stock market valuations rests on several key pillars. Their analysis suggests that current valuations are largely supported by strong earnings growth projections and a considered view of the interest rate environment.

Earnings Growth Projections

BofA predicts robust corporate earnings growth in the coming quarters. This projected growth, they argue, justifies current valuation multiples.

- BofA projects S&P 500 earnings growth of 10% in 2024.

- Strong growth is expected in the technology and consumer discretionary sectors.

- Improved profitability margins are anticipated due to increased efficiency and pricing power.

This robust earnings growth outlook suggests that the current stock market valuations are not detached from underlying fundamentals. The projected increase in profitability will support higher stock prices, counteracting concerns about overvaluation based solely on price-to-earnings ratios. Strong earnings growth is a key factor in determining whether current stock market valuations are sustainable.

Interest Rate Outlook and Its Impact on Valuations

BofA's analysis incorporates a considered view of the Federal Reserve's interest rate policy. While further interest rate hikes are anticipated, BofA believes the pace will slow, limiting the negative impact on stock prices.

- BofA predicts a terminal rate of around 5.5% before a potential pause.

- The anticipated slowing of rate hikes will reduce the impact on discount rates.

- This will help to maintain the present value of future earnings, supporting stock valuations.

Changes in interest rates directly influence discount rates, impacting the present value of future earnings. Higher interest rates generally decrease present values, potentially putting downward pressure on stock prices. However, BofA's projection of a slower pace of rate hikes suggests this effect will be moderated.

Macroeconomic Factors and Their Influence

BofA considers various macroeconomic factors influencing stock market valuations, including inflation, employment, and consumer spending. Their analysis suggests a balanced macroeconomic environment which supports current market valuations.

- BofA anticipates a gradual easing of inflationary pressures in the coming year.

- The labor market remains relatively strong, supporting consumer spending.

- Economic growth, though slowing, is expected to remain positive, supporting corporate profitability.

A healthy macroeconomic environment is crucial for sustaining stock market valuations. While inflationary pressures have been a concern, BofA's projection of a gradual easing indicates that these factors are being carefully factored into their assessment.

Counterarguments and Potential Risks

While BofA presents a positive outlook, it's crucial to acknowledge counterarguments and potential risks that could impact stock market valuations.

Valuation Metrics and Their Limitations

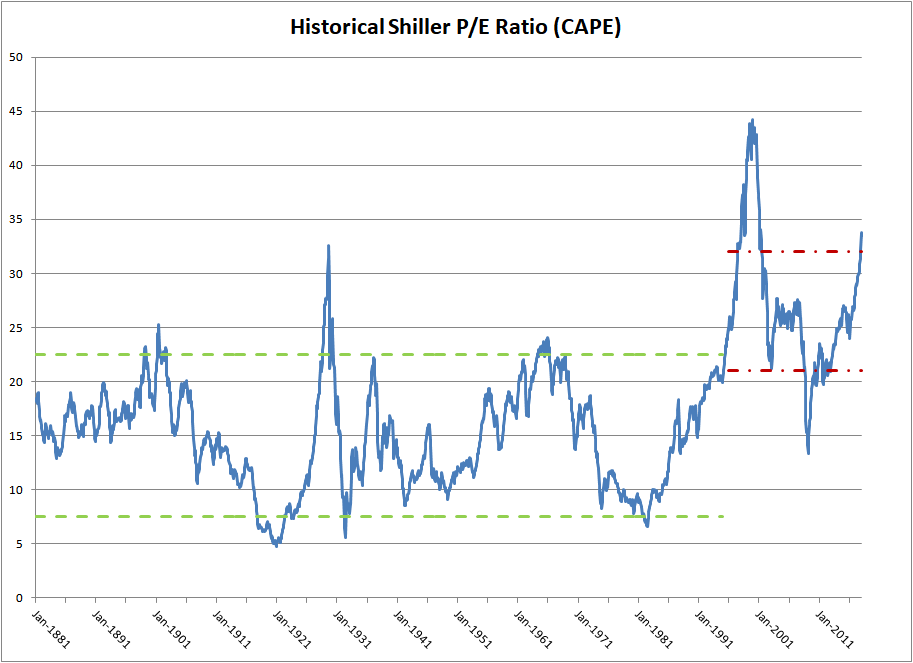

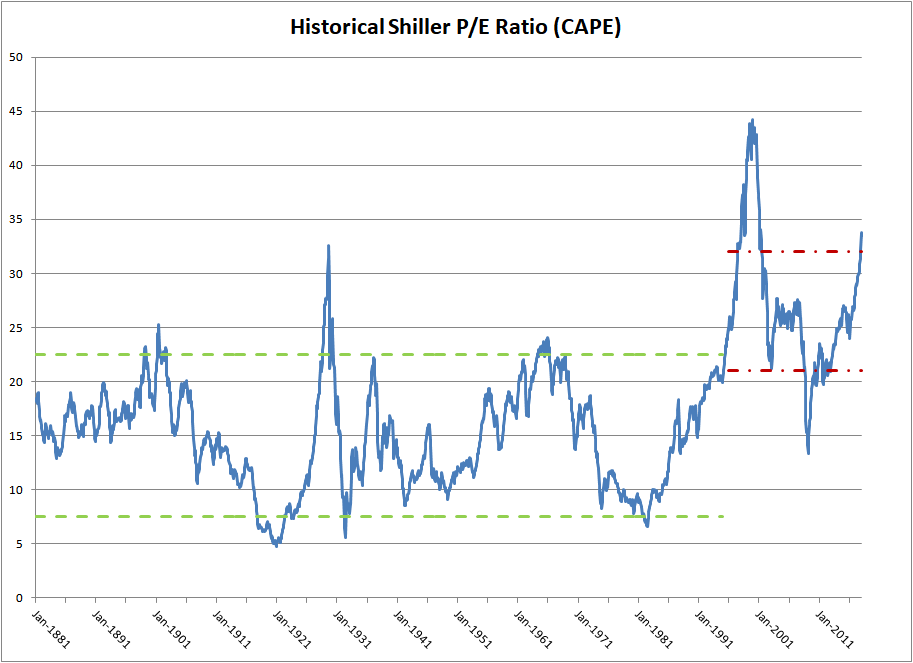

While BofA's analysis focuses on earnings growth, other valuation metrics paint a more mixed picture. Several indicators suggest that certain sectors might be overvalued.

- The Price-to-Earnings ratio (P/E) for some sectors remains elevated compared to historical averages.

- Market capitalization of some companies seems high relative to their fundamental performance.

- Relying on a single valuation metric, such as the P/E ratio, can provide an incomplete picture.

It's crucial to consider a range of valuation metrics and to understand their limitations before drawing definitive conclusions about overall stock market valuations. Using multiple metrics provides a broader and more reliable perspective.

Geopolitical Risks and Uncertainty

Geopolitical instability and unexpected global events represent significant risks that can significantly impact market sentiment and valuations.

- The ongoing war in Ukraine presents ongoing economic and political uncertainties.

- Geopolitical tensions in other regions could also trigger market volatility.

- Unexpected economic events, such as a major recession in a key global economy, could also negatively impact stock prices.

These geopolitical factors introduce significant uncertainties which cannot be fully factored into any valuation model. Investors should acknowledge these risks.

Unforeseen Black Swan Events

The inherent unpredictability of the market means unexpected "black swan" events can significantly impact stock market valuations.

- The 2008 financial crisis is a prime example of a black swan event.

- The COVID-19 pandemic also triggered unprecedented market volatility.

- Diversification is crucial to mitigating the risk associated with unforeseen black swan events.

These events are difficult, if not impossible, to predict and highlight the importance of a diversified investment strategy and not relying solely on any single institution's predictions.

Conclusion: Navigating Stock Market Valuations – BofA's Advice and Your Next Steps

BofA's analysis presents a largely positive outlook on stock market valuations, emphasizing strong earnings growth projections and a measured approach to interest rate hikes. However, it's vital to acknowledge the inherent risks and uncertainties associated with any market prediction. Geopolitical risks, unexpected events, and the limitations of valuation metrics all underscore the need for caution.

Conduct thorough research and consider consulting a financial advisor before making any investment decisions. Understanding stock market valuations requires a nuanced approach, carefully considering multiple factors and your personal risk tolerance. Learn more about stock market valuations and make informed choices to navigate the complexities of the market successfully.

Featured Posts

-

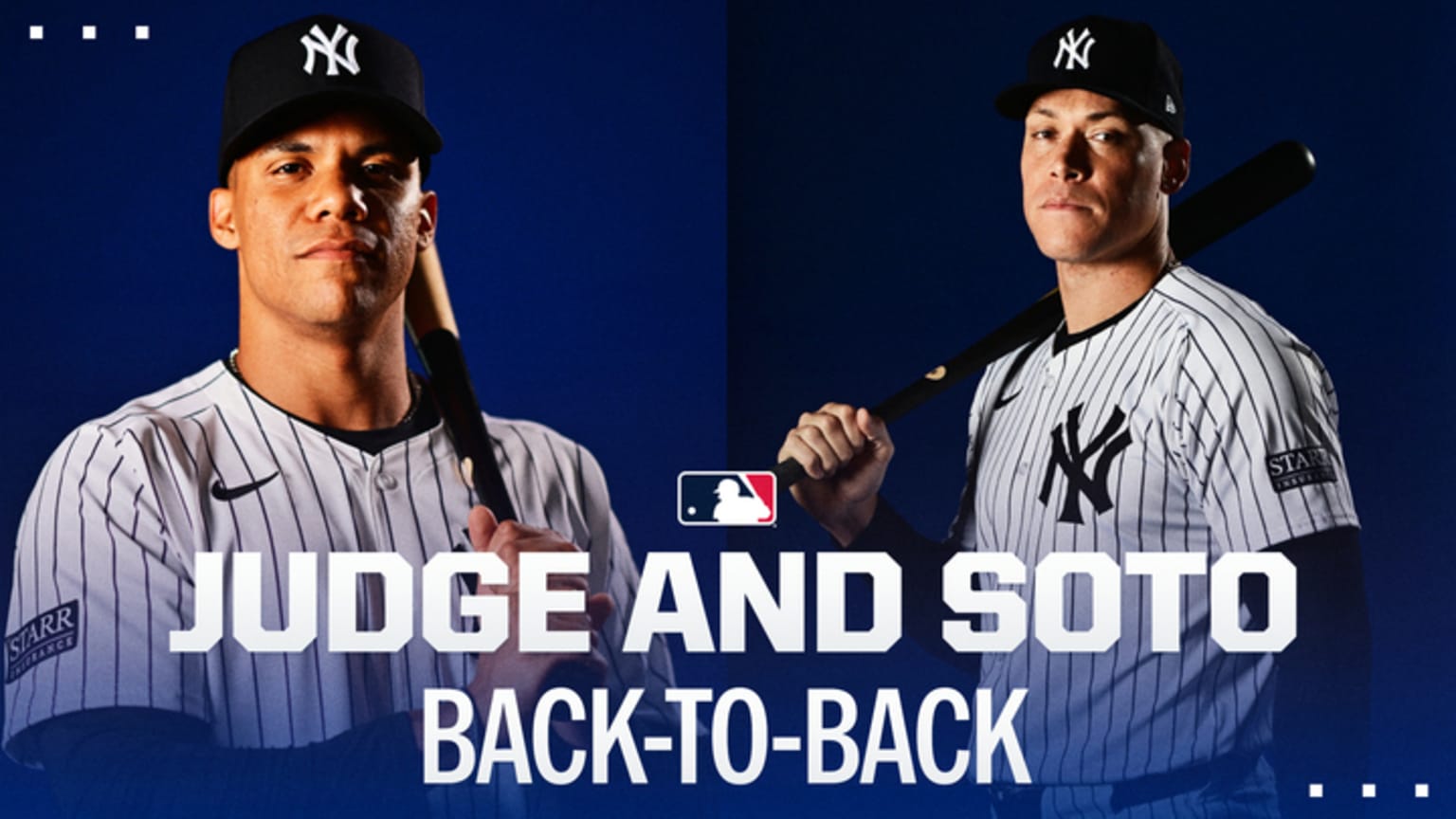

The Juan Soto Aaron Judge Dynamic And Its Effect On Sotos Recent Play

May 12, 2025

The Juan Soto Aaron Judge Dynamic And Its Effect On Sotos Recent Play

May 12, 2025 -

The 10 Best John Wick Inspired Action Films

May 12, 2025

The 10 Best John Wick Inspired Action Films

May 12, 2025 -

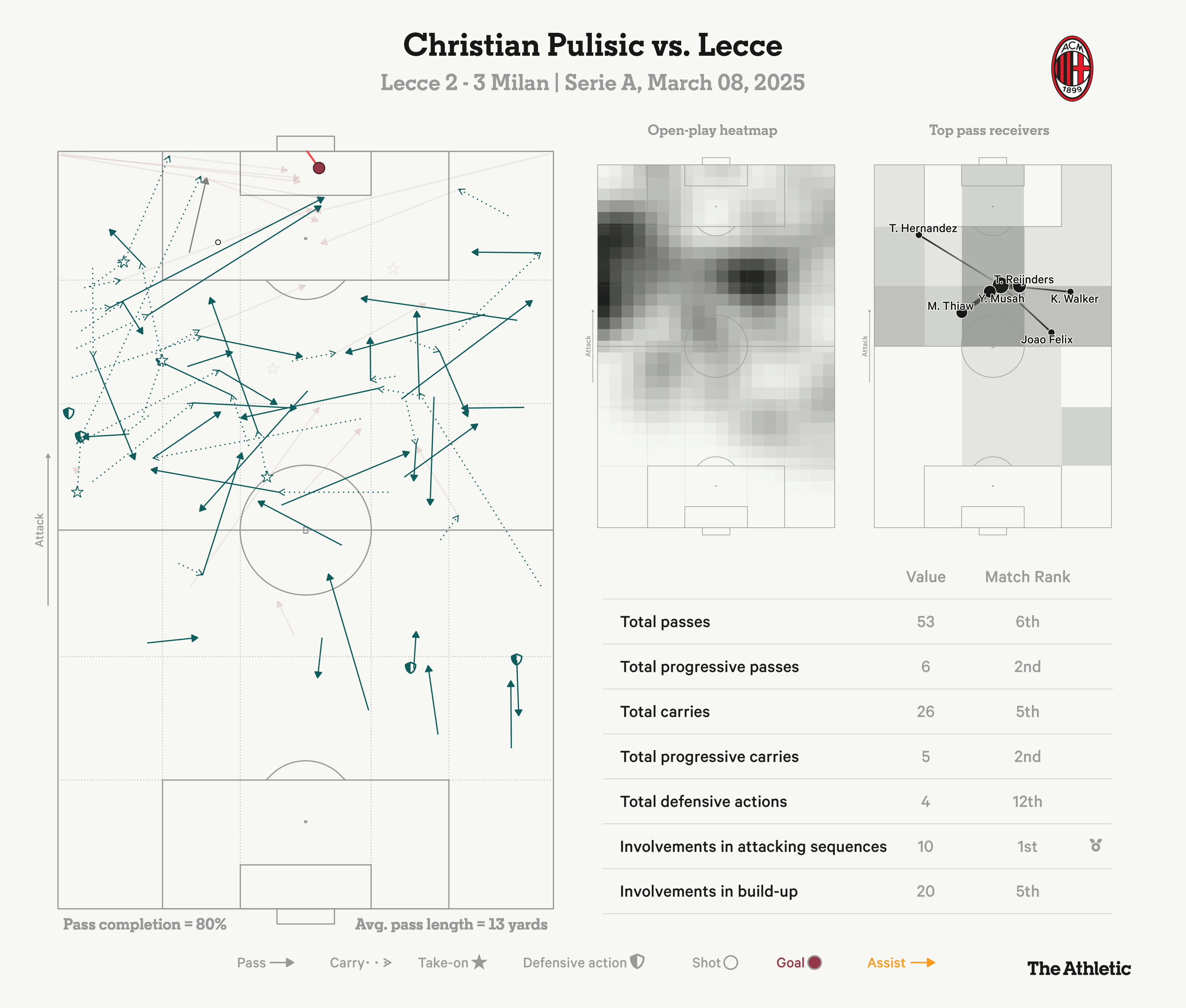

Usmnt Weekend Recap Dest Returns Pulisic Shines

May 12, 2025

Usmnt Weekend Recap Dest Returns Pulisic Shines

May 12, 2025 -

Onderzoek Prins Andrew Spionage Verjaardagskaarten En Onthullingen

May 12, 2025

Onderzoek Prins Andrew Spionage Verjaardagskaarten En Onthullingen

May 12, 2025 -

Equipment Failure At Newark Airport Impact On Flights And Passengers

May 12, 2025

Equipment Failure At Newark Airport Impact On Flights And Passengers

May 12, 2025

Latest Posts

-

Young Influencers Transition From Kamala Harris Campaign To Congress

May 13, 2025

Young Influencers Transition From Kamala Harris Campaign To Congress

May 13, 2025 -

From Social Media Influencer To Political Candidate A Gen Zs Journey

May 13, 2025

From Social Media Influencer To Political Candidate A Gen Zs Journey

May 13, 2025 -

Kamala Harris Influencer Seeks Congressional Seat A Gen Z Story

May 13, 2025

Kamala Harris Influencer Seeks Congressional Seat A Gen Z Story

May 13, 2025 -

From Kamala Harris Influencer To Congressional Candidate Gen Zs Political Rise

May 13, 2025

From Kamala Harris Influencer To Congressional Candidate Gen Zs Political Rise

May 13, 2025 -

Cp Music Productions A Father Son Musical Journey

May 13, 2025

Cp Music Productions A Father Son Musical Journey

May 13, 2025