Stock Market Valuations: BofA Explains Why Investors Shouldn't Worry

Table of Contents

BofA's Arguments Against Overvaluation Concerns

Bank of America's recent reports offer a counter-narrative to the prevailing pessimism. Their analysis highlights several key factors that temper concerns about inflated stock market valuations.

Strong Corporate Earnings and Profitability

Despite higher price-to-earnings (P/E) ratios, BofA points to robust corporate earnings and profit margins as justification for current valuations. Strong revenue growth and efficient cost management have enabled many companies to maintain impressive profitability even amidst economic uncertainty.

- Examples of high-performing sectors: Technology, healthcare, and consumer staples have shown resilience and continued growth, supporting overall market valuations.

- P/E ratio context: While current P/E ratios might seem high compared to historical averages, it's crucial to consider the context. Historically low interest rates and strong earnings growth help justify these higher multiples. A simple comparison to historical averages without considering the economic backdrop can be misleading.

- Drivers of profitability: Technological advancements, increased automation, and supply chain optimizations have all contributed to improved corporate profitability, supporting higher valuations.

Low Interest Rates and Monetary Policy

Low interest rates play a significant role in supporting stock market valuations. When interest rates are low, bonds become less attractive relative to equities, driving investors towards stocks in search of higher returns. Central bank policies, particularly quantitative easing programs in recent years, have also contributed to increased liquidity in the market, further bolstering stock prices.

- Current interest rate environment: While interest rates are rising, they remain historically low in many regions, continuing to favor equity investments over bonds. Future projections suggest a gradual increase, but not necessarily a dramatic shift.

- Bond yields vs. equity returns: The relatively low yields on government bonds compared to potential equity returns make stocks a comparatively attractive investment option for many investors.

- Future monetary policy: While future policy changes remain uncertain, central banks are likely to continue monitoring economic data closely and adjust policies gradually to avoid shocks to the market.

Long-Term Growth Potential and Technological Innovation

BofA highlights the substantial long-term growth potential driven by technological innovation and emerging markets as a key factor mitigating valuation concerns. The potential for disruptive technologies and expansion into new markets offsets anxieties around current valuations.

- Disruptive technologies: Artificial intelligence (AI), renewable energy, and biotechnology are examples of disruptive technologies with immense growth potential, driving future stock market appreciation.

- Emerging markets: Developing economies offer significant opportunities for growth and investment, providing a substantial engine for future market expansion.

- Long-term investment strategies: A long-term investment horizon is crucial in navigating market volatility. Focusing on fundamental company analysis and long-term growth potential can help mitigate short-term fluctuations.

Addressing Common Valuation Concerns

While BofA's analysis presents a positive outlook, it's essential to address common concerns related to stock market valuations.

High Price-to-Earnings Ratios (P/E)

High P/E ratios are a frequent source of investor anxiety. However, the context matters. In an environment of low interest rates and strong earnings growth, higher P/E ratios might not be as alarming as they initially seem.

- Types of P/E ratios: Understanding the nuances of different P/E ratios (forward vs. trailing) is crucial for accurate interpretation.

- Sectoral comparisons: Comparing P/E ratios across different sectors is important, as growth sectors typically command higher multiples than mature, stable sectors.

- Alternative valuation metrics: Investors should also consider other valuation metrics, such as price-to-sales ratio (P/S) or price-to-book ratio (P/B), to get a more comprehensive picture.

Market Volatility and Corrections

Market volatility and corrections are a normal part of the investment cycle. While these fluctuations can be unsettling, they don't necessarily signal a catastrophic market crash. In fact, healthy corrections can help to rebalance the market and pave the way for future growth.

- Historical examples: Throughout history, market corrections have been followed by periods of renewed growth.

- Risk management strategies: Diversification, dollar-cost averaging, and stop-loss orders can help mitigate risk during periods of volatility.

- Long-term investment approach: A long-term investment horizon significantly reduces the impact of short-term market fluctuations.

Stock Market Valuations: A Measured Approach

In conclusion, BofA's analysis suggests that while stock market valuations might appear high, several mitigating factors exist. Strong corporate earnings, low interest rates, and significant long-term growth potential driven by technological innovation and emerging markets all help to temper concerns about overvaluation. While market volatility and corrections are to be expected, they don't necessarily signal an impending crash. Adopt a measured approach to investing, considering the insights provided by BofA’s analysis. Avoid knee-jerk reactions based on short-term market fluctuations. Conduct thorough research into stock market valuations and develop a sound long-term investment strategy that aligns with your risk tolerance and financial goals. Don't let anxieties about stock market valuations paralyze you—a well-informed and strategic approach can lead to long-term success.

Featured Posts

-

Chainalysis Acquires Alterya Blockchain Meets Ai

Apr 22, 2025

Chainalysis Acquires Alterya Blockchain Meets Ai

Apr 22, 2025 -

Economists Weigh In Understanding The Bank Of Canadas Decision To Pause

Apr 22, 2025

Economists Weigh In Understanding The Bank Of Canadas Decision To Pause

Apr 22, 2025 -

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 22, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 22, 2025 -

Stock Market Live Dow Futures And Dollar React To Trade News

Apr 22, 2025

Stock Market Live Dow Futures And Dollar React To Trade News

Apr 22, 2025 -

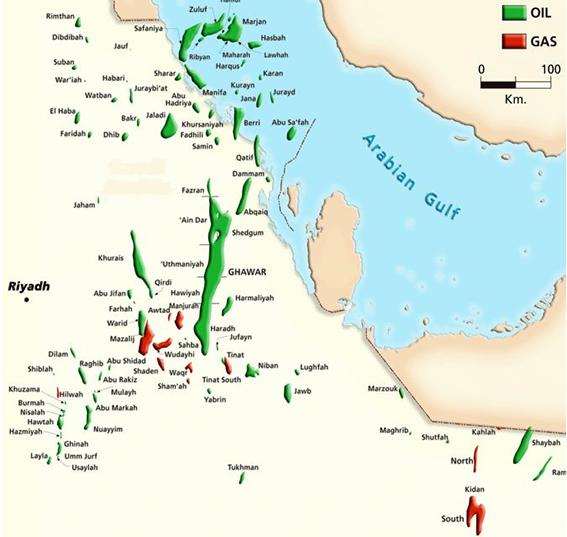

New Ev Technology Exploration Saudi Aramco And Byds Strategic Partnership

Apr 22, 2025

New Ev Technology Exploration Saudi Aramco And Byds Strategic Partnership

Apr 22, 2025

Latest Posts

-

Edmonton School Projects 14 Initiatives To Proceed Rapidly

May 10, 2025

Edmonton School Projects 14 Initiatives To Proceed Rapidly

May 10, 2025 -

Understanding The Impact Of Federal Riding Changes In Greater Edmonton

May 10, 2025

Understanding The Impact Of Federal Riding Changes In Greater Edmonton

May 10, 2025 -

Edmonton Unlimiteds Global Impact Strategy Scaling Tech And Innovation

May 10, 2025

Edmonton Unlimiteds Global Impact Strategy Scaling Tech And Innovation

May 10, 2025 -

Federal Riding Boundary Changes Their Effect On Edmonton Area Voters

May 10, 2025

Federal Riding Boundary Changes Their Effect On Edmonton Area Voters

May 10, 2025 -

Edmonton Unlimiteds New Tech And Innovation Strategy Scaling For Global Impact

May 10, 2025

Edmonton Unlimiteds New Tech And Innovation Strategy Scaling For Global Impact

May 10, 2025