Stock Market Valuations: BofA's Reassuring View For Investors

Table of Contents

BofA's Current Market Outlook

BofA maintains a cautiously optimistic outlook on the current market conditions. While acknowledging the challenges posed by persistent inflation and rising interest rates, their analysts believe that the underlying fundamentals of the economy remain relatively strong. This doesn't mean a completely rosy picture; it's a nuanced perspective that accounts for both risks and opportunities.

- Key Economic Indicators: BofA closely monitors inflation rates (CPI and PCE), interest rate adjustments by the Federal Reserve, and GDP growth figures. They also analyze employment data and consumer sentiment to gauge the overall health of the economy.

- Market Performance Predictions: BofA's predictions suggest moderate growth in the stock market over the next year, albeit with increased volatility. They anticipate a gradual slowdown in economic growth, but not a sharp recession.

- Sector-Specific Views: BofA is generally optimistic about the technology sector, particularly in areas like artificial intelligence and cloud computing, while expressing some caution regarding the energy sector due to potential price volatility.

Analysis of Stock Market Valuations

BofA employs a multi-faceted approach to evaluating stock market valuations, utilizing a range of key metrics. Their analysis goes beyond simple price-to-earnings ratios (P/E) to include a broader assessment of intrinsic value.

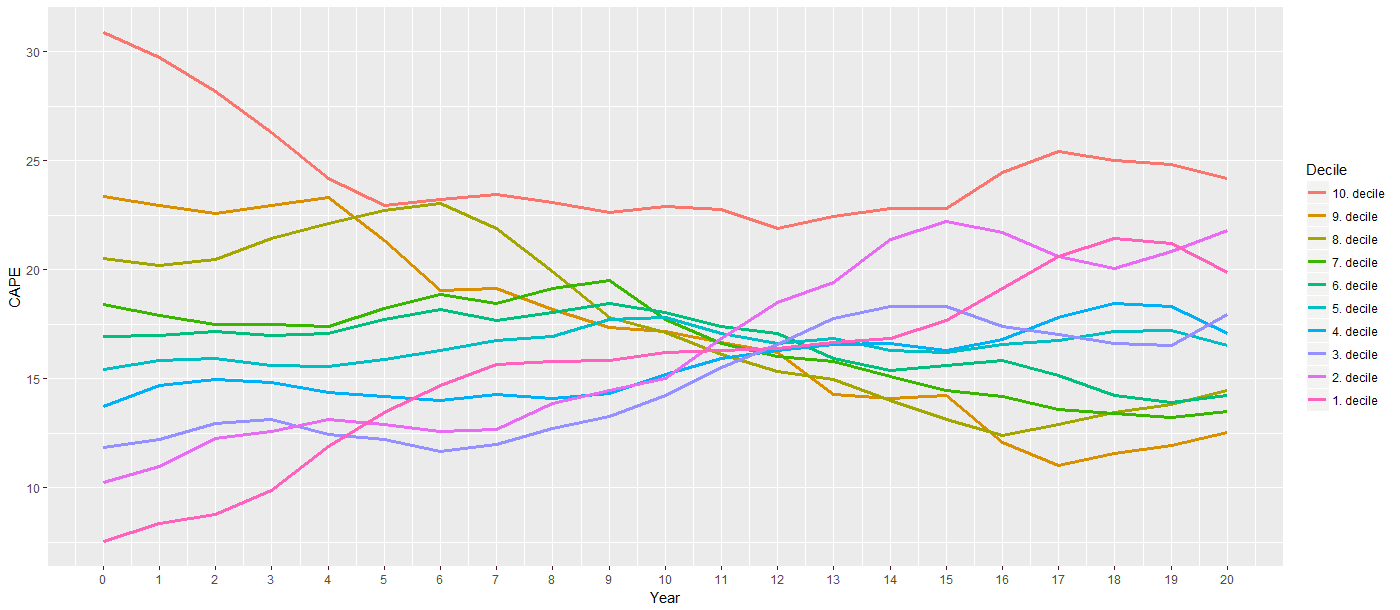

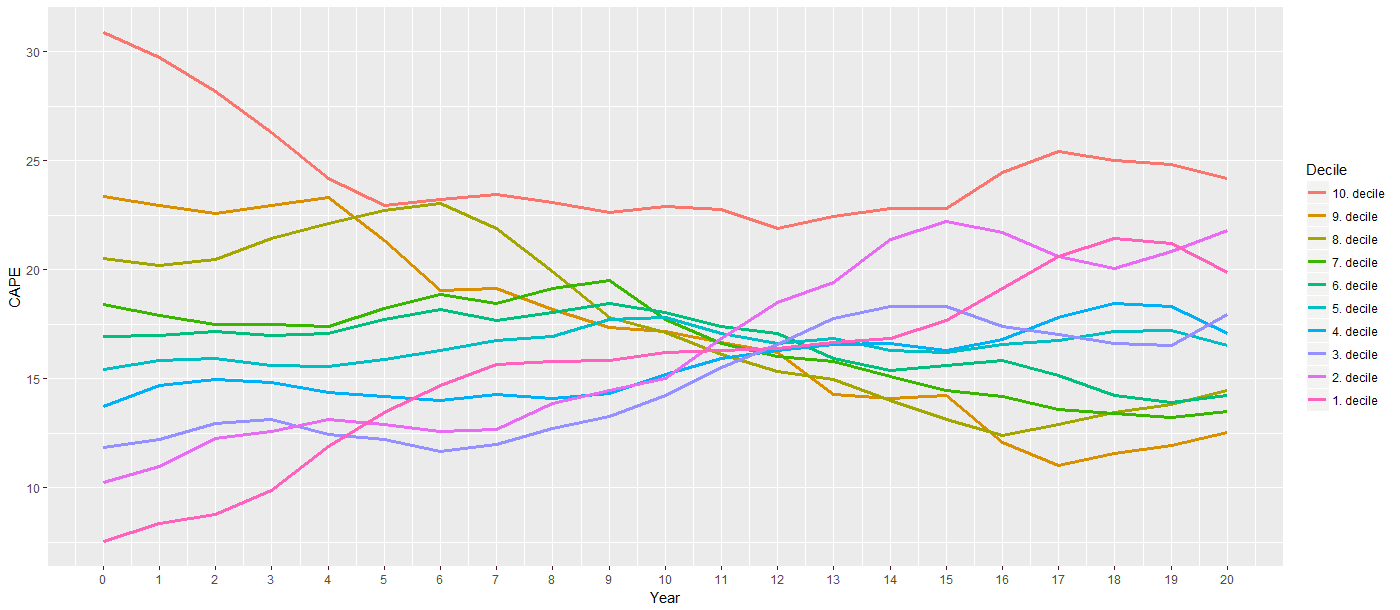

- Valuation Metrics: BofA uses several key valuation metrics, including price-to-earnings ratios (P/E), price-to-sales ratios (P/S), price-to-book ratios (P/B), and dividend yields. They carefully analyze these metrics across different sectors and compare them to historical averages.

- Historical Comparisons: By comparing current valuation metrics to historical averages, BofA seeks to identify potential overvaluations or undervaluations. This historical context is crucial for determining whether current prices are justified by underlying fundamentals.

- Overvalued and Undervalued Sectors: Based on their analysis, BofA has identified certain sectors that appear to be relatively overvalued compared to historical norms, while others seem undervalued, presenting potential investment opportunities. This information is often incorporated into their investment recommendations.

Factors Influencing BofA's Positive View

BofA's relatively positive outlook on stock market valuations is driven by several key factors. These factors, while not eliminating risk, contribute to their overall cautious optimism.

- Corporate Earnings Growth: BofA projects continued, albeit moderate, growth in corporate earnings over the next few years. This expectation underpins their belief in the long-term potential of the stock market.

- Interest Rate Adjustments: While acknowledging the impact of rising interest rates, BofA believes that the Federal Reserve will manage these adjustments carefully to avoid triggering a sharp economic downturn.

- Geopolitical Factors: While geopolitical events introduce uncertainty, BofA incorporates these risks into its analysis, accounting for their potential impact on various sectors and the overall market.

- Technological Advancements: BofA views continued technological innovation as a significant driver of future stock market growth, highlighting the potential for disruptive technologies to create new investment opportunities.

Addressing Investor Concerns about Stock Market Valuations

Many investors harbor concerns about the current market environment. BofA directly addresses these concerns in its analysis, providing reassurance and suggesting strategies for managing risk.

- Addressing Investor Concerns: BofA acknowledges concerns about inflation, recession fears, and geopolitical instability. They systematically address these issues in their reports, offering data-driven insights and explanations.

- Rebuttals to Bearish Arguments: BofA refutes some common bearish arguments by presenting alternative perspectives and highlighting positive indicators that counter the pessimistic narratives.

- Risk Mitigation Strategies: BofA suggests various strategies for mitigating risks, such as diversification, hedging, and focusing on fundamentally strong companies with sustainable business models. This emphasizes a long-term approach to investing.

Conclusion: Navigating Stock Market Valuations with Confidence

BofA's analysis of current stock market valuations provides a reassuring perspective for investors. While acknowledging inherent market risks, their research highlights the potential for moderate growth, driven by continued corporate earnings growth and technological advancements. By incorporating a nuanced understanding of economic indicators, historical valuations, and geopolitical factors, BofA offers a framework for navigating the current market environment with greater confidence. Stay informed on stock market valuations and make confident investment decisions by reviewing BofA's latest research and developing a well-informed investment strategy. [Link to BofA's research (if available)]

Featured Posts

-

The Impact Of Virtue Signaling On Architecture An Exclusive Interview

May 25, 2025

The Impact Of Virtue Signaling On Architecture An Exclusive Interview

May 25, 2025 -

Bbc Radio 1 Big Weekend Everything You Need To Know About Ticket Applications

May 25, 2025

Bbc Radio 1 Big Weekend Everything You Need To Know About Ticket Applications

May 25, 2025 -

Atletico Madrid In 3 Maclik Hasretine Son

May 25, 2025

Atletico Madrid In 3 Maclik Hasretine Son

May 25, 2025 -

Broadways Photo 5162787 Mia Farrow Supports Sadie Sink

May 25, 2025

Broadways Photo 5162787 Mia Farrow Supports Sadie Sink

May 25, 2025 -

Shooting Incident Prompts Safety Review At Popular Southern Vacation Location

May 25, 2025

Shooting Incident Prompts Safety Review At Popular Southern Vacation Location

May 25, 2025