Stock Markets Soar On Renewed U.S.-China Trade Optimism

Table of Contents

Positive Trade Signals Fuel Market Rally

Positive statements from high-level officials in both the U.S. and China regarding a potential breakthrough in trade negotiations sparked the renewed optimism. Reports suggest progress has been made on several key sticking points, including intellectual property rights and agricultural purchases. This positive news swiftly translated into a significant stock market rally.

- Market Reactions:

- The Dow Jones Industrial Average surged by 2.1%, its best single-day gain in several months.

- The S&P 500 climbed 2.3%, also marking a substantial increase.

- The Nasdaq Composite Index rose by 2.6%, boosted by strong performance in the technology sector.

- Trading volume increased significantly across all major exchanges, reflecting heightened investor confidence. The increased trading volume reflects a bullish sentiment fueled by U.S.-China trade optimism.

- Increased investor confidence in the stock market is evident in the substantial market gains observed. The rally is a clear indication that investors are responding positively to easing trade tensions. The positive signals have fueled a significant stock market rally, boosting investor confidence.

Easing Trade Tensions: A Boon for Global Growth

Reduced trade tensions between the world's two largest economies have significant implications for global economic growth. Easing trade restrictions leads to increased economic activity and stability. The positive impact of U.S.-China trade optimism on global growth is multifaceted.

- Positive Impacts:

- Increased International Trade and Investment: Reduced tariffs and trade barriers will facilitate the free flow of goods and services, boosting international trade. This, in turn, stimulates economic activity in participating countries.

- Reduced Uncertainty for Businesses: The uncertainty surrounding the trade war had hindered business investment and expansion plans. Easing tensions creates a more predictable environment, encouraging greater investment.

- Potential for Lower Consumer Prices: Reduced tariffs can translate into lower prices for consumers, increasing purchasing power and further stimulating economic activity.

- Positive Ripple Effect on Developing Economies: Reduced trade tensions between the U.S. and China will have a positive ripple effect on developing economies that are heavily reliant on trade with these two giants.

Cautious Optimism: Potential Risks and Uncertainties Remain

While the renewed U.S.-China trade optimism is encouraging, it's crucial to acknowledge potential risks and uncertainties. Market volatility can still occur. Maintaining a cautious approach is warranted.

- Potential Risks:

- Possibility of Future Trade Disputes: The current agreement might not resolve all underlying issues, leaving the potential for future disputes.

- Geopolitical Instability in Other Regions: Global economic stability is also influenced by geopolitical events unrelated to U.S.-China relations.

- Domestic Economic Factors: Domestic economic conditions in both countries can still impact market performance independent of trade relations.

- Uncertainty Regarding the Long-Term Implications: The long-term effects of the trade agreement remain uncertain and require close monitoring. The long-term implications of the recent U.S.-China trade optimism need further analysis.

Analyzing the Impact on Specific Sectors

The renewed U.S.-China trade optimism had a varied impact on different sectors.

- Technology: The tech sector experienced a significant surge, with many tech stocks experiencing double-digit gains. This reflects investor confidence in the sector's future growth prospects, which were previously hampered by trade uncertainty. The tech stock surge demonstrates investor confidence.

- Manufacturing: The manufacturing sector, heavily impacted by the trade war, showed a notable rebound. Reduced tariffs on imported goods and increased demand from China are key factors driving this recovery. The energy sector rebound is also linked to renewed U.S.-China trade optimism.

- Energy: The energy sector also saw a positive response, partly due to increased global demand and reduced uncertainty surrounding energy imports and exports.

Conclusion

The surge in stock markets reflects the significant market reaction to renewed U.S.-China trade optimism. While this signals potential positive impacts on global growth through increased international trade and reduced uncertainty, it is crucial to maintain a cautious outlook. Potential risks, such as future trade disputes and geopolitical instability, remain. Specific sectors, like technology and manufacturing, have shown notable gains, reflecting the varied impact of this positive development.

To stay informed about the evolving situation, monitor the stock market's reaction to trade developments and understand the implications of U.S.-China trade negotiations on your investments. For in-depth analysis, consult reputable financial news sources and economic reports. Stay informed about U.S.-China trade optimism and its implications for the global economy.

Featured Posts

-

Bianca Censoris Fears A Source Speaks Out On Kanye West

May 14, 2025

Bianca Censoris Fears A Source Speaks Out On Kanye West

May 14, 2025 -

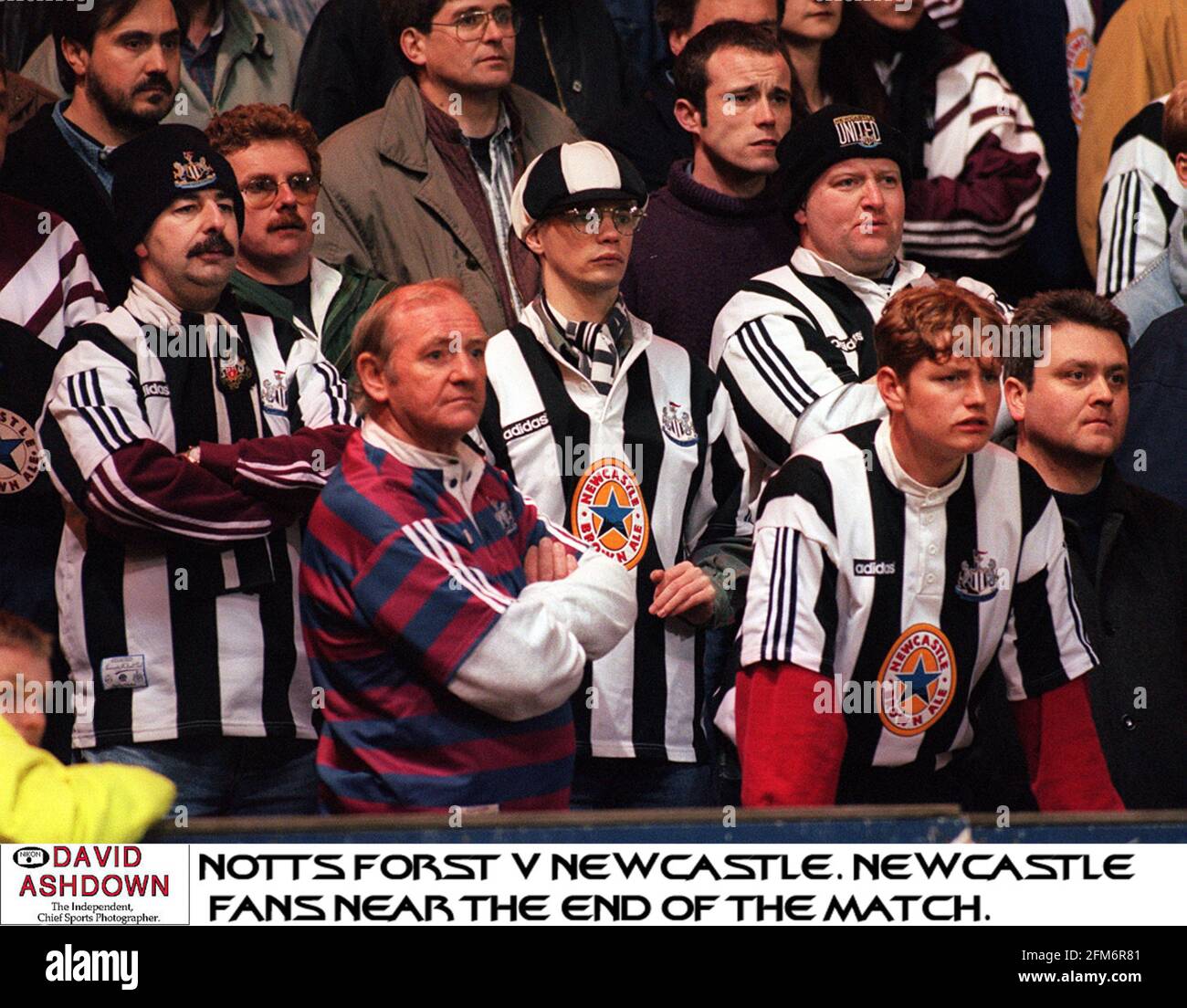

Newcastles Pursuit Of Premier League Defender Stalls

May 14, 2025

Newcastles Pursuit Of Premier League Defender Stalls

May 14, 2025 -

A Comparative Study Of Tennis Branding Sinners Fox And Federers Rf

May 14, 2025

A Comparative Study Of Tennis Branding Sinners Fox And Federers Rf

May 14, 2025 -

Apple Tv Confirms Ted Lasso Season 4 Writers Guild Listing Details

May 14, 2025

Apple Tv Confirms Ted Lasso Season 4 Writers Guild Listing Details

May 14, 2025 -

Communication Responsable Eramet Grande Cote Un Mecanisme De Gestion Des Plaintes Performant

May 14, 2025

Communication Responsable Eramet Grande Cote Un Mecanisme De Gestion Des Plaintes Performant

May 14, 2025