Stocks Fall: US Fiscal Worries Spark Market Unease

Table of Contents

The Looming Debt Ceiling Debate and its Market Impact

The US government's looming debt ceiling deadline is a primary driver of current market unease. The debt ceiling is the legal limit on the amount of money the US government can borrow. Failure to raise this limit could lead to a catastrophic default, with severe consequences for the US economy and global financial markets. This "Debt Ceiling Crisis" is not just theoretical; past near-misses have sent shockwaves through the markets.

- Potential government shutdown scenarios and their market implications: A government shutdown, even a temporary one, could disrupt essential government services and severely impact investor confidence, potentially leading to further stock market declines.

- Impact on investor confidence and risk appetite: The uncertainty surrounding the debt ceiling debate erodes investor confidence, prompting a shift towards less risky assets and a reduction in overall market activity. This decreased risk appetite contributes directly to stock market falls.

- Historical precedents of debt ceiling crises and their market effects: Analyzing past debt ceiling debates reveals a clear correlation between the uncertainty surrounding these events and periods of increased market volatility and decreased stock prices. Charts illustrating this correlation can be found in numerous reputable financial news outlets.

Inflation Concerns and the Federal Reserve's Response

Persistently high inflation remains a major headwind for the US economy and stock markets. The Federal Reserve (Fed) has been aggressively raising interest rates to combat inflation, but this monetary policy tightening comes with its own set of risks.

- Analysis of the Fed's interest rate hikes and their effect on stock prices: While interest rate hikes aim to curb inflation, they can also slow economic growth and negatively impact corporate earnings, thereby putting downward pressure on stock prices.

- Potential for further interest rate increases and their impact on economic growth: The possibility of further interest rate increases adds to the uncertainty, leaving investors hesitant to commit capital. This hesitancy can lead to prolonged periods of lower stock valuations and decreased trading volume.

- Relationship between inflation, interest rates, and stock market performance: The complex interplay between these three factors necessitates a nuanced understanding of macroeconomic trends for effective investment strategies. High inflation coupled with rising interest rates creates a challenging environment for stock market growth.

Geopolitical Factors Exacerbating Market Anxiety

Geopolitical instability adds another layer of complexity to the current market situation. Global events, such as the ongoing war in Ukraine and escalating international tensions, contribute significantly to market unease.

- Specific examples of geopolitical events affecting US stock markets: The war in Ukraine, for instance, has disrupted global supply chains, increased energy prices, and created considerable uncertainty, all of which weigh heavily on investor sentiment.

- Impact on energy prices, supply chains, and investor sentiment: These disruptions lead to higher costs for businesses, reduced consumer spending, and decreased corporate profits, ultimately affecting stock prices negatively.

- Uncertainty and its effect on long-term investment strategies: The heightened geopolitical risk makes long-term investment planning more challenging, prompting many investors to adopt a more cautious approach.

The Ukraine Conflict and its Ripple Effects

The war in Ukraine has had a profound and multifaceted impact on the US stock market. Beyond the direct effects on energy prices and supply chains, the conflict fuels broader concerns about global stability and the potential for further escalation. Expert analyses consistently highlight the link between the ongoing conflict and heightened market volatility.

Conclusion

In summary, the recent decline in stock prices is attributable to a confluence of factors: the looming debt ceiling debate, persistent inflation and the Fed's response, and escalating geopolitical uncertainties. Understanding these interconnected challenges is crucial for investors.

Key Takeaways: The current market volatility underscores the importance of staying informed about US fiscal policy, the Federal Reserve's actions, and global events. Ignoring these factors can lead to poor investment decisions.

Call to Action: To navigate the complexities of "Stocks Fall: US Fiscal Worries Spark Market Unease," stay informed by regularly consulting reputable financial news sources and seeking advice from qualified financial advisors before making any investment decisions. Understanding the interplay between US fiscal policy and global events is crucial for making sound investment choices in this volatile market. Don't let market fluctuations catch you off guard; stay informed and adapt your strategies accordingly.

The need for vigilance and informed decision-making in the face of current market volatility cannot be overstated. Stay informed, stay adaptable, and stay invested wisely.

Featured Posts

-

Thqyq Mqtl Mwzfy Alsfart Alisrayylyt Melwmat Jdydt En Ilyas Rwdryjyz

May 23, 2025

Thqyq Mqtl Mwzfy Alsfart Alisrayylyt Melwmat Jdydt En Ilyas Rwdryjyz

May 23, 2025 -

Man Utd Flop Blames Personal Life For Poor Performance

May 23, 2025

Man Utd Flop Blames Personal Life For Poor Performance

May 23, 2025 -

The Whos Roger Daltrey Opens Up About His Struggle With Blindness And Deafness

May 23, 2025

The Whos Roger Daltrey Opens Up About His Struggle With Blindness And Deafness

May 23, 2025 -

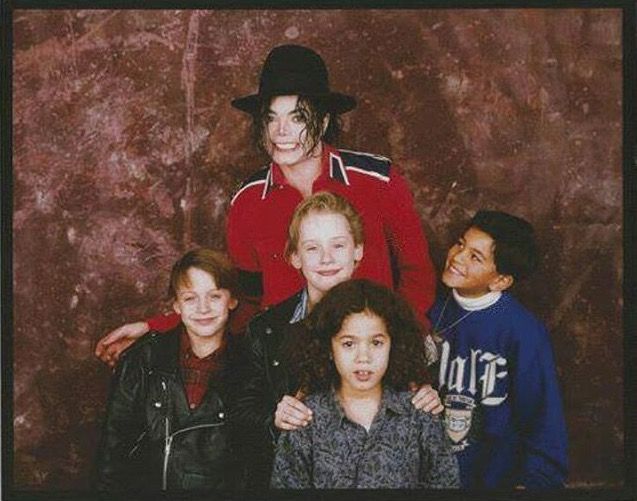

Kieran Culkin And Michael Jackson Exploring The Unexpected Link

May 23, 2025

Kieran Culkin And Michael Jackson Exploring The Unexpected Link

May 23, 2025 -

Kieran Culkins Role In Sunrise On The Reaping Revealed

May 23, 2025

Kieran Culkins Role In Sunrise On The Reaping Revealed

May 23, 2025

Latest Posts

-

Close Call Antony And A Manchester United Rival

May 23, 2025

Close Call Antony And A Manchester United Rival

May 23, 2025 -

Revealed Antonys Near Transfer To A Man Utd Rival

May 23, 2025

Revealed Antonys Near Transfer To A Man Utd Rival

May 23, 2025 -

Antonys Manchester United Rival Transfer Near Miss

May 23, 2025

Antonys Manchester United Rival Transfer Near Miss

May 23, 2025 -

The Untold Story Antony And Manchester Uniteds Rivals

May 23, 2025

The Untold Story Antony And Manchester Uniteds Rivals

May 23, 2025 -

Costly Mistakes Jaap Stams Assessment Of Man United Under Ten Hag

May 23, 2025

Costly Mistakes Jaap Stams Assessment Of Man United Under Ten Hag

May 23, 2025