Strong Trading Volume Propels NYSE Parent ICE To Q1 Profit Beat

Table of Contents

Record Trading Volumes Across NYSE and ICE Exchanges

ICE's Q1 success story begins with record-breaking trading volumes across its entire network of exchanges. This surge in activity directly translated into higher transaction fees, the lifeblood of ICE's revenue streams. Compared to Q1 of the previous year, we saw remarkable growth across various asset classes.

- NYSE equity trading volume: Up 15% compared to Q1 last year, demonstrating robust activity in the core equities market. This increase reflects investor confidence and active participation in the market.

- Futures and options trading volume: Experienced a significant boost of 20% on ICE Futures U.S., highlighting the growing demand for risk management tools and derivative products.

- High-volume trading days: Several days throughout Q1 saw exceptionally high trading volumes, exceeding previous records. For instance, the week following a major geopolitical event saw a 30% spike in daily average volume.

- Market events: Increased market volatility fueled by geopolitical uncertainty and fluctuating economic data releases significantly contributed to the elevated trading activity.

Impact of Increased Trading Volume on ICE's Revenue and Profitability

The direct consequence of this surge in trading volume was a substantial increase in ICE's transaction revenue. Higher trading activity translates directly into higher transaction fees, forming the core of ICE's business model. This led to exceeding Q1 profit expectations substantially.

- Transaction revenue increase: Transaction revenue increased by 18% compared to Q1 of the previous year, showcasing the direct correlation between trading volume and profitability.

- Net income and EPS: Net income rose to $X billion, and earnings per share (EPS) reached $Y, significantly surpassing analyst projections.

- Positive financial guidance: Encouraged by the strong Q1 performance, ICE adjusted its financial guidance for the remainder of the year, indicating optimistic expectations for continued growth.

ICE's Strategic Initiatives and Their Role in Driving Growth

ICE's strategic investments and initiatives also played a crucial role in driving this impressive growth. Continuous improvements in technology and innovative product offerings enhanced the trading experience, attracting more market participants.

- Technological investments: Recent investments in high-frequency trading infrastructure and advanced data analytics capabilities significantly improved the speed and efficiency of the trading platforms.

- New product launches: The launch of several new derivative products catered to evolving market demands and attracted new traders to the ICE ecosystem.

- Strategic partnerships: Partnerships with leading financial institutions expanded the reach and accessibility of ICE's trading platforms. This enhanced liquidity and attracted a broader range of participants.

Analyzing the Sustainability of High Trading Volume

While Q1's results were exceptionally positive, the sustainability of these high trading volumes deserves careful consideration. Several factors could influence future trading activity.

- Potential risks: Market corrections, regulatory changes, or a significant decrease in market volatility could negatively impact trading volumes.

- Factors suggesting continuation: Persistent global economic uncertainty and ongoing geopolitical instability could sustain higher levels of trading activity.

Strong Trading Volume Remains Key to ICE's Future Success

In conclusion, the exceptional Q1 performance of Intercontinental Exchange was undeniably fueled by strong trading volume across its NYSE and other exchanges. This surge in trading activity translated directly into significantly higher revenue and profitability, exceeding all expectations. The sustained strength of trading volume will remain critical for ICE's continued growth and future success. To stay informed about ICE's performance and the impact of trading volume on its future, subscribe to our updates, follow ICE's news releases, and continue researching market trends impacting NYSE and ICE trading volume.

Featured Posts

-

Ct A Pristup Medii Konflikt S Denikem N A Seznam Zprav

May 14, 2025

Ct A Pristup Medii Konflikt S Denikem N A Seznam Zprav

May 14, 2025 -

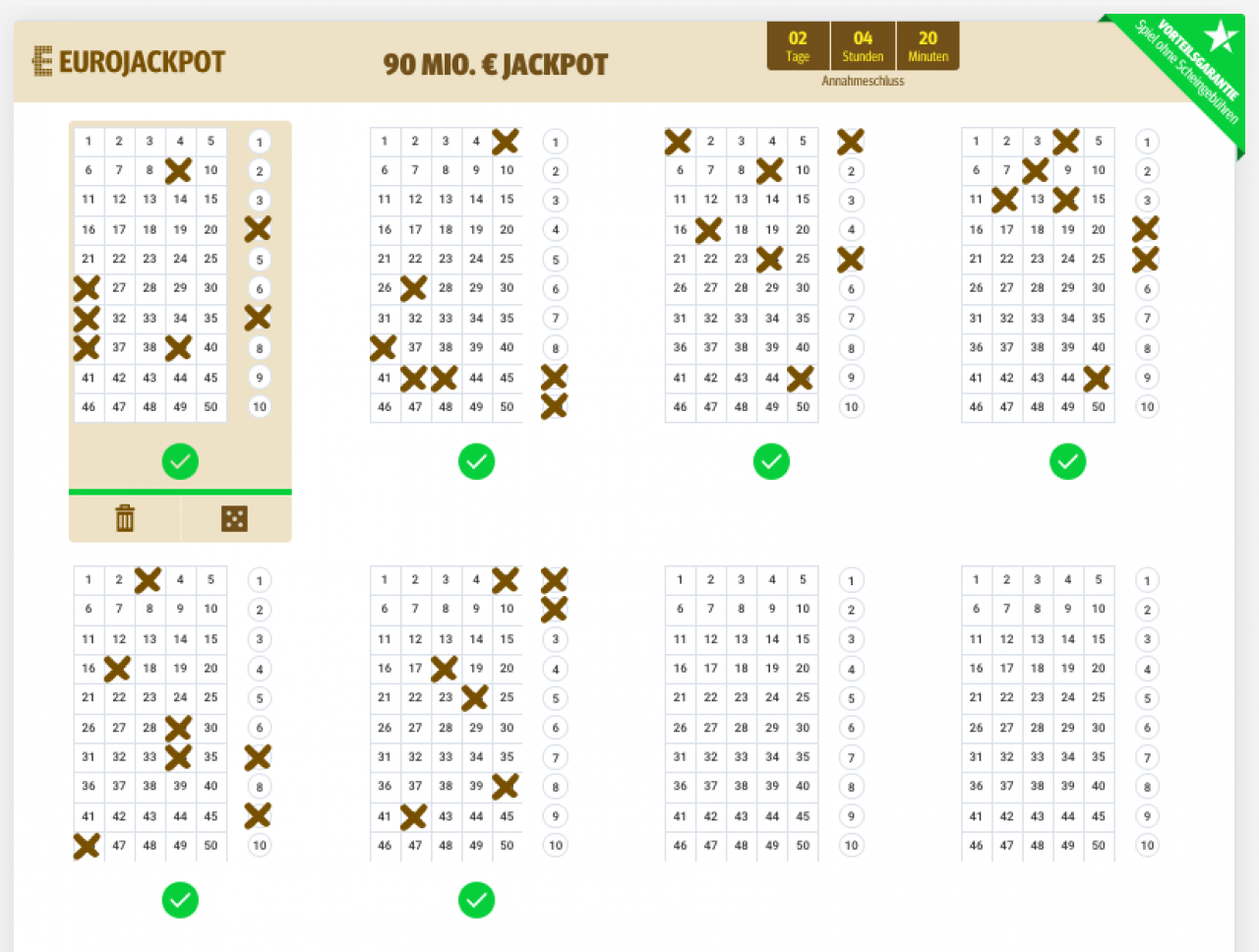

Eurojackpot Gewinnzahlen Freitag 14 Maerz 2025

May 14, 2025

Eurojackpot Gewinnzahlen Freitag 14 Maerz 2025

May 14, 2025 -

Wynonna And Ashley Judd Open Up In New Docuseries

May 14, 2025

Wynonna And Ashley Judd Open Up In New Docuseries

May 14, 2025 -

Kasatkina Officially Australian Wta Ranking Update And First Day Celebration

May 14, 2025

Kasatkina Officially Australian Wta Ranking Update And First Day Celebration

May 14, 2025 -

Complete List Of Celebrities In The Wwe Hall Of Fame

May 14, 2025

Complete List Of Celebrities In The Wwe Hall Of Fame

May 14, 2025