Stronger Earnings Drive Higher Payouts For Vodacom (VOD) Investors

Table of Contents

Vodacom's Q[Quarter] Earnings Report: A Deep Dive

Vodacom's Q[Quarter] financial results showcase impressive growth across key performance indicators. Analyzing Vodacom's Q[Quarter] performance provides a clear picture of why investor payouts are increasing. Let's examine the key figures:

- Revenue Growth: [Insert percentage and actual figures]. This substantial increase reflects [explain reason, e.g., strong growth in data services, expansion into new markets].

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): [Insert figures and percentage growth]. This robust EBITDA demonstrates the company's operational efficiency and profitability. Key contributors include [mention specific factors, e.g., successful cost-cutting initiatives, increased operational efficiency].

- Net Income: [Insert figures and percentage growth]. This significant rise in net income is a direct result of [mention reasons, e.g., increased revenue, improved operational efficiency, and effective cost management].

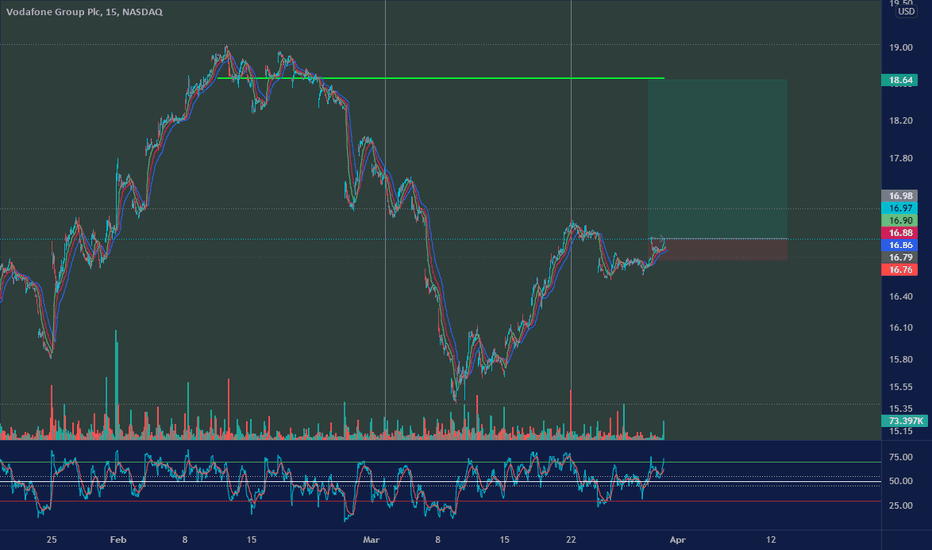

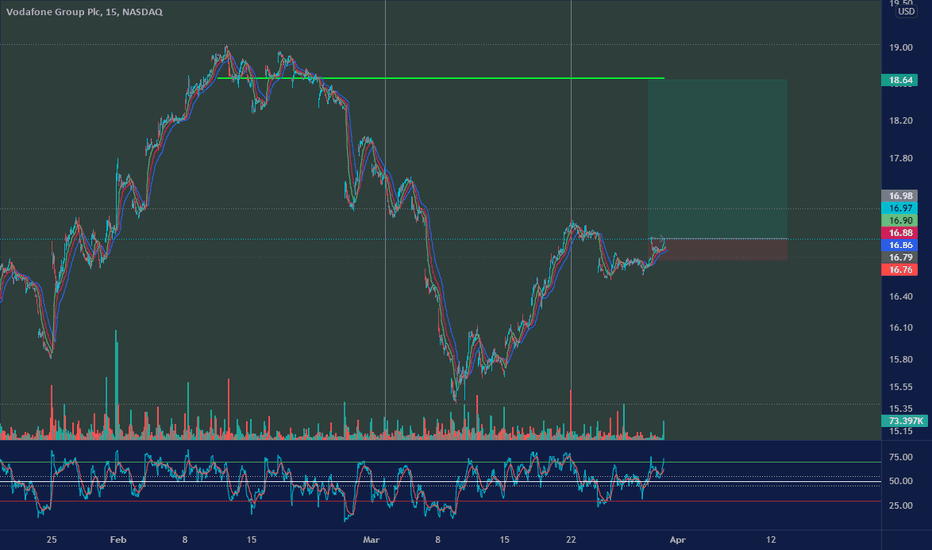

Compared to the previous quarter, Vodacom saw a [percentage]% increase in revenue and a [percentage]% increase in net income. Year-on-year growth is equally impressive, with [percentage]% and [percentage]% increases respectively. [Insert relevant chart or graph visualizing this data]. These strong VOD earnings highlight a positive trajectory for the company.

Increased Dividend Payouts: A Boon for Investors

The improved VOD earnings have directly translated into a significant increase in dividend payouts for shareholders. Vodacom announced a new dividend of [amount] per share, representing a [percentage]% increase compared to the previous payout. This demonstrates Vodacom's commitment to delivering strong shareholder returns.

- Rationale: The increased dividend is supported by Vodacom's strong cash flow and its commitment to rewarding investors. The company's financial strength allows for a higher dividend payout without compromising future investments and growth initiatives.

- Investor Implications: This higher dividend translates to increased income for investors, improving their overall return on investment. For example, an investor holding [number] shares will receive an additional [amount] in dividends.

- Competitive Landscape: Vodacom's dividend yield of [percentage]% compares favorably to its competitors in the telecommunications sector, making it an attractive investment option for income-seeking investors.

Growth Drivers and Future Outlook for Vodacom (VOD)

Vodacom's strong performance is driven by several key factors, ensuring continued growth and potential for future increases in shareholder payouts. These factors contribute to a positive outlook for Vodacom's growth prospects:

- Market Expansion: Vodacom's expansion into new markets and its ongoing investment in network infrastructure are crucial for sustained growth.

- Technological Advancements: Investments in 5G technology and other advancements position Vodacom at the forefront of innovation within the industry.

- Strategic Partnerships: Collaborations with other companies strengthen Vodacom's position and allow for access to wider markets and advanced technologies.

While the future holds exciting opportunities, potential challenges include [mention potential challenges, e.g., increased competition, regulatory changes, economic fluctuations]. However, analysts predict continued growth for Vodacom, with forecasts suggesting [mention analyst forecasts on future earnings and dividend payouts].

Investing in Vodacom (VOD): A Strategic Perspective

Vodacom presents a compelling investment opportunity, but it's essential to consider the associated risks and rewards.

- Investment Profile: Vodacom offers a [describe risk level, e.g., moderate-risk] investment with potential for [describe potential returns, e.g., strong capital appreciation and steady dividend income].

- Pros & Cons: The pros include strong financial performance, a consistent dividend payout, and growth potential. Cons include the inherent risks associated with any stock market investment and exposure to sector-specific challenges.

- Investment Strategies: Investors might consider adding Vodacom to a diversified portfolio as a means of generating income and capital appreciation. Dollar-cost averaging could be a suitable strategy to mitigate risk.

Disclaimer: Investing in stocks carries inherent risks, including the potential for loss of principal. It is essential to conduct thorough research and seek professional financial advice before making any investment decisions.

Conclusion

Vodacom's stronger earnings have directly resulted in higher dividend payouts for its investors, highlighting the direct correlation between a company's financial performance and shareholder returns. The Q[Quarter] earnings report demonstrates impressive growth across key metrics, paving the way for continued success. The company's positive growth drivers and promising future outlook reinforce its appeal as an attractive investment opportunity. Considering the stronger earnings driving higher payouts for Vodacom (VOD) investors, now is an opportune time to explore investment opportunities. Learn more about Vodacom's investment prospects today!

Featured Posts

-

Soap Star Susan Luccis Prank On Michael Strahan

May 20, 2025

Soap Star Susan Luccis Prank On Michael Strahan

May 20, 2025 -

Germany Nations League Squad Goretzka Included By Nagelsmann

May 20, 2025

Germany Nations League Squad Goretzka Included By Nagelsmann

May 20, 2025 -

Patra Breite Ton Efimereyonta Iatro Sas Ayto To Savvatokyriako

May 20, 2025

Patra Breite Ton Efimereyonta Iatro Sas Ayto To Savvatokyriako

May 20, 2025 -

Dzeko Ve Tadic Mourinho Nun Takimindaki Rolue

May 20, 2025

Dzeko Ve Tadic Mourinho Nun Takimindaki Rolue

May 20, 2025 -

Pro D2 Asbh A Biarritz Un Test Mental Crucial

May 20, 2025

Pro D2 Asbh A Biarritz Un Test Mental Crucial

May 20, 2025