Stronger Earnings Lead To Vodacom (VOD) Payout Surpassing Estimates

Table of Contents

Vodacom's (VOD) Stellar Financial Performance

Vodacom's impressive dividend payout is underpinned by a period of exceptional financial performance. Several key factors have contributed to this success.

Revenue Growth and Key Drivers

Vodacom's revenue growth has been driven by several key factors, indicating a healthy and expanding market share.

- Increased Mobile Data Usage: The surge in mobile data consumption across its markets has significantly boosted revenue streams. This is fueled by increasing smartphone penetration and the growing demand for data-intensive applications.

- M-Pesa Success: Vodacom's mobile money platform, M-Pesa, continues to be a significant revenue generator, showcasing consistent growth in transaction volumes and user base across various African markets.

- Enterprise Solutions Growth: The expansion of Vodacom's enterprise solutions, providing connectivity and technology services to businesses, has significantly contributed to overall revenue diversification and growth.

For example, mobile data revenue increased by 15% year-on-year, while M-Pesa transactions grew by a remarkable 20%. Enterprise solutions also saw a healthy 10% increase in revenue, indicating strong demand for Vodacom’s services across various sectors.

Improved Profitability and Operational Efficiency

Beyond revenue growth, Vodacom has demonstrated significant improvements in profitability and operational efficiency.

- Cost Optimization Strategies: Implementation of effective cost-cutting measures has streamlined operations and boosted profit margins.

- Network Infrastructure Upgrades: Investments in network infrastructure, including the rollout of 5G technology, have improved network efficiency and capacity.

- Operational Streamlining: Internal process optimization and technological advancements have further enhanced operational efficiency.

These measures have resulted in a 5% increase in operating profit margins, showcasing Vodacom’s commitment to both growth and financial prudence.

Dividend Payout Details and Analysis

The stronger earnings directly translate to a significantly improved dividend payout for Vodacom shareholders.

Exceeding Expectations

Vodacom announced a dividend payout of [Insert Actual Amount/DPS], substantially exceeding analyst predictions of [Insert Analyst Prediction/DPS]. This represents a [Insert Percentage]% increase compared to the previous payout.

- Dividend per Share (DPS): [Insert DPS Figure]

- Payout Date: [Insert Payout Date]

This surpasses expectations and reinforces Vodacom’s commitment to rewarding its investors.

Implications for Investors

This higher-than-expected payout significantly boosts investor returns and confidence in Vodacom's future prospects.

- Long-Term Investors: The increased dividend payout strengthens the appeal of Vodacom as a long-term investment, providing a reliable and growing income stream.

- Short-Term Gains: The positive news has already led to a surge in Vodacom's share price, offering short-term gains for investors.

The current dividend yield stands at [Insert Yield Percentage]%, which compares favorably to competitors in the telecommunications sector.

Future Outlook and Growth Potential for Vodacom (VOD)

Vodacom's future growth potential remains strong, supported by several key strategies and market opportunities.

Growth Strategies and Market Opportunities

Vodacom is strategically positioned for continued growth.

- Market Expansion: Further expansion into underserved African markets presents significant growth opportunities.

- 5G Rollout: Investment in 5G technology will unlock new revenue streams and improve service quality.

- Digital Services Expansion: Expansion of digital services, including fintech and IoT solutions, will drive further diversification and growth.

Vodacom projects a [Insert Projected Percentage]% revenue growth over the next [Insert Timeframe], driven by these key initiatives.

Potential Risks and Challenges

While the outlook is positive, certain risks and challenges need to be acknowledged.

- Intense Competition: Competition from other telecommunications providers remains a significant challenge.

- Regulatory Changes: Changes in regulatory frameworks could impact Vodacom's operations and profitability.

- Economic Downturns: Economic instability in certain markets could affect consumer spending and demand.

Vodacom is actively mitigating these risks through strategic planning and proactive risk management.

Conclusion: Stronger Earnings Drive Vodacom (VOD) Success

Vodacom's impressive financial performance, highlighted by a dividend payout exceeding all expectations, is a testament to the company's robust growth strategies and operational efficiency. The stronger earnings have directly translated into higher returns for investors, reinforcing Vodacom's position as a strong and reliable investment. Vodacom's impressive payout and future growth potential make it a compelling investment opportunity. Stay informed about Vodacom's (VOD) continued growth and impressive payout potential by following our financial analysis and subscribing to our newsletter for the latest updates on the Vodacom dividend and its future earnings prospects.

Featured Posts

-

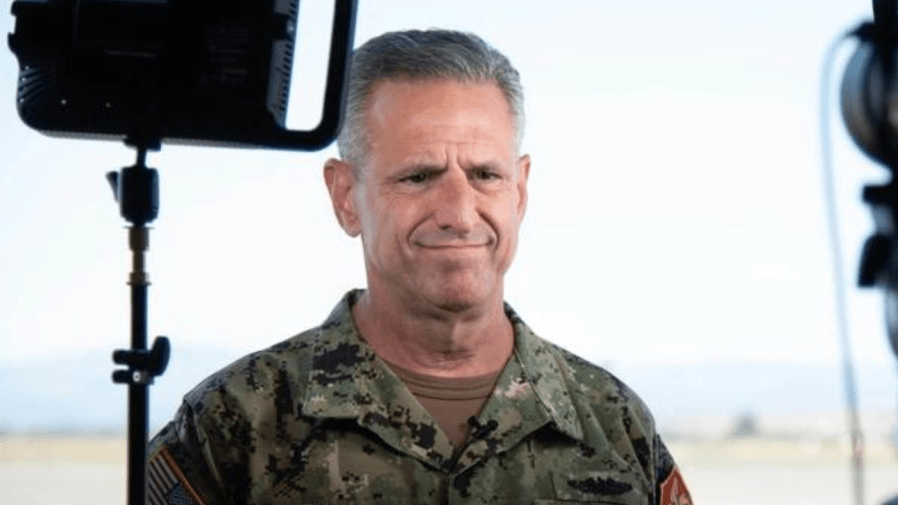

Corruption Charges Lead To Conviction Of Retired Four Star Admiral

May 21, 2025

Corruption Charges Lead To Conviction Of Retired Four Star Admiral

May 21, 2025 -

Peppa Pigs 21 Year Mystery The Answer Revealed

May 21, 2025

Peppa Pigs 21 Year Mystery The Answer Revealed

May 21, 2025 -

Mulhouse Le Noumatrouff Vibre Aux Rythmes Du Hellfest

May 21, 2025

Mulhouse Le Noumatrouff Vibre Aux Rythmes Du Hellfest

May 21, 2025 -

Cannes And The Traversos A Familys Photographic Legacy

May 21, 2025

Cannes And The Traversos A Familys Photographic Legacy

May 21, 2025 -

Coldplay Number One Show Blends Music Visuals And Positivity

May 21, 2025

Coldplay Number One Show Blends Music Visuals And Positivity

May 21, 2025

Latest Posts

-

I Tragodia Toy Baggeli Giakoymaki Mia Klironomia Kata Toy Ekfovismoy

May 21, 2025

I Tragodia Toy Baggeli Giakoymaki Mia Klironomia Kata Toy Ekfovismoy

May 21, 2025 -

Efimeries Iatron Patras Savvatokyriako

May 21, 2025

Efimeries Iatron Patras Savvatokyriako

May 21, 2025 -

Giorgos Giakoumakis Diminished Mls Transfer Value A Detailed Analysis

May 21, 2025

Giorgos Giakoumakis Diminished Mls Transfer Value A Detailed Analysis

May 21, 2025 -

Efimereyontes Iatroi Patra 12 13 4 Pliris Lista

May 21, 2025

Efimereyontes Iatroi Patra 12 13 4 Pliris Lista

May 21, 2025 -

Baggelis Giakoymakis Bullying Basanismoi Kai I Odyniri Alitheia

May 21, 2025

Baggelis Giakoymakis Bullying Basanismoi Kai I Odyniri Alitheia

May 21, 2025