Student Loans And Mortgages: Understanding The Challenges And Solutions

Table of Contents

The weight of student loan debt is heavier than ever before, with millions struggling to manage repayments. Adding the significant financial commitment of a mortgage to this already substantial burden creates a unique set of challenges for young adults entering the workforce. This article addresses the complex interplay of student loans and mortgages, exploring the difficulties they present and offering practical solutions to navigate this demanding financial landscape. We'll delve into the financial strain, explore effective management strategies, and highlight potential sources of assistance to help you effectively manage your debt.

H2: The Financial Burden of Student Loans and Mortgages

Successfully juggling student loan repayments and mortgage payments can feel like an insurmountable task. The combined weight of these financial obligations creates significant hurdles, impacting various aspects of your financial well-being.

H3: High Debt-to-Income Ratio

A high debt-to-income (DTI) ratio is a common consequence of simultaneously managing substantial student loan debt and mortgage payments. This ratio, calculated by dividing your total monthly debt payments by your gross monthly income, significantly impacts your credit score and future financial opportunities.

- Example: A typical student loan payment might be $500 per month, while a mortgage payment could easily exceed $1500. Combined with other expenses, this can quickly lead to a DTI ratio exceeding 43%, making it difficult to qualify for further credit, such as auto loans or credit cards.

- Impact on Credit Scores: A high DTI ratio negatively affects your creditworthiness, potentially leading to higher interest rates on future loans and impacting your ability to secure favorable terms. Lenders view a high DTI as an indicator of increased financial risk.

- Keyword Integration: Managing your student loan debt and mortgage payments effectively requires careful attention to your debt-to-income ratio.

H3: Limited Financial Flexibility

The substantial monthly payments associated with student loans and mortgages severely restrict financial flexibility. This financial strain significantly limits your ability to pursue other important financial goals.

- Saving for Retirement: Allocating funds for retirement savings becomes a challenge when a large portion of your income is already committed to debt repayment.

- Emergency Funds: Building an emergency fund to cover unexpected expenses (job loss, medical emergencies) becomes difficult, leaving you vulnerable to unforeseen financial crises.

- Investing: Opportunities for investing in your future, such as stocks or real estate, are significantly limited due to the substantial financial commitments already in place.

- Career Changes/Further Education: Pursuing a career change or returning to school for further education becomes a risky proposition due to the added financial burden.

- Keyword Integration: The resulting financial strain and budget constraints necessitate careful managing finances to achieve a sustainable financial situation.

H2: Strategies for Managing Student Loans and Mortgages

Effectively managing the combined burden of student loans and mortgages requires a proactive and strategic approach encompassing budgeting, refinancing, and exploring government assistance programs.

H3: Budgeting and Financial Planning

A detailed budget is the cornerstone of effective debt management. Prioritizing payments and tracking expenses meticulously are crucial steps towards gaining control of your finances.

- Budgeting Apps and Tools: Utilize budgeting apps like Mint, YNAB (You Need a Budget), or Personal Capital to track income and expenses, automate savings, and gain valuable insights into your spending habits.

- Tracking Expenses: Regularly monitor your spending to identify areas where you can reduce expenses and free up funds for debt repayment.

- The 50/30/20 Rule: Consider following the 50/30/20 rule, allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Keyword Integration: Implementing sound budgeting strategies and utilizing effective financial planning tools are essential for successful debt management.

H3: Refinancing Options

Refinancing your student loans or mortgage can potentially lower your monthly payments by securing a lower interest rate. However, careful consideration of the pros and cons is crucial.

- Student Loan Refinancing: Consolidating multiple student loans into a single loan with a lower interest rate can simplify payments and potentially reduce the overall cost.

- Mortgage Refinancing: Refinancing your mortgage can lower your monthly payment, but closing costs and potential penalties should be factored into the decision.

- Eligibility: Eligibility for refinancing depends on your credit score, income, and the overall health of your financial situation. A good credit score is usually a prerequisite.

- Keyword Integration: Explore student loan refinancing and mortgage refinancing options to secure lower interest rates.

H3: Exploring Government Assistance Programs

Several government programs might offer assistance with student loan payments or mortgage payments, depending on your circumstances and location.

- Income-Driven Repayment Plans (IDR): These plans adjust your student loan payments based on your income and family size.

- Public Service Loan Forgiveness (PSLF): This program can forgive remaining student loan debt after 10 years of qualifying public service.

- Mortgage Assistance Programs: Several programs offer assistance to homeowners facing financial hardship, such as forbearance or modification options. Research programs available in your area.

- Keyword Integration: Research available government student loan programs and mortgage assistance programs to access potential financial aid.

Conclusion:

The simultaneous management of student loans and mortgages presents significant financial challenges, including high DTI ratios and limited financial flexibility. However, by implementing effective budgeting strategies, exploring refinancing options, and researching available government assistance programs, you can significantly mitigate these challenges. Take proactive steps towards managing your debt effectively. Create a detailed budget, explore refinancing possibilities, and investigate government assistance programs tailored to your situation. Solving student loan and mortgage challenges requires careful planning and proactive management to secure a stable and sustainable financial future. Don't hesitate to seek professional financial advice if needed – mastering the complexities of managing student loan debt and mortgage payments effectively is achievable with the right strategies and support.

Featured Posts

-

Can You Buy A House While Paying Off Student Loans

May 17, 2025

Can You Buy A House While Paying Off Student Loans

May 17, 2025 -

Ubers Future Is It A Good Long Term Investment

May 17, 2025

Ubers Future Is It A Good Long Term Investment

May 17, 2025 -

Potential Wnba Strike Angel Reeses Perspective On Player Compensation

May 17, 2025

Potential Wnba Strike Angel Reeses Perspective On Player Compensation

May 17, 2025 -

10 Critically Acclaimed Tv Shows Cancelled Too Soon

May 17, 2025

10 Critically Acclaimed Tv Shows Cancelled Too Soon

May 17, 2025 -

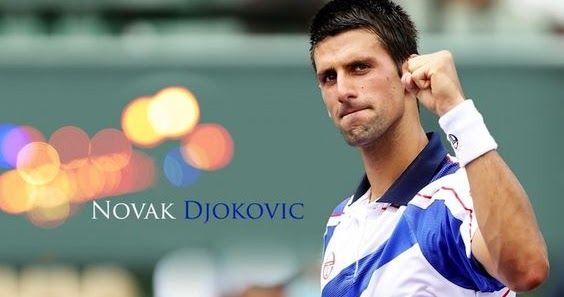

Novak Djokovic Kortlarda Zirvenin Yenilmez Krali

May 17, 2025

Novak Djokovic Kortlarda Zirvenin Yenilmez Krali

May 17, 2025