Suncor: High Production, Lower Sales Due To Inventory Increase

Table of Contents

Record Production Levels at Suncor

Suncor's recent financial reports showcase impressive growth in oil production, yet this hasn't translated into proportionally higher sales. Understanding the reasons behind this discrepancy is key to grasping the current situation.

Increased Oil Sands Extraction

Suncor's oil production has seen a substantial increase, significantly exceeding previous years. This surge can be attributed to several factors, all contributing to a higher "Suncor oil production" output.

- Quantifiable data: Suncor's Q[Insert Quarter] 2024 oil sands production reached [Insert specific number] barrels per day, a [percentage]% increase compared to the same period last year. This represents a significant jump in "Suncor output."

- Contributing projects: The expansion of the Fort Hills and other oil sands projects has played a crucial role in this increased "Suncor oil production."

- Year-over-year comparison: Compared to Q[Insert Quarter] 2023, the current production represents a notable increase in "oil sands production," showcasing the company's success in extraction.

Operational Efficiency Improvements

Beyond simply expanding operations, Suncor has implemented several initiatives to boost operational efficiency, leading to higher "Suncor oil production" with improved cost-effectiveness.

- Technological advancements: The implementation of advanced technologies in extraction and processing has streamlined operations and minimized downtime. This has directly impacted "Suncor efficiency."

- Process streamlining: Internal process improvements and optimized workflows have contributed to increased productivity and reduced operational costs. This focus on "production optimization" is crucial for profitability.

- Quantifiable efficiency gains: These improvements have resulted in a [percentage]% reduction in operational costs per barrel produced, further highlighting the success of "Suncor efficiency" improvements.

The Impact of Increased Suncor Inventory

The substantial increase in Suncor inventory is the primary factor behind the disconnect between production and sales. This "Suncor inventory glut" warrants careful examination.

Reasons for Inventory Buildup

Several factors have contributed to the significant rise in "Suncor inventory levels."

- Weakening global demand: Reduced global oil demand, influenced by economic slowdowns and shifts towards renewable energy, has impacted the ability to sell the increased "Suncor output."

- Pipeline constraints: Bottlenecks in pipeline capacity have limited the ability to efficiently transport and distribute the oil produced, thus contributing to the "inventory glut."

- Refining capacity limitations: Insufficient refining capacity, either internally or through third-party agreements, further exacerbates the issue of managing the increased "Suncor inventory levels."

Financial Implications of High Inventory

Holding large quantities of oil in storage carries significant financial consequences.

- Storage costs and price fluctuations: The costs associated with storing large volumes of oil, coupled with the risk of price volatility, can lead to substantial financial losses. These are significant factors impacting "Suncor financials."

- Impact on profitability and cash flow: The inability to quickly convert increased production into sales directly impacts profitability and cash flow, putting pressure on "Suncor financials."

- Potential write-downs or impairments: In extreme cases, prolonged periods of high inventory may necessitate write-downs or impairments of asset values, further impacting "Suncor financials."

Market Dynamics and Future Outlook for Suncor

Understanding the broader energy market and Suncor's strategy are crucial to predicting its future performance.

Global Oil Market Conditions

The global oil market remains volatile and unpredictable.

- Oil price volatility: Current oil prices are subject to significant fluctuations influenced by geopolitical events and global economic conditions. Analyzing the "oil price forecast" is vital.

- Future oil demand predictions: Forecasts for future "global oil demand" vary, making it challenging to predict the pace at which Suncor can reduce its inventory.

- Geopolitical factors: Geopolitical instability in various oil-producing regions continues to impact the "global oil demand" and overall market stability.

Suncor's Strategy to Manage Inventory

Suncor is implementing various strategies to address its high "Suncor inventory levels."

- Increasing refining capacity: Expanding refining capabilities will allow Suncor to process more of its own production, reducing reliance on external markets. This is central to their "inventory management" strategy.

- Sales strategies: Suncor is likely employing various "sales strategies" to increase sales and reduce inventory, including potentially offering discounts or adjusting sales targets.

- Improved pipeline access: Securing increased pipeline access is crucial for improving distribution and alleviating the pressure on "Suncor inventory." This improves their overall "inventory management."

Conclusion

Suncor's recent performance illustrates the intricate relationship between production, market demand, and efficient "Suncor inventory management" within the energy sector. While the company achieved impressive production gains, the resulting "Suncor inventory glut" poses a significant financial challenge. Understanding the reasons behind the increased Suncor inventory and the company's strategies to resolve the situation is crucial for investors and industry analysts alike. Monitoring the evolution of the Suncor inventory situation and the company's response to market dynamics remains vital for anyone interested in the future of this energy giant. Continue to follow developments regarding the Suncor inventory to gain further insights.

Featured Posts

-

Lais Ve Day Speech A Warning Against Rising Totalitarianism In Taiwan

May 09, 2025

Lais Ve Day Speech A Warning Against Rising Totalitarianism In Taiwan

May 09, 2025 -

Nyt Strands Wednesday Puzzle April 9 2025 Clues And Spangram Help

May 09, 2025

Nyt Strands Wednesday Puzzle April 9 2025 Clues And Spangram Help

May 09, 2025 -

Silniy Snegopad Aeroport Permi Zakryt Do 4 00 Utra

May 09, 2025

Silniy Snegopad Aeroport Permi Zakryt Do 4 00 Utra

May 09, 2025 -

Hot Mic Exposes Colapinto Sponsor Breaking F1 News

May 09, 2025

Hot Mic Exposes Colapinto Sponsor Breaking F1 News

May 09, 2025 -

Britannian Kruununperimysjaerjestys Paeivitetty Lista Ja Selitys

May 09, 2025

Britannian Kruununperimysjaerjestys Paeivitetty Lista Ja Selitys

May 09, 2025

Latest Posts

-

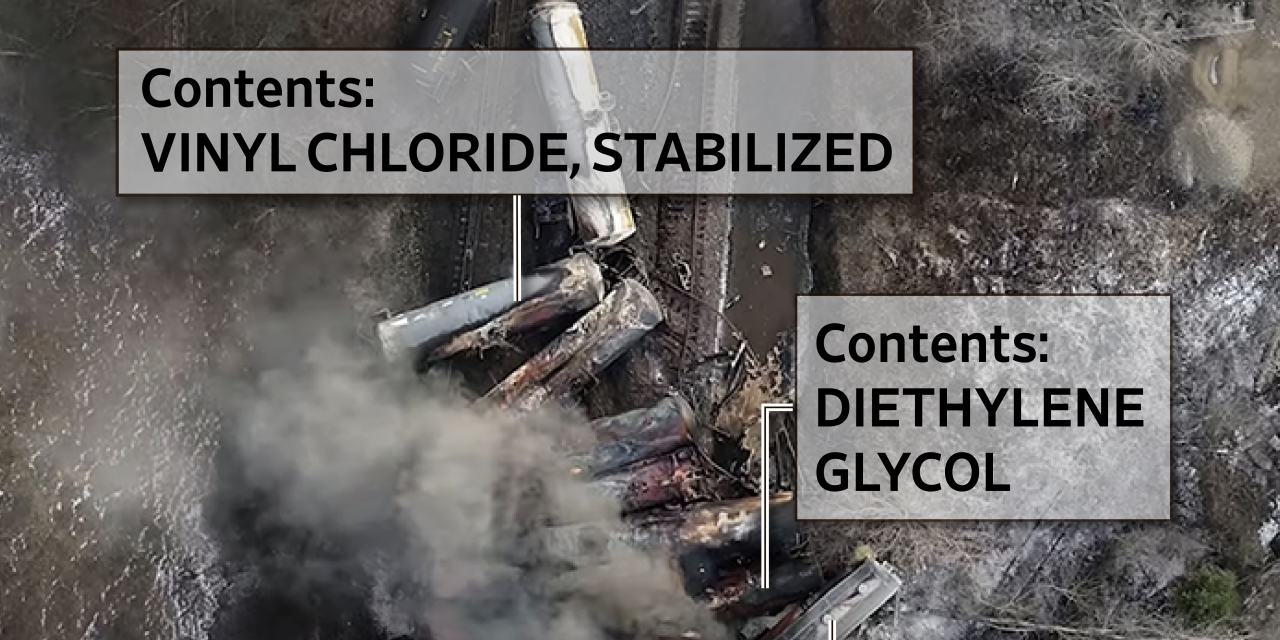

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025 -

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025 -

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025 -

Cybercriminals Office365 Scheme Nets Millions Federal Indictment

May 10, 2025

Cybercriminals Office365 Scheme Nets Millions Federal Indictment

May 10, 2025 -

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025