Sustainable Funding Options For Small And Medium Businesses

Table of Contents

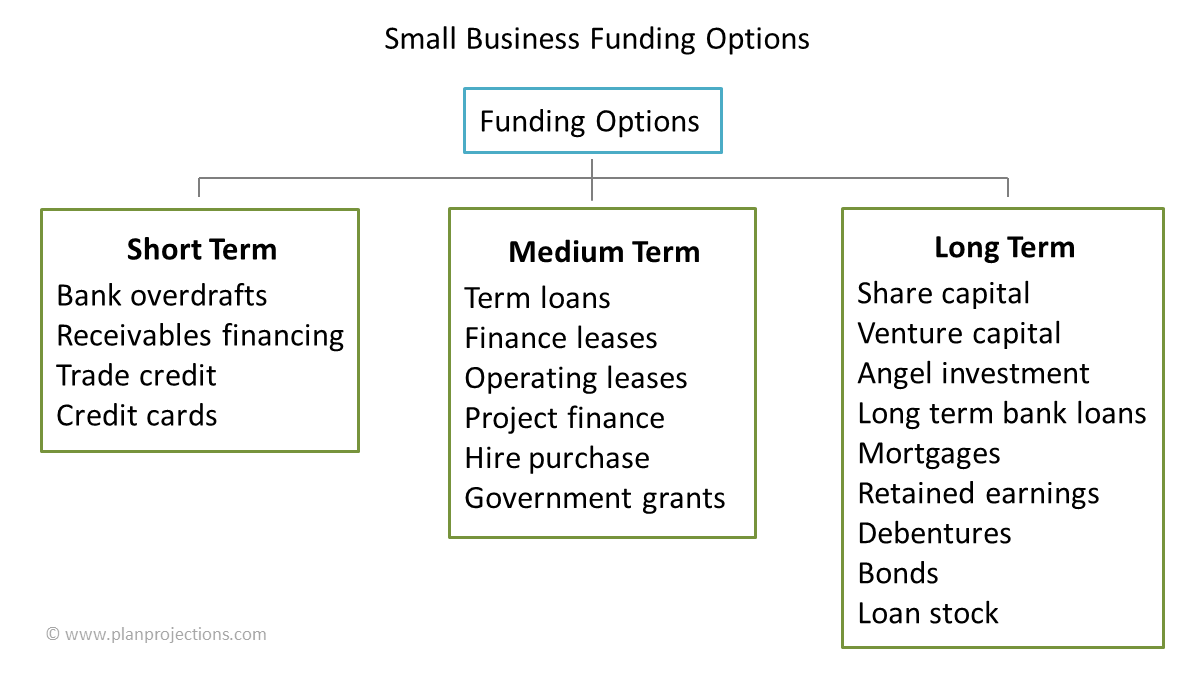

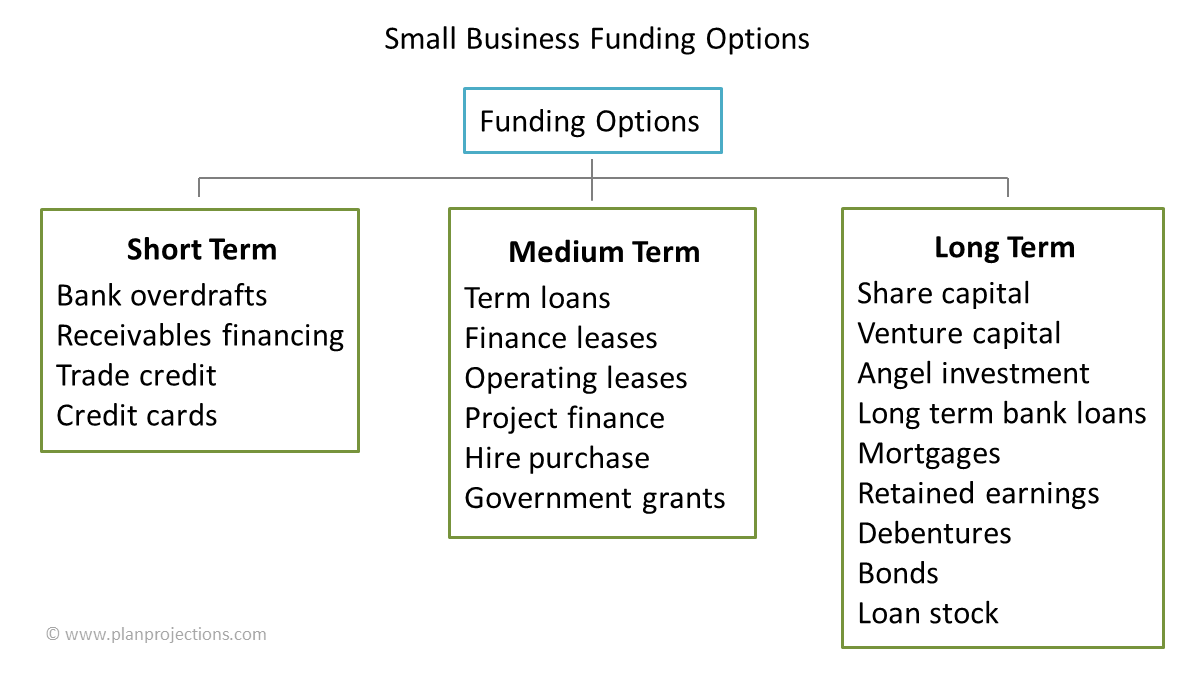

Traditional Funding with a Sustainable Twist

Traditional funding methods can be adapted to support sustainable business practices, offering a blend of familiar structures and environmentally conscious goals.

Green Business Loans

Many financial institutions now offer green business loans specifically designed to support environmentally friendly initiatives. These loans often come with attractive terms, including lower interest rates and government incentives, making them a compelling option for eco-conscious businesses. Banks and credit unions with strong ESG lending programs are particularly well-suited to providing these types of loans.

- Examples of qualifying green initiatives:

- Renewable energy installations (solar panels, wind turbines)

- Energy efficiency upgrades (LED lighting, insulation improvements)

- Sustainable waste management systems (recycling programs, composting)

- Implementing water conservation technologies

- Investing in electric vehicle fleets

Sustainable Investment from Angel Investors and Venture Capital

Attracting angel investors and venture capitalists who prioritize impact investing and ESG factors requires a strong demonstration of your company's commitment to sustainability. Prepare a comprehensive sustainability report showcasing your environmental and social impact. This report will be a crucial element in your pitch.

- Strategies for highlighting your business's social and environmental impact:

- Quantify your environmental footprint reduction (e.g., carbon emissions saved).

- Detail your social initiatives (e.g., fair labor practices, community involvement).

- Present a clear roadmap for future sustainability goals.

- Showcase measurable results and progress towards your ESG targets.

Alternative and Innovative Funding Sources

Beyond traditional routes, several alternative funding sources cater specifically to sustainable businesses.

Crowdfunding Platforms for Sustainable Businesses

Platforms like Kickstarter and Indiegogo provide avenues to raise capital through crowdfunding, building brand awareness simultaneously. A compelling campaign highlighting your sustainability efforts can resonate strongly with environmentally and socially conscious consumers.

- Tips for creating a successful crowdfunding campaign:

- Clearly articulate your business's mission and its positive social/environmental impact.

- Offer compelling rewards to backers, aligning with your sustainable ethos.

- Utilize strong visuals and storytelling to engage your audience.

- Actively engage with potential backers on social media and other platforms.

Grants and Subsidies for Sustainable Initiatives

Numerous government agencies and private foundations offer grants and subsidies to support sustainable business practices. Thorough research is key to identifying relevant opportunities and crafting strong grant applications.

- Strategies for researching and applying for relevant grants and subsidies:

- Identify relevant government agencies and private foundations.

- Scrutinize grant criteria meticulously and tailor your application accordingly.

- Develop a strong narrative highlighting the impact of your project.

- Seek professional assistance with grant writing if needed.

Social Impact Bonds (SIBs)

Social Impact Bonds (SIBs) represent a results-based financing model where investors provide funding for social programs, with repayments contingent upon achieving pre-defined social outcomes. This approach is particularly suitable for businesses with a clear and measurable social impact.

- Examples of successful SIB projects:

- Reducing recidivism through rehabilitation programs.

- Improving educational outcomes in underprivileged communities.

- Enhancing healthcare access in underserved areas.

Improving Your Access to Sustainable Funding

Proactive steps can significantly enhance your ability to secure sustainable funding.

Developing a Strong Sustainability Report

A transparent and verifiable sustainability report is crucial. It showcases your commitment to ESG principles and provides potential investors with the confidence needed to support your business. Consider using established frameworks like the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB) to guide your reporting.

- Key performance indicators (KPIs) to include in your sustainability report:

- Greenhouse gas emissions

- Energy consumption

- Water usage

- Waste generation

- Employee well-being

- Community engagement

Building Relationships with Impact Investors

Networking is essential for connecting with impact investors who prioritize sustainability. Demonstrate a thorough understanding of ESG principles and their relevance to your business model.

- Networking strategies:

- Attend industry conferences and events focused on sustainable business and impact investing.

- Engage with impact investors on social media and online platforms.

- Join relevant industry associations and networks.

Seeking Professional Guidance

Engaging sustainable business consultants and financial advisors can provide valuable expertise and personalized strategies tailored to your specific business needs and goals.

- Types of experts who can assist:

- Sustainable business consultants

- Financial advisors specializing in ESG investing

- Grant writing specialists

Conclusion

Securing sustainable funding is paramount for the long-term viability and success of SMBs. By exploring the diverse options outlined above – from green business loans and sustainable investments to crowdfunding, grants, and Social Impact Bonds – you can access the capital needed to achieve your business goals while minimizing your environmental impact and maximizing your positive social contributions. Remember to emphasize your commitment to ESG principles, develop a compelling sustainability report, and build strong relationships with impact investors. Don't delay; explore these sustainable funding options today and pave the way for a prosperous and responsible future for your business.

Featured Posts

-

Iran Issues Death Penalties In Mosque Attack Case

May 19, 2025

Iran Issues Death Penalties In Mosque Attack Case

May 19, 2025 -

Orlando Healths Brevard County Hospital Closure Impact And Future Plans

May 19, 2025

Orlando Healths Brevard County Hospital Closure Impact And Future Plans

May 19, 2025 -

Cooke Maroney And Jennifer Lawrence Seen Out Confirmation Of Second Child Speculation

May 19, 2025

Cooke Maroney And Jennifer Lawrence Seen Out Confirmation Of Second Child Speculation

May 19, 2025 -

Park Music Festivals Cancelled Following Court Ruling

May 19, 2025

Park Music Festivals Cancelled Following Court Ruling

May 19, 2025 -

College Admissions Balancing Merit And Diversity In A Changing Landscape

May 19, 2025

College Admissions Balancing Merit And Diversity In A Changing Landscape

May 19, 2025