Swissquote Bank: Analyzing The Euro's Rise Against A Falling US Dollar

Table of Contents

Understanding the Current Euro/USD Exchange Rate Dynamics

Factors Contributing to the Euro's Strength

The recent strengthening of the Euro against the US dollar is a result of several interconnected factors:

-

Increased European Central Bank (ECB) Interest Rates: The ECB's aggressive interest rate hikes aim to combat inflation within the Eurozone. Higher interest rates make Euro-denominated assets more attractive to investors seeking higher returns, increasing demand for the Euro. Data from the ECB shows a steady increase in key interest rates throughout 2023, impacting the Euro/USD exchange rate positively. [Link to ECB data]

-

Improving Eurozone Economic Outlook: While challenges remain, the Eurozone's economic outlook has shown signs of resilience. Improved economic forecasts and positive growth projections contribute to investor confidence, boosting demand for the Euro. [Link to reputable economic forecast]

-

Geopolitical Factors Impacting the Dollar: Geopolitical instability and uncertainty surrounding the US dollar's global role have contributed to its decline. Concerns about the US economy and its political landscape can lead investors to seek alternative currencies, weakening the dollar's value. [Link to relevant news source discussing geopolitical impacts]

-

Weakening US Economic Data (Inflation, GDP Growth): Persistent inflation in the US and slower-than-expected GDP growth have raised concerns about the US economy's health. These factors negatively impact investor confidence in the dollar, driving down its value relative to the Euro. [Link to US economic data sources like the Federal Reserve]

Factors Contributing to the US Dollar's Weakness

The US dollar's recent weakness is multifaceted:

-

Federal Reserve's Monetary Policy Shifts: The Federal Reserve's efforts to control inflation through interest rate hikes have had a mixed impact. While aiming to curb inflation, these actions also contribute to a slowing economy, making the dollar less attractive. [Link to Federal Reserve statements on monetary policy]

-

Persistent Inflation Concerns in the US: High inflation erodes the purchasing power of the dollar, making it less desirable as a store of value. Until inflation is brought under control, the dollar may continue to experience downward pressure. [Link to US inflation data]

-

Political Uncertainty: Political instability and uncertainty within the US can negatively impact investor confidence, leading to a decline in the dollar's value. [Link to relevant news sources discussing political impact]

-

Global Economic Slowdown Impacting the Dollar's Safe-Haven Status: The dollar traditionally serves as a safe-haven currency during times of global economic uncertainty. However, a global economic slowdown can diminish this status, leading investors to seek more stable currencies, weakening the dollar's appeal. [Link to reports on global economic slowdown]

Swissquote Bank's Role in Navigating the Euro/USD Market

Trading the Euro/USD with Swissquote

Swissquote Bank provides a comprehensive platform for trading the Euro/USD currency pair:

-

Forex Trading Platform: Swissquote offers a user-friendly and advanced forex trading platform with access to a wide range of currency pairs, including the Euro/USD. [Link to Swissquote's platform description]

-

Margin Trading: Leverage margin trading to amplify your potential profits (and losses) but always remember the increased risk involved. Swissquote provides clear information on margin requirements. [Link to Swissquote's margin trading information]

-

Technical Analysis Tools: Access sophisticated charting tools, indicators, and other technical analysis resources to assist in your trading decisions. [Link to Swissquote's technical analysis tools]

-

Competitive Spreads and Trading Conditions: Swissquote is known for offering competitive spreads and favorable trading conditions, enhancing your profitability. [Link to Swissquote's pricing information]

Effective risk management is crucial when trading volatile currency pairs like the Euro/USD. Utilize:

-

Stop-Loss Orders: Protect your capital by automatically closing your position when the price reaches a predetermined level.

-

Take-Profit Orders: Secure your profits by automatically closing your position when the price reaches a target level.

-

Position Sizing: Manage your risk by carefully determining the appropriate size of your trades based on your risk tolerance.

Swissquote's Market Analysis and Resources

Swissquote provides a wealth of resources to help traders understand and analyze the Euro/USD exchange rate:

-

Market Analysis Tools: Access real-time market data, charts, and insightful analysis to inform your trading strategies. [Link to Swissquote's market analysis tools]

-

Research Reports: Benefit from expert-driven research reports and market commentary to gain deeper insights into macroeconomic trends. [Link to Swissquote's research reports]

-

Educational Resources: Enhance your trading knowledge with educational materials, webinars, and tutorials provided by Swissquote. [Link to Swissquote's educational resources]

-

Economic Calendar: Stay updated on upcoming economic events that can significantly impact the Euro/USD exchange rate. [Link to Swissquote's economic calendar]

By combining Swissquote's resources with your own independent analysis, you can make more informed trading decisions.

Conclusion

The recent rise of the Euro against the US dollar is a complex phenomenon driven by a confluence of factors, including ECB monetary policy, the Eurozone's economic outlook, geopolitical events, and the weakness of the US economy. Swissquote Bank offers a comprehensive platform and valuable resources to help traders effectively navigate this dynamic market. Understanding these factors and utilizing the tools and analysis offered by Swissquote empowers traders to make informed decisions and potentially capitalize on the fluctuating Euro/USD exchange rate.

Call to Action: Stay informed on the dynamic Euro/USD exchange rate and leverage the resources and tools available at Swissquote Bank. Start trading the Euro/USD currency pair confidently with Swissquote’s user-friendly platform and expert market analysis. Learn more about Swissquote's forex trading options and capitalize on the opportunities presented by the fluctuating Euro/USD exchange rate today. Visit Swissquote Bank's website to explore your trading options. [Link to Swissquote's website]

Featured Posts

-

Credit Mutuel Am Et Les Risques Geopolitiques Pour L Environnement Maritime

May 19, 2025

Credit Mutuel Am Et Les Risques Geopolitiques Pour L Environnement Maritime

May 19, 2025 -

Ta Onomastiria Toy Ierosolymon T Heofiloy Imera Giortis Kai Paradosi

May 19, 2025

Ta Onomastiria Toy Ierosolymon T Heofiloy Imera Giortis Kai Paradosi

May 19, 2025 -

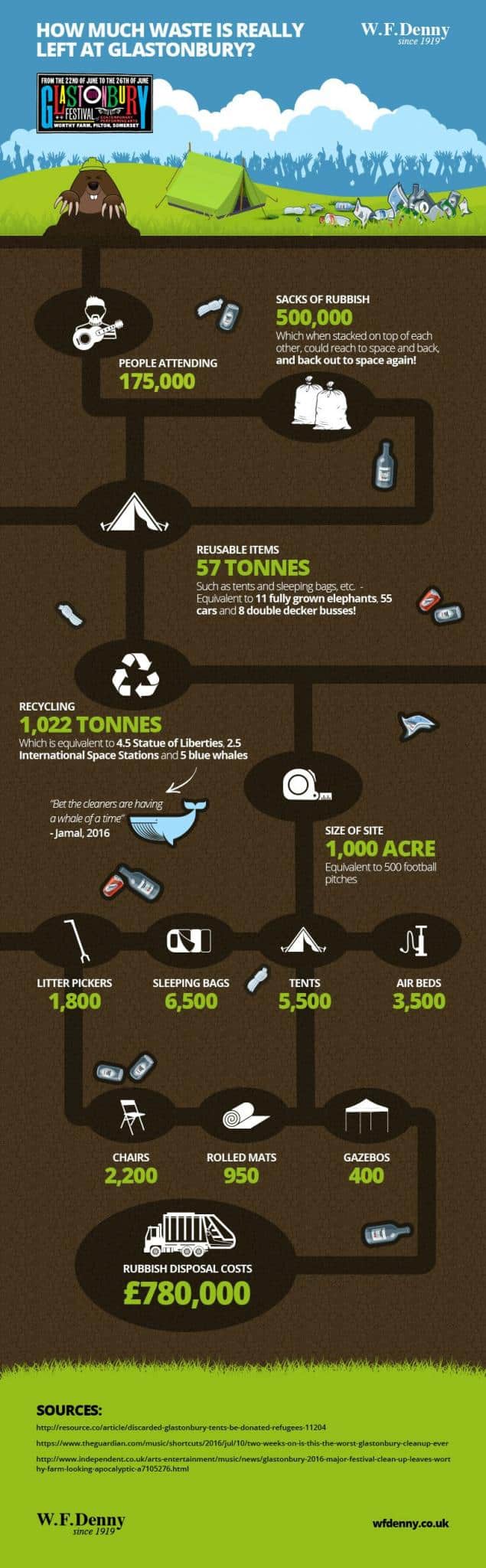

Rylances Condemnation The Impact Of Music Festivals On London Parks

May 19, 2025

Rylances Condemnation The Impact Of Music Festivals On London Parks

May 19, 2025 -

Ufc Fight Night 220 Predictions Staff Picks And Betting Analysis

May 19, 2025

Ufc Fight Night 220 Predictions Staff Picks And Betting Analysis

May 19, 2025 -

Collier County Mom Fights For School Bus Safety After Childrens Wrong Stop Incident

May 19, 2025

Collier County Mom Fights For School Bus Safety After Childrens Wrong Stop Incident

May 19, 2025