Swissquote Bank Report: Euro Strength And US Dollar Weakness

Table of Contents

Factors Contributing to Euro Strength

Several key factors have contributed to the Euro's recent surge against the US dollar. Understanding these drivers is crucial for navigating the current forex market landscape.

Improved Economic Outlook for the Eurozone

The Eurozone economy has shown signs of resilience, bolstering the Euro's value. Several positive economic indicators contribute to this improved outlook:

- GDP Growth: Recent GDP growth figures for the Eurozone have exceeded expectations, signaling a robust economic recovery. Countries like Germany and France, key players in the Eurozone economy, have shown particularly strong performance.

- Inflation Rates: While inflation remains a concern, it's showing signs of moderating in several Eurozone countries, moving closer to the ECB's target range. This reduces pressure on the ECB to aggressively hike interest rates, potentially stabilizing the Euro.

- Unemployment Figures: Unemployment rates in the Eurozone have fallen, indicating a strengthening labor market and increased consumer spending. This positive trend further supports the Euro's strength. These factors collectively point towards a healthy Eurozone economy, a key driver of Euro strength.

European Central Bank (ECB) Monetary Policy

The European Central Bank's monetary policy plays a significant role in shaping the Euro's value. The ECB's recent decisions regarding interest rate hikes and quantitative easing have had a direct impact on investor sentiment:

- Interest Rate Hikes: While the ECB has implemented interest rate hikes, the pace has been more measured than that of the Federal Reserve. This difference in monetary policy approaches between the ECB and the Fed has contributed to the divergence in the value of the Euro and the US dollar.

- Quantitative Easing (QE): The phasing out of QE programs has also influenced the Euro's value. The market closely watches future ECB actions, speculating on the potential for further rate hikes and the overall direction of monetary policy in the Eurozone. This uncertainty can create volatility but also contributes to the Euro's overall strength relative to the weakening dollar.

Geopolitical Factors Impacting the Euro

Geopolitical events also play a role in influencing the Euro's strength. While these factors can be unpredictable, their impact on investor sentiment is undeniable:

- Ukraine Conflict Impact on Euro: The ongoing war in Ukraine has undoubtedly created economic uncertainty across Europe. However, the Eurozone's response and resilience have, in some ways, strengthened its position relative to the US.

- Energy Crisis and Euro: The energy crisis has presented challenges, but the Eurozone's efforts to diversify energy sources and improve energy efficiency are mitigating some of the negative impacts. This proactive approach can be interpreted positively by investors, indirectly supporting the Euro.

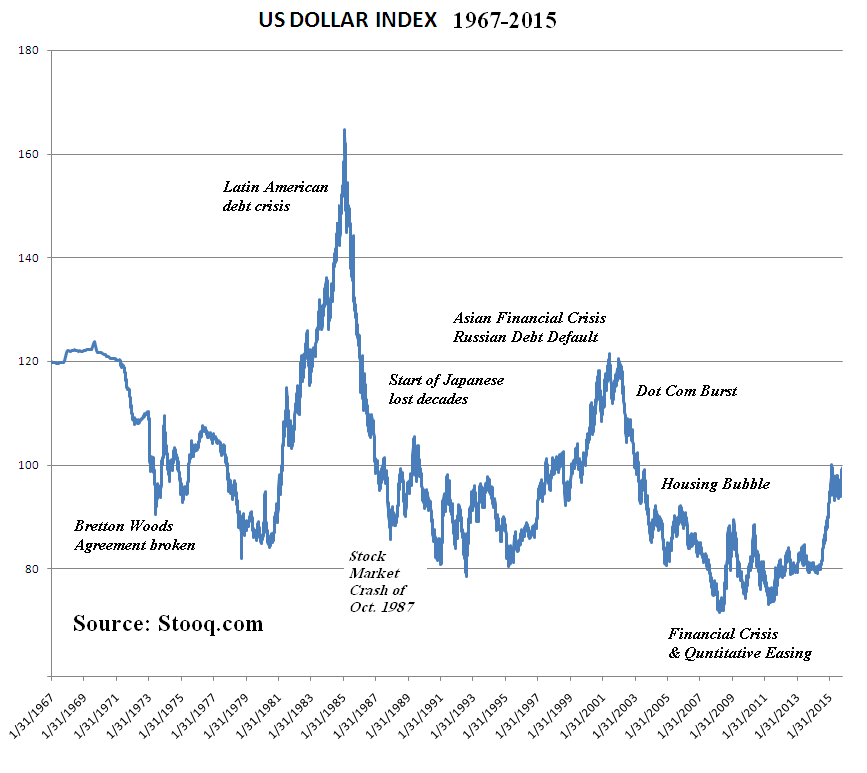

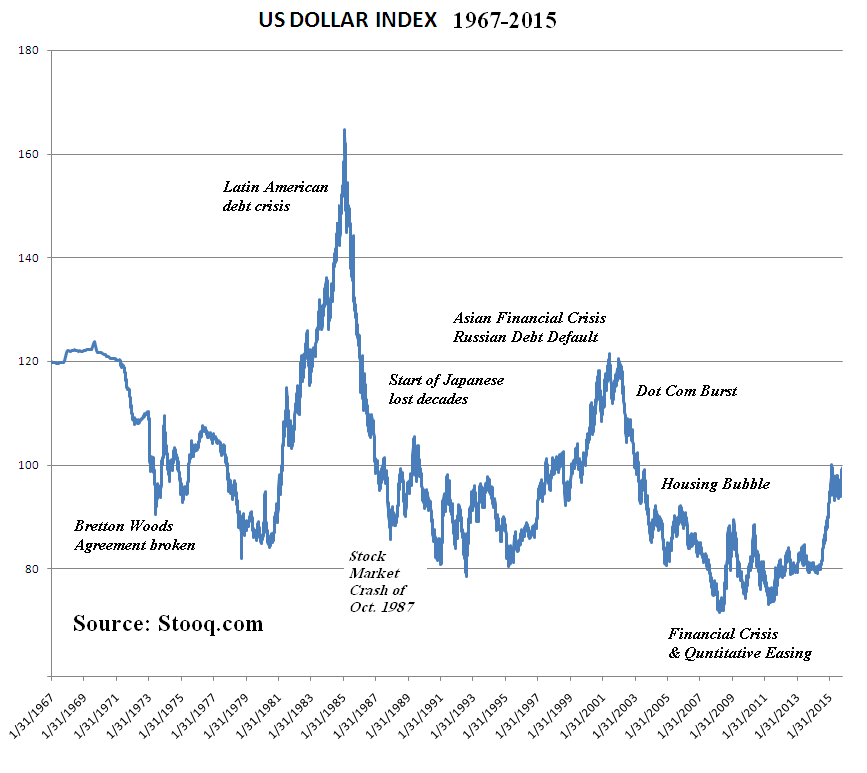

Reasons Behind US Dollar Weakness

The US dollar's recent weakness is multifaceted, stemming from several interconnected factors.

US Inflation and Federal Reserve Policy

High inflation in the US has been a major driver of the dollar's decline. The Federal Reserve's response to this inflationary pressure has further influenced the dollar's value:

- US Inflation: Persistent high inflation has eroded the purchasing power of the dollar, making it less attractive to investors.

- Federal Reserve Policy: The Federal Reserve's aggressive interest rate hikes, while aimed at curbing inflation, have also raised concerns about a potential economic slowdown in the US. This uncertainty has contributed to the dollar's weakness. Market expectations regarding future Fed actions continue to significantly impact the USD.

US Economic Slowdown Concerns

Concerns about a potential US economic slowdown are weighing heavily on the dollar:

- US Economic Slowdown: Various economic indicators, such as declining consumer confidence and slowing manufacturing activity, point to the possibility of a US economic slowdown or even a recession. This dampens investor confidence in the US economy and consequently weakens the dollar.

- Recession Risk: The risk of a US recession is a key factor influencing the USD's value. Investors are moving away from the dollar as a safe haven, seeking alternative assets.

Global Risk Appetite

Global risk appetite plays a crucial role in determining the value of the dollar:

- Risk Aversion: During periods of heightened global uncertainty, investors often flock to the US dollar as a safe-haven currency. However, with increasing global risk appetite, investors are shifting their focus towards riskier assets, leading to a decline in the demand for the US dollar.

- Global Market Sentiment: Overall market sentiment, whether optimistic or pessimistic, also plays a significant role. A shift towards optimism weakens the safe-haven appeal of the dollar.

Swissquote Bank's Forecast and Recommendations

Swissquote Bank's report offers a detailed forecast for the EUR/USD pair and provides recommendations for traders. While specific trading strategies mentioned in the report require a deeper dive into the document itself, the overall sentiment generally points towards a continued period of Euro strength, at least in the near term. The bank's analysis should be considered alongside your own risk tolerance and investment strategy.

Conclusion

The Swissquote Bank report provides valuable insights into the factors driving the Euro's strength and the US dollar's weakness. The improved Eurozone economic outlook, the ECB's monetary policy, and geopolitical factors have all contributed to the Euro's rise. Conversely, high US inflation, concerns about a US economic slowdown, and shifting global risk appetite have weakened the US dollar. Understanding these interconnected factors is crucial for investors and traders navigating the forex market. To stay updated on the latest EUR/USD analysis and access the complete Swissquote Bank report on Euro strength and US dollar weakness, please visit [link to report here]. Learn more about navigating the forex market with Swissquote Bank's insights.

Featured Posts

-

Ufc 313 Alex Pereira And Magomed Ankalaev Headline This Weekends Event

May 19, 2025

Ufc 313 Alex Pereira And Magomed Ankalaev Headline This Weekends Event

May 19, 2025 -

Ana Paola Hall Agradece El Apoyo Ciudadano Declaratoria Inminente

May 19, 2025

Ana Paola Hall Agradece El Apoyo Ciudadano Declaratoria Inminente

May 19, 2025 -

Bbc Radio 2 Eleccion De La Mejor Entrada De Eurovision Del Siglo Xxi

May 19, 2025

Bbc Radio 2 Eleccion De La Mejor Entrada De Eurovision Del Siglo Xxi

May 19, 2025 -

Juan Aguilera Fallecimiento De Una Promesa Del Tenis

May 19, 2025

Juan Aguilera Fallecimiento De Una Promesa Del Tenis

May 19, 2025 -

Mark Rylance London Parks Transformed Into Music Festival Jails

May 19, 2025

Mark Rylance London Parks Transformed Into Music Festival Jails

May 19, 2025