Taiwanese Regulator Targets Firms For Alleged ETF Sales Staff Pressure

Table of Contents

The Securities and Futures Bureau (SFB) of Taiwan's Financial Supervisory Commission (FSC) has launched a significant investigation into alleged unethical sales practices within the Exchange Traded Fund (ETF) market. This crackdown targets firms suspected of pressuring sales staff to meet unrealistic targets, leading to aggressive sales tactics and potential misrepresentation of ETF products. This article delves into the specifics of the investigation, its impact on the Taiwanese ETF market, and the potential for future regulatory changes. Understanding the implications of the Taiwanese Regulator Targets Firms for Alleged ETF Sales Staff Pressure is crucial for investors and industry professionals alike.

<h2>SFB's Investigation into Unethical ETF Sales Practices</h2>

The SFB's investigation centers on allegations of widespread unethical sales practices within the Taiwanese ETF industry. The core issue revolves around aggressive sales tactics and the imposition of unrealistic sales targets and quotas on sales staff. This pressure, investigators believe, is directly linked to instances of misrepresentation of ETF products and a lack of due diligence regarding investor suitability.

<h3>Unrealistic Sales Targets and Quotas</h3>

Reports suggest that sales staff faced extremely high and often unattainable sales quotas for various ETFs. This created a high-pressure environment that incentivized unethical behavior. Examples of aggressive tactics employed to meet these targets reportedly include:

- High-pressure phone calls: Sales staff were allegedly pressured to make numerous calls, regardless of investor interest or suitability.

- Misleading marketing materials: Materials may have overstated potential returns or downplayed risks associated with specific ETFs.

- Unsolicited sales calls: Potential investors were contacted without prior consent or expressed interest.

This relentless pursuit of sales quotas overshadowed the crucial aspects of responsible financial advising.

<h3>Misrepresentation of ETF Products</h3>

The investigation also focuses on allegations of misrepresentation of ETF products to potential investors. This includes:

- Exaggerated returns: Presenting unrealistically high projected returns without proper risk disclosures.

- Downplaying risks: Minimizing or omitting crucial information about the inherent risks associated with specific ETFs, such as volatility and market fluctuations.

- Omitting key details: Failing to provide comprehensive information about the ETF's underlying assets, fees, and expense ratios.

Such misrepresentations could have led investors to make ill-informed investment decisions, potentially resulting in significant financial losses.

<h3>Lack of Due Diligence and Investor Suitability</h3>

A critical concern is the apparent lack of due diligence performed to ensure that the recommended ETFs aligned with the individual investors' risk profiles and financial goals. Examples of unsuitable ETF recommendations include:

- High-risk ETFs for conservative investors: Recommending highly volatile ETFs to investors with a low-risk tolerance.

- Ignoring investor financial goals: Failing to consider the investor's long-term financial objectives when recommending specific ETFs.

- Lack of personalized advice: Providing generic investment advice without considering the individual investor's unique circumstances.

<h2>Impact on the Taiwanese ETF Market and Investor Confidence</h2>

The SFB's investigation carries significant implications for the Taiwanese ETF market and investor confidence. The potential consequences are far-reaching and could affect both short-term market dynamics and long-term investor sentiment.

<h3>Short-term Market Volatility</h3>

The investigation itself could lead to short-term market volatility. Uncertainty surrounding the implicated firms and potential regulatory actions may cause fluctuations in ETF trading volumes and prices.

<h3>Long-term Investor Confidence</h3>

The long-term impact hinges on the SFB's response and the measures taken to restore trust. Transparency and robust investor protection mechanisms are crucial for rebuilding investor confidence in the Taiwanese ETF market. A lack of decisive action could lead to a decline in investment and damage the reputation of the Taiwanese financial industry.

<h3>Reputational Damage to Financial Institutions</h3>

The implicated financial institutions face significant reputational damage. This could result in lost business, decreased client loyalty, and difficulty attracting new investors. The impact could extend beyond the firms directly involved, potentially affecting the perception of the entire Taiwanese financial sector.

<h2>Regulatory Response and Future Implications</h2>

The SFB's response to these allegations will set a precedent for future regulatory actions within the Taiwanese ETF market. Potential penalties and proposed regulatory reforms are crucial in preventing similar incidents.

<h3>Potential Penalties and Sanctions</h3>

The SFB has the authority to impose a range of penalties on firms found guilty, including substantial fines, temporary or permanent suspensions of business licenses, and even criminal charges in severe cases. The severity of the penalties will depend on the extent of the violations and the resulting harm to investors.

<h3>Proposed Regulatory Reforms</h3>

The investigation is likely to trigger regulatory reforms aimed at preventing future instances of sales pressure and promoting ethical sales practices. These could include:

- Stricter guidelines on sales quotas: Implementing stricter regulations on the setting and enforcement of sales targets.

- Improved training for sales staff: Mandating comprehensive training programs focused on ethical sales practices and investor suitability.

- Enhanced oversight of sales practices: Increasing regulatory oversight and monitoring of sales practices within the ETF market.

<h2>Conclusion</h2>

The Taiwanese Regulator Targets Firms for Alleged ETF Sales Staff Pressure investigation underscores the critical need for ethical conduct and robust investor protection within the Taiwanese ETF market. The outcome of this investigation will significantly impact investor confidence and potentially lead to sweeping regulatory reforms. To stay abreast of developments concerning the Taiwanese Regulator Targets Firms for Alleged ETF Sales Staff Pressure and its impact on the market, stay informed by regularly consulting reputable financial news sources and official statements from the FSC and SFB.

Featured Posts

-

Charges Filed Against Correas Former Vp For Murder Of Ecuadorian Candidate

May 16, 2025

Charges Filed Against Correas Former Vp For Murder Of Ecuadorian Candidate

May 16, 2025 -

Triumf Tampy Bey Kucherov Vedyot Komandu K Pobede Nad Floridoy V N Kh L

May 16, 2025

Triumf Tampy Bey Kucherov Vedyot Komandu K Pobede Nad Floridoy V N Kh L

May 16, 2025 -

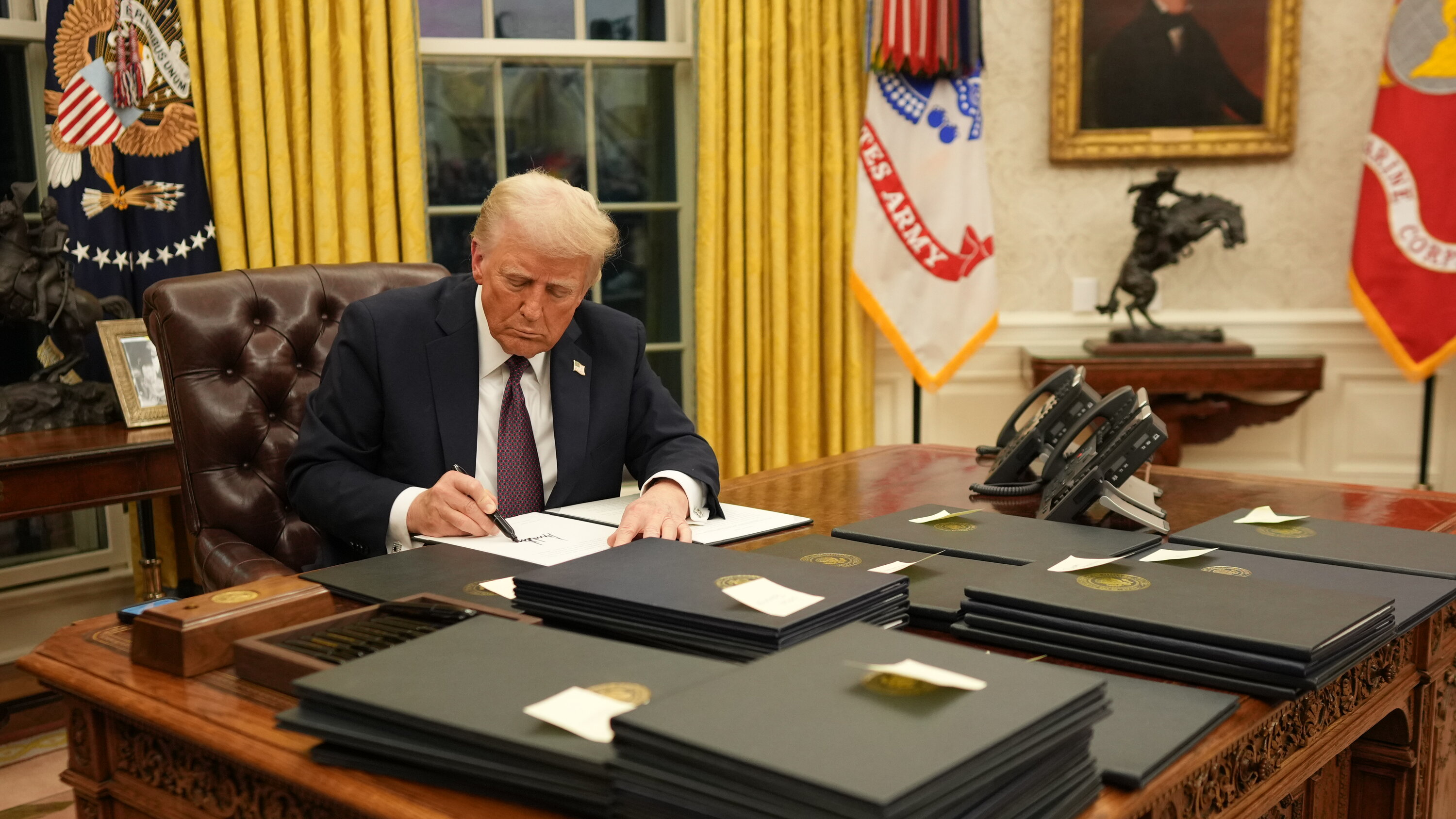

16 Billion At Stake How Trumps Tariffs Affect Californias Revenue

May 16, 2025

16 Billion At Stake How Trumps Tariffs Affect Californias Revenue

May 16, 2025 -

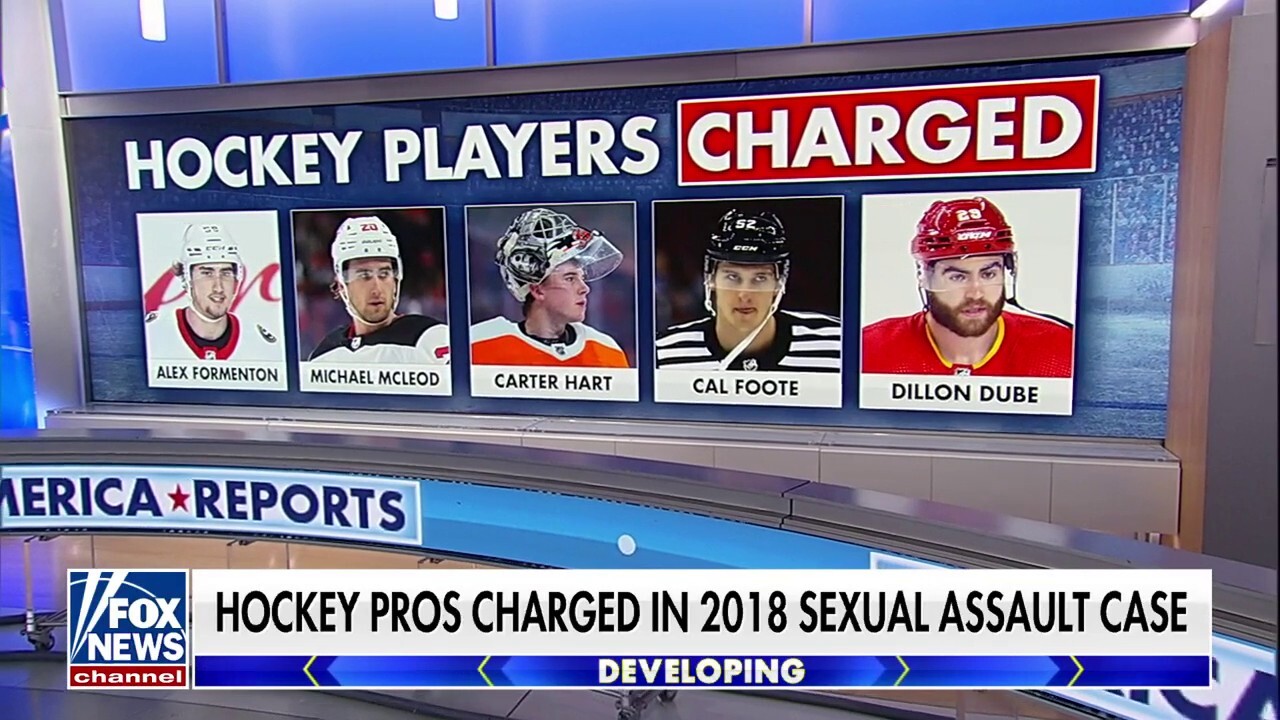

Minority Owner Suspended By Nhl After Alleged Online Harassment And Terrorism Remarks

May 16, 2025

Minority Owner Suspended By Nhl After Alleged Online Harassment And Terrorism Remarks

May 16, 2025 -

The Impact Of A Judges Ruling On E Bay And Banned Chemical Listings

May 16, 2025

The Impact Of A Judges Ruling On E Bay And Banned Chemical Listings

May 16, 2025