Tesla Q1 Earnings Decline: Musk's Role And Market Reaction

Table of Contents

Analysis of Tesla's Q1 Earnings Decline

Factors Contributing to the Decline

The Tesla Q1 earnings decline wasn't a single event but a confluence of factors impacting profitability and overall performance. Several key elements contributed to this downturn:

-

Increased Competition in the EV Market: The EV market is rapidly evolving, with established automakers like Ford, Volkswagen, and Hyundai, along with emerging competitors like Rivian and Lucid, aggressively entering the space. This heightened competition forces Tesla to contend with pricing pressures and a more saturated market.

-

Price Reductions Impacting Profitability Margins: Tesla's significant price cuts across its vehicle lineup, implemented to boost sales volume and maintain market share, directly impacted profit margins. While increasing sales, these reductions squeezed profitability.

-

Supply Chain Disruptions and Their Ongoing Impact: The ongoing global supply chain issues, including semiconductor shortages and logistical bottlenecks, continued to affect Tesla's production capacity and efficiency throughout Q1, leading to reduced output and increased costs.

-

Increased Operating Costs and Expenses: Rising costs for raw materials, labor, and energy added further pressure to Tesla's bottom line, impacting profitability and margins. These expenses, coupled with production challenges, significantly reduced the company's overall financial performance.

-

Geopolitical Factors Influencing Sales and Production: Geopolitical instability and regional conflicts impacted both sales in certain markets and production at Tesla's manufacturing facilities, leading to further constraints on revenue and output.

Detailed Financial Performance

Tesla's Q1 2024 report revealed a significant drop in net income compared to the previous quarter and analyst expectations. While revenue showed moderate growth, the profit margins significantly narrowed, indicating a considerable decline in profitability. [Insert chart/graph here comparing Q1 2024 revenue, net income, and profit margins to previous quarters and analyst projections.] This data clearly illustrates the severity of the Tesla Q1 earnings decline and the challenges the company faced during the period. The lower-than-expected profit margins, despite increased sales volume, highlight the impact of price reductions and increased operational costs.

Elon Musk's Role in the Q1 Performance

Impact of Musk's Leadership and Decisions

Elon Musk's leadership style and major decisions during Q1 played a significant role in shaping Tesla's performance. His focus on aggressive price cuts, while aiming to boost sales, negatively affected profitability. Furthermore, the considerable time and resources dedicated to the acquisition and management of Twitter arguably diverted attention and resources from Tesla's core business operations.

Investor Sentiment and Musk's Communication

Musk's public statements and actions significantly influenced investor sentiment. His sometimes erratic communication style and controversial tweets often created market volatility. The negative publicity surrounding Musk and his ventures directly impacted investor confidence in Tesla. The correlation between Musk's actions and the fluctuations in Tesla's stock price is undeniable, highlighting the significant impact of his public persona on the company's valuation.

Market Reaction to Tesla's Q1 Earnings Decline

Immediate Stock Market Response

The immediate market reaction to the Tesla Q1 earnings decline was a sharp drop in the company's stock price. Trading volume surged as investors reacted to the disappointing financial results. Several financial analysts downgraded their ratings for Tesla's stock, reflecting concerns about the company's future performance.

Long-Term Implications for Tesla's Valuation

The Tesla Q1 earnings decline raises significant concerns about the company's long-term valuation. The sustained impact on investor confidence could affect Tesla's ability to secure funding for future projects and expansion plans. The decline also necessitates a reassessment of Tesla's growth strategy and its ability to navigate the increasingly competitive EV landscape.

Conclusion: Understanding the Tesla Q1 Earnings Decline

The Tesla Q1 earnings decline was a multifaceted event resulting from a combination of factors, including increased competition, price reductions impacting margins, supply chain issues, rising operating costs, and geopolitical influences. Elon Musk's leadership style and his involvement in other ventures also played a significant role. The market reacted negatively, with a sharp drop in Tesla's stock price and concerns raised about its long-term valuation. This analysis highlights the complex interplay of internal and external factors shaping Tesla's performance. To understand the complete picture, it’s vital to remain updated on the company’s future performance. Stay updated on Tesla's Q2 earnings and follow the ongoing saga of Tesla's market performance to gain a clearer understanding of its future trajectory in the evolving electric vehicle industry. Learn more about the future of Tesla and the EV industry.

Featured Posts

-

Consumers Curb Spending Impact On Credit Card Companies

Apr 24, 2025

Consumers Curb Spending Impact On Credit Card Companies

Apr 24, 2025 -

Remembering Jett Travolta John Travolta Shares Emotional Photo On What Would Have Been His Sons 33rd Birthday

Apr 24, 2025

Remembering Jett Travolta John Travolta Shares Emotional Photo On What Would Have Been His Sons 33rd Birthday

Apr 24, 2025 -

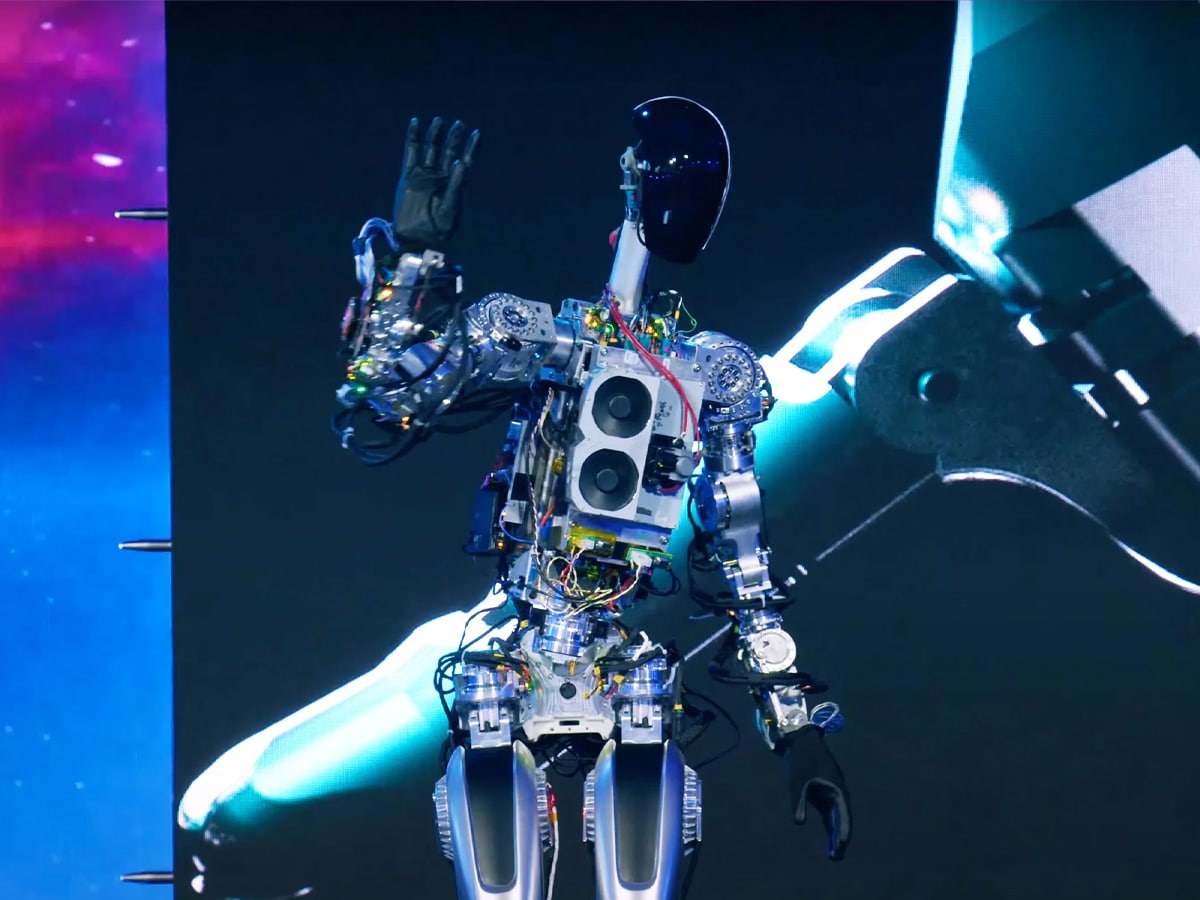

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025 -

Bold And The Beautiful Spoilers For Thursday February 20 Steffy Liam And Finn

Apr 24, 2025

Bold And The Beautiful Spoilers For Thursday February 20 Steffy Liam And Finn

Apr 24, 2025 -

Tesla Space X And The Epa How Elon Musk And Dogecoin Changed The Narrative

Apr 24, 2025

Tesla Space X And The Epa How Elon Musk And Dogecoin Changed The Narrative

Apr 24, 2025