Tesla Stock Slump Drags Elon Musk's Net Worth Under $300 Billion

Table of Contents

The Dramatic Fall of Tesla Stock and its Impact

Tesla's stock price has experienced a steep decline in recent months, plummeting by [Insert precise percentage]% from its peak. This represents a substantial loss in market capitalization, [Insert precise dollar amount] wiped off in a relatively short period. The following chart illustrates the dramatic fluctuation in Tesla's stock price over the past [Insert timeframe, e.g., six months]:

[Insert chart or graph visually representing Tesla stock price fluctuations]

Factors Contributing to the Tesla Stock Slump:

-

Increased Competition in the Electric Vehicle Market: Tesla is no longer alone at the forefront of the EV revolution. Established automakers like Ford, General Motors, and Volkswagen, along with new entrants like Rivian and Lucid, are aggressively expanding their EV offerings, intensifying competition and putting pressure on Tesla's market share.

-

Concerns about Tesla's Production and Delivery Targets: Missed production targets and delays in deliveries have raised concerns about Tesla's ability to meet growing demand and maintain its aggressive growth trajectory. This has negatively impacted investor confidence.

-

Overall Market Volatility and Economic Uncertainty: The broader economic climate, marked by inflation, rising interest rates, and geopolitical instability, has contributed to the overall market downturn, impacting even high-growth tech stocks like Tesla.

-

Elon Musk's Controversial Social Media Activity and its Impact on Investor Confidence: Elon Musk's often unpredictable and controversial tweets and actions have repeatedly caused significant volatility in Tesla's stock price, eroding investor trust and confidence.

-

Production Challenges and Quality Concerns: Reports of quality control issues and production bottlenecks have further fueled concerns among investors.

Analysis of Elon Musk's Diminished Net Worth

Elon Musk's net worth, heavily tied to Tesla's stock price, has seen a significant reduction, falling below $300 billion to approximately [Insert current estimated net worth]. It's crucial to understand that net worth is calculated based on the current market value of assets, primarily Tesla shares in Musk's case. Therefore, any fluctuation in Tesla's stock price directly impacts his net worth.

Impact on Musk's Business Ventures:

-

SpaceX: The decline in Musk's net worth could potentially impact SpaceX's fundraising and future expansion plans, although SpaceX is a relatively independent entity with its own revenue streams.

-

Twitter (now X): The substantial investment Musk made in acquiring Twitter (X) and subsequent operational challenges could be further strained by his reduced net worth. This might impact future investments and strategic decisions regarding the platform.

-

Other Ventures: The overall reduction in Musk's personal wealth could potentially affect his ability to invest in other ventures or provide personal funding for ambitious projects.

Future Predictions and Market Outlook for Tesla

Predicting Tesla's future stock performance is challenging, but several market analysts offer varying perspectives. Some believe that the current slump represents a buying opportunity, anticipating a rebound driven by new product launches and continued growth in the EV market. Others are more cautious, citing ongoing challenges and persistent headwinds.

Strategies Tesla Might Employ for Recovery:

-

New Product Launches and Technological Advancements: Introducing new models, such as the highly anticipated Cybertruck, or breakthrough innovations in battery technology could revitalize investor interest and boost demand.

-

Cost-Cutting Measures and Improved Efficiency: Streamlining production processes, optimizing supply chains, and reducing operational costs could enhance profitability and strengthen investor confidence.

-

Targeted Marketing Campaigns to Boost Consumer Confidence: Aggressive marketing campaigns emphasizing the unique features and benefits of Tesla vehicles could reignite consumer demand and strengthen the brand's image.

The Broader Implications of the Tesla Stock Slump

The Tesla stock slump has implications that extend far beyond the company itself. It impacts the broader electric vehicle market and investor sentiment towards the entire sector.

Ripple Effects on the EV Industry:

-

Impact on Investor Sentiment towards Other EV Companies: Tesla's decline could negatively influence investor sentiment towards other EV companies, leading to decreased investments in the sector.

-

Potential Changes in Investment Strategies for the EV Sector: The current situation may cause investors to re-evaluate their investment strategies in the EV market, potentially leading to a more cautious and selective approach.

-

Slowdown in EV Market Growth?: While the overall EV market is still expected to grow, Tesla's struggles could temporarily slow down the pace of expansion, at least in the short term.

Conclusion

The Tesla stock slump has resulted in a substantial decrease in Elon Musk's net worth, falling below the $300 billion mark. This significant decline is attributed to a combination of factors, including increased competition, production challenges, economic uncertainty, and Elon Musk's controversial social media presence. While the future remains uncertain, Tesla's potential strategies for recovery include new product launches, cost-cutting measures, and improved marketing. The impact extends beyond Tesla, affecting investor sentiment in the broader EV market. Keep a close eye on the Tesla stock slump and its continuing impact on the market. Follow our site for the latest updates and analysis on this evolving situation and stay informed about the future of Tesla and the EV industry.

Featured Posts

-

Zelenskiy Odin Na 9 Maya Pochemu Nikto Ne Priekhal

May 09, 2025

Zelenskiy Odin Na 9 Maya Pochemu Nikto Ne Priekhal

May 09, 2025 -

Doohans Future At Williams Team Principals Response To Colapinto Links

May 09, 2025

Doohans Future At Williams Team Principals Response To Colapinto Links

May 09, 2025 -

Tougher Uk Immigration Rules English Language Proficiency A Must

May 09, 2025

Tougher Uk Immigration Rules English Language Proficiency A Must

May 09, 2025 -

Trump Tariffs Heated Debate Erupts Between Fox News Personalities

May 09, 2025

Trump Tariffs Heated Debate Erupts Between Fox News Personalities

May 09, 2025 -

Oilers Draisaitl Out Injury Update And Winnipeg Jets Game Impact

May 09, 2025

Oilers Draisaitl Out Injury Update And Winnipeg Jets Game Impact

May 09, 2025

Latest Posts

-

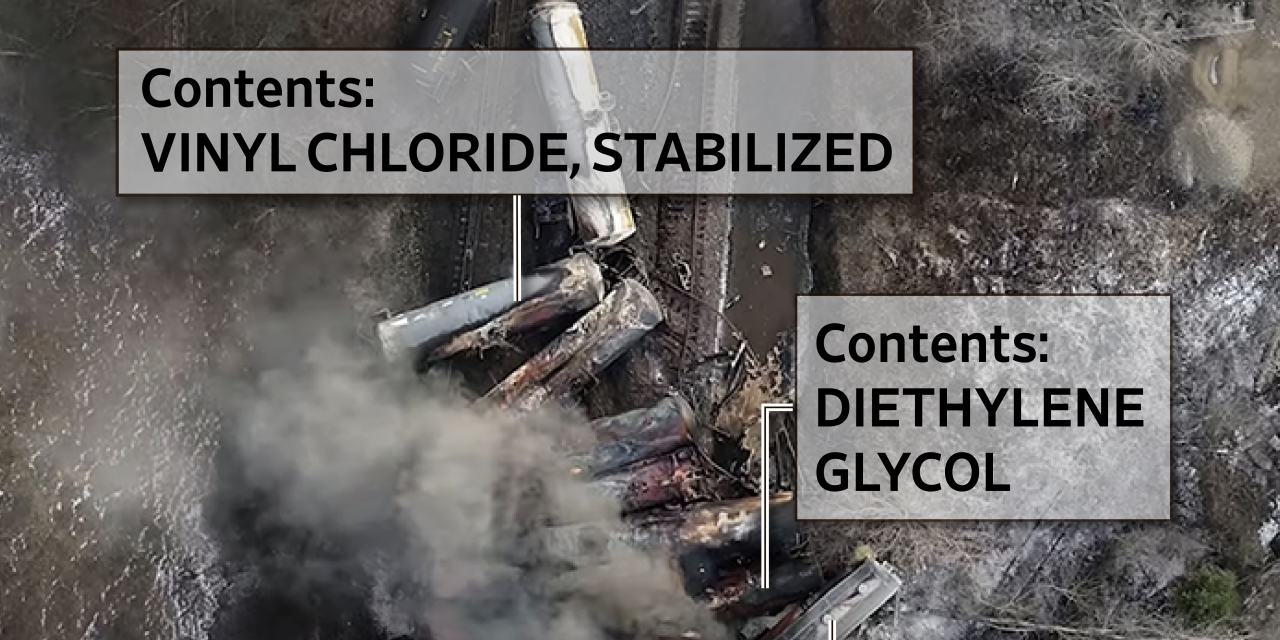

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025 -

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025 -

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025 -

Cybercriminals Office365 Scheme Nets Millions Federal Indictment

May 10, 2025

Cybercriminals Office365 Scheme Nets Millions Federal Indictment

May 10, 2025 -

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025