Thailand's Central Bank Governor Search: Navigating Tariff Challenges

Table of Contents

The search for Thailand's next Central Bank Governor unfolds against a backdrop of significant economic challenges, most notably the escalating impact of global tariff disputes. This crucial appointment demands a leader capable of navigating complex monetary policy decisions while mitigating the risks posed by fluctuating international trade policies. The right candidate must possess a deep understanding of both domestic and international economic forces to effectively steer the Bank of Thailand (BOT) through these turbulent times. This article explores the key challenges facing the next governor and the crucial considerations for their appointment.

The Impact of Tariffs on the Thai Economy

Thailand's export-oriented economy makes it particularly vulnerable to global trade tensions and the resulting tariff increases. The next governor must understand these vulnerabilities and formulate appropriate responses.

Export Dependence and Vulnerability

Thailand's economy is heavily reliant on exports, making it particularly susceptible to trade wars and tariff increases. Key export sectors, including automotive parts, electronics, and tourism, are directly impacted.

- Impact on key export sectors: Reduced demand from major trading partners leads to decreased production, factory closures, and job losses.

- Potential job losses: Thousands of jobs are at risk in export-dependent industries, impacting families and communities across Thailand.

- Decreased GDP growth: Reduced exports directly translate to lower GDP growth, slowing overall economic progress and potentially impacting government revenue.

The recent imposition of tariffs on certain Thai goods has already demonstrated the negative consequences. For example, increased tariffs on Thai automotive parts have led to reduced orders from key markets, forcing some manufacturers to cut back on production and lay off workers. The projected impact of future tariff increases requires careful monitoring and proactive mitigation strategies.

Inflationary Pressures

Increased import costs due to tariffs inevitably translate into higher consumer prices, leading to inflationary pressures. This requires deft management by the central bank.

- Mechanics of tariff-induced inflation: Tariffs raise the cost of imported goods, which are then passed on to consumers through higher prices.

- Growth vs. Inflation trade-off: The central bank faces a difficult trade-off between maintaining economic growth and controlling inflation. Raising interest rates to combat inflation can stifle growth, while allowing inflation to rise unchecked can erode purchasing power.

- Managing inflation in a globalized economy: Inflation in Thailand is affected by global economic conditions, making it even more challenging to manage amidst global tariff disputes.

Thailand's current inflation rate is [Insert current inflation rate data here], and projections suggest that tariffs could exacerbate this figure. The next governor must develop strategies to manage this delicate balance effectively.

Key Qualities of the Next Central Bank Governor

The next Bank of Thailand governor needs a unique combination of skills and experience to navigate the current economic climate.

Experience in Navigating Global Economic Uncertainty

The ability to navigate global economic uncertainty is paramount. The next governor must possess a deep understanding of international finance and proven experience managing economic crises.

- Necessary skillsets: Crisis management, international trade negotiations, risk assessment, strong communication and negotiation skills are crucial.

- Foreign exchange market expertise: Managing fluctuations in the Thai baht and mitigating risks associated with capital flows will be essential.

- Global trade agreement understanding: Navigating complex global trade agreements and their impact on the Thai economy is critical.

Strong Communication and Policy Coordination Skills

Effective communication and policy coordination are vital for building confidence and fostering economic stability.

- Transparent policymaking: Open and transparent communication of central bank decisions is crucial for maintaining public trust.

- Coordination with the government: Effective collaboration with the government is necessary to implement consistent and effective economic policies.

- Building investor confidence: The central bank’s actions significantly influence investor confidence, impacting foreign investment and economic growth. Clear and consistent communication is therefore key.

Potential Monetary Policy Responses to Tariff Challenges

The central bank may need to utilize various policy tools to counteract the negative economic effects of tariffs.

Interest Rate Adjustments

Adjusting interest rates is a primary tool for managing inflation and stimulating growth. However, its application in the context of tariff-related shocks requires careful consideration.

- Potential scenarios: Raising interest rates combats inflation but might slow economic growth. Lowering interest rates can stimulate growth but risks increasing inflation.

- Impact on investment and consumption: Interest rate changes directly impact investment decisions and consumer spending, creating a ripple effect throughout the economy.

- Economic consequences: The governor must carefully weigh the economic consequences of interest rate changes, considering their impact on various sectors and societal groups.

The effectiveness of interest rate adjustments alone in mitigating tariff-related challenges is limited, underscoring the need for a multifaceted approach.

Other Policy Tools

Beyond interest rates, the central bank may explore other tools to mitigate the negative impacts of tariffs.

- Foreign exchange interventions: The central bank might intervene in foreign exchange markets to stabilize the Thai baht and manage capital flows.

- Quantitative easing: This unconventional policy involves injecting liquidity into the economy, stimulating lending and economic activity.

These alternative policy tools, however, come with potential risks and side effects that must be carefully assessed before implementation. The next governor needs to be comfortable using a range of tools strategically and effectively.

Conclusion

The selection of Thailand's next Central Bank Governor is a crucial decision with far-reaching consequences. The successful candidate must possess a deep understanding of monetary policy, international economics, and the specific challenges posed by escalating tariff disputes. The ability to effectively navigate these complex issues is essential for maintaining macroeconomic stability and fostering sustainable economic growth in Thailand. The search should prioritize candidates with proven experience in crisis management, effective communication, and a nuanced understanding of the impact of tariff challenges on the Thai economy. Choosing the right leader is critical for navigating Thailand’s economic future and mitigating the impact of these Tariff Challenges. The future stability of Thailand's economy depends on selecting a governor with the experience and vision to successfully address these crucial issues.

Featured Posts

-

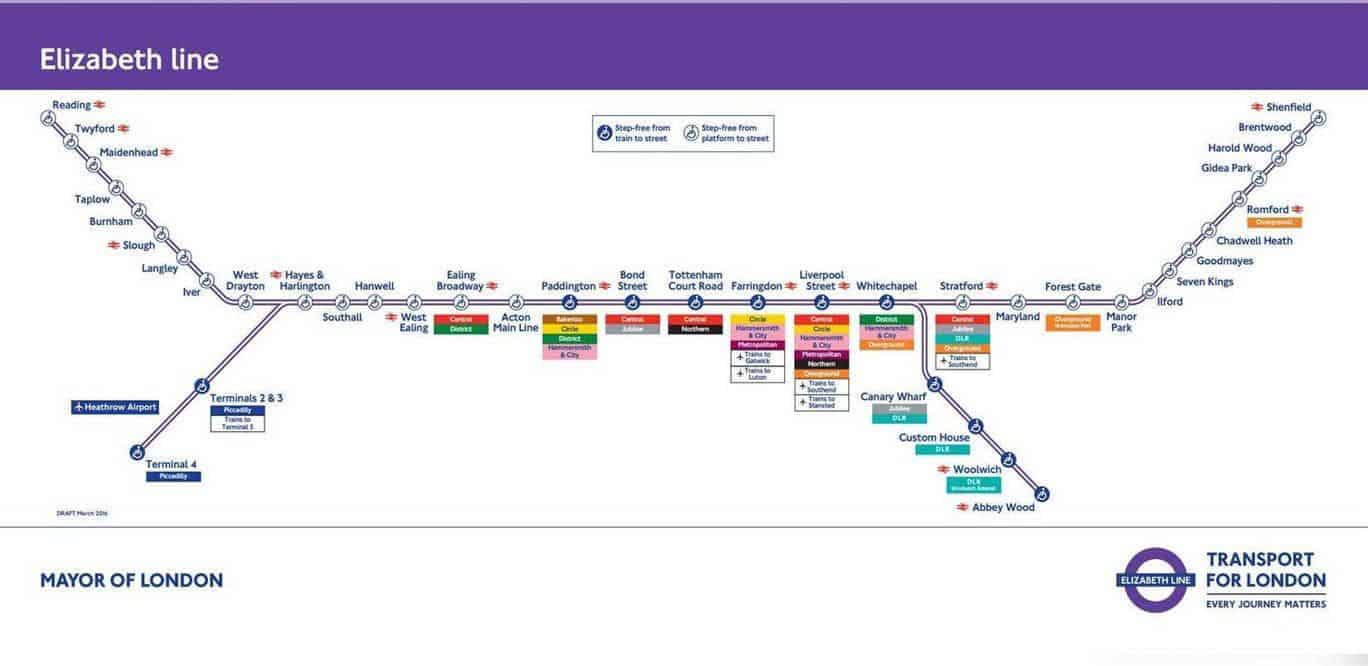

Elizabeth Line Industrial Action Updated Service Information For February And March

May 09, 2025

Elizabeth Line Industrial Action Updated Service Information For February And March

May 09, 2025 -

Dakota Johnsons Stunning White Dress At Materialists Premiere

May 09, 2025

Dakota Johnsons Stunning White Dress At Materialists Premiere

May 09, 2025 -

Liga Chempionov 2024 2025 Prognoz Na Polufinaly I Final Gde Smotret

May 09, 2025

Liga Chempionov 2024 2025 Prognoz Na Polufinaly I Final Gde Smotret

May 09, 2025 -

Bayern Munichs Champions League Quarterfinal Defeat To Inter Milan

May 09, 2025

Bayern Munichs Champions League Quarterfinal Defeat To Inter Milan

May 09, 2025 -

Kyle Kuzma Responds To Jayson Tatums Controversial Instagram Post

May 09, 2025

Kyle Kuzma Responds To Jayson Tatums Controversial Instagram Post

May 09, 2025

Latest Posts

-

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025 -

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025