Thailand's Deflation: More Interest Rate Cuts On The Horizon?

Table of Contents

The Causes of Thailand's Deflation:

Thailand's deflation is a complex issue stemming from a confluence of factors. Understanding these root causes is crucial for formulating effective countermeasures.

Weak Domestic Demand:

Sluggish consumer spending and investment are significant contributors to Thailand's deflation. This weakness is fueled by several interconnected factors:

- Low Consumer Confidence: Uncertainty about the future, coupled with job insecurity and stagnant wage growth, has dampened consumer spending.

- High Household Debt: Elevated levels of household debt constrain disposable income and limit consumers' ability to spend.

- Weak Tourism Sector: While tourism has begun to recover post-pandemic, its full resurgence is yet to materialize, impacting a crucial sector of the Thai economy. The pre-pandemic decline also played a significant role in weakening domestic demand.

Falling Global Commodity Prices:

Thailand's export-oriented economy is vulnerable to fluctuations in global commodity prices. A decline in these prices directly impacts export revenues and contributes to deflationary pressures. Key sectors affected include:

- Agricultural Products: Lower prices for rice, rubber, and other agricultural exports reduce farmer income and overall economic output.

- Manufacturing Goods: Decreased demand for manufactured goods globally translates to lower export revenues for Thai manufacturers.

- Energy: Fluctuations in global energy prices directly influence production costs and export competitiveness.

Strong Baht:

The appreciation of the Thai Baht against other currencies makes Thai exports more expensive in international markets, reducing their competitiveness and potentially contributing to deflation. This strong Baht also lowers import prices, further adding to deflationary pressures:

- Reduced Export Competitiveness: A stronger Baht erodes the price advantage of Thai goods compared to those from other countries.

- Increased Import Volumes: Cheaper imports due to the strong Baht can lead to a surge in imports and potentially negatively impact local producers.

The Bank of Thailand's Response:

The BOT has implemented various measures to counter deflationary pressures. However, the effectiveness of these strategies remains a subject of ongoing debate.

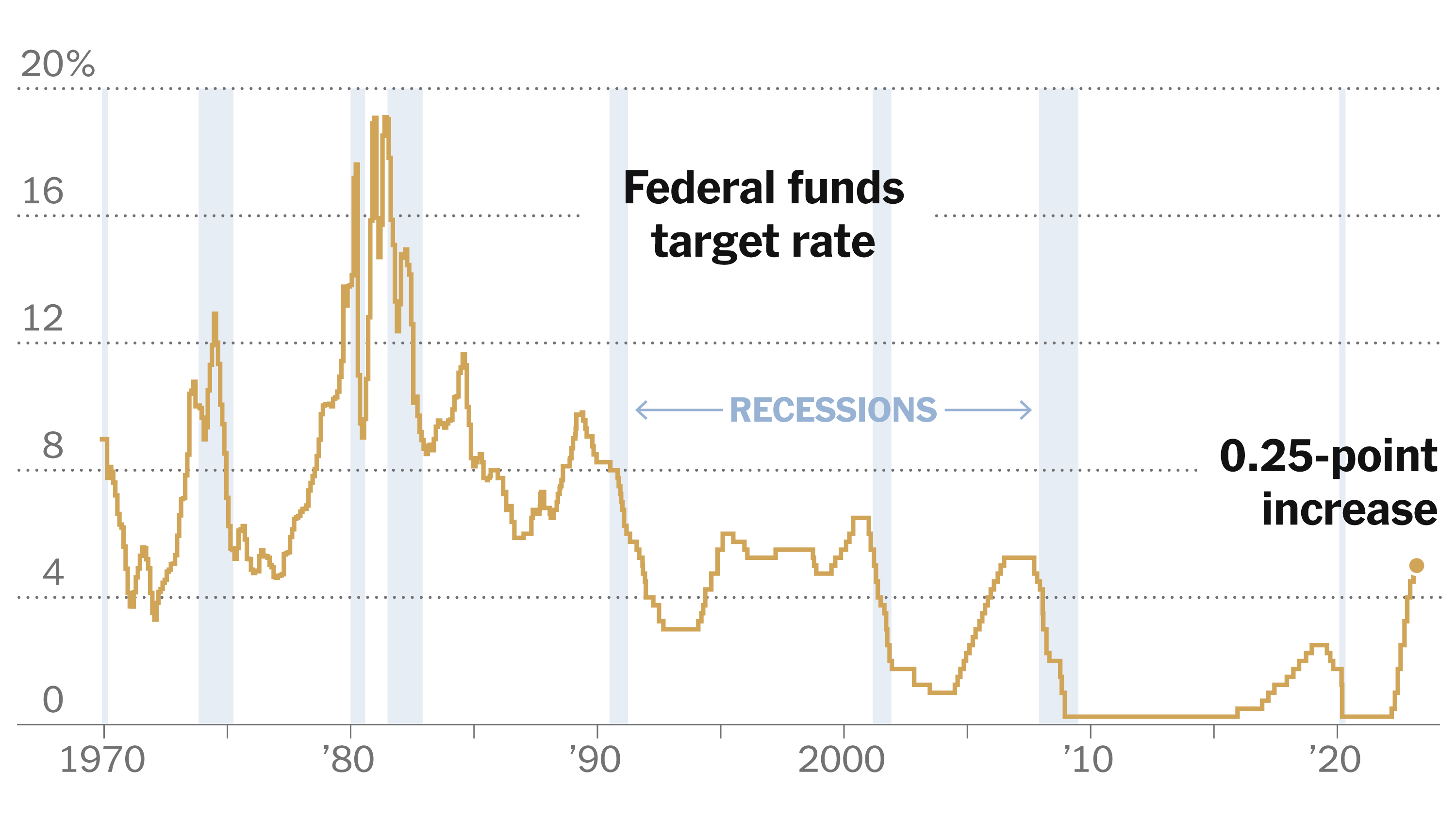

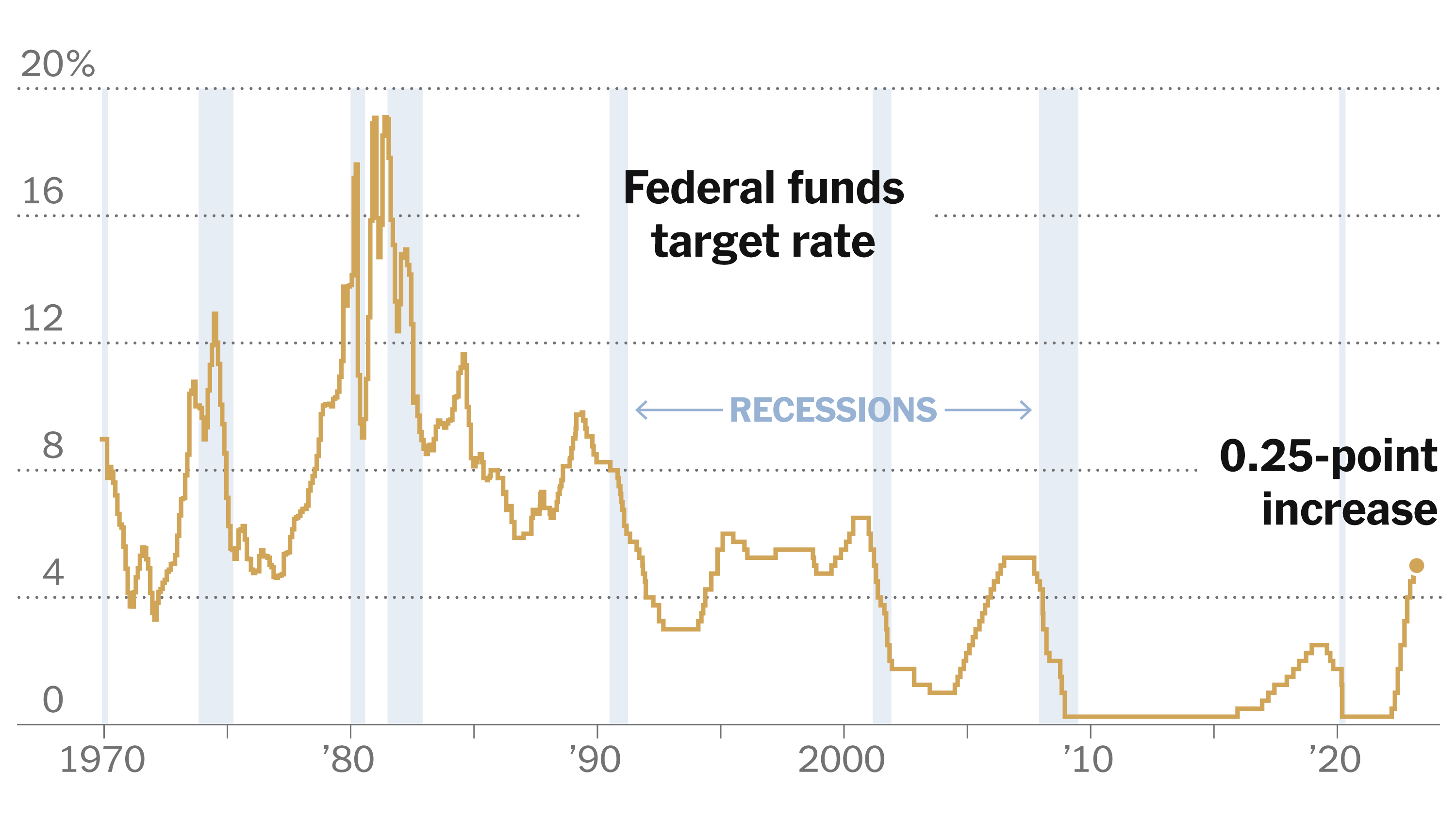

Past Interest Rate Cuts:

The BOT has undertaken several interest rate cuts in recent years, aiming to stimulate borrowing and investment. These cuts include:

- May 2020: A 25 basis point cut.

- July 2020: A further 25 basis point cut.

- August 2020: Another 25 basis point cut.

The effectiveness of these past cuts in reviving economic activity remains debatable.

Quantitative Easing Measures:

While not as extensive as in some other countries, the BOT has also explored quantitative easing (QE) measures, including:

- Asset Purchases: Purchasing government bonds to inject liquidity into the financial system.

- Loan Guarantees: Providing guarantees to encourage lending to businesses and individuals.

The impact of these QE measures on combating deflation needs further evaluation.

Other Policy Interventions:

The Thai government has implemented various fiscal stimulus packages to boost economic activity, including infrastructure projects and support for small and medium-sized enterprises (SMEs). These initiatives aim to complement the BOT's monetary policy efforts.

Forecasting Future Interest Rate Cuts:

Predicting future interest rate adjustments requires careful consideration of several economic indicators and the evolving global economic landscape.

Economic Indicators:

The BOT will closely monitor several key indicators:

- Inflation Rate: The primary indicator of price stability. A sustained decline in the inflation rate would signal a persistent deflationary trend.

- GDP Growth: A measure of the overall economic expansion or contraction. Weak GDP growth indicates a weakening economy.

- Unemployment Rate: High unemployment reflects weak domestic demand and suggests a need for further stimulus.

Global Economic Outlook:

Global economic conditions play a pivotal role in Thailand's economic trajectory and the BOT's policy decisions. Factors such as:

- Global Trade Wars: Could significantly impact Thailand's export-oriented economy.

- Geopolitical Risks: Uncertainties in global politics can negatively affect investor sentiment and investment flows into Thailand.

- Global Recessions: A global recession would likely deepen Thailand's deflationary pressures.

These global factors heavily influence the BOT's strategic choices.

Expert Opinions:

Many economists and analysts anticipate further interest rate cuts by the BOT, given the persistent deflationary pressures. However, the timing and magnitude of these cuts remain uncertain, dependent on the evolution of the above-mentioned factors. (For specific expert opinions, consult recent reports from reputable financial institutions like the IMF or World Bank).

Conclusion: Navigating Thailand's Deflationary Landscape

Thailand's deflation is a multifaceted issue stemming from weak domestic demand, falling global commodity prices, and a strong Baht. The BOT's response, which includes interest rate cuts and other policy interventions, requires ongoing evaluation. The likelihood of further interest rate cuts hinges on the performance of key economic indicators and the global economic outlook. Staying informed about Thailand's deflation and the BOT's policy decisions is crucial for navigating the country's economic future. To remain updated, follow reputable financial news sources and subscribe to economic newsletters that cover Southeast Asian economic trends. Understanding the dynamics of Thailand's deflation is crucial for navigating the country's economic future.

Featured Posts

-

Svetovy Pohar Hokeja 2028 Nhl Ohlasila Navrat Turnaja

May 07, 2025

Svetovy Pohar Hokeja 2028 Nhl Ohlasila Navrat Turnaja

May 07, 2025 -

Improved Playoffs For Randle Timberwolves Key To Success

May 07, 2025

Improved Playoffs For Randle Timberwolves Key To Success

May 07, 2025 -

Google Ad Tech Monopoly Us Demands Forced Sale Of Assets

May 07, 2025

Google Ad Tech Monopoly Us Demands Forced Sale Of Assets

May 07, 2025 -

Is There A Deeper Connection Between Ed Sheeran And Rihanna

May 07, 2025

Is There A Deeper Connection Between Ed Sheeran And Rihanna

May 07, 2025 -

Nova Fotosesiya Rianni Spokuslive Rozheve Merezhivo

May 07, 2025

Nova Fotosesiya Rianni Spokuslive Rozheve Merezhivo

May 07, 2025