The Bank Of Canada And The Trump Tariffs: An April Interest Rate Contemplation

Table of Contents

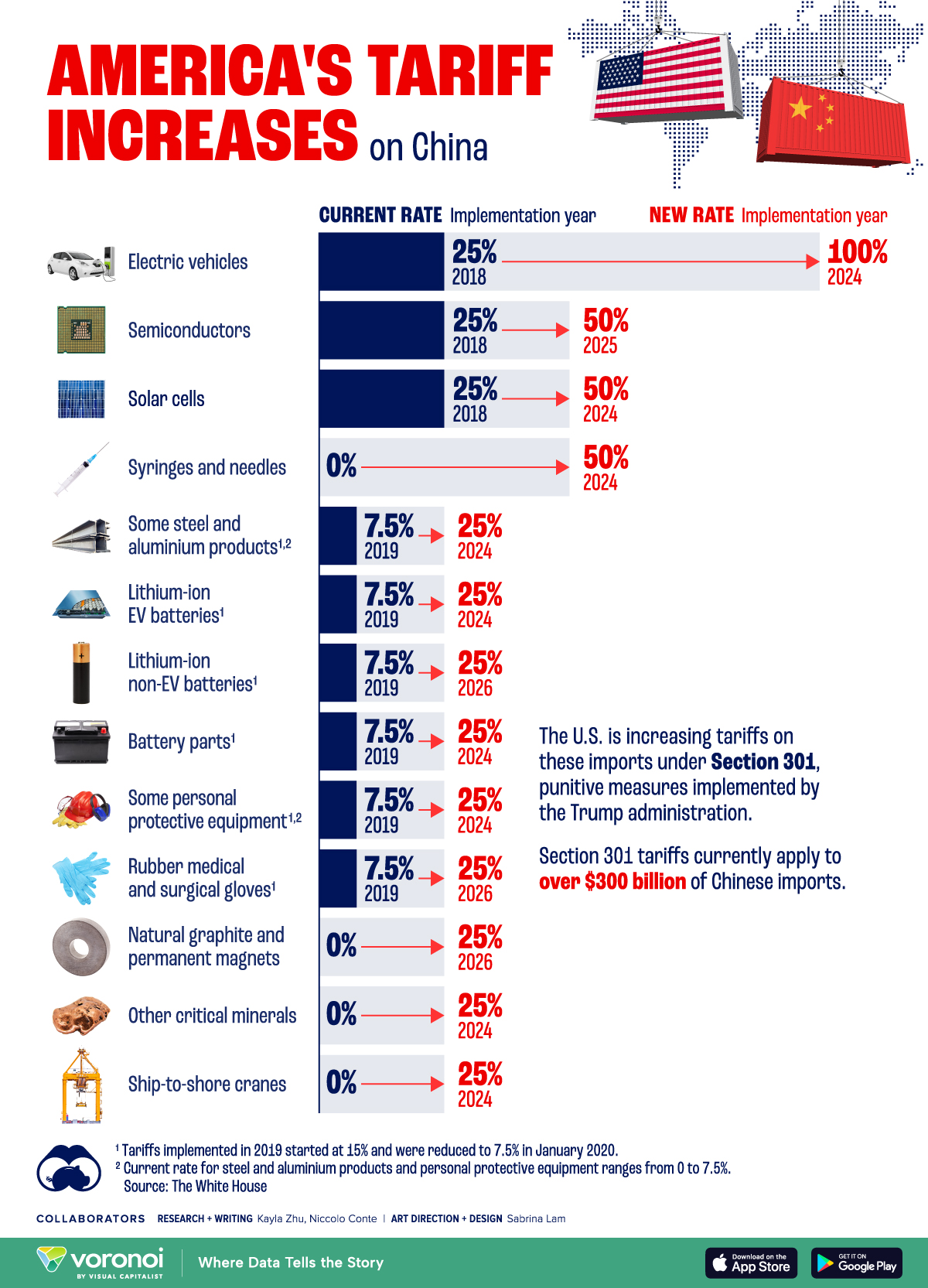

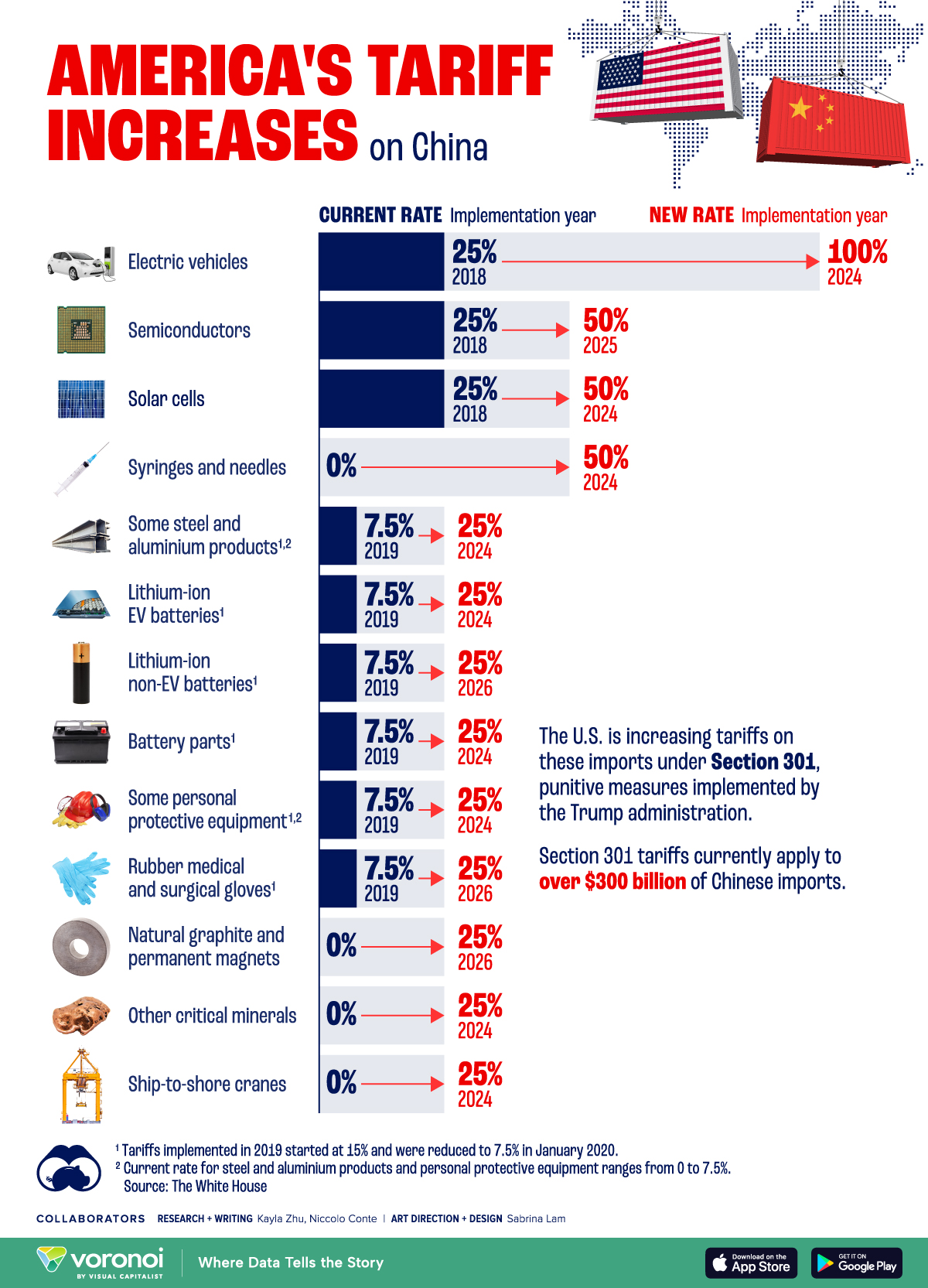

The Lingering Impact of Trump Tariffs on the Canadian Economy

Trump's tariffs significantly impacted key Canadian industries. The lumber industry, for instance, faced retaliatory tariffs, leading to reduced exports and job losses. Similarly, the agricultural sector, particularly the dairy and softwood lumber industries, experienced substantial economic disruption. The automotive sector also felt the pinch, as supply chains were disrupted and production costs increased.

The ripple effect extended beyond specific sectors. Reduced exports led to decreased investment, impacting overall economic growth. Job losses were felt across various industries, contributing to a slowdown in employment growth.

-

Specific examples of tariff impacts: Retaliatory tariffs on Canadian lumber resulted in a significant decline in exports to the US, impacting forestry companies and related industries. The dairy sector faced increased competition from US dairy products due to tariff adjustments.

-

Quantitative data illustrating economic consequences: Statistics Canada reported a [insert specific GDP growth figures and job loss data related to Trump tariffs]. [Cite reliable sources, e.g., Statistics Canada reports, Bank of Canada publications].

-

Citations of reliable economic sources: [Insert citations here].

Inflationary Pressures and the Bank of Canada's Mandate

The Bank of Canada's primary mandate is to maintain price stability and full employment. Trump's tariffs contributed to inflationary pressures in Canada, primarily through increased import costs. The tariffs raised the prices of imported goods, directly impacting consumer prices and fueling inflationary trends. This created a classic policy dilemma: the need to control inflation often clashes with the desire to stimulate economic growth. Raising interest rates to combat inflation could stifle economic growth, potentially worsening unemployment.

-

Explanation of the Bank of Canada's inflation target: The Bank of Canada targets an inflation rate of [insert current target].

-

Discussion of supply chain disruptions caused by tariffs: Tariffs disrupted established supply chains, leading to shortages and price increases for various goods.

-

Analysis of the impact of inflation on consumer spending: Increased inflation can erode consumer purchasing power, reducing demand and potentially impacting economic growth.

Analyzing the April Interest Rate Decision in Context

The Bank of Canada's April interest rate decision wasn't solely influenced by the lingering effects of Trump's tariffs. Other factors played a crucial role, including: global economic growth, domestic consumer confidence, and the prevailing unemployment rate. Several scenarios were possible:

-

Interest rate hike: This would aim to curb inflation but could potentially slow economic growth.

-

Interest rate hold: Maintaining the status quo would reflect a cautious approach, acknowledging both inflationary pressures and the need for economic stability.

-

Interest rate cut: A rate cut would stimulate economic growth, but it could exacerbate inflationary pressures.

-

Discussion of current economic indicators: The unemployment rate in April stood at [insert data], while consumer confidence was [insert data - high, low, stable]. These factors, alongside global economic uncertainty, influenced the Bank's deliberations.

-

Analysis of global economic conditions and their influence: [Discuss global economic factors].

-

Potential impacts of each interest rate decision on various economic sectors: An interest rate hike might disproportionately affect sectors with high debt levels.

Alternative Monetary Policy Tools Beyond Interest Rates

Beyond interest rate adjustments, the Bank of Canada possesses alternative monetary policy tools to manage the economic effects of past tariffs. These include quantitative easing (QE), where the central bank purchases government bonds to increase the money supply. Other non-traditional measures could involve targeted lending programs or direct interventions in specific markets.

-

Description of alternative monetary policy tools: Quantitative easing involves injecting liquidity into the financial system to lower long-term interest rates and stimulate lending.

-

Analysis of the effectiveness of each tool in the context of the situation: The effectiveness of QE depends on the prevailing economic conditions and market response.

-

Discussion of potential risks and side effects: QE carries the risk of inflation if not managed carefully.

The Bank of Canada's Response and Future Outlook

The Bank of Canada's response to the lingering effects of Trump's tariffs reflects a delicate balancing act between managing inflation and supporting economic growth. The April interest rate decision, and future decisions, will be heavily influenced by ongoing economic data and global developments. Understanding the complexities of monetary policy in response to external economic shocks like these trade disputes is critical. We can anticipate the Bank of Canada to closely monitor key economic indicators and adapt its monetary policy accordingly. The future trajectory of interest rates will depend on the evolving economic landscape.

Call to Action: Stay updated on the Bank of Canada's response to trade tariffs and their impact on interest rates by following the Bank's official website and reputable financial news sources. Understanding the Bank of Canada's actions regarding the lingering effects of trade policies is crucial for navigating the Canadian economic climate. Follow the Bank of Canada's interest rate decisions related to trade impacts to stay informed.

Featured Posts

-

Manchester Uniteds Transfer Woes Souness Weighs In

May 02, 2025

Manchester Uniteds Transfer Woes Souness Weighs In

May 02, 2025 -

Tulsa Day Center Prepares For Winter Donate Coats Hats And Gloves

May 02, 2025

Tulsa Day Center Prepares For Winter Donate Coats Hats And Gloves

May 02, 2025 -

Souness Praises Lewis Skellys Exceptional Attitude

May 02, 2025

Souness Praises Lewis Skellys Exceptional Attitude

May 02, 2025 -

Fortnites Changing Landscape Impact Of Game Mode Shutdowns

May 02, 2025

Fortnites Changing Landscape Impact Of Game Mode Shutdowns

May 02, 2025 -

Rupert Lowe Credible Evidence Of A Toxic Workplace Culture

May 02, 2025

Rupert Lowe Credible Evidence Of A Toxic Workplace Culture

May 02, 2025

Latest Posts

-

The 10 Best Film Noir Movies Ever Made

May 10, 2025

The 10 Best Film Noir Movies Ever Made

May 10, 2025 -

The Kreischers Marriage And The Netflix Stand Up Routine

May 10, 2025

The Kreischers Marriage And The Netflix Stand Up Routine

May 10, 2025 -

Top 10 Must See Film Noir Movies

May 10, 2025

Top 10 Must See Film Noir Movies

May 10, 2025 -

Bert Kreischers Netflix Specials A Look At His Wifes Perspective On His Jokes

May 10, 2025

Bert Kreischers Netflix Specials A Look At His Wifes Perspective On His Jokes

May 10, 2025 -

10 Essential Film Noir Movies To Watch

May 10, 2025

10 Essential Film Noir Movies To Watch

May 10, 2025