The BCE Inc. Dividend Cut: A Comprehensive Investor Analysis

Table of Contents

Reasons Behind the BCE Inc. Dividend Cut

BCE Inc.'s decision to reduce its dividend wasn't impulsive; it stems from a confluence of factors impacting the company's financial strategy and long-term growth objectives.

Increased Capital Expenditures

BCE is heavily investing in upgrading its network infrastructure. This includes a significant push towards 5G rollout and the expansion of its fiber optic network. These capital-intensive projects, while crucial for long-term competitiveness and growth, require substantial upfront investment, directly impacting the free cash flow available for dividend payouts.

- Specific examples: Expansion of 5G coverage across major Canadian cities, nationwide fiber optic network upgrades, and investments in advanced network technologies.

- Projected costs: Billions of dollars are being allocated to these projects over the next few years.

- Long-term benefits: These investments aim to solidify BCE's position as a leading telecom provider, attracting and retaining customers through superior network performance and advanced services. This will ultimately lead to higher revenue streams in the long term, outweighing the short-term impact of the dividend reduction. The trade-off between short-term dividend reduction and long-term growth potential is a key consideration for BCE and its shareholders.

Debt Management and Financial Leverage

Maintaining a healthy balance sheet is paramount for a telecommunications giant like BCE Inc. While BCE has a strong credit rating, managing debt levels effectively remains a priority. The dividend cut likely reflects a proactive strategy to reduce financial leverage and enhance the company's financial flexibility.

- Key financial ratios: Analyzing BCE's debt-to-equity ratio and interest coverage ratio provides insights into its financial health and ability to service its debt obligations.

- Credit rating changes: Maintaining a strong credit rating is crucial for accessing affordable capital for future investments.

- Implications: A more conservative financial approach, while impacting short-term dividend payments, ensures long-term financial stability and reduces vulnerability to economic downturns. This is particularly important in a sector as capital-intensive as telecommunications.

Impact of the Economic Environment

The macroeconomic climate significantly influences BCE's decisions. Inflation, rising interest rates, and the potential for a recession create economic headwinds. These factors necessitate a cautious approach to financial management, and the dividend cut might be a preemptive measure to navigate these uncertainties.

- Specific economic indicators: Inflation rates, interest rate hikes by the Bank of Canada, consumer spending patterns, and GDP growth forecasts all play a role.

- Correlation with BCE's performance: Economic slowdown can affect consumer spending on telecom services, impacting BCE's revenue and profitability.

- Impact on dividend payments: Maintaining a consistent dividend payout during economic uncertainty might jeopardize the company's financial strength. The dividend cut allows BCE to retain more capital for operational resilience and future investments.

Impact on Investors and Potential Strategies

The BCE Inc. dividend cut has immediate and long-term implications for investors. Understanding these implications is crucial for making informed investment decisions.

Immediate Impact on Dividend Income

Shareholders will experience a reduction in their dividend income. This is a significant factor for income-seeking investors who relied on BCE's dividend as a key part of their investment strategy.

- Previous dividend payout: [Insert previous dividend amount per share]

- Current dividend payout: [Insert current dividend amount per share]

- Percentage reduction: [Insert percentage reduction]

- Effective date of change: [Insert date]

- Alternative income sources: Investors might consider exploring other dividend-paying stocks, high-yield bonds, or other income-generating assets to compensate for the reduced income from BCE.

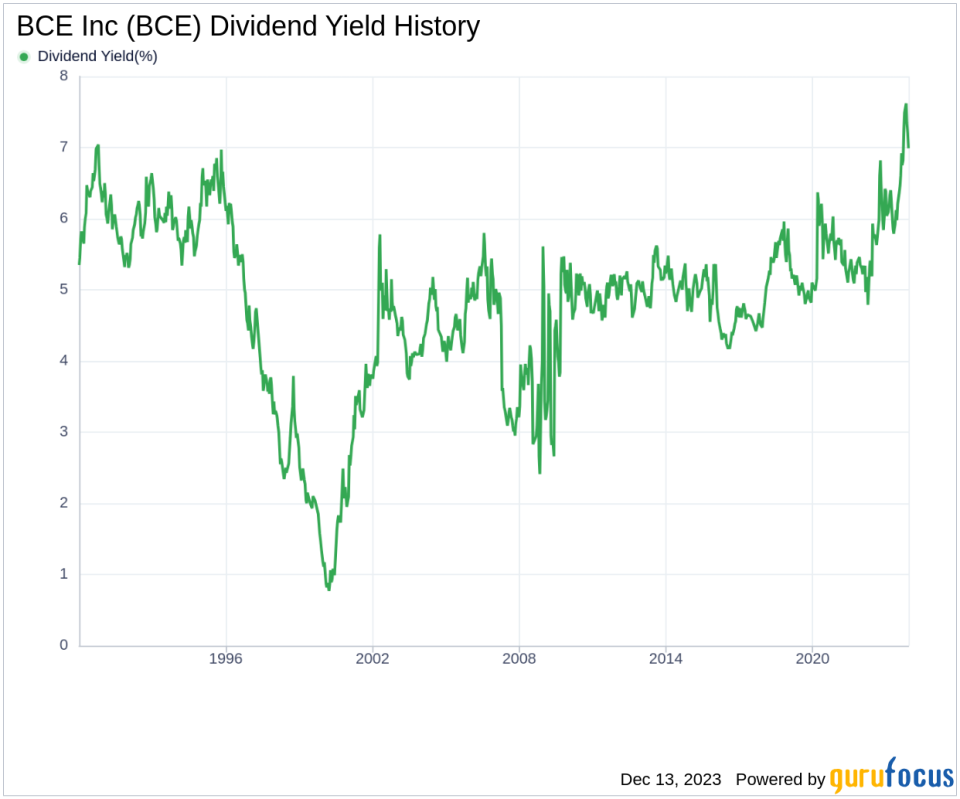

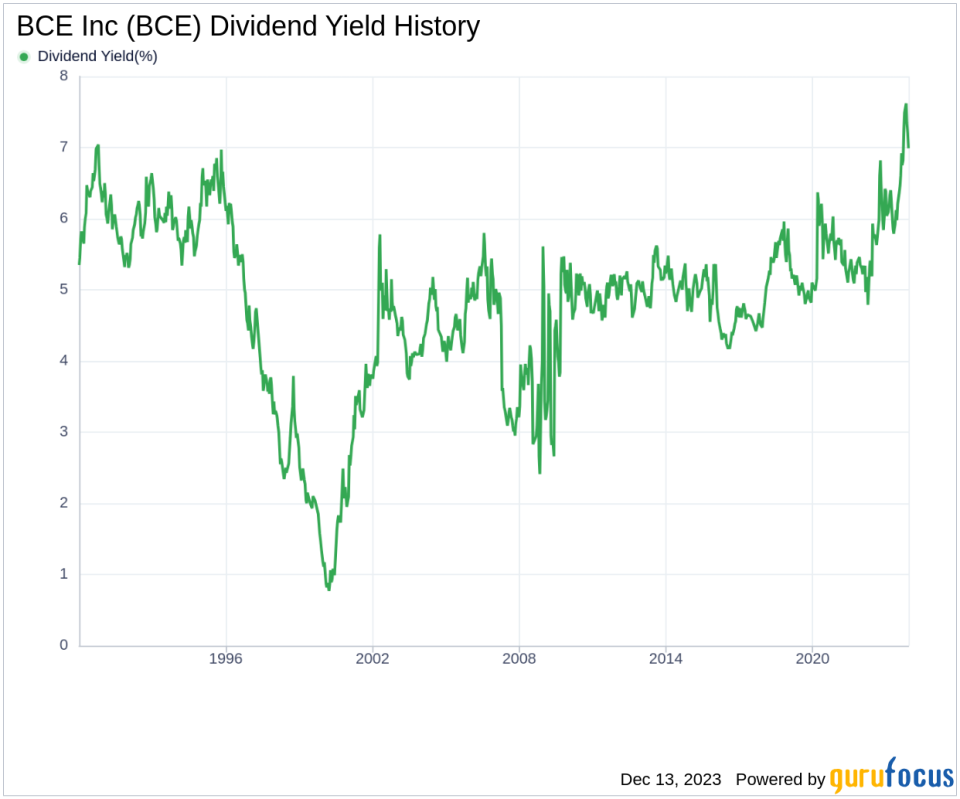

Long-Term Implications for BCE Stock Price

The market's reaction to the dividend cut will shape the long-term trajectory of BCE's stock price. Several factors will influence this, including investor sentiment, future growth prospects, and the competitive landscape.

- Potential price movements: The stock price could potentially increase, decrease, or remain stagnant depending on investor perception of the strategic rationale behind the dividend cut and the company's future growth outlook.

- Factors influencing price changes: Analyst ratings, future earnings reports, and overall market conditions will significantly influence price movements.

- Strategies for investors: Investors might consider holding their BCE stock, believing the long-term growth potential outweighs the reduced dividend, or they might sell, seeking higher yields elsewhere. A thorough assessment of the company's financial health and growth prospects is essential.

Alternative Investment Options for Dividend Income

Investors seeking alternative sources of dividend income within the telecom or broader Canadian market can explore various options.

- Examples of alternative stocks: Research other Canadian telecom companies or explore other sectors offering stable dividend yields.

- Comparison with BCE: Analyzing other companies' financial strength, growth potential, and dividend history is essential for informed decision-making.

Conclusion

The BCE Inc. dividend cut is a strategic move reflecting a need to balance short-term dividend payments with long-term investments in network infrastructure and financial stability. While the immediate impact on income-seeking investors is undeniable, the long-term benefits of these investments could lead to stronger growth and a healthier company. Understanding the rationale behind the decision and considering the broader economic context is crucial for making informed investment choices. Conduct thorough research before making any investment decisions related to BCE Inc. or any other dividend-paying stock. Staying informed about BCE Inc. and its dividend policy is key to making well-informed decisions about your investment portfolio.

Featured Posts

-

Unexpected Hit Henry Cavill In The Action Thriller Night Hunter

May 12, 2025

Unexpected Hit Henry Cavill In The Action Thriller Night Hunter

May 12, 2025 -

Experience The Michael Johnson Grand Slam Speed Stars And Significant Prize Money

May 12, 2025

Experience The Michael Johnson Grand Slam Speed Stars And Significant Prize Money

May 12, 2025 -

A Former Singapore Airlines Stewardess Shares Her Story

May 12, 2025

A Former Singapore Airlines Stewardess Shares Her Story

May 12, 2025 -

Meeting Shane Lowry Tips For Success

May 12, 2025

Meeting Shane Lowry Tips For Success

May 12, 2025 -

Nba Sixth Man Of The Year Payton Pritchard Makes History For The Celtics

May 12, 2025

Nba Sixth Man Of The Year Payton Pritchard Makes History For The Celtics

May 12, 2025

Latest Posts

-

Celebrating Cultural Exchange The India Myanmar Food Festival

May 13, 2025

Celebrating Cultural Exchange The India Myanmar Food Festival

May 13, 2025 -

Tasman Council Faces Realistic Demands To Maintain Key Road Access

May 13, 2025

Tasman Council Faces Realistic Demands To Maintain Key Road Access

May 13, 2025 -

Shared Flavors Stronger Bonds The India Myanmar Food Festival

May 13, 2025

Shared Flavors Stronger Bonds The India Myanmar Food Festival

May 13, 2025 -

Realistic Assessment Needed The Future Of A Key Road In Tasman

May 13, 2025

Realistic Assessment Needed The Future Of A Key Road In Tasman

May 13, 2025 -

Food Festival Forges Stronger India Myanmar Relations

May 13, 2025

Food Festival Forges Stronger India Myanmar Relations

May 13, 2025