The Brexit Effect: Slowing Growth In UK Luxury Exports To The EU

Table of Contents

Increased Trade Barriers and Bureaucracy

Brexit has introduced significant trade barriers and increased bureaucracy, significantly impacting the export of luxury goods to the EU. The once-seamless flow of high-value items has been disrupted by new customs checks, tariffs, and complex paperwork. This has resulted in several key negative consequences:

- Increased shipping times and costs: Delays at customs checkpoints lead to longer transit times and increased freight costs, eating into profit margins. This is particularly problematic for time-sensitive luxury goods.

- Complex customs declarations and documentation: The new regulatory environment demands extensive paperwork and compliance with complex customs regulations, adding administrative burdens and increasing the risk of errors and delays.

- Higher import duties and taxes for luxury goods: Luxury goods often face higher tariffs, increasing their final price for EU consumers and reducing their competitiveness.

- Delays and disruptions to supply chains: The added complexities have created bottlenecks in supply chains, leading to unpredictable delivery times and impacting the availability of luxury products in EU markets. This affects everything from sourcing raw materials to final delivery to the customer. These Brexit trade barriers are a major concern for UK luxury exporters.

Weakened Pound and Currency Fluctuations

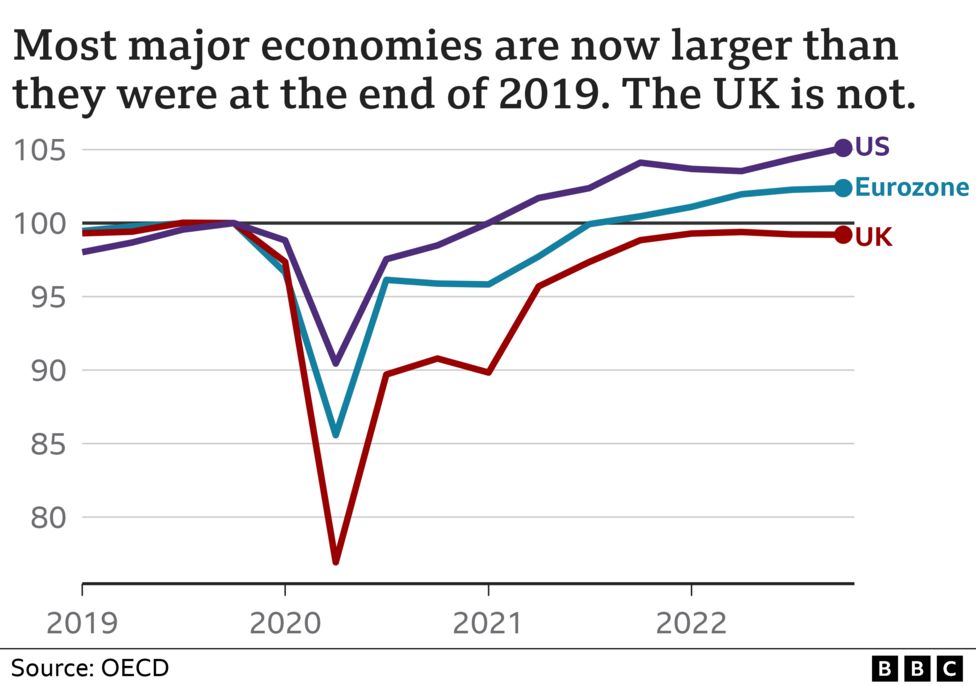

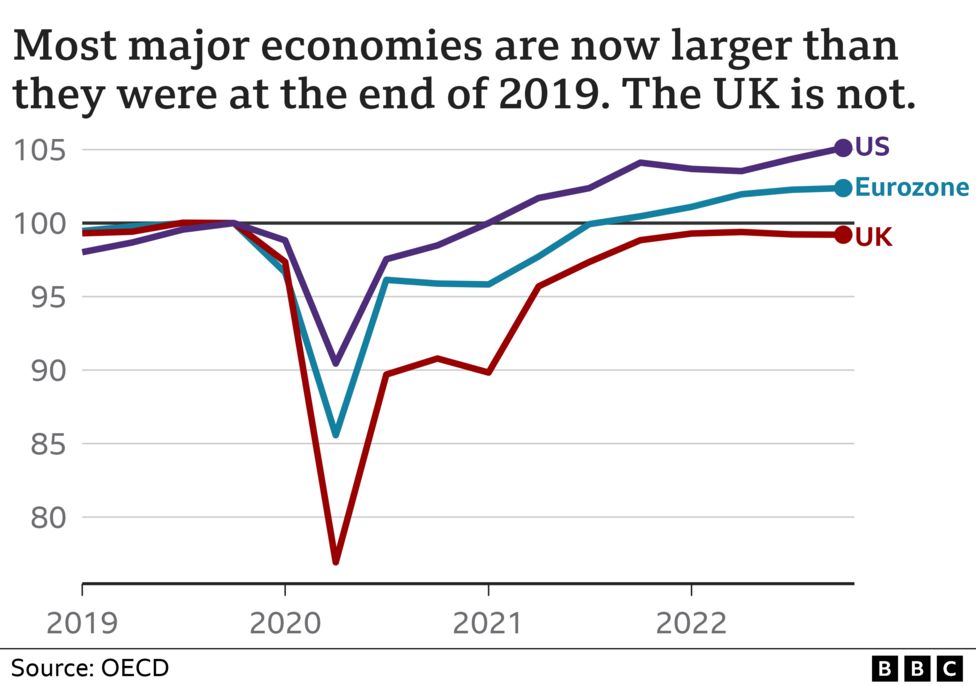

The post-Brexit weakening of the pound sterling has further exacerbated the challenges faced by UK luxury exporters. The fluctuating exchange rate directly impacts the price competitiveness of UK luxury goods within the EU market.

- Increased prices for EU consumers: A weaker pound translates to higher prices for EU consumers, potentially reducing demand for British luxury products.

- Reduced demand for UK luxury products: Higher prices make UK luxury goods less attractive compared to competitors from other countries with more stable currencies.

- Impact on profitability for UK luxury exporters: Increased costs and reduced demand directly affect the profitability of UK luxury businesses exporting to the EU. The Brexit impact on currency is a significant factor impacting the bottom line.

Loss of Frictionless Trade and Market Access

Before Brexit, UK businesses enjoyed frictionless trade within the EU single market. This provided significant advantages that are now lost. The loss of this frictionless trade has had a profound effect on luxury goods.

- Simplified customs procedures under the single market: The single market previously offered streamlined customs procedures, significantly reducing administrative burdens and costs.

- Easier access to EU consumers and distributors: Businesses could easily reach EU consumers and establish strong distribution networks without significant regulatory hurdles.

- Reduced logistical complexities: The ease of movement of goods within the single market facilitated efficient logistics and reduced supply chain complexities.

- The impact of new regulatory barriers: New regulatory barriers, such as differing product standards and labeling requirements, create further challenges for UK luxury exporters seeking access to the EU market. These are significant hurdles to overcome.

The Impact on Specific Luxury Sectors

The challenges outlined above disproportionately affect specific luxury sectors. The UK luxury fashion exports, for example, have experienced a decline, as have Brexit impact on jewelry exports and high-end car exports.

- Case study: Burberry, a renowned British luxury brand, has reported increased logistical costs and complexities in exporting its products to the EU since Brexit.

- Quantifiable data: Reports from industry bodies indicate a significant drop in the value of UK luxury goods exported to the EU following Brexit. Specific figures illustrating the decline in individual sectors should be included here, backed by reputable sources.

Conclusion: Navigating the Brexit Effect on UK Luxury Exports to the EU

In summary, the slowdown in UK luxury exports to the EU post-Brexit is a result of interconnected factors: increased trade barriers, currency fluctuations, and the loss of frictionless trade. These challenges have negatively impacted the UK luxury sector and have the potential for long-term consequences. The Brexit effect on UK luxury exports to the EU requires urgent attention.

Understanding the Brexit effect on UK luxury exports to the EU is crucial for businesses navigating this new reality. Stay informed about ongoing developments, explore strategies to mitigate the challenges, and consider seeking professional advice on navigating the post-Brexit trade landscape. Successfully navigating the complexities of the Brexit effect requires proactive strategies and a deep understanding of the evolving regulatory environment.

Featured Posts

-

L Alfa Romeo Junior 1 2 Turbo Speciale Selon Le Matin Auto

May 21, 2025

L Alfa Romeo Junior 1 2 Turbo Speciale Selon Le Matin Auto

May 21, 2025 -

Designer Athena Calderones Lavish Roman Milestone Celebration

May 21, 2025

Designer Athena Calderones Lavish Roman Milestone Celebration

May 21, 2025 -

Rum Culture In Guyana The Kartel Influence

May 21, 2025

Rum Culture In Guyana The Kartel Influence

May 21, 2025 -

Analyzing The Valuation Of D Wave Quantum Qbts Following Kerrisdale Capitals Report

May 21, 2025

Analyzing The Valuation Of D Wave Quantum Qbts Following Kerrisdale Capitals Report

May 21, 2025 -

Legal Battle Continues Ex Tory Councillors Wife And The Racial Hatred Tweet Appeal

May 21, 2025

Legal Battle Continues Ex Tory Councillors Wife And The Racial Hatred Tweet Appeal

May 21, 2025

Latest Posts

-

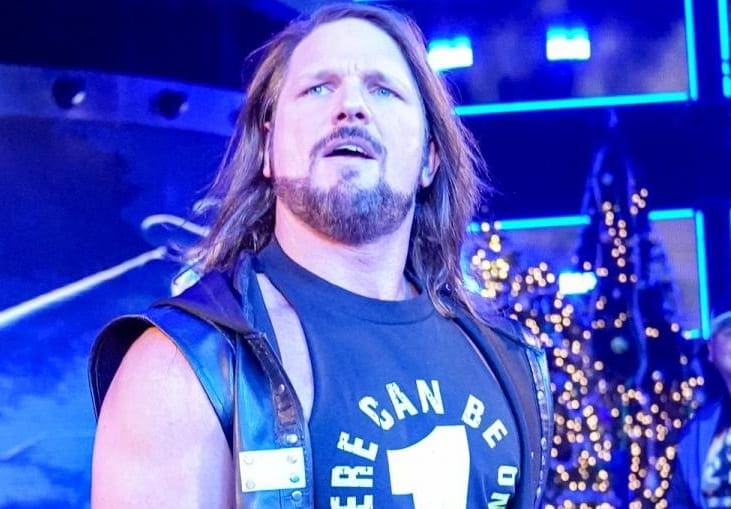

Wwes Aj Styles Contract Status And Future Speculation

May 21, 2025

Wwes Aj Styles Contract Status And Future Speculation

May 21, 2025 -

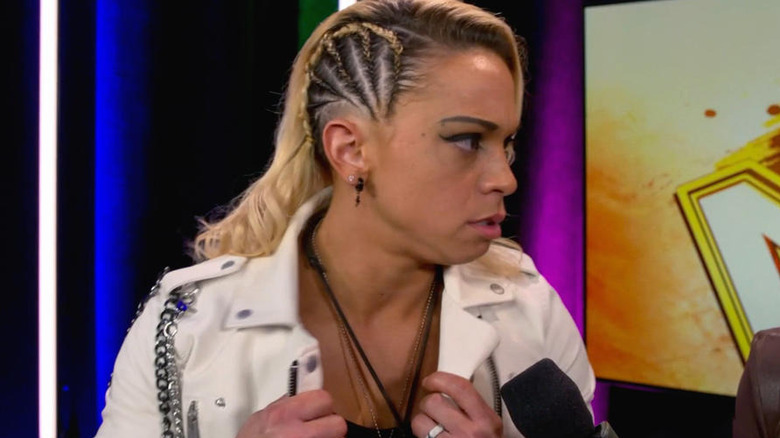

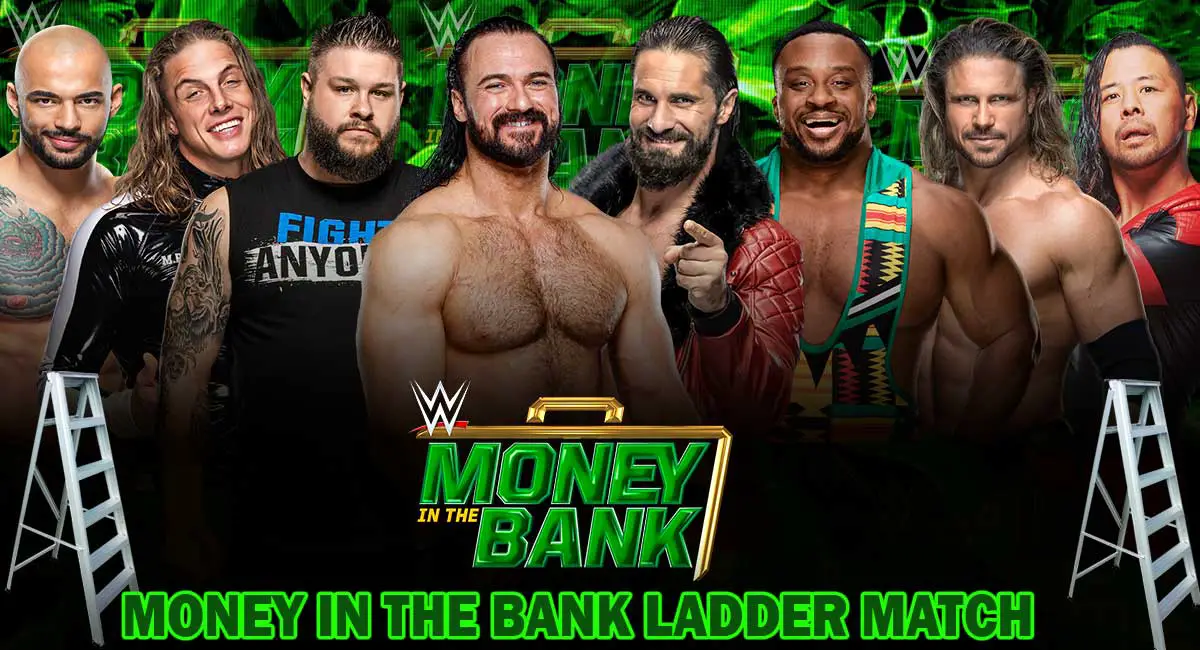

Road To Money In The Bank 2025 Ripley And Perez Earn Their Place

May 21, 2025

Road To Money In The Bank 2025 Ripley And Perez Earn Their Place

May 21, 2025 -

Zoey Starks Injury Wwe Raw Match Update And Recovery Timeline

May 21, 2025

Zoey Starks Injury Wwe Raw Match Update And Recovery Timeline

May 21, 2025 -

2025 Money In The Bank Perez And Ripley Qualify For Ladder Match

May 21, 2025

2025 Money In The Bank Perez And Ripley Qualify For Ladder Match

May 21, 2025 -

Wwe Raw Zoey Starks Injury And Potential Impact On Future Matches

May 21, 2025

Wwe Raw Zoey Starks Injury And Potential Impact On Future Matches

May 21, 2025