The Connection Between Late Student Loan Payments And Creditworthiness

Table of Contents

How Late Student Loan Payments Affect Your Credit Score

Missing student loan payments has serious repercussions for your credit score. When you're late, your loan servicer reports this delinquency to the three major credit bureaus: Equifax, Experian, and TransUnion. These bureaus then incorporate this negative information into your credit report, directly impacting your FICO score and VantageScore – the numbers lenders use to assess your credit risk.

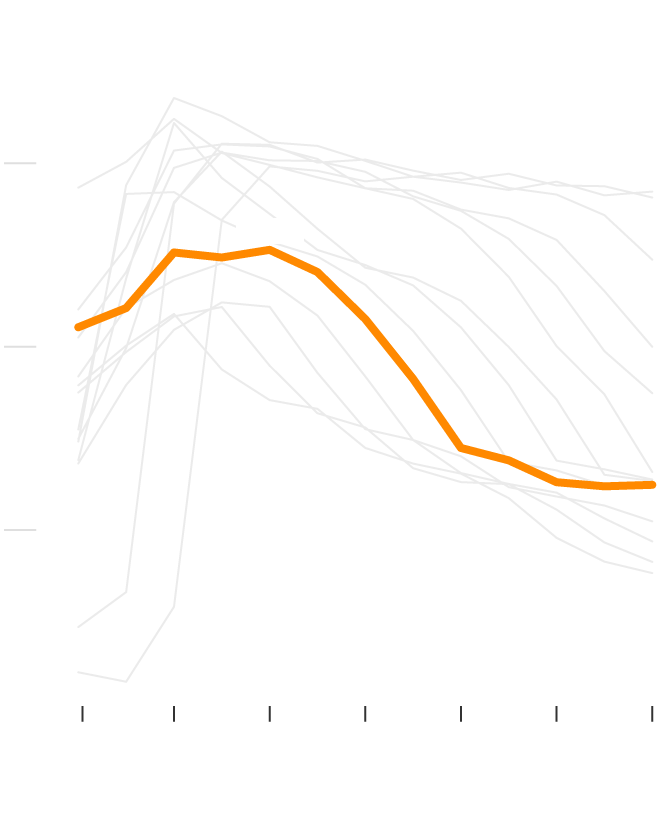

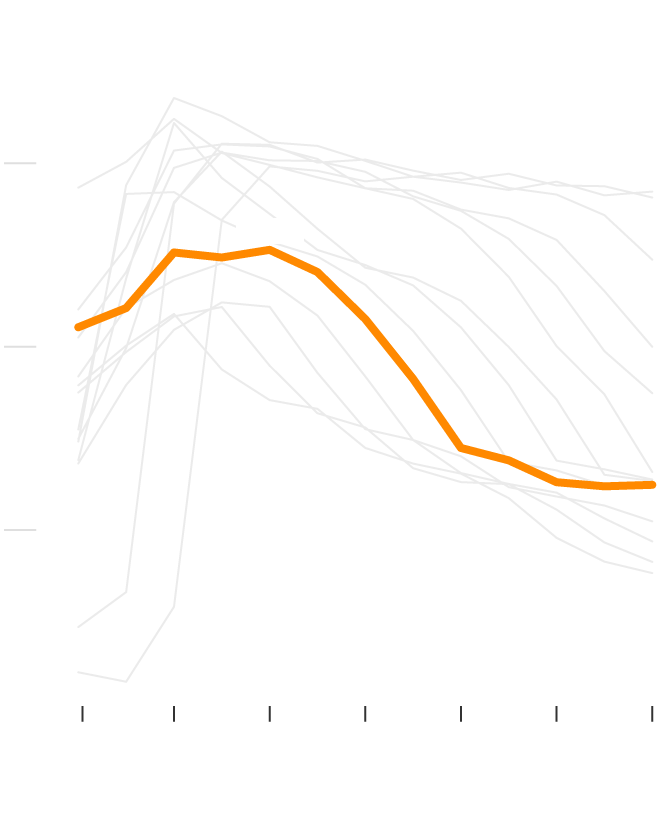

- Severity of Impact: The damage to your credit score depends on the severity and frequency of late payments. A single missed payment might cause a minor dip, but repeated late payments or prolonged delinquency can severely damage your score, making it much harder to obtain future credit.

- Delinquency Ranges: The impact escalates as the delinquency period lengthens. A payment 30 days late will negatively impact your score less than one 90 days or more overdue. Beyond 90 days, the debt may be sent to collections, resulting in even more significant damage.

- Collection Agencies: If your account goes to collections, a negative mark remains on your credit report for seven years, making it even harder to obtain credit at favorable rates in the future.

Understanding the Reporting Process of Student Loan Delinquency

Understanding the reporting process is vital to protecting your credit. Generally, your loan servicer will report your payment status to the credit bureaus monthly. However, the exact timing can vary slightly depending on the servicer and the type of loan.

- Federal vs. Private Loans: The reporting process might differ slightly between federal and private student loans. Federal loans often have more stringent reporting procedures, while private lenders might have more flexibility.

- Loan Servicers' Role: Your loan servicer is responsible for accurately reporting your payment history. While they typically do a good job, it's essential to monitor your credit report regularly for any inaccuracies.

- Addressing Reporting Errors: If you discover an error on your credit report concerning your student loan payments, immediately contact your loan servicer and the credit bureaus to dispute the incorrect information. Provide supporting documentation to prove your case.

Long-Term Consequences of Poor Student Loan Payment History

A history of late student loan payments casts a long shadow on your financial future. The damage extends far beyond your credit score.

- Securing Loans: A poor credit score makes it significantly more difficult, and often more expensive, to obtain future loans, such as auto loans, mortgages, and personal loans. Lenders perceive you as a higher risk.

- Higher Interest Rates: Even if you qualify for a loan, you'll likely face higher interest rates and less favorable loan terms, increasing your overall borrowing costs.

- Insurance and Rentals: Your credit score can influence your insurance premiums and even your ability to secure an apartment rental. Landlords and insurers often check credit reports to assess risk.

- Financial Difficulty: The cumulative effect of higher interest rates, limited access to credit, and potential difficulties with insurance and housing can create a significant financial burden and limit opportunities.

Strategies to Avoid Late Student Loan Payments and Maintain Good Credit

Proactive student loan management is key to protecting your creditworthiness. Implementing these strategies can help you avoid the negative consequences of late payments.

- Automatic Payments: Set up automatic payments from your bank account to ensure on-time payments every month. This eliminates the risk of forgetting or missing a payment deadline.

- Budgeting and Financial Planning: Create a realistic budget that incorporates your student loan payments. Utilize budgeting apps or seek advice from a financial advisor to develop a comprehensive financial plan.

- Income-Driven Repayment Plans: Explore income-driven repayment plans (IDR) offered by the federal government. These plans adjust your monthly payment based on your income, making it more manageable.

- Contact Your Loan Servicer: If you anticipate difficulties making your payments, immediately contact your loan servicer to discuss options like forbearance or deferment before your account falls into delinquency.

- Financial Advice: Consider seeking professional financial advice. A financial advisor can help you develop a personalized plan to manage your student loan debt effectively.

Conclusion: Protecting Your Creditworthiness Through Timely Student Loan Repayment

In conclusion, late student loan payments significantly harm your creditworthiness and have far-reaching financial consequences. Avoiding late student loan payments is crucial for securing favorable loan terms, lower interest rates, and overall financial stability. By proactively managing your student loan debt, setting up automatic payments, and exploring available repayment options, you can protect your credit score and build a strong financial future. Take control of your student loan repayment and avoid the long-term implications of delinquency. Start improving your student loan payment history today by implementing these strategies and managing your student loan debt effectively. For further resources on student loan repayment and credit management, consider exploring the websites of the National Foundation for Credit Counseling (NFCC) and the Consumer Financial Protection Bureau (CFPB).

Featured Posts

-

Reddit Fixes Outage Platform Back Online After Period Of Downtime

May 17, 2025

Reddit Fixes Outage Platform Back Online After Period Of Downtime

May 17, 2025 -

Knicks Playoff Hopes Dented By Jalen Brunson Injury

May 17, 2025

Knicks Playoff Hopes Dented By Jalen Brunson Injury

May 17, 2025 -

Dubay Dlya Rossiyan V 2025 Rabota Zhizn I Realnost Vtoroy Moskvy

May 17, 2025

Dubay Dlya Rossiyan V 2025 Rabota Zhizn I Realnost Vtoroy Moskvy

May 17, 2025 -

Analyzing The Knicks Near Miss In Overtime

May 17, 2025

Analyzing The Knicks Near Miss In Overtime

May 17, 2025 -

Everton Vina 0 0 Coquimbo Unido Resumen Del Partido Goles Y Resultados

May 17, 2025

Everton Vina 0 0 Coquimbo Unido Resumen Del Partido Goles Y Resultados

May 17, 2025