The Diverging Views On Japan's Steep Bond Curve And Its Economic Consequences

Table of Contents

The Causes of Japan's Steep Bond Curve: A Battle of Perspectives

Several factors contribute to Japan's steep yield curve, with differing opinions on their relative importance.

The Bank of Japan's (BOJ) Yield Curve Control (YCC) Policy

The BOJ's Yield Curve Control (YCC) policy, implemented to stimulate the Japanese economy, aimed to keep short-term interest rates near zero while guiding long-term yields around zero percent. This intervention aimed to lower borrowing costs and encourage investment. However, critics argue YCC distorts the market, suppressing natural yield fluctuations and potentially creating future instability. The recent adjustments to YCC, allowing for greater flexibility in long-term yields, reflect the BOJ's struggle to balance its economic goals with market realities.

- Market manipulation concerns: Critics argue YCC artificially suppresses yields, preventing accurate market signaling.

- Inflationary pressures: While YCC aimed to stimulate inflation, its effectiveness has been debated amidst persistent deflationary pressures.

- JGB market liquidity: The BOJ's massive JGB holdings raise concerns about market liquidity and potential future difficulties in managing its portfolio.

Global Monetary Policy Tightening

The aggressive global monetary tightening undertaken by central banks, particularly the US Federal Reserve, significantly impacts Japan. As global interest rates rise, investors seek higher returns, leading to capital outflow from Japan and pushing up Japanese bond yields. This creates upward pressure on the long end of the JGB yield curve.

- US interest rates: Increases in US interest rates directly influence capital flows into and out of Japan.

- Capital outflow: Higher returns elsewhere attract investment away from JGBs, increasing their yields.

- Flight to safety: Although JGBs are considered safe-haven assets, the allure of higher yields in other markets reduces demand.

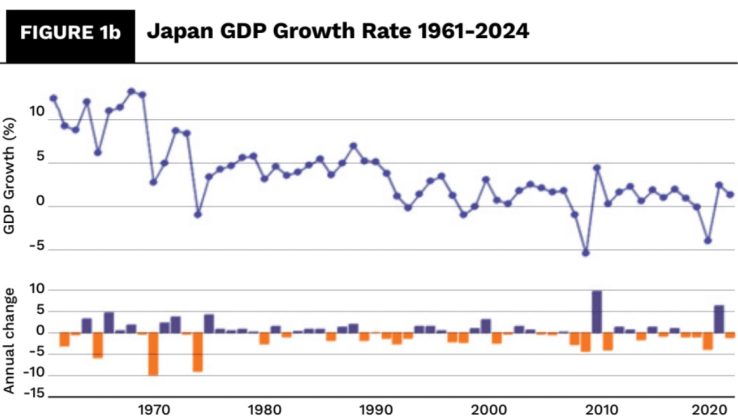

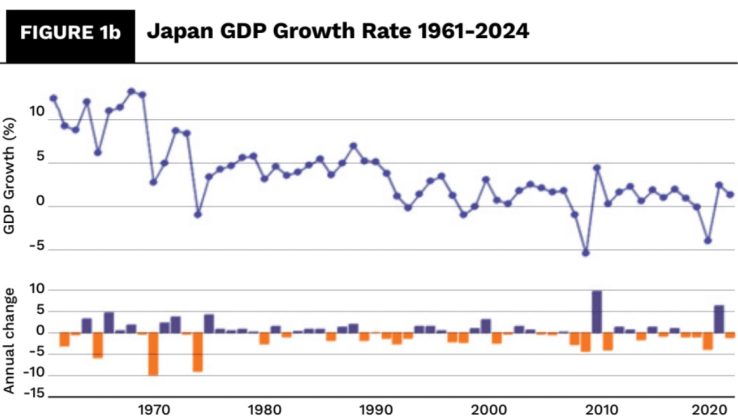

Domestic Economic Factors

Internal factors within the Japanese economy also influence its yield curve.

- Inflationary pressures: While modest inflation has emerged, it is still below the BOJ's target, influencing monetary policy decisions and JGB yields.

- Fiscal sustainability: Japan's high public debt raises concerns about the long-term sustainability of its fiscal policy, affecting investor confidence in JGBs.

- Demographics: Japan's aging population and shrinking workforce pose challenges for economic growth and influence long-term interest rate expectations.

Economic Consequences: Boom or Bust?

The implications of Japan's steep yield curve are debated, with both positive and negative scenarios being presented.

Potential Positive Impacts

Some argue that the steep curve reflects a strengthening economy, with higher long-term yields indicating investor confidence in future growth.

- Increased investment: Higher yields might encourage greater investment in Japanese assets, stimulating economic activity.

- Economic growth: A steep curve could signal a positive outlook for long-term economic expansion.

- Higher returns for savers: Higher yields on long-term bonds offer better returns for Japanese savers.

Potential Negative Impacts

Conversely, others warn of potential negative consequences, highlighting the risks associated with unsustainable debt levels and market instability.

- Debt sustainability: The steep curve could indicate growing difficulties in financing Japan's massive public debt.

- Increased borrowing costs: Higher long-term yields translate into increased borrowing costs for businesses and the government, potentially hindering economic growth.

- Market volatility: A sharp correction in the bond market, triggered by a sudden shift in investor sentiment, poses a significant risk.

Navigating Japan's Steep Bond Curve – A Path Forward

The diverging viewpoints surrounding Japan's steep bond curve highlight the complexity and uncertainty surrounding its future trajectory. While a strengthening economy and increased investment are potential positive outcomes, the risks of unsustainable debt, increased borrowing costs, and market volatility cannot be ignored. A balanced assessment is crucial. Further research and discussion on Japan's yield curve and its long-term implications for the Japanese economy and the global financial system are vital. Explore related articles on the Japanese bond market and the JGB yield curve to gain a deeper understanding of this crucial economic development. Understanding the nuances of this situation is crucial for investors and policymakers alike.

Featured Posts

-

Uspekh V Industrialnykh Parkakh Strategii Razvitiya Biznesa V Usloviyakh Vysokoy Konkurentsii

May 17, 2025

Uspekh V Industrialnykh Parkakh Strategii Razvitiya Biznesa V Usloviyakh Vysokoy Konkurentsii

May 17, 2025 -

Prestamos Estudiantiles Morosos El Departamento De Educacion Toma Acciones

May 17, 2025

Prestamos Estudiantiles Morosos El Departamento De Educacion Toma Acciones

May 17, 2025 -

Best Australian Crypto Casinos Your 2025 Gambling Guide

May 17, 2025

Best Australian Crypto Casinos Your 2025 Gambling Guide

May 17, 2025 -

Sherlock Holmes 10 Greatest Quotes Of All Time

May 17, 2025

Sherlock Holmes 10 Greatest Quotes Of All Time

May 17, 2025 -

Is Reddit Down In The Us Users Report Page Not Found

May 17, 2025

Is Reddit Down In The Us Users Report Page Not Found

May 17, 2025