The Economic Fallout: If Trump Tariffs Return To Europe

Table of Contents

Increased Prices for European Goods in the US

Trump tariffs on Europe directly translate to higher prices for American consumers. The fundamental principle is simple: tariffs are taxes on imported goods, and these taxes are ultimately passed on to the buyer. This means that everyday items, from automobiles and clothing to agricultural products like cheese and wine, would become significantly more expensive.

- Higher prices for consumers leading to reduced purchasing power: Increased costs for imported goods erode consumer purchasing power, forcing families to cut back on spending in other areas. This ripple effect can significantly dampen economic growth.

- Impact on inflation in the US: A surge in prices for imported goods directly contributes to inflation, making it more expensive for everyone. This could lead to the Federal Reserve taking action to increase interest rates to curb inflation, potentially slowing down economic activity even further.

- Potential for decreased consumer confidence: Facing higher prices and reduced purchasing power, consumers may become less confident about the economy, leading to decreased spending and a potential recessionary spiral. This impacts businesses reliant on consumer spending. Specific examples include the increased cost of German automobiles and French wines, impacting American consumers directly.

Retaliatory Tariffs from Europe

The EU is highly unlikely to passively accept new tariffs from the US. History shows that retaliatory tariffs are a common response to protectionist trade policies. If the US imposes tariffs on European goods, the EU would almost certainly respond in kind, targeting key US industries.

- Examples of US goods potentially facing retaliatory tariffs: American agricultural products (soybeans, corn), automobiles, and manufactured goods are all vulnerable to retaliatory tariffs. The impact on US farmers and manufacturers would be severe.

- Economic impact on affected US industries: Retaliatory tariffs would reduce the competitiveness of US goods in the European market, leading to lost sales, decreased production, and potential job losses. The agricultural sector, a major exporter to the EU, would be particularly hard hit.

- Potential job losses in the US: The impact on employment across various sectors, from manufacturing to agriculture, could be substantial, exacerbating existing economic anxieties. This job displacement would negatively impact communities reliant on these industries.

Disruption to Global Supply Chains

The imposition of Trump tariffs on Europe would severely disrupt established trade relationships and global supply chains. This is because many products involve components sourced from multiple countries, including both the US and Europe. Tariffs introduce uncertainty and increase the cost of these intricate supply chains.

- Increased uncertainty for businesses: Companies become hesitant to invest and expand when facing unpredictable trade policies, leading to a dampening effect on business growth.

- Higher transportation costs: Businesses might explore alternative, often more expensive, routes to avoid tariffs, driving up transportation costs and ultimately increasing the final price for consumers.

- Potential delays and shortages of goods: Disrupted supply chains can lead to shortages of goods, impacting both businesses and consumers, creating further economic instability.

Political Instability and Strained Transatlantic Relations

Renewed trade tensions would severely damage the already delicate relationship between the US and the EU. This goes beyond mere economics; it impacts diplomatic cooperation on a range of global issues.

- Impact on international cooperation on other issues: Trade disputes can overshadow cooperation on issues such as climate change, security, and global health initiatives. A fractured relationship diminishes the effectiveness of international collaborations.

- Potential for escalation of trade disputes: Retaliatory tariffs can escalate into broader trade conflicts, creating further uncertainty and instability in the global economy.

- Damage to the credibility of international trade agreements: A return to protectionist trade policies weakens the credibility of existing trade agreements, undermining the rules-based international trading system.

Long-Term Economic Impacts and Uncertainty

The long-term consequences of a protracted trade war between the US and Europe could be devastating. The uncertainty and instability created would severely impact business investment and economic growth.

- Reduced foreign direct investment: Businesses will be hesitant to invest in countries involved in trade disputes, slowing down economic growth and innovation.

- Slowed economic growth in both regions: Both the US and European economies would suffer from reduced trade, investment, and consumer confidence, leading to a significant reduction in overall economic growth.

- Increased risk aversion among investors: Uncertainty stemming from trade disputes makes investors more risk-averse, leading to reduced investment and a further slowdown in economic activity.

Conclusion

Understanding the potential economic fallout from a return of Trump tariffs on Europe is crucial. The potential consequences are far-reaching, including increased prices for consumers, retaliatory tariffs, disrupted supply chains, strained political relations, and long-term economic instability for both the US and Europe. Advocating for continued dialogue and cooperation to prevent a resurgence of these damaging trade policies is vital for global economic stability. Avoiding a repeat of the damaging Trump tariffs on Europe requires proactive measures to foster strong and mutually beneficial trade relationships between the US and the EU.

Featured Posts

-

Sicherheitsalarm An Braunschweiger Grundschule Entwarnung Gegeben

May 13, 2025

Sicherheitsalarm An Braunschweiger Grundschule Entwarnung Gegeben

May 13, 2025 -

Horario Y Canal Atalanta Vs Lazio En Vivo Serie A 2025

May 13, 2025

Horario Y Canal Atalanta Vs Lazio En Vivo Serie A 2025

May 13, 2025 -

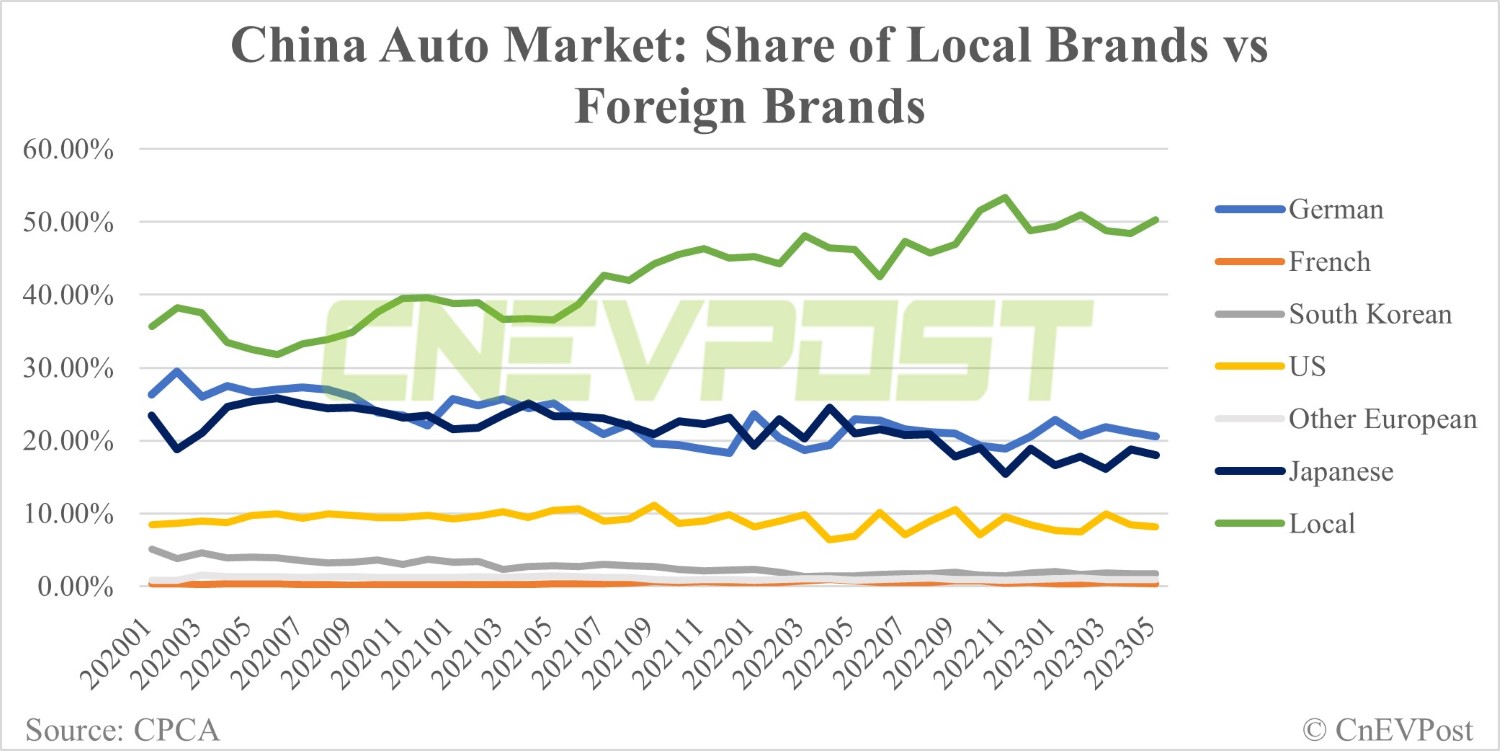

Luxury Car Sales In China A Look At The Struggles Of Brands Like Bmw And Porsche

May 13, 2025

Luxury Car Sales In China A Look At The Struggles Of Brands Like Bmw And Porsche

May 13, 2025 -

Heavy Traffic Expected Schiphol Roads And Ferries During Easter And Spring Holiday Peak

May 13, 2025

Heavy Traffic Expected Schiphol Roads And Ferries During Easter And Spring Holiday Peak

May 13, 2025 -

Atalanta Vs Venezia Serie A Prediksi Skor Susunan Pemain Dan Data Pertandingan Lengkap

May 13, 2025

Atalanta Vs Venezia Serie A Prediksi Skor Susunan Pemain Dan Data Pertandingan Lengkap

May 13, 2025