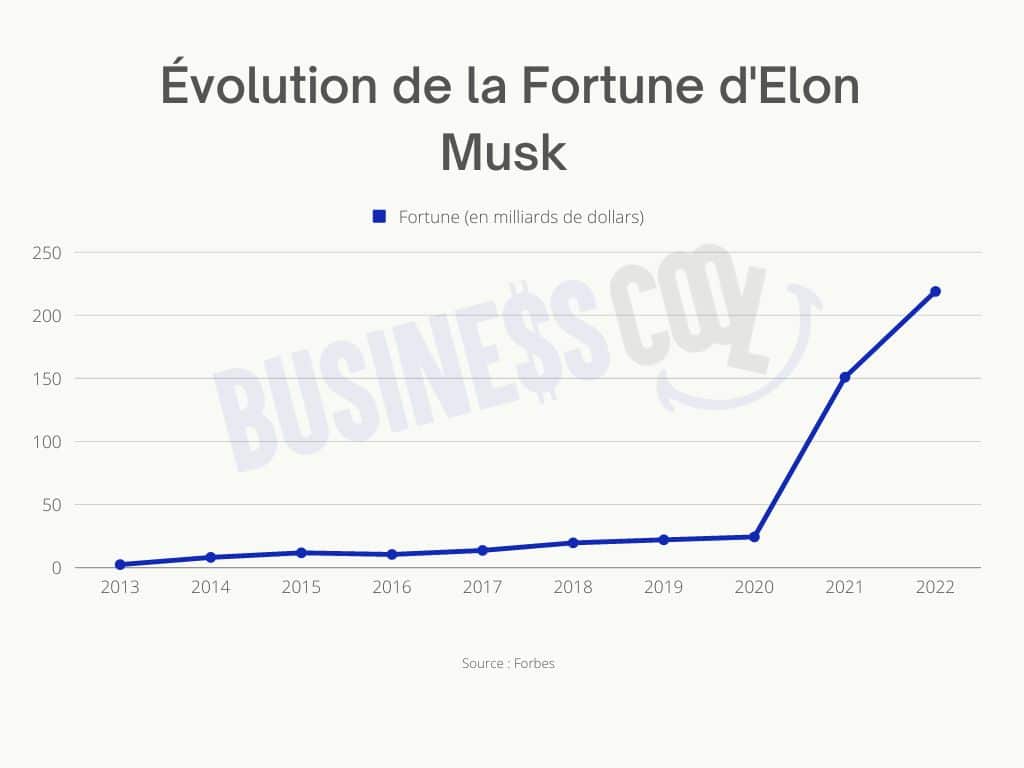

The Elon Musk Fortune: Examining The Business Strategies Of The World's Richest Man

Table of Contents

The Early Years and Foundation of the Elon Musk Fortune

PayPal and the Early Acquisition of Wealth

Elon Musk's entrepreneurial journey began long before Tesla and SpaceX. His pivotal role in the creation and subsequent sale of PayPal laid the crucial financial groundwork for his future ventures. His contributions to the company, particularly in its early stages, were instrumental in its growth and eventual acquisition by eBay for $1.5 billion in 2002. This significant windfall provided the capital he needed to pursue his ambitious vision in the fields of electric vehicles and space exploration.

- Key Role: Musk was instrumental in merging X.com with Confinity, the company that created PayPal.

- Sale Price & Proceeds: The $1.5 billion sale of PayPal provided Musk with significant capital, a crucial part of his initial "Elon Musk net worth." A substantial portion of these proceeds funded his subsequent investments and the launch of SpaceX and Tesla.

- Strategic Use of Funds: The funds from the PayPal sale weren't just used for immediate expenses; they were strategically invested in high-risk, high-reward ventures that aligned with his long-term vision. This exemplifies his early investment strategy.

Strategic Investments and Risk Tolerance

Musk's early investments demonstrate a high-risk, high-reward approach. He wasn't afraid to invest in nascent technologies and unconventional ideas. This risk tolerance, a cornerstone of his "Musk business strategies," is a key differentiator.

- Successful Investments: While details of all his early investments aren't publicly available, his investments in various companies showcasing his strategic acumen. His calculated risks played a significant role in building his "Elon Musk net worth".

- Less Successful Ventures: Not all of Musk's investments have been successful, highlighting the inherent risks in his investment strategy. However, his willingness to take calculated risks has proven crucial to his overall success.

- Venture Capital Approach: His approach mirrors that of venture capitalists, focusing on disruptive technologies with high potential returns, even if those returns are uncertain. This forms a significant part of his "Musk's investment strategy."

Tesla's Disruptive Business Model and Contribution to the Elon Musk Fortune

Revolutionizing the Electric Vehicle Market

Tesla's impact on the "Elon Musk fortune" is undeniable. The company's disruptive entry into the electric vehicle (EV) market redefined industry standards. Tesla's success stems from a combination of technological innovation, a direct-to-consumer sales model, and powerful branding.

- Innovation in Battery Technology: Tesla's advancements in battery technology have been critical to its success, leading to longer ranges and faster charging times for its EVs. This has made electric vehicles a viable alternative for a wider range of consumers.

- Direct-to-Consumer Sales Model: Bypassing traditional dealerships and selling directly to consumers, Tesla has streamlined its sales process and enhanced its brand control, contributing significantly to its profitability.

- Strong Brand Image: Tesla has cultivated a powerful brand image associated with innovation, luxury, and sustainability, attracting a loyal customer base and driving demand for its products. This positive brand image has influenced the "Tesla stock" price significantly.

Vertical Integration and Supply Chain Control

Tesla's strategy of vertical integration – controlling key aspects of its supply chain, including battery production – has been crucial to its profitability and market share.

- Gigafactories: Tesla's massive Gigafactories are a prime example of this strategy, enabling the company to produce batteries at scale and reduce its reliance on external suppliers. This has led to cost savings and greater control over the production process.

- Battery Production: By controlling battery production, Tesla has secured a key component of its electric vehicles, mitigating supply chain risks and driving down costs.

- Benefits of Vertical Integration: This approach reduces reliance on third-party suppliers, ensuring consistent quality and potentially lower costs, boosting overall profit margins, directly impacting the "Elon Musk fortune".

SpaceX: Ambitious Vision and the Growth of the Elon Musk Fortune

Innovation in Space Exploration and its Financial Implications

SpaceX's success in developing reusable rockets has revolutionized the space industry and significantly contributed to the "Elon Musk fortune". Its innovative approach to space travel has opened up new avenues for revenue generation.

- Falcon 9 and Starship: SpaceX's Falcon 9 and Starship rockets represent significant advancements in space technology, enabling more frequent and cost-effective space launches.

- Contracts with NASA and Private Companies: SpaceX has secured numerous contracts with NASA and private companies, generating significant revenue and bolstering its valuation.

- Revenue Generation Models: SpaceX's revenue streams extend beyond government contracts, including satellite launches, and potential commercial space tourism, offering diverse revenue streams that impact "SpaceX revenue".

Government Contracts and Private Investment

SpaceX's funding has come from a combination of government contracts and private investment, both contributing to its growth and Elon Musk's wealth.

- NASA Contracts: Contracts with NASA have provided SpaceX with substantial funding, supporting its research and development efforts and validating its technological capabilities.

- Private Investment Rounds: SpaceX has secured significant funding through private investment rounds, demonstrating investor confidence in the company's potential.

- Impact on Company Valuation: The combination of government contracts and private investment has significantly increased SpaceX's valuation, thereby boosting the "Elon Musk net worth."

Leadership Style and Its Influence on the Elon Musk Fortune

Visionary Leadership and Risk-Taking

Elon Musk's leadership style is characterized by a visionary approach, a willingness to take significant risks, and a relentless focus on innovation.

- Decision-Making Process: Musk's decision-making often involves bold, unconventional choices that have proven to be pivotal in the success of his companies.

- Innovative Thinking: His relentless pursuit of innovation drives his companies to push the boundaries of what is possible.

- Risk Tolerance: His willingness to embrace high-risk ventures is integral to his success, often leading to breakthroughs that others wouldn't attempt. This "risk-taking entrepreneur" approach is crucial to his "Elon Musk leadership style".

Building High-Performing Teams

Musk's ability to build and manage high-performing teams across his various companies is a significant factor in his success.

- Talent Acquisition: He attracts top talent by offering challenging and ambitious projects, fostering a culture of innovation and high achievement.

- Team Dynamics: While his management style has been described as demanding, he fosters a collaborative environment where team members are empowered to contribute their expertise.

- Fostering Innovation: By encouraging a culture of innovation and risk-taking, Musk creates an environment where groundbreaking ideas can flourish. This is vital to his "Elon Musk team management" style.

Conclusion

The "Elon Musk fortune" is a result of a unique confluence of factors: strategic early investments, disruptive business models at Tesla and SpaceX, and a highly effective, albeit demanding, leadership style. His success highlights the importance of visionary leadership, a high-risk tolerance, and the ability to build and manage high-performing teams. The success of PayPal provided the initial capital, while the revolutionary approaches of Tesla and SpaceX significantly amplified his wealth. His innovative spirit, relentless drive, and audacious risk-taking have redefined multiple industries, creating a lasting impact on the global economy.

Key Takeaways:

- Early strategic investments formed the foundation of his wealth.

- Disruptive business models in the EV and space exploration sectors have been instrumental.

- His visionary leadership and ability to build high-performing teams have been crucial.

What lessons can we learn from the remarkable business strategies behind the Elon Musk fortune? Share your thoughts in the comments below!

Featured Posts

-

Ghettoisation Fears A Uk Citys Struggle With Transient Populations

May 10, 2025

Ghettoisation Fears A Uk Citys Struggle With Transient Populations

May 10, 2025 -

The Post Roe Landscape Examining The Role Of Otc Birth Control

May 10, 2025

The Post Roe Landscape Examining The Role Of Otc Birth Control

May 10, 2025 -

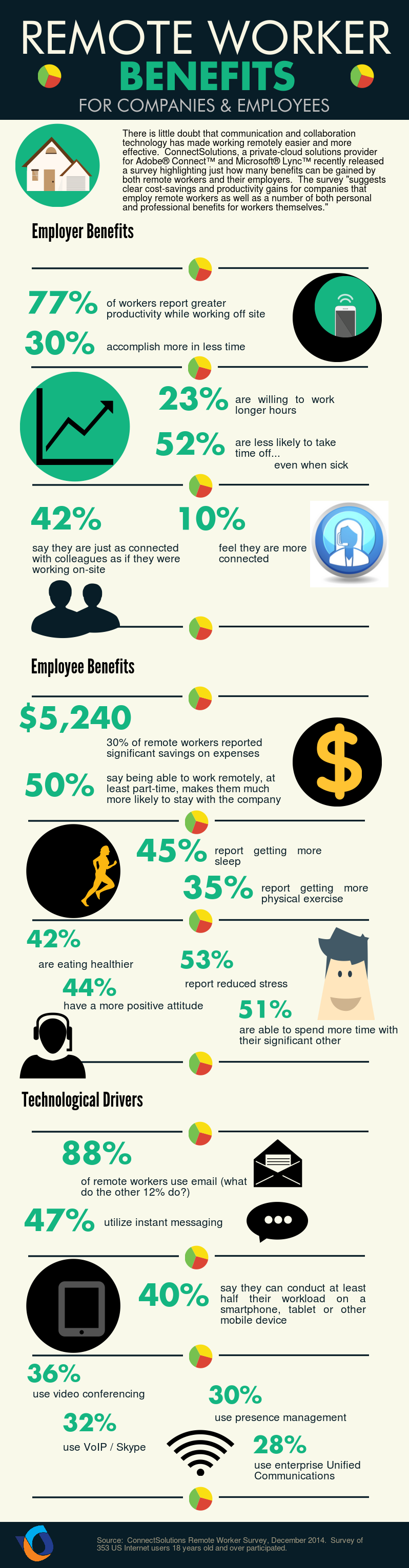

The Importance Of Middle Management Benefits For Companies And Employees

May 10, 2025

The Importance Of Middle Management Benefits For Companies And Employees

May 10, 2025 -

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Automakers

May 10, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Automakers

May 10, 2025 -

Benson Boone Responds To Harry Styles Copying Accusations

May 10, 2025

Benson Boone Responds To Harry Styles Copying Accusations

May 10, 2025