The EUR/USD And Lagarde's Push For Greater Euro Global Impact

Table of Contents

ECB Monetary Policy and its Impact on the EUR/USD

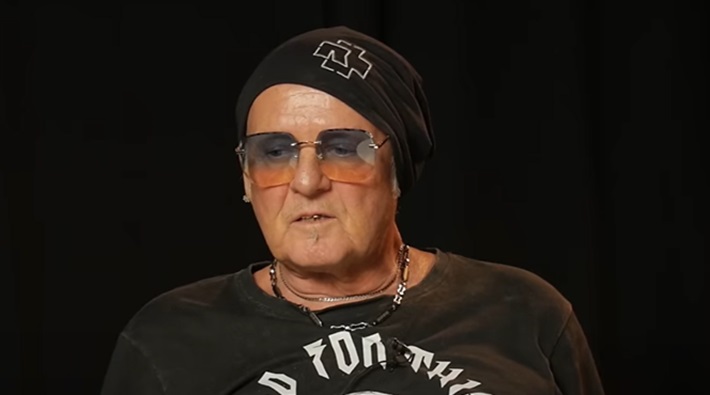

The ECB's monetary policy decisions directly affect the EUR/USD exchange rate. Lagarde's leadership heavily influences these decisions, making her a pivotal figure in the forex market.

Interest Rate Decisions

Interest rate adjustments by the ECB are a primary driver of EUR/USD movements. Higher interest rates generally attract foreign investment, increasing demand for the Euro and strengthening the EUR/USD. Conversely, lower interest rates can weaken the Euro.

- Example 1: The ECB's interest rate hikes in 2022 led to a temporary strengthening of the EUR/USD, as investors sought higher returns.

- Example 2: Periods of low interest rates, such as during the Eurozone debt crisis, often saw a weakening of the EUR/USD.

- Market expectations regarding future interest rate changes significantly influence the EUR/USD even before official announcements. Speculation and analysis of economic indicators constantly shape the market's outlook.

- [Insert relevant chart showing correlation between ECB interest rates and EUR/USD].

Quantitative Easing (QE) and its Effect on the Euro

Quantitative easing (QE), a monetary policy tool involving the creation of new money to buy assets, has a complex impact on the Euro and the EUR/USD. While it can stimulate economic growth, it can also lead to inflation and potentially weaken the Euro's value in the long term.

- QE programs influence inflation, which in turn affects investor sentiment and the EUR/USD. High inflation can erode the purchasing power of the Euro, making it less attractive to investors.

- The long-term implications of QE on currency strength are debated. While short-term effects can be positive for economic growth, prolonged QE may lead to currency depreciation.

- [Insert data on previous QE programs and their subsequent impact on the EUR/USD].

Lagarde's Communication Strategy and Market Sentiment

Lagarde's communication style and the clarity of her forward guidance play a substantial role in shaping market sentiment and influencing the EUR/USD.

The Importance of Forward Guidance

Clear and consistent communication from the ECB president helps to manage market expectations and can contribute to stability in the EUR/USD exchange rate. Conversely, ambiguous or unexpected statements can lead to increased volatility.

- Transparent communication regarding future monetary policy decisions helps investors make informed decisions, reducing uncertainty in the market.

- Ambiguous statements or conflicting signals from Lagarde can confuse investors, prompting speculative trading and potentially destabilizing the EUR/USD.

- Analysis of Lagarde's press conferences reveals how her tone and messaging can affect immediate and long-term EUR/USD movements. Specific examples should be cited.

Building Confidence in the Eurozone

Lagarde's efforts to strengthen the Euro's global role and bolster investor confidence in the Eurozone also impact the EUR/USD. Her initiatives aim to foster economic stability and growth, making the Euro more attractive.

- Policies focused on sustainable economic growth, fiscal responsibility, and financial stability within the Eurozone contribute to a stronger Euro and a more stable EUR/USD.

- Geopolitical events heavily influence Lagarde’s strategies, requiring adaptable policies to mitigate negative impacts on the Euro and the EUR/USD.

- Structural reforms within the Eurozone, such as banking union initiatives, can increase confidence and positively affect the EUR/USD.

Geopolitical Factors Influencing the EUR/USD and Lagarde's Response

Global events significantly impact the EUR/USD, and Lagarde's response to these challenges is crucial.

The Role of the Euro in Global Trade

The Euro's role as a major reserve currency and its importance in global trade directly influence the EUR/USD exchange rate.

- Global economic slowdowns, trade wars, or recessions can negatively impact the demand for Euros, weakening the EUR/USD.

- Lagarde's policies aim to maintain the Euro's competitiveness in the global economy, strengthening its position as a reserve currency and supporting the EUR/USD.

- [Insert data on the Euro's share in global trade and reserves].

Dealing with External Shocks

External economic shocks, such as energy crises or pandemics, pose significant challenges, impacting the EUR/USD. Lagarde's leadership is tested by the ECB's response to these situations.

- The ECB’s crisis management strategies, including emergency liquidity measures, influence investor confidence and the EUR/USD.

- External shocks can lead to increased uncertainty and volatility in the EUR/USD. Investor sentiment, greatly impacted by crisis news, drives significant fluctuations.

- [Provide examples of past crises and the ECB's responses, analyzing their effectiveness on EUR/USD].

Conclusion: The Future of the EUR/USD Under Lagarde's Leadership

Lagarde's policies, communication, and response to external shocks are inextricably linked to the EUR/USD exchange rate. Her ability to manage monetary policy, foster confidence in the Eurozone, and navigate geopolitical challenges will significantly shape the future trajectory of the EUR/USD. The outlook for the EUR/USD hinges on the continued success of her strategies and the stability of the global economy. Understanding Lagarde's influence on the EUR/USD is vital for investors and businesses operating in the global market.

Stay updated on the latest news regarding ECB monetary policy and its implications for the EUR/USD to effectively manage your financial strategies. Monitoring Lagarde's pronouncements and the ECB's actions is essential for navigating the complexities of the EUR/USD exchange rate and mitigating associated risks.

Featured Posts

-

Hailee Steinfeld And Fiance Josh Allens Wedding A Four Month Engagement Celebration

May 28, 2025

Hailee Steinfeld And Fiance Josh Allens Wedding A Four Month Engagement Celebration

May 28, 2025 -

Chelsea Contacting Alejandro Garnacho Transfer Speculation Mounts

May 28, 2025

Chelsea Contacting Alejandro Garnacho Transfer Speculation Mounts

May 28, 2025 -

Angels Dominate Dodgers Clinch Freeway Series Sweep

May 28, 2025

Angels Dominate Dodgers Clinch Freeway Series Sweep

May 28, 2025 -

Peksuv Odchod Znamena To Konec Pro Piraty

May 28, 2025

Peksuv Odchod Znamena To Konec Pro Piraty

May 28, 2025 -

Josh Allen Balancing Football And Wedding Preparations With Hailee Steinfeld

May 28, 2025

Josh Allen Balancing Football And Wedding Preparations With Hailee Steinfeld

May 28, 2025

Latest Posts

-

Ulasan Kawasaki W800 My 2025 Sentuhan Klasik Performa Tangguh Harga Terkini

May 30, 2025

Ulasan Kawasaki W800 My 2025 Sentuhan Klasik Performa Tangguh Harga Terkini

May 30, 2025 -

Ticketmaster Y Setlist Fm La Guia Definitiva Para Preparar Tu Concierto

May 30, 2025

Ticketmaster Y Setlist Fm La Guia Definitiva Para Preparar Tu Concierto

May 30, 2025 -

Review Harga Kawasaki Ninja 500 Bersolek Lebih Dari Rp 100 Juta

May 30, 2025

Review Harga Kawasaki Ninja 500 Bersolek Lebih Dari Rp 100 Juta

May 30, 2025 -

Spesifikasi Lengkap Dan Harga Kawasaki W800 My 2025 Motor Klasik Ikonik

May 30, 2025

Spesifikasi Lengkap Dan Harga Kawasaki W800 My 2025 Motor Klasik Ikonik

May 30, 2025 -

Ninja 500 Series Modifikasi Eksplorasi Harga Di Atas Rp 100 Juta

May 30, 2025

Ninja 500 Series Modifikasi Eksplorasi Harga Di Atas Rp 100 Juta

May 30, 2025