The Extreme Cost Of Broadcom's VMware Deal: AT&T's Perspective

Table of Contents

Increased VMware Licensing Costs for AT&T

Broadcom's acquisition of VMware carries a significant risk of increased licensing fees for AT&T. Broadcom has a history of aggressive pricing strategies post-acquisition, and VMware's substantial market share leaves little room for negotiation for large-scale users like AT&T.

- Potential Price Increase Scenarios: We could see percentage-based increases across the board, potentially ranging from 10% to 20% or more, or the implementation of a new, less favorable tiered pricing structure that disproportionately affects high-volume users like AT&T. This could translate to millions, if not tens of millions, of dollars in added annual expenses.

- Impact on AT&T's IT Budget: These increases will directly strain AT&T's overall IT budget, forcing difficult choices between maintaining current services, investing in other crucial technologies, or potentially reducing workforce numbers. The financial implications are far-reaching and will likely necessitate a comprehensive budget reallocation.

- Alternative Virtualization Solutions: The high potential costs may drive AT&T to explore alternative virtualization solutions. Open-source options like Proxmox or open-source cloud platforms provide cost-effective alternatives, although migrating from VMware will be complex and time-consuming. Commercial alternatives like Citrix and Nutanix offer a middle ground, though cost comparisons are crucial.

- Long-Term Financial Implications: The long-term financial burden of significantly higher VMware licensing costs could impact AT&T's profitability, hindering innovation and investment in other critical areas of its business. Careful financial modeling is necessary to assess the long-term impact.

Disruption to AT&T's IT Infrastructure and Operations

The integration process following the Broadcom-VMware merger presents a significant risk of disruption to AT&T's operations. Upgrading to new VMware versions and integrating them into AT&T's existing, complex systems requires careful planning and execution.

- Compatibility Issues: Integrating updated VMware software with AT&T's existing infrastructure could lead to compatibility issues, requiring substantial modifications and testing to ensure seamless operation. This process is potentially lengthy and expensive.

- Downtime and Associated Costs: The potential for downtime during the migration process poses a serious threat. Even short periods of downtime can result in significant losses of revenue and productivity. The cost of mitigating such disruptions needs careful consideration.

- Staff Retraining: AT&T's IT staff will require extensive retraining to manage and maintain the new VMware software and any associated changes to infrastructure. The costs involved in training and potential productivity loss during training need to be factored in.

- Data Security Risks: System migration and integration increase the risk of data breaches and security vulnerabilities. Implementing robust security measures throughout this process is paramount, and these add further costs to the overall transition.

Strategic Implications and Alternatives for AT&T

The Broadcom-VMware deal forces AT&T to reassess its long-term IT strategy. The increased costs and potential disruptions necessitate a thorough evaluation of alternative approaches.

- Alternatives to VMware: AT&T could explore open-source solutions, reducing licensing costs significantly. However, this necessitates a deep understanding of open-source technologies and a substantial investment in internal expertise. Commercial alternatives like Citrix or Nutanix offer a different cost structure and feature set that needs to be weighed against the advantages of VMware.

- Cost-Benefit Analysis: A detailed cost-benefit analysis of each alternative is critical. Factors to consider include cost of implementation, ongoing maintenance costs, compatibility with existing infrastructure, and long-term support.

- Impact on Competitiveness: The increased IT costs could reduce AT&T's competitiveness in the telecommunications market by limiting investment in other areas or raising prices for services.

- Negotiation Strategies: AT&T needs to develop robust negotiation strategies to mitigate the increased costs. Leveraging its size and market position to secure favorable licensing agreements is crucial.

Broadcom's Track Record and Potential for Future Price Hikes

Broadcom's history of acquisitions provides insight into its pricing strategies and suggests the potential for further price increases in the future.

- Past Acquisitions: Examining Broadcom's past acquisitions and their subsequent price increases on acquired products reveals a pattern of post-acquisition price hikes. This should serve as a cautionary tale for AT&T.

- Business Model Analysis: Broadcom's business model, focused on acquiring and consolidating market leaders, often leads to less competition and higher prices. Understanding this model is crucial for anticipating future price changes.

- Antitrust Concerns: The potential for antitrust concerns regarding Broadcom's market dominance must be considered. Regulatory scrutiny might limit future price hikes, but this is not guaranteed.

- Implications for Other Enterprises: The impact of the Broadcom-VMware deal extends beyond AT&T. Other large enterprises relying on VMware products face similar challenges and uncertainties.

Conclusion: Assessing the Real Cost of Broadcom's VMware Deal for AT&T

The Broadcom-VMware acquisition presents substantial financial and operational challenges for AT&T. Increased licensing costs, potential operational disruptions, and strategic implications all contribute to a significant, and potentially underestimated, overall cost. The long-term impact on AT&T's competitiveness cannot be ignored. This necessitates a thorough Broadcom VMware cost analysis and exploration of alternative virtualization solutions to mitigate the impact of these increased costs. We urge enterprises to conduct their own Broadcom VMware cost analysis and explore VMware alternative solutions to proactively address potential price increases. Don't wait for the costs to hit your bottom line – start planning your mitigation strategy now.

Featured Posts

-

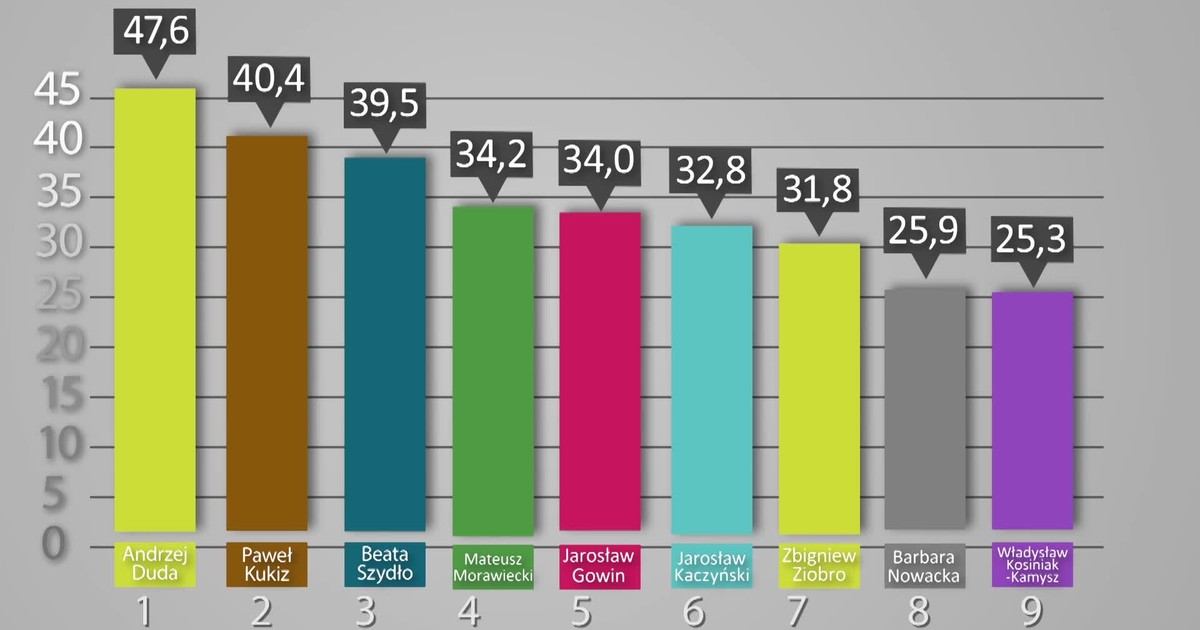

Ib Ri S Dla Onetu Trzaskowski Morawiecki Duda Ranking Zaufania

May 07, 2025

Ib Ri S Dla Onetu Trzaskowski Morawiecki Duda Ranking Zaufania

May 07, 2025 -

Alex Ovechkins Mystery Training Partner Uncovered Its Darius Kasparaitis

May 07, 2025

Alex Ovechkins Mystery Training Partner Uncovered Its Darius Kasparaitis

May 07, 2025 -

Behind The Scenes Of Who Wants To Be A Millionaire Celebrity Special A Look At The Production

May 07, 2025

Behind The Scenes Of Who Wants To Be A Millionaire Celebrity Special A Look At The Production

May 07, 2025 -

Ps 5 Vs Xbox Series S A Detailed Comparison Of Key Differences

May 07, 2025

Ps 5 Vs Xbox Series S A Detailed Comparison Of Key Differences

May 07, 2025 -

Steelers Wide Receiver Future The Decision Is In

May 07, 2025

Steelers Wide Receiver Future The Decision Is In

May 07, 2025