The Fate Of Trump's Tax Bill: A Look At The Political Landscape

Table of Contents

The Economic Impact of Trump's Tax Cuts: A Retrospective

Trump's tax bill implemented sweeping changes, including slashing the corporate tax rate from 35% to 21%. The initial economic effects were a source of both celebration and contention. Proponents pointed to increased GDP growth in the immediate aftermath, while critics highlighted the disproportionate benefits enjoyed by corporations and the wealthy.

Analyzing the data, we see a mixed picture. While GDP growth did experience a temporary bump, attributing this solely to the tax cuts is difficult, as various other economic factors were at play. Furthermore, job creation, while positive, didn't significantly outpace pre-existing trends.

- Increased corporate profits: Many large corporations did see a substantial increase in profits, leading to increased stock buybacks and shareholder dividends rather than significant investment in job creation or expansion.

- Stimulus to investment (or lack thereof): The anticipated surge in business investment failed to fully materialize, raising questions about the effectiveness of the tax cuts as a stimulus measure.

- Impact on income inequality: The tax cuts exacerbated existing income inequality, with the wealthiest Americans receiving a disproportionate share of the benefits.

- Long-term effects on national debt: The substantial reduction in tax revenue contributed significantly to the burgeoning national debt, raising concerns about long-term fiscal sustainability.

Political Fallout and Public Opinion on Trump's Tax Bill

Public opinion on Trump's tax bill has been, and remains, sharply divided. Initial polling data suggested a modest level of public support, but this has since shifted. Many Americans felt the benefits did not reach them directly, leading to a decline in approval. This negative sentiment has had significant political consequences for the Republican party, impacting both midterm and presidential elections.

- Shifting public opinion since the bill's passage: Early positive polling results have been overtaken by a more critical appraisal as the long-term consequences become clearer.

- Impact on midterm and presidential elections: The lack of tangible benefits for many voters contributed to electoral losses for Republicans in subsequent elections.

- The role of media coverage in shaping public perception: Media coverage played a crucial role in shaping public opinion, with differing narratives emerging from various news outlets and platforms. The debate surrounding the bill's fairness and effectiveness continues to dominate political discourse.

- Arguments for and against repeal or amendment: Arguments against the bill largely center on its contribution to the national debt and its regressive nature. Proposals for amendments range from targeted tax increases on higher earners to closing corporate loopholes.

Potential for Legislative Changes to Trump's Tax Bill

The possibility of future legislative action to modify or repeal aspects of Trump's tax bill remains a significant factor in its long-term fate. However, achieving bipartisan support for significant changes will be a major challenge. The current political climate is highly polarized, leading to legislative gridlock and making substantial alterations to the tax code highly unlikely.

- Proposals for amending specific sections of the bill: There have been numerous proposals to amend certain sections of the bill, focusing on issues such as the corporate tax rate and individual income tax brackets.

- Challenges in achieving bipartisan consensus on tax reform: The deep partisan divisions in Congress make achieving bipartisan consensus on significant tax reforms extremely difficult.

- The influence of lobbying groups and special interests: Lobbying groups and special interests will continue to exert significant influence on any future legislative efforts related to tax reform.

The Long-Term Implications and Uncertain Future of Trump's Tax Legacy

The long-term economic and societal effects of Trump's tax bill are still unfolding and subject to much debate among economists and policy experts. Several scenarios are possible, depending on future political outcomes and prevailing economic conditions.

- Long-term impact on the national debt: The increased national debt due to the tax cuts poses a significant challenge for future generations.

- Potential for future tax reforms under different administrations: Future administrations may seek to reverse or modify aspects of the bill, potentially leading to further changes in tax policy.

- The bill's legacy in the context of broader economic policy debates: The Trump tax bill will undoubtedly continue to be a focal point in broader economic policy debates for years to come.

Conclusion: Understanding the Uncertain Fate of Trump's Tax Bill

The future of Trump's tax bill remains uncertain, contingent upon a complex interplay of economic performance, evolving political landscapes, and the will of future legislative bodies. While the initial economic impacts were mixed, and the political fallout significant, the possibility of future amendments or even repeal cannot be discounted. The long-term consequences for the national debt and income inequality are still emerging.

Stay informed on the ongoing debate surrounding Trump's tax bill and its impact on the nation's future. Continue to follow developments and engage in respectful discussion to ensure a more informed understanding of this crucial aspect of economic and political policy. Understanding the nuances of Trump's tax bill is key to participating in meaningful conversations about tax policy and its long-term effects on the American economy.

Featured Posts

-

Cao Toc Dong Nai Vung Tau Thong Xe Du Kien 2 9

May 22, 2025

Cao Toc Dong Nai Vung Tau Thong Xe Du Kien 2 9

May 22, 2025 -

Tikkie Gebruiken In Nederland Een Complete Handleiding

May 22, 2025

Tikkie Gebruiken In Nederland Een Complete Handleiding

May 22, 2025 -

Blake Lively A Look At Recent Controversies And Public Perception

May 22, 2025

Blake Lively A Look At Recent Controversies And Public Perception

May 22, 2025 -

Stock Market Valuation Concerns Bof As Rationale For Investor Confidence

May 22, 2025

Stock Market Valuation Concerns Bof As Rationale For Investor Confidence

May 22, 2025 -

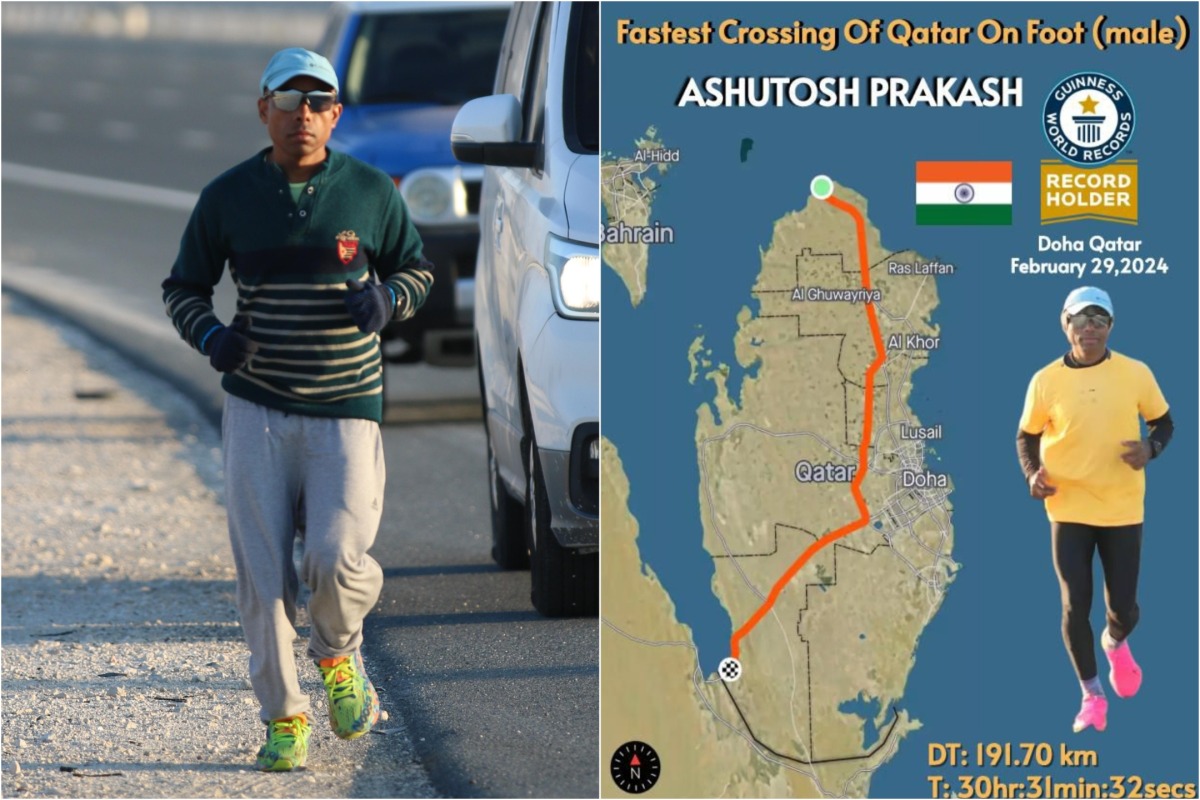

New Record Man Breaks Fastest Time For Crossing Australia On Foot

May 22, 2025

New Record Man Breaks Fastest Time For Crossing Australia On Foot

May 22, 2025

Latest Posts

-

Investigation Into Lancaster City Stabbing Timeline And Key Facts

May 22, 2025

Investigation Into Lancaster City Stabbing Timeline And Key Facts

May 22, 2025 -

Route 15 On Ramp Closed Following Crash Traffic Delays Expected

May 22, 2025

Route 15 On Ramp Closed Following Crash Traffic Delays Expected

May 22, 2025 -

Lancaster City Stabbing Incident Police Report And Victim Information

May 22, 2025

Lancaster City Stabbing Incident Police Report And Victim Information

May 22, 2025 -

Lancaster City Stabbing Latest Updates And Investigation Details

May 22, 2025

Lancaster City Stabbing Latest Updates And Investigation Details

May 22, 2025 -

Investigation Launched After Fed Ex Truck Fire On Route 283 Lancaster County

May 22, 2025

Investigation Launched After Fed Ex Truck Fire On Route 283 Lancaster County

May 22, 2025