The Fed's Decision: Holding Rates Steady In Face Of Inflation And Unemployment

Table of Contents

The Federal Reserve's recent decision to hold interest rates steady sends ripples through the US economy, leaving investors and consumers grappling with the complexities of persistent inflation and fluctuating unemployment. This article analyzes the Federal Reserve's decision to maintain interest rates, exploring the underlying economic factors and potential consequences of this policy choice in the context of inflation and unemployment. We will examine inflation data, unemployment figures, potential risks, and market reactions to provide a comprehensive understanding of this pivotal monetary policy decision.

<h2>Inflationary Pressures and the Fed's Dilemma</h2>

<h3>Persistent Inflation</h3>

Inflation remains a persistent challenge for the US economy. The Consumer Price Index (CPI) continues to show elevated levels, although the rate of increase has slowed from its peak. Several factors contribute to this persistent inflationary pressure:

- Supply chain disruptions: Ongoing global supply chain bottlenecks continue to constrain the availability of goods, driving up prices.

- Energy prices: Fluctuations in global energy markets, particularly oil and natural gas, significantly impact inflation across various sectors.

- Strong consumer demand: Robust consumer spending, fueled by pent-up demand and a strong labor market, contributes to upward pressure on prices.

The Federal Reserve's target inflation rate is generally around 2%. Current inflation rates are significantly above this target, presenting a considerable challenge for the central bank.

<h3>The Fed's Mandate</h3>

The Federal Reserve operates under a dual mandate: to promote maximum employment and price stability. This presents a complex balancing act:

- Trade-off between inflation and employment: Raising interest rates typically helps curb inflation by slowing economic growth and reducing demand, but it can also lead to job losses and increased unemployment.

- Balancing competing goals: The Fed must carefully weigh the risks of allowing inflation to remain elevated against the risks of triggering a recession by raising rates too aggressively. This requires navigating a delicate path, making precise judgments based on complex economic data.

<h2>Unemployment Trends and Labor Market Dynamics</h2>

<h3>Current Unemployment Rates</h3>

The unemployment rate currently sits at [insert current unemployment rate and source], indicating a relatively strong labor market. However, a closer look reveals nuances:

- Job creation: [Insert data on recent job creation figures and source]. While job creation remains positive, the pace may be slowing.

- Labor force participation rate: [Insert data on labor force participation rate and source]. This indicates the percentage of the working-age population actively seeking employment.

- Wage growth: [Insert data on wage growth and source]. Strong wage growth can contribute to inflationary pressures.

<h3>Impact of Interest Rate Decisions on Employment</h3>

The Fed's interest rate decisions have a significant impact on employment:

- Risk of recession: Aggressive interest rate hikes can stifle economic growth, potentially leading to a recession and significant job losses.

- Inflationary pressures: Conversely, keeping interest rates too low for too long can exacerbate inflationary pressures, eroding purchasing power and potentially leading to economic instability.

<h2>Analyzing the Fed's Rationale for Holding Rates Steady</h2>

<h3>Economic Data and Projections</h3>

The Fed's decision to hold rates steady was likely based on a careful assessment of various economic indicators:

- Key economic models: The Fed utilizes sophisticated econometric models to forecast economic growth, inflation, and unemployment.

- Uncertainty surrounding future growth: The current economic landscape is characterized by considerable uncertainty, making accurate forecasting particularly challenging. Global geopolitical events and unexpected economic shocks add further complexity.

<h3>Potential Risks and Uncertainties</h3>

Both raising and lowering interest rates carry inherent risks:

- Stagflation: The risk of stagflation – a combination of high inflation and high unemployment – remains a significant concern.

- Soft landing vs. hard landing: The Fed aims for a "soft landing," where inflation is brought under control without triggering a recession. However, achieving this is difficult, and a "hard landing" (a recession) remains a possibility.

<h2>Market Reactions and Investor Sentiment</h2>

<h3>Stock Market Response</h3>

The stock market's initial reaction to the Fed's decision was [insert description of market reaction and source]. This reflects:

- Changes in major stock indices: [Insert data on changes in major stock indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq].

- Investor confidence: Investor sentiment is often influenced by the Fed's actions, and this decision likely impacted investor confidence in various ways.

<h3>Bond Market and Interest Rates</h3>

The bond market also reacted to the announcement, with [insert description of bond market reaction and source]. This impacted:

- Changes in bond yields: [Insert data on changes in bond yields].

- Borrowing costs: Changes in bond yields affect borrowing costs for businesses and consumers.

<h2>Conclusion: The Fed's Decision: Implications and Future Outlook</h2>

The Federal Reserve's decision to hold interest rates steady reflects a cautious approach in the face of persistent inflation and a relatively strong labor market. The decision considers the delicate balance between controlling inflation and avoiding a recession. The market's reaction highlights the uncertainty surrounding future economic prospects. The Fed's future decisions on interest rates will be crucial in shaping the economic landscape. Careful monitoring of inflation, unemployment, and other economic indicators is essential.

Stay informed about future announcements from the Federal Reserve regarding interest rates and their impact on inflation and unemployment. Understanding the Fed's decisions is crucial for making informed financial decisions. Following Federal Reserve policy closely allows individuals and businesses to better navigate the economic climate and adapt their strategies accordingly.

Featured Posts

-

Pam Bondis Assertion Details On The Alleged Epstein Client List

May 10, 2025

Pam Bondis Assertion Details On The Alleged Epstein Client List

May 10, 2025 -

Young Thugs Vow Of Fidelity To Mariah The Scientist Revealed In Leaked Snippet

May 10, 2025

Young Thugs Vow Of Fidelity To Mariah The Scientist Revealed In Leaked Snippet

May 10, 2025 -

Nl Federal Election 2023 Candidate Profiles And Platforms

May 10, 2025

Nl Federal Election 2023 Candidate Profiles And Platforms

May 10, 2025 -

Anchor Brewing Company Shuttering A Legacy Comes To An End After 127 Years

May 10, 2025

Anchor Brewing Company Shuttering A Legacy Comes To An End After 127 Years

May 10, 2025 -

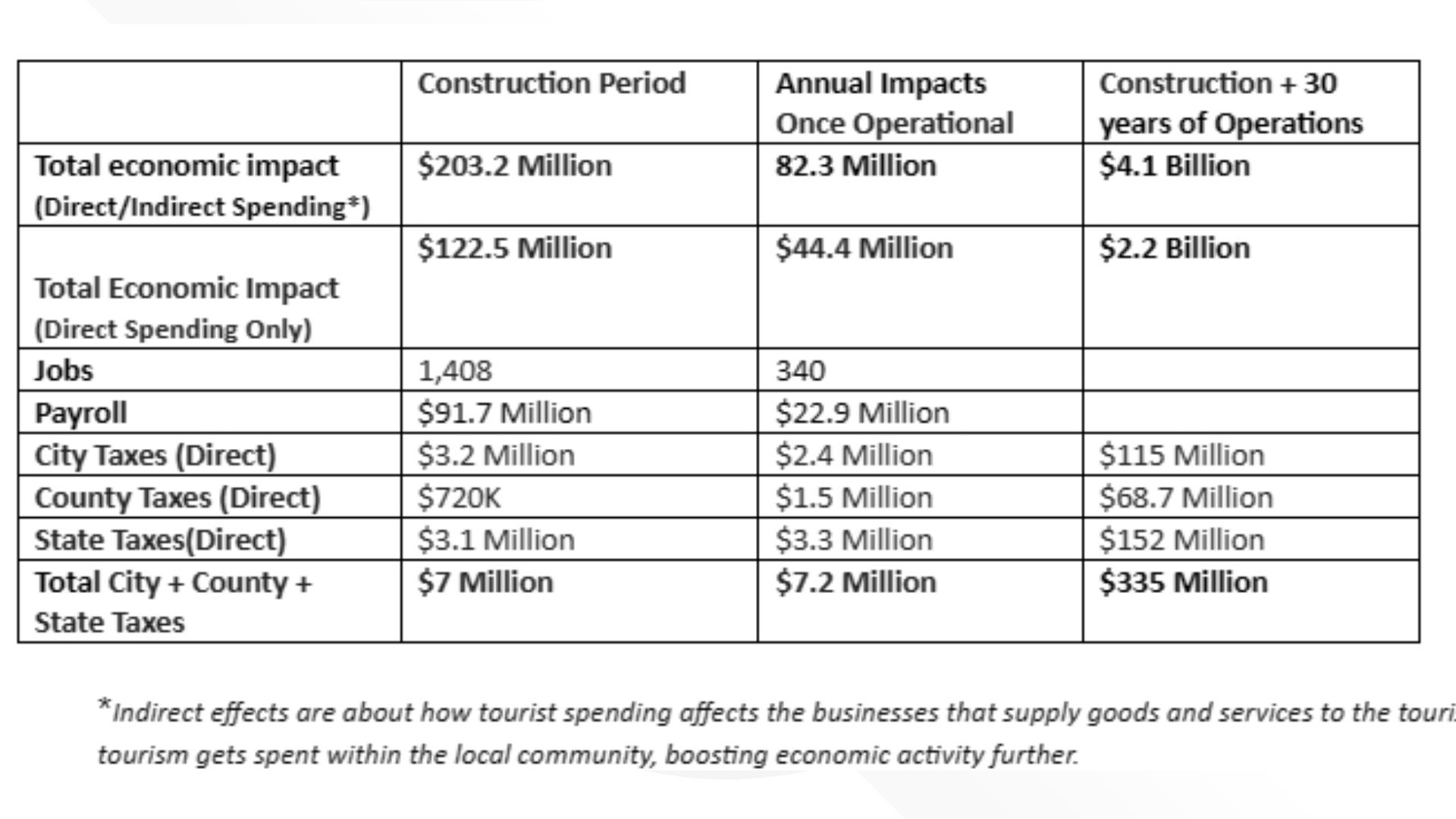

Sports Stadium Development And Downtown Economic Growth

May 10, 2025

Sports Stadium Development And Downtown Economic Growth

May 10, 2025