The Future Is Driverless: Investing In Uber's Autonomous Vehicle Tech Via ETFs

Table of Contents

Understanding Uber's Autonomous Vehicle Initiatives

Uber's journey into autonomous driving began with a significant investment in research and development, recognizing the potential to disrupt its core ride-sharing business and expand into new areas like delivery services. Uber's Advanced Technologies Group (ATG) spearheads these efforts, focusing on the development of self-driving technology, including sophisticated sensor systems, mapping technology, and artificial intelligence algorithms for navigation and decision-making.

Uber ATG has forged key partnerships and collaborations with various technology companies and research institutions to accelerate its development. These strategic alliances provide access to cutting-edge technologies and expertise, bolstering Uber's position in the competitive autonomous vehicle landscape.

- Key milestones achieved by Uber ATG: Successful completion of autonomous test miles in various cities, development of advanced sensor fusion technology, and partnerships with leading technology firms.

- Challenges faced by Uber in autonomous vehicle development: High development costs, regulatory hurdles, ensuring safety and reliability, and intense competition from established automakers and tech giants.

- Potential future applications of Uber's self-driving technology: Expansion beyond ride-sharing to include autonomous delivery services (Uber Eats), autonomous trucking, and potentially even robotaxi fleets.

- Uber's competitive landscape in the autonomous vehicle sector: Uber faces stiff competition from companies like Waymo, Cruise, Tesla, and other emerging autonomous driving technology developers.

Identifying Relevant ETFs for Exposure to Autonomous Vehicle Technology

Exchange Traded Funds (ETFs) offer a diversified approach to investing in the autonomous vehicle industry. Unlike investing in individual stocks, ETFs provide exposure to a basket of companies involved in various aspects of AV technology, mitigating risk and offering broader market participation. The benefits of using ETFs over individual stocks include:

- Diversification: Reduced risk by spreading investments across multiple companies.

- Lower Fees: Generally lower expense ratios compared to actively managed mutual funds.

- Liquidity: Easier to buy and sell compared to many individual stocks.

Several ETFs offer significant holdings in companies related to autonomous driving technology. Note: ETF holdings can change, so always check the latest fact sheet before investing. Remember to conduct your own thorough research.

(Please note: The following are examples only and should not be considered investment advice. Always conduct thorough research before making any investment decisions. ETF holdings change, so check current holdings before investing.)

- Example ETF 1 (Ticker: hypothetical example - $AVTECH): This ETF focuses on companies involved in the development of autonomous driving technology, including sensor manufacturers, software developers, and mapping companies. Top holdings might include companies that indirectly benefit from Uber's technology developments. Expense Ratio: 0.5%. (Link to hypothetical fact sheet)

- Example ETF 2 (Ticker: hypothetical example - $DRIVER): This ETF targets companies across the automotive value chain related to autonomous driving, encompassing automakers, technology suppliers, and infrastructure providers. It might include companies that Uber partners with for specific components. Expense Ratio: 0.4%. (Link to hypothetical fact sheet)

Analyzing ETF Holdings for Uber-Related Exposure (Indirect Exposure)

Direct investment in Uber's specific autonomous vehicle technology through ETFs is currently limited due to Uber's corporate structure and the way ATG's technology is integrated. However, investors can gain indirect exposure by carefully analyzing ETF holdings. Look for ETFs that hold shares in companies that benefit from or collaborate with Uber's advancements. This includes:

- Technology providers: Companies supplying crucial components like sensors, AI software, or high-precision mapping solutions. If Uber uses their technology, their success is indirectly linked to Uber's AV progress.

- Sensor manufacturers: Companies producing LiDAR, radar, and camera systems are crucial for autonomous driving. Increased demand driven by the wider AV industry benefits these companies, potentially including those working with Uber.

- Mapping companies: Accurate and detailed maps are essential. Companies providing high-definition mapping services could see increased demand from AV developers like Uber.

Risks and Considerations of Investing in Autonomous Vehicle ETFs

Investing in emerging technologies like autonomous vehicles carries inherent risks. The autonomous vehicle sector is still in its relatively early stages of development and commercialization, making it inherently volatile.

- Regulatory uncertainty: Government regulations surrounding autonomous vehicles are still evolving and can significantly impact the industry. Changes in legislation could hinder or accelerate the adoption of AV technology.

- Technological risks: Significant technological challenges remain in achieving fully autonomous driving capabilities. Delays or setbacks in technology development could negatively affect the performance of related companies and ETFs.

- Competitive landscape: The autonomous vehicle sector is highly competitive, with numerous companies vying for market share. Intense competition could lead to price wars and lower profit margins.

- Market volatility: The technology sector, including autonomous vehicles, is known for its volatility. Market downturns can significantly impact the value of ETFs invested in this space.

Drive Your Investment Portfolio into the Future with Autonomous Vehicle ETFs

Investing in Uber's autonomous vehicle technology indirectly, via ETFs, offers a diversified approach to participating in the potentially lucrative autonomous vehicle revolution. While the sector carries inherent risks, careful research and consideration of the points discussed above can help investors manage those risks and potentially benefit from long-term growth. Remember that diversification is key and understanding the inherent risks in investing in emerging technologies is crucial.

Start your journey into the future of transportation by researching the ETFs discussed and building a diversified portfolio focused on investing in Uber's autonomous vehicle tech via ETFs. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Watch Paige Bueckers U Conn Huskies Of Honor Senior Day Induction

May 19, 2025

Watch Paige Bueckers U Conn Huskies Of Honor Senior Day Induction

May 19, 2025 -

Chateau Diy From Concept To Completion A Comprehensive Guide

May 19, 2025

Chateau Diy From Concept To Completion A Comprehensive Guide

May 19, 2025 -

2025 Eurovision Az Rbaycan V S Fur Nin T Msilciliyi

May 19, 2025

2025 Eurovision Az Rbaycan V S Fur Nin T Msilciliyi

May 19, 2025 -

Mets Vs Cubs A Showdown Of Pitching Prowess And Offensive Firepower

May 19, 2025

Mets Vs Cubs A Showdown Of Pitching Prowess And Offensive Firepower

May 19, 2025 -

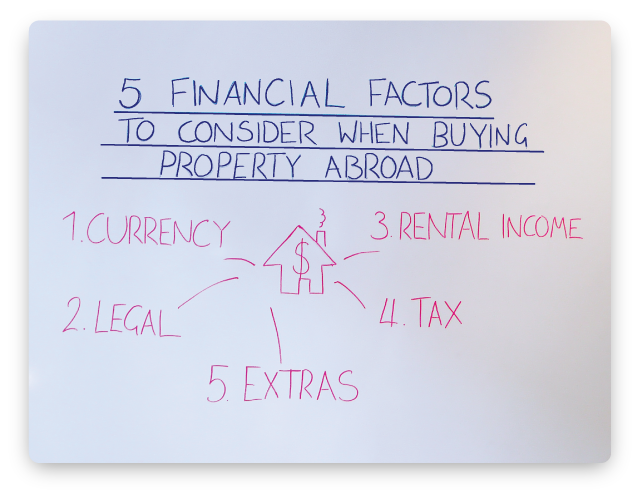

Is A Place In The Sun Right For You Factors To Consider Before Buying Overseas Property

May 19, 2025

Is A Place In The Sun Right For You Factors To Consider Before Buying Overseas Property

May 19, 2025