The GOP Tax Plan And The National Deficit: Fact Vs. Fiction

Table of Contents

The GOP Tax Plan's Core Provisions and Projected Economic Impacts

The Tax Cuts and Jobs Act of 2017 significantly altered the US tax code. Key provisions included:

- Corporate Tax Rate Reduction: The most significant change was slashing the corporate tax rate from 35% to 21%. Proponents argued this would boost investment, increase competitiveness, and ultimately stimulate economic growth.

- Individual Income Tax Changes: The plan altered individual income tax brackets, often resulting in lower rates for many taxpayers. Standard deduction amounts were also increased. However, some tax credits were altered or eliminated.

- Supply-Side Economics: The plan's architects based their projections on supply-side economics, arguing that lower taxes would incentivize businesses to invest more, leading to higher economic growth and ultimately increased tax revenue.

- Sunset Provisions: Crucially, several provisions of the TCJA were temporary, meaning they were set to expire after a certain period, potentially leading to future tax increases.

Actual Economic Performance Following the Tax Cuts

Following the implementation of the TCJA, analyzing the actual economic performance is crucial to assess its impact. While economic data is complex and influenced by many factors beyond tax policy alone, some key indicators include:

- GDP Growth: While GDP growth did experience a modest increase in the years immediately following the tax cuts, comparing this to projected growth figures reveals whether the supply-side predictions materialized. Many independent analyses suggest the growth was less than predicted.

- Employment Rate: The unemployment rate continued its downward trend, but attributing this solely to the tax cuts is difficult due to other economic factors at play. A thorough analysis must consider these extraneous variables.

- Inflation Rates: Inflation rates also need examination. While moderate in the immediate aftermath, assessing potential long-term impacts on inflation due to increased government borrowing is important.

- Visual Representation: Charts and graphs illustrating GDP growth, employment figures, and inflation rates across this period are crucial to effectively communicate the economic trends.

The Impact of the GOP Tax Plan on the National Deficit and Debt

The effect of the GOP tax plan on the national deficit and debt is arguably the most contentious aspect.

- Projected vs. Actual: The initial projections of deficit reduction often touted by supporters of the plan differed substantially from the actual figures. Independent analysis suggests the tax cuts significantly increased the national debt.

- Increased Government Spending: It is essential to remember that government spending levels during this period played a significant role. Increases in spending, separate from the tax cuts, added to the national deficit.

- Long-Term Implications: The long-term consequences of adding trillions to the national debt due to the tax cuts are considerable and a point of ongoing debate. The debt-to-GDP ratio is a key metric to examine.

- CBO Reports: Data from independent and reputable sources, such as the Congressional Budget Office (CBO), are crucial for impartial analysis. CBO reports provide valuable insights into the fiscal impact of the tax cuts.

Counterarguments and Criticisms of the Tax Plan

Numerous criticisms have been leveled against the TCJA.

- Income Inequality: Critics argue that the tax cuts disproportionately benefited high-income earners and corporations, exacerbating income inequality. Analysis of the distribution of tax benefits across various income brackets is vital to assess this claim.

- Fiscal Sustainability: The long-term fiscal unsustainability of continually increasing the national debt is a major point of concern. Arguments for and against increasing the national debt must be carefully examined.

- Government Borrowing: The increased government borrowing required to offset the revenue loss from the tax cuts carries potential negative consequences, including higher interest rates and potentially reduced investment in other crucial areas.

Conclusion

Understanding the GOP tax plan's impact on the national deficit requires careful consideration of multiple factors. While proponents pointed to projected economic growth and potential revenue increases, actual data shows significant increases in the national deficit and debt. The economic growth spurred by the TCJA was less than predicted, and the tax cuts disproportionately benefited high-income individuals and corporations. The long-term consequences of this added debt remain a subject of ongoing debate and concern.

Understanding the GOP tax plan's impact on the national deficit is crucial for informed policy discussions. Learn more about the long-term consequences of the GOP tax plan and its effect on the national debt through further research and analysis of data from reliable sources like the Congressional Budget Office. What are your thoughts on the lasting impact of the TCJA? Share your insights in the comments below.

Featured Posts

-

Het Kamerbrief Verkoopprogramma Abn Amro Alles Wat U Moet Weten

May 21, 2025

Het Kamerbrief Verkoopprogramma Abn Amro Alles Wat U Moet Weten

May 21, 2025 -

Benjamin Kaellman Huuhkajien Uusi Taehti

May 21, 2025

Benjamin Kaellman Huuhkajien Uusi Taehti

May 21, 2025 -

Australian Foot Crossing New Speed Record Set By Man

May 21, 2025

Australian Foot Crossing New Speed Record Set By Man

May 21, 2025 -

Manhattans Forgotten Foods Festival Showcases Unique Culinary Heritage

May 21, 2025

Manhattans Forgotten Foods Festival Showcases Unique Culinary Heritage

May 21, 2025 -

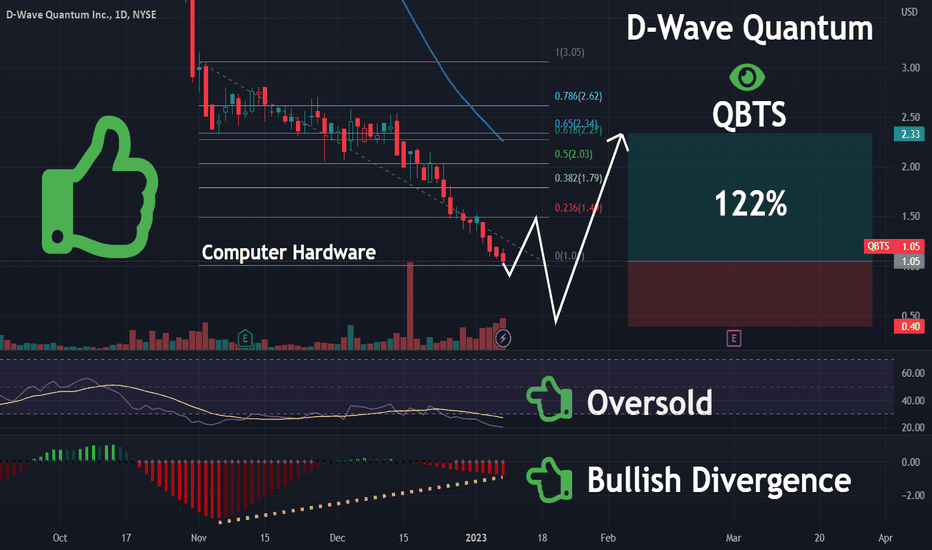

Why Did D Wave Quantum Qbts Stock Plunge On Monday

May 21, 2025

Why Did D Wave Quantum Qbts Stock Plunge On Monday

May 21, 2025

Latest Posts

-

Latest Wwe News John Cena Vs Randy Orton And Bayleys Injury Update

May 21, 2025

Latest Wwe News John Cena Vs Randy Orton And Bayleys Injury Update

May 21, 2025 -

Former Aew Star Rey Fenix Smack Down Debut And New Wwe Name

May 21, 2025

Former Aew Star Rey Fenix Smack Down Debut And New Wwe Name

May 21, 2025 -

Wwe Rumors John Cena Randy Orton Feud And Bayleys Injury

May 21, 2025

Wwe Rumors John Cena Randy Orton Feud And Bayleys Injury

May 21, 2025 -

Aews Rey Fenix Debuts On Wwe Smack Down Official Ring Name Unveiled

May 21, 2025

Aews Rey Fenix Debuts On Wwe Smack Down Official Ring Name Unveiled

May 21, 2025 -

Rollins And Breakker Bully Sami Zayn On Wwe Raw Full Recap

May 21, 2025

Rollins And Breakker Bully Sami Zayn On Wwe Raw Full Recap

May 21, 2025