The Impact Of Student Loan Debt On Your Ability To Buy A Home

Table of Contents

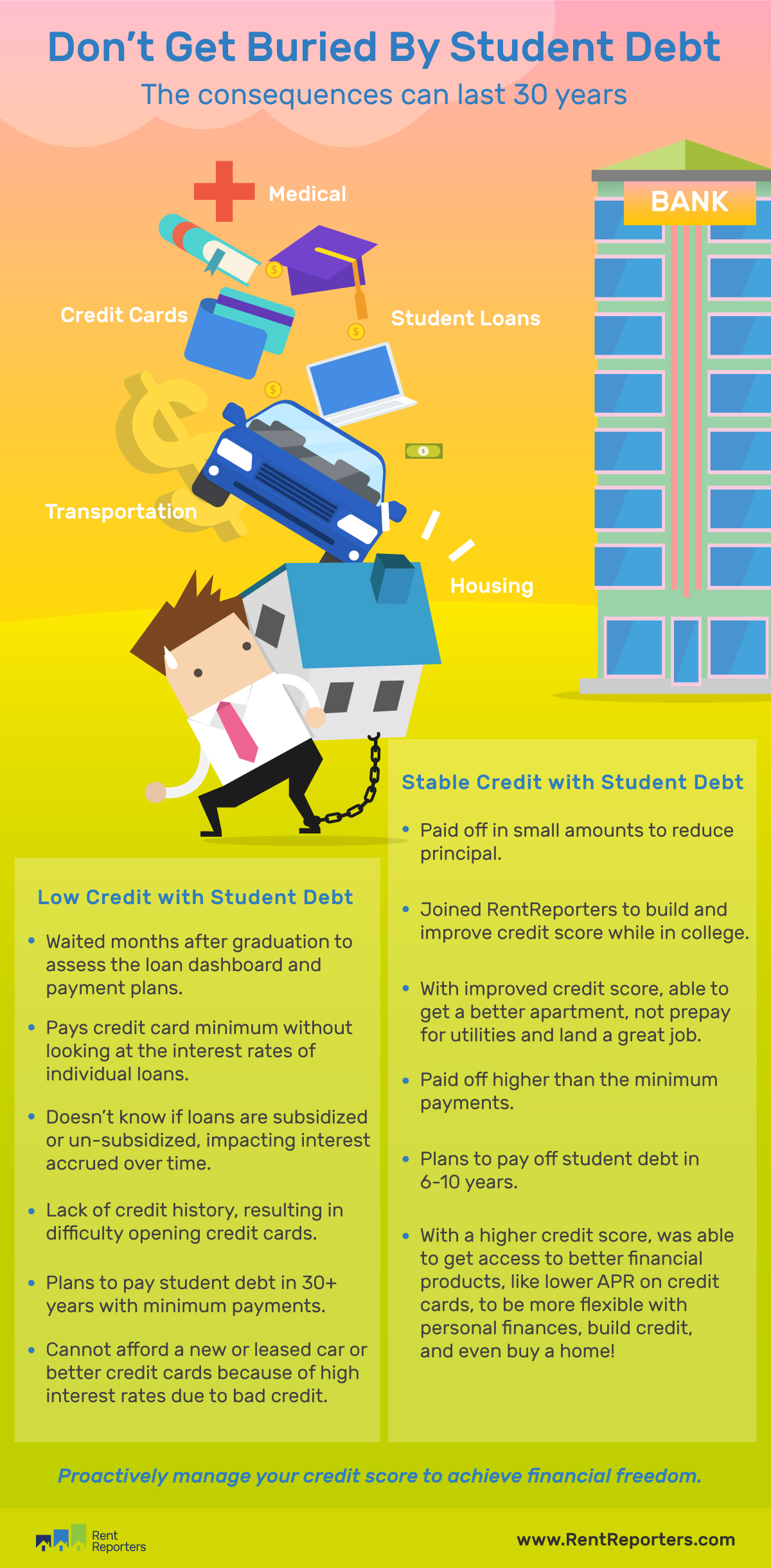

How Student Loan Debt Affects Your Credit Score

A high credit score is essential for securing a mortgage at a favorable interest rate. Student loan debt directly impacts your credit score in several ways, making it harder to qualify for a home loan. A high debt-to-income ratio (DTI), heavily influenced by your student loan payments, is a major factor lenders consider when assessing your creditworthiness. Lenders analyze your credit report meticulously, looking for indicators of responsible borrowing and repayment history.

- Negative impacts on your credit score stemming from student loan debt include:

- Missed or late payments significantly lower your credit score.

- High credit utilization (using a large percentage of your available credit) negatively impacts your score.

- Applying for multiple loans in a short period can also hurt your credit score.

Responsible debt management is paramount. Strategies for credit repair include paying down existing debts, maintaining a low credit utilization rate, and promptly paying all bills on time. Regularly monitoring your credit report for inaccuracies is also crucial.

The Impact of Student Loan Debt on Your Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) represents the percentage of your gross monthly income that goes towards paying your debts. Lenders use DTI to determine your ability to manage additional debt, such as a mortgage. A high DTI, often caused by substantial student loan payments, significantly reduces your borrowing power and limits your mortgage eligibility.

- How student loan debt impacts DTI and mortgage eligibility:

- Example 1: With a $50,000 annual income and $500 in monthly student loan payments, your DTI is approximately 12%. This is generally considered favorable.

- Example 2: With the same income but $1500 in monthly student loan payments, your DTI jumps to 36%, significantly reducing your chances of mortgage approval.

Strategies to improve your DTI include debt consolidation (combining multiple loans into one with potentially lower interest rates), increasing your income through a higher-paying job or side hustle, and aggressively paying down high-interest debt.

The Challenges of Saving for a Down Payment with Student Loan Debt

A substantial down payment is often required to secure a mortgage. The larger your down payment, the lower your loan amount and monthly mortgage payments, and often the better interest rate you can obtain. However, juggling substantial student loan repayments while simultaneously saving for a significant down payment presents a considerable challenge.

- Strategies for saving while managing student loan debt:

- Prioritize savings: Create a realistic budget that allocates a specific amount each month to your down payment savings.

- Explore down payment assistance programs: Many government and non-profit organizations offer programs to help first-time homebuyers with down payment assistance. Research options in your area.

- Consider alternatives: FHA loans, for example, often require lower down payments than conventional loans, making them more accessible to those with student loan debt.

Careful budgeting and financial discipline are essential to overcome this hurdle.

Strategies for Buying a Home with Student Loan Debt

Despite the challenges, buying a home with student loan debt is achievable with careful planning and strategic financial management.

-

Options for managing student loan debt:

- Refinance student loans: Refinancing can potentially lower your monthly payments, freeing up more money for down payment savings or other expenses. Shop around for the best rates.

- Income-driven repayment plans: These plans adjust your monthly payments based on your income, making them more manageable.

-

Additional advice:

- Prioritize your finances: Create a detailed budget and stick to it.

- Seek financial counseling: A financial advisor can provide personalized advice and guidance.

- Explore different mortgage options: Shop around for the best interest rates and terms.

- Utilize down payment assistance programs: Research and apply for relevant programs in your area.

Conclusion

Student loan debt presents significant challenges to aspiring homeowners, impacting credit scores, DTI ratios, and the ability to save for a down payment. However, with careful planning, responsible financial management, and the exploration of available resources, it is possible to navigate these challenges and achieve the dream of homeownership.

Call to Action: Don't let student loan debt derail your homeownership dreams. Understand the impact of your student loan debt on your homeownership journey and take proactive steps today to improve your financial situation and secure your future. Explore available resources and seek professional advice to create a personalized plan that addresses your specific circumstances regarding student loan debt and homeownership.

Featured Posts

-

Penarol 0 2 Olimpia Resumen Del Partido Goles Y Mejores Momentos

May 17, 2025

Penarol 0 2 Olimpia Resumen Del Partido Goles Y Mejores Momentos

May 17, 2025 -

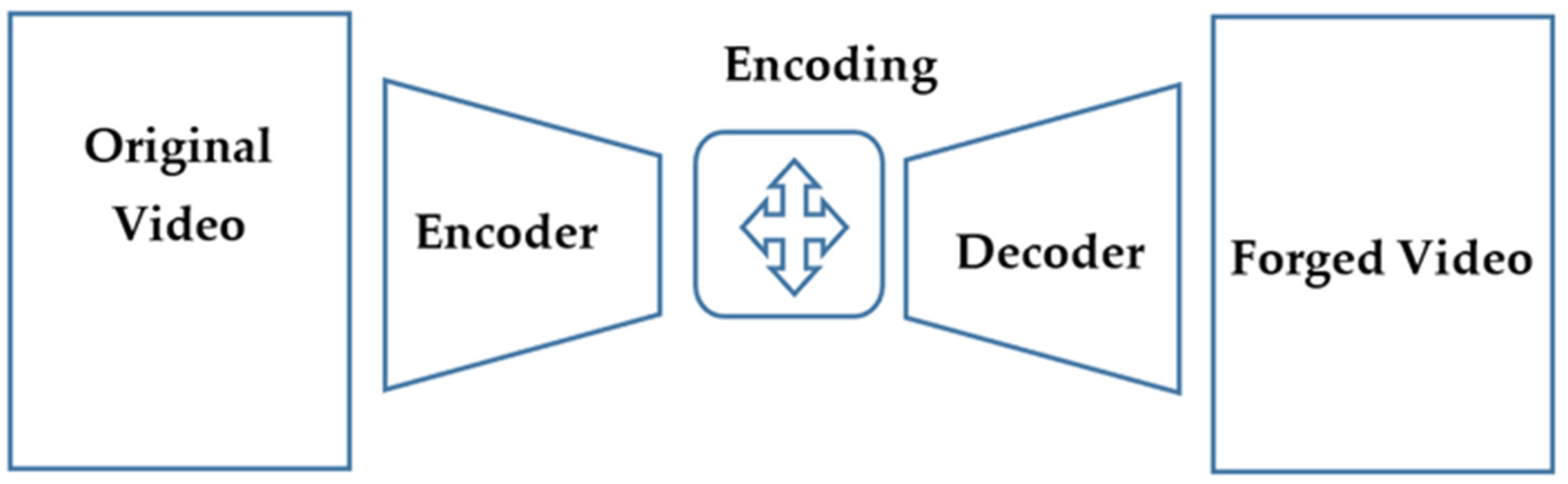

Deepfake Detection Foiled Cybersecurity Experts Clever Technique

May 17, 2025

Deepfake Detection Foiled Cybersecurity Experts Clever Technique

May 17, 2025 -

Jalen Brunsons Reported Discontent Could Mean Missing Next Weeks Raw

May 17, 2025

Jalen Brunsons Reported Discontent Could Mean Missing Next Weeks Raw

May 17, 2025 -

Mariners Giants Injury News Key Players Out April 4 6

May 17, 2025

Mariners Giants Injury News Key Players Out April 4 6

May 17, 2025 -

Nba Teisejo Klaida Leme Pistons Ir Knicks Rungtyniu Baigti Taip Nutinka Retai

May 17, 2025

Nba Teisejo Klaida Leme Pistons Ir Knicks Rungtyniu Baigti Taip Nutinka Retai

May 17, 2025