The Impact Of Tariffs On IPOs: Current Market Analysis And Future Predictions

Table of Contents

How Tariffs Increase Uncertainty in the IPO Market

Tariffs introduce a significant layer of uncertainty into the already complex IPO process. This uncertainty stems from several key factors, directly influencing investor behavior and company valuations.

Reduced Investor Confidence

Tariffs create a climate of economic uncertainty, leading to reduced investor confidence. This translates to:

- Decreased investment: Investors become more risk-averse, opting for safer investments rather than potentially volatile IPOs.

- Higher risk aversion: The unpredictable nature of tariff changes makes it difficult to forecast future profitability, increasing perceived risk.

- Flight to safety: Investors often move their capital into established, less volatile markets, reducing the demand for new offerings.

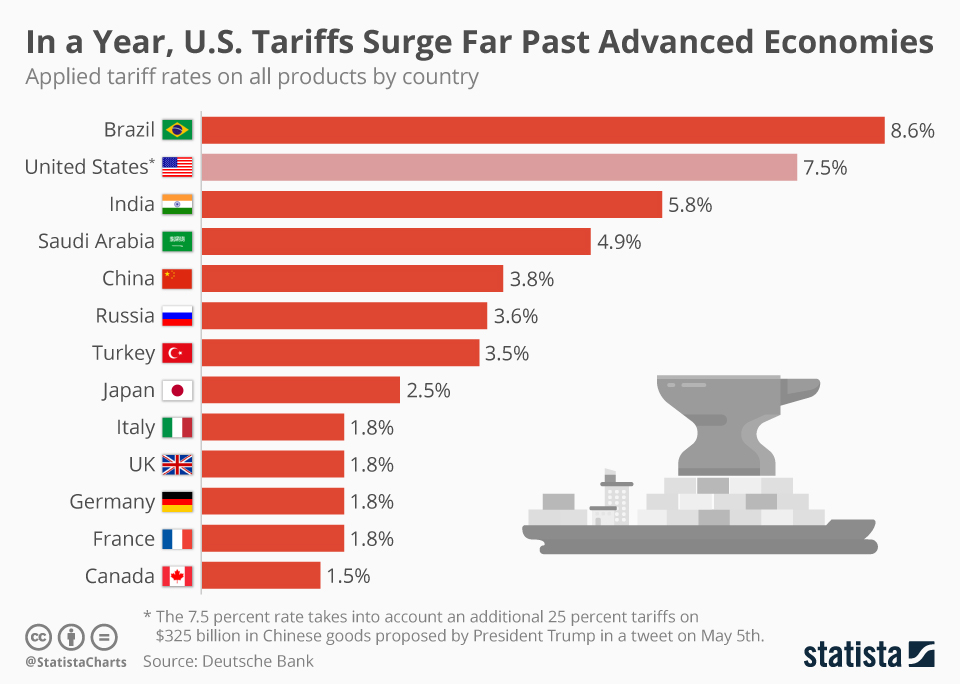

Data from the past few years shows a clear correlation between increased tariff implementation and a decline in IPO activity and valuations, particularly in sectors heavily impacted by trade disputes. For instance, a study by [Insert reputable source and specific data] indicated a [Percentage]% decrease in IPO filings during periods of heightened tariff imposition.

Supply Chain Disruptions

Tariffs significantly impact a company's supply chain, leading to disruptions that directly affect their IPO valuation. These disruptions include:

- Increased production costs: Tariffs on imported goods increase the cost of raw materials and components, impacting profit margins.

- Potential delays: Navigating tariff complexities and navigating customs procedures can create delays in production and delivery.

- Impact on profitability projections: Uncertainties in supply chain costs make it difficult to accurately project future profitability, a key factor for IPO valuation.

For example, [Insert example of a company whose IPO was negatively affected by supply chain disruptions due to tariffs]. Their IPO valuation was significantly lowered due to concerns about their ability to maintain profit margins in the face of increased import costs.

The Impact of Tariffs on Specific Sectors

The impact of tariffs varies across different sectors, depending on their reliance on international trade.

Industries Heavily Reliant on Imports/Exports

Industries like technology and manufacturing, heavily reliant on imports and exports, are particularly vulnerable.

- Specific examples: Companies in the electronics industry, for instance, often rely on imported components, making them highly susceptible to tariff increases.

- Data/Statistics: Comparing IPO performance data across sectors reveals a significant disparity, with sectors heavily reliant on international trade showing a much lower success rate during periods of high tariffs. [Insert data source and findings here].

Domestically Focused Industries

While domestically focused industries are less directly affected by tariffs, they are not immune to the overall economic climate.

- Examples: Companies in sectors like utilities or local services might experience less direct impact but may still face challenges due to decreased consumer spending resulting from broader economic uncertainty.

- Data/Statistics: Analysis shows that even domestically focused companies experience reduced IPO valuations during periods of widespread tariff implementation, demonstrating the interconnectedness of global markets. [Insert data source and findings here].

Predicting Future Trends: Tariffs and the IPO Landscape

Predicting the future impact of tariffs on IPOs requires considering potential policy shifts and adapting to a changing global economy.

Potential for Policy Changes

Future changes in tariff policies or the negotiation of new trade agreements will significantly influence IPO activity.

- Scenarios: A reduction or removal of tariffs would likely boost investor confidence, leading to increased IPO activity and valuations. Conversely, further tariff escalations would likely exacerbate existing uncertainties.

- Expert Opinions: [Quote relevant economists or financial analysts on their predictions for future tariff policies and their likely impact on IPOs].

Adapting to a Changing Global Economy

Companies preparing for an IPO can adopt strategies to mitigate tariff risks:

- Diversification: Diversifying supply chains to reduce reliance on single-source suppliers can lessen the impact of tariffs.

- Supply chain restructuring: Restructuring supply chains to incorporate domestic sourcing can minimize tariff-related costs and uncertainties.

- Transparent risk assessment: A transparent and comprehensive assessment of tariff risks should be integral to the IPO preparation process.

Successful companies are proactively adapting, finding innovative solutions to navigate tariff challenges. [Provide examples of companies that successfully adapted their strategies].

Conclusion

The impact of tariffs on IPOs is significant, affecting investor confidence, disrupting supply chains, and impacting various sectors differently. Reduced investor confidence, coupled with supply chain disruptions, significantly impacts IPO valuations, particularly for companies reliant on international trade. Understanding these dynamics is critical. Key takeaways include the need for thorough risk assessment, proactive supply chain management, and awareness of the broader economic implications of tariff policies. Understanding the impact of tariffs on IPOs is crucial for both companies planning to go public and investors considering participation. Conduct thorough due diligence and stay informed about evolving trade policies before making any decisions.

Featured Posts

-

Expulsion Oqtf Deux Collegiens Et Leur Mere Separes Pendant Les Vacances

May 14, 2025

Expulsion Oqtf Deux Collegiens Et Leur Mere Separes Pendant Les Vacances

May 14, 2025 -

Public Perception Of Tommy Fury Following In Molly Mae Hagues Footsteps

May 14, 2025

Public Perception Of Tommy Fury Following In Molly Mae Hagues Footsteps

May 14, 2025 -

Israel Eurovision Boycott Directors Response

May 14, 2025

Israel Eurovision Boycott Directors Response

May 14, 2025 -

Novakove Patike 1 500 Evra Za Vrkhunski Kvalitet

May 14, 2025

Novakove Patike 1 500 Evra Za Vrkhunski Kvalitet

May 14, 2025 -

Power Hitting In Arkansas Softball A New Queen Takes The Throne

May 14, 2025

Power Hitting In Arkansas Softball A New Queen Takes The Throne

May 14, 2025