The Impact Of The Trade War: A Canadian Aluminum Trader's Collapse

Table of Contents

The Role of Tariffs and Trade Restrictions

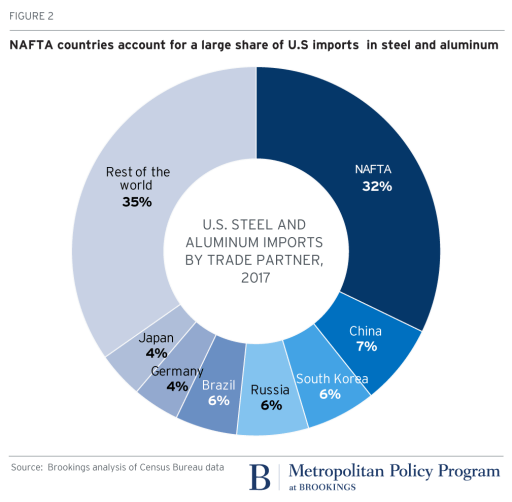

Increased tariffs on aluminum imports significantly impacted the Canadian aluminum trader's profitability and competitiveness. The imposition of these duties resulted in a cascade of negative consequences, ultimately contributing to the company's demise. The USMCA, while intended to foster trade, failed to fully mitigate the effects of the trade war in this specific instance.

- Increased costs of raw materials: Tariffs inflated the price of imported aluminum, a crucial raw material for the trader's operations. This squeezed profit margins and reduced competitiveness against companies sourcing aluminum from countries without tariffs.

- Reduced market access due to retaliatory tariffs: Retaliatory tariffs imposed by other countries on Canadian aluminum exports further restricted market access and decreased sales volume. This created a double bind, increasing costs while simultaneously reducing revenue streams.

- Difficulty in competing with subsidized foreign producers: The trader struggled to compete with foreign producers who benefited from government subsidies, effectively lowering their production costs and creating an uneven playing field.

- Loss of contracts due to price increases: Unable to offer competitive pricing due to increased input costs, the company lost lucrative contracts to rivals offering lower prices. This led to a significant decrease in revenue.

The complexities of trade agreements like the USMCA, while aiming for free trade, often fail to fully anticipate or address the unforeseen repercussions of broader global trade conflicts, highlighting the vulnerabilities of businesses reliant on international trade flows.

Financial Strain and Liquidity Issues

The increased pressures from the trade war exacerbated pre-existing financial vulnerabilities, leading to the company's eventual collapse. The trader faced a perfect storm of financial difficulties, ultimately crippling its ability to operate.

- Decreased revenue streams due to reduced sales: The combination of higher costs and reduced market access resulted in a sharp decline in sales, drastically reducing revenue.

- Increased debt burden from financing operations during the trade war: To maintain operations amidst the trade war, the company took on significant debt, further straining its finances.

- Inability to secure additional funding from lenders: Facing mounting losses and a precarious financial situation, the company was unable to secure additional funding from lenders, who were increasingly risk-averse.

- Cash flow problems hindering operational continuity: The lack of sufficient cash flow hampered the trader's ability to meet its operational expenses, leading to a vicious cycle of decline.

The relationship between the trade war pressures and the company's financial vulnerabilities is undeniable; the trade war acted as a catalyst, accelerating the company's existing financial weaknesses towards a critical breaking point. This is a common pattern observed in many businesses caught in the crossfire of global trade disputes.

Geopolitical Instability and Market Volatility

Unpredictable geopolitical events and market fluctuations significantly exacerbated the company's problems. The aluminum market is notoriously volatile, and the trade war only amplified this instability.

- Impact of fluctuating aluminum prices on profitability: Fluctuations in aluminum prices created immense uncertainty, making it extremely difficult to accurately forecast profitability and manage risk.

- Uncertainty surrounding future trade policies: The unpredictable nature of trade policies added to the uncertainty, making it difficult for the company to plan long-term strategies.

- Increased risk aversion among investors: The combination of trade war uncertainty and the company's weakening financial position led to increased risk aversion among investors, making it difficult to attract further investment.

- Difficulty in forecasting future demand and supply: The disruptions caused by the trade war made it extremely difficult to accurately forecast future demand and supply, making effective business planning nearly impossible.

These factors compounded the effects of the trade war, creating a perfect storm that ultimately led to the company's collapse. The volatility, in addition to the trade issues, created a situation of extreme difficulty for the business.

The Impact on the Broader Canadian Aluminum Industry

The collapse of the Canadian aluminum trader sent ripples throughout the broader aluminum industry, with significant consequences for related businesses and the Canadian economy.

- Job losses and economic consequences for related industries: The closure of the trading company resulted in significant job losses and economic hardship for employees and associated businesses.

- Increased concentration of market power among remaining players: The collapse reduced the number of major players in the market, potentially leading to increased concentration of market power among the remaining companies.

- Potential for further consolidation and restructuring within the sector: The collapse might trigger further consolidation and restructuring within the Canadian aluminum industry as companies grapple with the changed market conditions.

- Impact on Canada's trade relationships with other countries: The collapse further strained Canada's trade relationships with other countries, highlighting the significant impact of trade disputes on international relations.

Government interventions, such as financial aid packages or targeted support programs for affected industries, are often necessary to mitigate the negative consequences of such collapses and help the industry recover.

Conclusion

The collapse of this Canadian aluminum trader serves as a cautionary tale illustrating the significant and far-reaching consequences of international trade wars. The interplay of tariffs, financial instability, geopolitical uncertainties, and market volatility ultimately led to the company's demise, impacting not only its employees and stakeholders but also the broader Canadian aluminum industry. Understanding the intricacies of this case study is crucial for policymakers, businesses operating in global markets, and anyone seeking to navigate the complex landscape of international trade. Preventing similar collapses of Canadian aluminum traders requires proactive strategies to mitigate the risks associated with trade disputes and global economic uncertainty. Learning from this Canadian aluminum trader's collapse is essential for future resilience in the industry.

Featured Posts

-

Pembeli Nft Nike Hadapi Gugatan Ratusan Miliar Rupiah

May 29, 2025

Pembeli Nft Nike Hadapi Gugatan Ratusan Miliar Rupiah

May 29, 2025 -

Jamie Foxxs All Star Weekend Robert Downey Jr S Hispanic Role

May 29, 2025

Jamie Foxxs All Star Weekend Robert Downey Jr S Hispanic Role

May 29, 2025 -

The Ultimate Bargain Hunt How To Save Money On Everything

May 29, 2025

The Ultimate Bargain Hunt How To Save Money On Everything

May 29, 2025 -

Van Ilyen 100 Ft Osod Akar Felmillio Forintot Is Erhet

May 29, 2025

Van Ilyen 100 Ft Osod Akar Felmillio Forintot Is Erhet

May 29, 2025 -

Fired Without Warning An Aussie Womans Experience

May 29, 2025

Fired Without Warning An Aussie Womans Experience

May 29, 2025

Latest Posts

-

Grigor Dimitrov Vliyanieto Na Kontuziyata Vrkhu Karierata Mu

May 31, 2025

Grigor Dimitrov Vliyanieto Na Kontuziyata Vrkhu Karierata Mu

May 31, 2025 -

Kontuziyata Na Grigor Dimitrov Aktualna Informatsiya I Analiz

May 31, 2025

Kontuziyata Na Grigor Dimitrov Aktualna Informatsiya I Analiz

May 31, 2025 -

Trumps Uncertainty What Made Him Question Elon Musk

May 31, 2025

Trumps Uncertainty What Made Him Question Elon Musk

May 31, 2025 -

Uncertainty And The End Trumps Doubts About Elon Before The Break

May 31, 2025

Uncertainty And The End Trumps Doubts About Elon Before The Break

May 31, 2025 -

Everything Revealed In The Star Trek Strange New Worlds Season 3 Teaser

May 31, 2025

Everything Revealed In The Star Trek Strange New Worlds Season 3 Teaser

May 31, 2025