The Impact Of Trump's Tariffs On The Small Business Economy

Table of Contents

Increased Costs of Goods and Services

Trump's tariffs directly impacted the cost of imported raw materials and finished goods for countless small businesses. This increase in input costs squeezed profit margins and forced many to make difficult choices.

-

Higher prices for imported components leading to increased production costs: Many small businesses rely on imported components for their products. Tariffs increased the cost of these inputs, directly translating to higher production costs. This was particularly true for manufacturers who relied on steel, aluminum, or other materials subject to tariffs. For example, a small furniture maker using imported wood saw their material costs increase significantly, impacting their ability to remain competitive.

-

Reduced competitiveness due to increased pricing compared to businesses not reliant on imports: Small businesses relying on imported goods found themselves at a disadvantage compared to competitors who sourced materials domestically or from countries not subject to tariffs. This led to a loss in market share and reduced profitability.

-

Difficulty in absorbing increased costs without passing them onto consumers: Absorbing increased costs was often impossible for small businesses with already thin profit margins. Passing these costs onto consumers, however, risked reducing sales volume, creating a difficult balancing act.

-

Examples of specific industries heavily affected (e.g., manufacturing, retail): The manufacturing sector, particularly those involved in producing goods with imported components, felt the brunt of these increased costs. Similarly, retailers selling imported goods faced higher wholesale prices, limiting their ability to offer competitive retail pricing.

Reduced Sales and Market Share

The impact of Trump's tariffs extended beyond increased costs; they also significantly reduced sales and market share for many small businesses.

-

Higher prices reducing consumer purchasing power: As businesses passed on increased costs to consumers, purchasing power decreased, leading to lower sales volumes. Consumers, facing higher prices across the board, cut back on spending, directly impacting small businesses.

-

Retaliatory tariffs from other countries impacting export opportunities: Trump's tariffs triggered retaliatory tariffs from other countries, impacting the export opportunities of American small businesses. This created a double whammy – reduced domestic sales and constrained export markets. Agricultural businesses, for instance, faced significant challenges exporting their goods.

-

Loss of market share to competitors from countries unaffected by tariffs: Small businesses found themselves competing with businesses from countries not affected by tariffs. These competitors offered lower prices, gaining a significant competitive advantage and snatching market share from American small businesses.

-

Impact on specific sectors heavily reliant on exports (e.g., agriculture): The agricultural sector suffered considerably, as retaliatory tariffs significantly reduced the demand for American agricultural products in overseas markets.

Access to Capital and Financing

The economic uncertainty created by Trump's tariffs made it significantly more challenging for small businesses to access capital and financing.

-

Increased uncertainty making lenders hesitant to provide loans: Lenders became hesitant to provide loans due to the increased uncertainty in the market. The risk associated with lending to small businesses during this period increased, leading to tighter lending standards.

-

Reduced profitability decreasing the attractiveness of investment opportunities: Reduced profitability, a direct consequence of the tariffs, made it less attractive for investors to fund small businesses. This further constrained the ability of small businesses to expand or even maintain operations.

-

Difficulty securing government assistance programs designed for small businesses: While some government assistance programs were available, navigating the application process and securing funding proved challenging for many small businesses, exacerbating the financial strain.

-

The overall impact of economic uncertainty on small business credit scores: The economic downturn and reduced profitability negatively impacted the credit scores of many small businesses, further hindering their ability to secure loans and credit.

Adaptability and Resilience of Small Businesses

Despite the significant challenges, many small businesses demonstrated remarkable adaptability and resilience in response to Trump's tariffs.

-

Examples of businesses that successfully navigated the challenges: Some businesses successfully diversified their supply chains, sourcing materials from multiple countries to reduce their dependence on any single source affected by tariffs. Others focused on domestic markets to minimize their exposure to international trade disruptions.

-

Strategies employed, such as diversifying supply chains, reducing reliance on imports, or focusing on domestic markets: Strategies implemented by successful businesses included diversifying their supplier base, exploring domestic alternatives to imported goods, and investing in automation to improve efficiency and reduce reliance on imported labor.

-

Government support programs utilized to help small businesses weather the storm: While access to government assistance programs was challenging, some small businesses successfully accessed funds and resources designed to support them during this period of economic instability.

-

Lessons learned and best practices for future economic downturns: The experience highlighted the importance of proactive risk management, diversification, and a flexible business model capable of adapting to changing economic conditions.

Conclusion

Trump's tariffs had a significant negative impact on the small business economy, resulting in increased costs, reduced sales, and challenges in accessing capital. While some businesses demonstrated remarkable resilience and adaptability, the overall effect was detrimental to many. Understanding the lasting impact of Trump's tariffs on small businesses is crucial. Continue learning about the effects of trade policy on small businesses and support legislation that protects their economic well-being. The long-term implications of these tariffs underscore the need for proactive measures to safeguard the small business sector against future economic fluctuations and the importance of considering the impact of trade policies on this vital segment of the economy.

Featured Posts

-

Lily Collins And Charlie Mc Dowells Growing Family Introducing Tove

May 12, 2025

Lily Collins And Charlie Mc Dowells Growing Family Introducing Tove

May 12, 2025 -

Sylvester Stallone Regrette T Il Ce Film Culte Des Annees 80

May 12, 2025

Sylvester Stallone Regrette T Il Ce Film Culte Des Annees 80

May 12, 2025 -

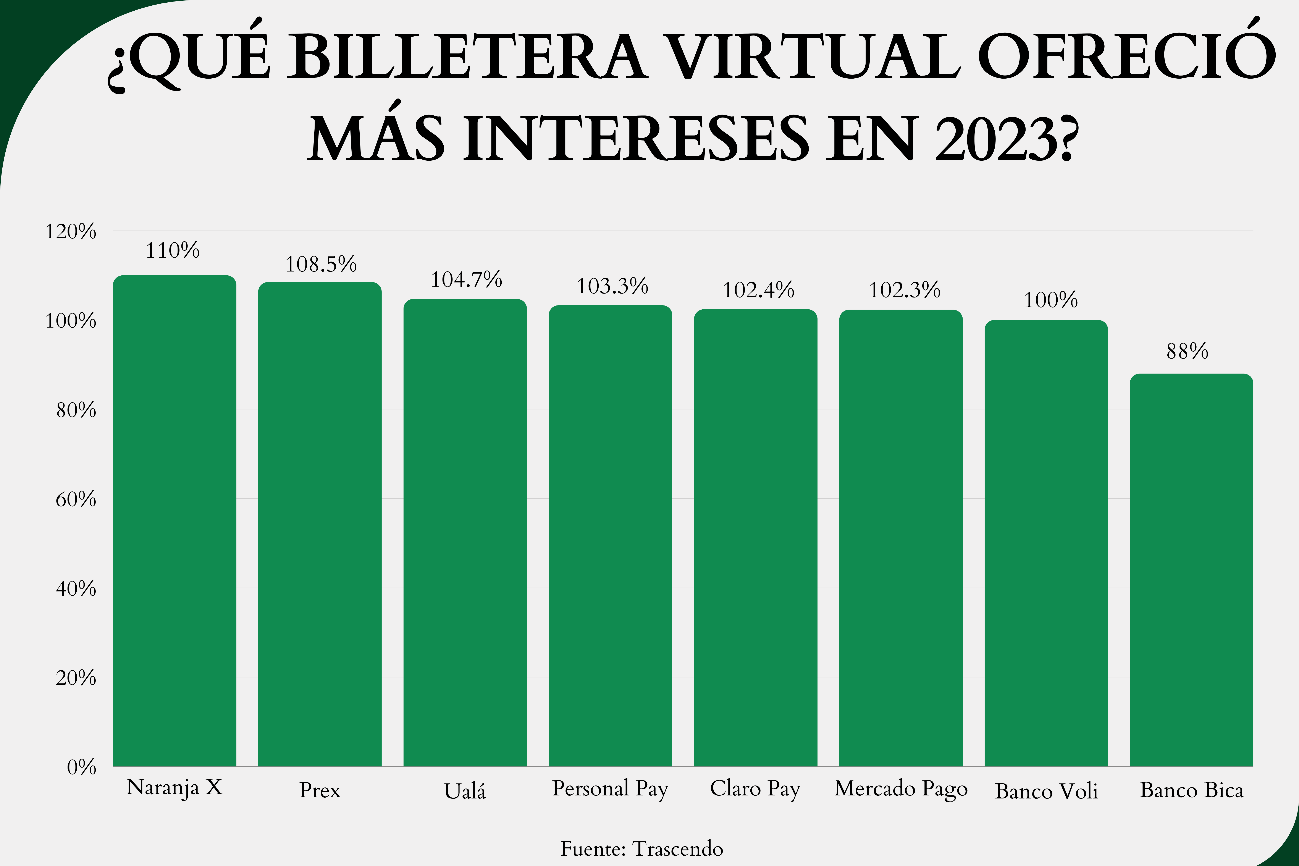

Billeteras Virtuales Uruguayas Con Apertura De Cuenta Gratuita Para Argentinos

May 12, 2025

Billeteras Virtuales Uruguayas Con Apertura De Cuenta Gratuita Para Argentinos

May 12, 2025 -

Stilska Analiza Kim Kardashi An I Ne Zinata Nova Kreatsi A

May 12, 2025

Stilska Analiza Kim Kardashi An I Ne Zinata Nova Kreatsi A

May 12, 2025 -

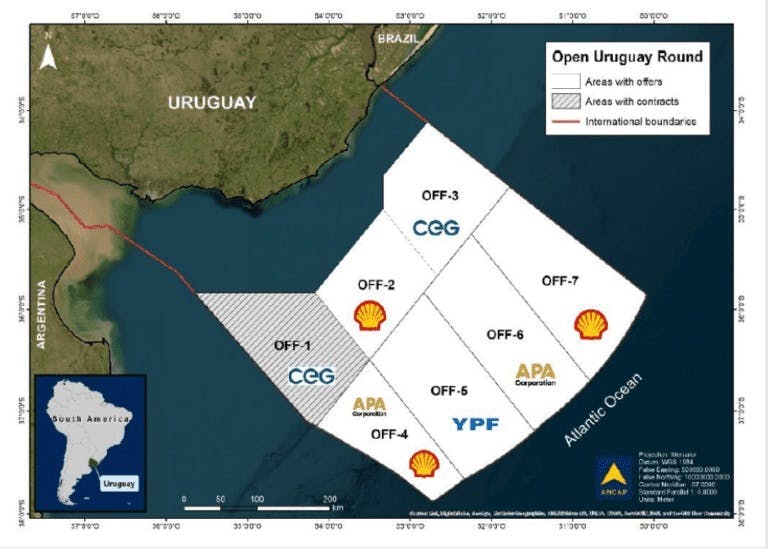

The Promise And Peril Of Offshore Oil Exploration In Uruguay

May 12, 2025

The Promise And Peril Of Offshore Oil Exploration In Uruguay

May 12, 2025

Latest Posts

-

Wnba Preseason Undrafted Rookie Deja Kelly Sinks Game Winning Shot

May 13, 2025

Wnba Preseason Undrafted Rookie Deja Kelly Sinks Game Winning Shot

May 13, 2025 -

Town City Name Residents Recent Obituary Notices

May 13, 2025

Town City Name Residents Recent Obituary Notices

May 13, 2025 -

Angela Swartz Insights Into Her Professional Journey

May 13, 2025

Angela Swartz Insights Into Her Professional Journey

May 13, 2025 -

Town City Name Obituaries Those We Ve Lost Recently

May 13, 2025

Town City Name Obituaries Those We Ve Lost Recently

May 13, 2025 -

Former Oregon Duck Deja Kelly Leads Aces To Victory With Late Basket

May 13, 2025

Former Oregon Duck Deja Kelly Leads Aces To Victory With Late Basket

May 13, 2025