The Implications Of SSE's £3 Billion Spending Reduction

Table of Contents

Impact on Renewable Energy Projects

The SSE spending reduction will undoubtedly have a significant impact on renewable energy projects across the UK. This decreased investment threatens to undermine the nation's ambitious net-zero targets and could have far-reaching consequences for the energy transition.

Delayed Wind and Solar Farm Developments

The most immediate consequence will likely be delays or even cancellations of planned wind and solar farm developments. This reduced investment in renewable energy infrastructure will directly hinder the UK's progress toward its decarbonization goals.

- Fewer new wind farms coming online: The pipeline of new offshore and onshore wind farms, crucial for generating clean electricity, will be significantly affected, potentially leading to slower growth in renewable energy generation capacity.

- Setbacks for planned solar energy installations: Similar delays are anticipated for large-scale solar energy projects, which also play a vital role in diversifying the UK's renewable energy mix.

- Potential impact on job creation in the renewable energy sector: The reduced investment will inevitably impact employment opportunities within the burgeoning renewable energy sector, leading to potential job losses and hindering the growth of this crucial industry.

- Increased reliance on fossil fuels in the short term: With fewer renewable energy projects coming online, the UK may become more reliant on fossil fuels to meet its energy demands in the short term, potentially delaying the transition to a cleaner energy system.

Reduced Investment in Energy Storage

The SSE spending reduction also threatens to impact investments in energy storage solutions, which are critical for integrating intermittent renewable energy sources like wind and solar power into the national grid.

- Less funding for battery storage projects: Battery storage is essential for managing the fluctuating output of renewable energy sources, ensuring a stable and reliable electricity supply. Reduced investment will hamper the development of this crucial infrastructure.

- Challenges in balancing supply and demand on the grid: Without sufficient energy storage capacity, balancing supply and demand on the national grid will become increasingly challenging, potentially leading to greater energy price volatility and increased risk of blackouts.

- Potential for increased energy price volatility: The lack of sufficient energy storage could exacerbate price fluctuations, particularly during periods of high demand or low renewable energy generation, potentially leading to higher energy bills for consumers.

Economic Consequences of the SSE Spending Reduction

The implications of the SSE spending reduction extend beyond the energy sector, impacting the broader UK economy through job losses and supply chain disruptions.

Job Losses and Supply Chain Impacts

The cutbacks in capital expenditure are likely to result in job losses across the energy sector and throughout its extensive supply chain. This will have a ripple effect, negatively impacting local communities and the national economy.

- Potential redundancies among SSE employees and contractors: The reduction in investment will inevitably lead to job losses within SSE itself and among the numerous contractors and subcontractors involved in its projects.

- Reduced demand for goods and services from companies supporting the energy sector: Companies supplying equipment, materials, and services to the energy sector will experience reduced demand, leading to potential financial difficulties and further job losses.

- Negative impact on local economies dependent on energy infrastructure projects: Communities that rely on energy infrastructure projects for employment and economic activity will suffer significant negative consequences, potentially experiencing increased unemployment and reduced economic growth.

Impact on UK Energy Security

Reduced investment in energy infrastructure, resulting from the SSE spending reduction, could also compromise the UK's energy security and resilience, making it more vulnerable to external shocks.

- Increased dependence on energy imports: Slower development of domestic renewable energy resources could increase the UK's reliance on energy imports, making it more susceptible to price fluctuations and supply disruptions in the global energy market.

- Potential for higher energy prices for consumers: Increased reliance on imports and a less diversified energy mix could lead to higher energy prices for households and businesses, negatively impacting living standards and economic competitiveness.

- Greater vulnerability to geopolitical events impacting energy supply: A less resilient energy system, resulting from the reduced investment, could leave the UK more vulnerable to geopolitical events that disrupt global energy supplies.

SSE's Rationale and Alternative Strategies

Understanding the reasoning behind SSE's decision and exploring potential alternative strategies is crucial for mitigating the negative impacts of this significant spending cut.

Reasons Behind the Spending Cut

SSE's announcement cites a number of factors contributing to the £3 billion spending reduction. These include:

- Analysis of SSE's official statements: SSE's official statements highlight economic uncertainty, high inflation rates, and changing regulatory environments as key factors influencing their decision.

- Consideration of external factors influencing their decision: External factors such as increased interest rates and supply chain challenges have also likely contributed to the decision to reduce capital expenditure.

- Assessment of the financial implications for SSE: The company's financial position and the need for prudent financial management are likely central to the decision.

Potential Alternative Strategies

While the decision to reduce spending is understandable given the current economic climate, alternative strategies could have been explored to minimize the negative impacts on renewable energy development.

- Exploring options for phased investment: A phased approach to investment, prioritizing critical projects, could have allowed for continued progress while managing financial constraints.

- Potential for partnerships with other companies or government initiatives: Collaborations with other energy companies or participation in government-backed initiatives could have provided access to additional funding and resources.

- Investigating innovative financing models for renewable energy projects: Exploring innovative financing models, such as green bonds or crowdfunding, could have unlocked alternative funding sources for renewable energy projects.

Conclusion

SSE's £3 billion spending reduction carries significant implications for the UK's energy transition, economic growth, and energy security. The delays and potential cancellations of renewable energy projects raise serious concerns about the nation's ability to meet its net-zero targets. The economic consequences, including job losses and supply chain disruptions, cannot be ignored. Understanding the rationale behind this decision and exploring alternative strategies is crucial for mitigating its negative impacts. Further analysis of the SSE spending reduction and its long-term consequences is essential for policymakers and stakeholders alike to ensure a secure and sustainable energy future. Continued monitoring of the impact of this significant spending cut is vital. We need a robust plan to ensure the UK continues to invest in renewable energy infrastructure. We urge policymakers to address the challenges presented by this SSE spending reduction to ensure a smooth transition to a net-zero economy.

Featured Posts

-

Peppa Pig Meets The Baby 10 Episode Cinema Experience This May

May 22, 2025

Peppa Pig Meets The Baby 10 Episode Cinema Experience This May

May 22, 2025 -

The Curious Case Of Gumballs Next Episodes

May 22, 2025

The Curious Case Of Gumballs Next Episodes

May 22, 2025 -

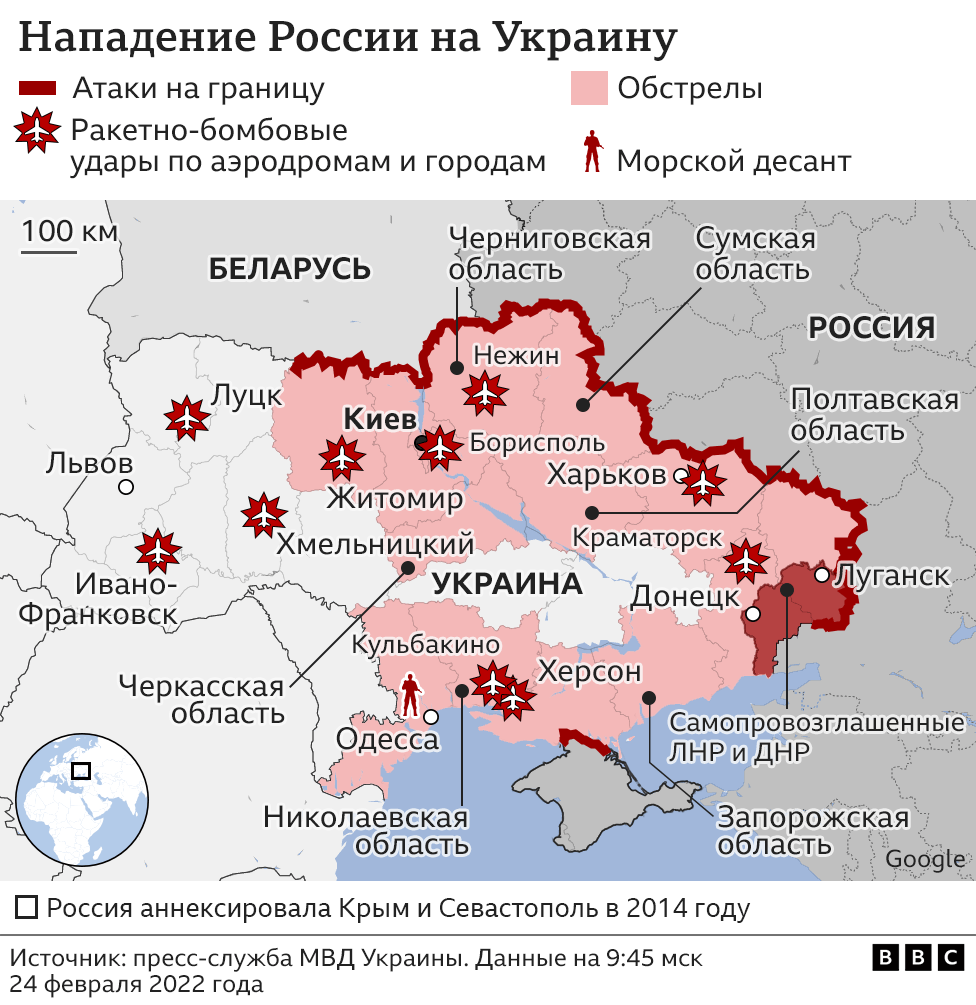

Vstuplenie Ukrainy V Nato Pozitsiya Evrokomissara I Perspektivy Peregovorov

May 22, 2025

Vstuplenie Ukrainy V Nato Pozitsiya Evrokomissara I Perspektivy Peregovorov

May 22, 2025 -

How Google Is Making Virtual Meetings Better

May 22, 2025

How Google Is Making Virtual Meetings Better

May 22, 2025 -

Voedselexport Naar Vs Keldert Abn Amro Analyseert Impact Heffingen

May 22, 2025

Voedselexport Naar Vs Keldert Abn Amro Analyseert Impact Heffingen

May 22, 2025

Latest Posts

-

Core Weaves Ipo Revised Listing Price Of 40 A Share

May 22, 2025

Core Weaves Ipo Revised Listing Price Of 40 A Share

May 22, 2025 -

Market Reaction Deciphering Core Weaves Crwv Tuesday Stock Decrease

May 22, 2025

Market Reaction Deciphering Core Weaves Crwv Tuesday Stock Decrease

May 22, 2025 -

Core Weave Crwv Stock Market Rally Analysis Of Todays Gains

May 22, 2025

Core Weave Crwv Stock Market Rally Analysis Of Todays Gains

May 22, 2025 -

Wednesdays Core Weave Crwv Stock Rally A Detailed Look

May 22, 2025

Wednesdays Core Weave Crwv Stock Rally A Detailed Look

May 22, 2025 -

Understanding Jim Cramers Investment In Core Weave Crwv And Its Open Ai Ties

May 22, 2025

Understanding Jim Cramers Investment In Core Weave Crwv And Its Open Ai Ties

May 22, 2025