The Most Profitable Dividend Strategy: Simplicity And Success

Table of Contents

Understanding Dividend Investing Fundamentals

Defining Dividend Yield and its Importance

Dividend yield is a crucial metric in dividend investing. It represents the annual dividend per share, divided by the share price, expressed as a percentage. A higher dividend yield suggests a potentially greater return on your investment. However, it's vital to understand the difference between dividend yield and the dividend payout ratio.

- Dividend Yield: The annual dividend per share relative to the share price. For example, a stock with a $2 annual dividend and a $50 share price has a 4% dividend yield ($2/$50 = 0.04).

- Payout Ratio: The percentage of a company's earnings paid out as dividends. A high payout ratio (e.g., above 70%) might signal risk, as the company might struggle to maintain dividends if earnings decline. A lower payout ratio (e.g., below 50%) indicates more financial stability.

- Importance: A consistent and growing dividend yield, coupled with a sustainable payout ratio, is a strong indicator of a healthy and reliable dividend-paying stock. Don't just chase high yields; focus on sustainable, long-term growth.

Identifying High-Quality Dividend Stocks

Selecting reliable dividend-paying companies requires careful analysis. Prioritize companies with a proven track record of consistent dividend growth and strong financial health.

- Financial Strength: Look for low debt levels and high credit ratings (e.g., A- or above). This signifies the company's ability to withstand economic downturns and continue paying dividends.

- Consistent Earnings Growth: Analyze historical earnings data. Companies with a history of consistent earnings growth are more likely to sustain dividend payments.

- Long History of Dividend Payments: A long history of uninterrupted dividend payments demonstrates commitment to shareholder returns. Look for companies with a minimum of 5-10 years of consecutive dividend payouts.

- Sustainable Dividend Payout Ratio: Aim for companies with a payout ratio below 70%, leaving room for reinvestment, future growth, and dividend increases.

The Power of Dividend Reinvestment

Reinvesting your dividends is a powerful wealth-building strategy. The compounding effect of reinvesting dividends accelerates your returns over time.

- Compounding Effect: Imagine reinvesting your dividends to buy more shares. Those additional shares will also generate dividends, leading to exponential growth over time.

- Tax Advantages (DRIPs): Dividend Reinvestment Plans (DRIPs) can offer tax advantages in some jurisdictions, depending on your local tax laws. Research your options.

- Long-Term Benefits: The longer you reinvest dividends, the greater the compounding effect becomes, leading to significantly larger returns in the long run. A profitable dividend strategy thrives on this principle.

Building a Diversified Dividend Portfolio

Diversification Across Sectors and Market Caps

Diversifying your portfolio across various sectors (e.g., technology, healthcare, consumer staples, energy, financials) and market caps (large-cap, mid-cap, small-cap) minimizes risk.

- Sector Diversification: Spreading investments across different industries protects against sector-specific downturns. If one sector underperforms, others might compensate.

- Market Cap Diversification: Large-cap stocks offer stability, mid-cap stocks growth potential, and small-cap stocks high-risk, high-reward opportunities. Balancing these creates a robust portfolio.

- Asset Allocation: Carefully allocate your investments across different sectors and market caps based on your risk tolerance and investment goals, ensuring a well-diversified dividend portfolio.

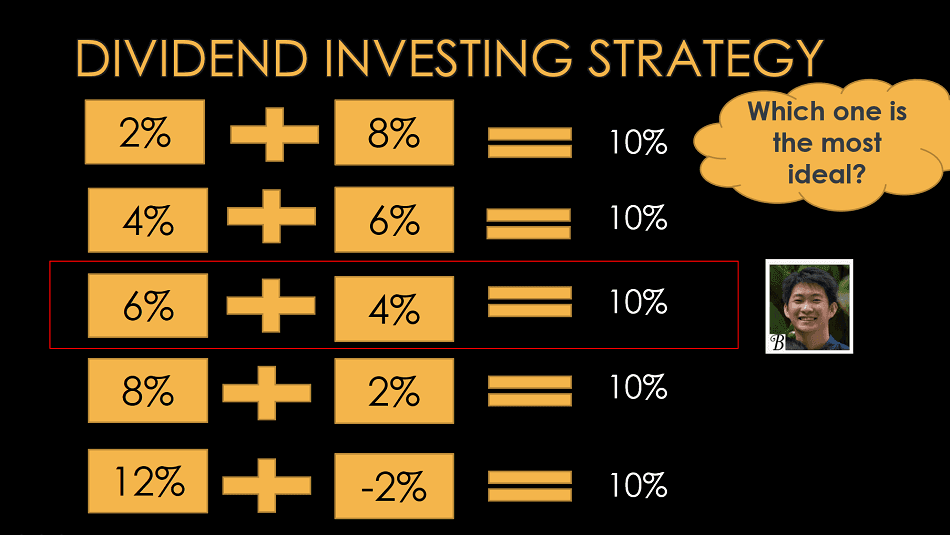

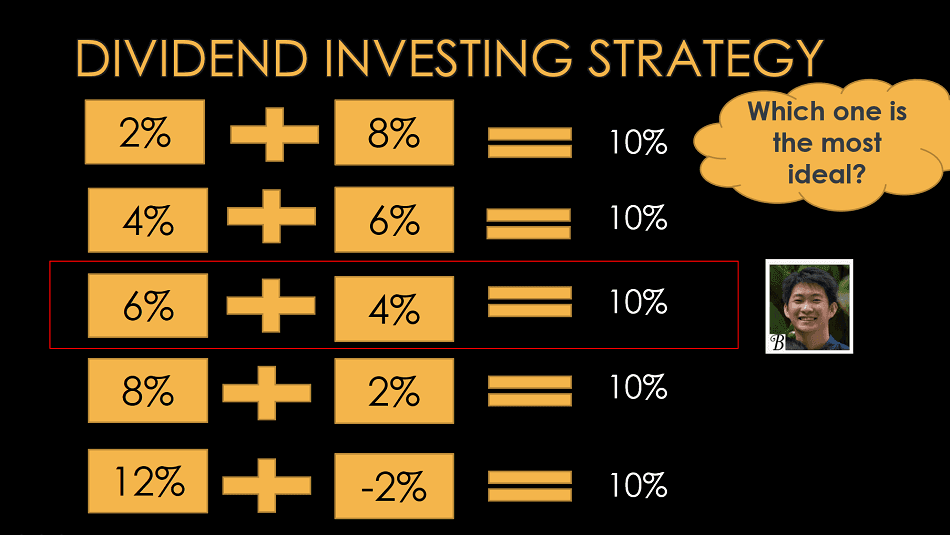

Strategic Asset Allocation for Dividend Growth

Your asset allocation strategy should reflect your risk tolerance and investment goals.

- Conservative Approach: Focus on high-yield, established companies with lower growth potential. This minimizes risk but may offer lower long-term returns.

- Balanced Approach: A mix of high-yield and growth stocks strikes a balance between risk and reward. This is suitable for most investors.

- Aggressive Approach: Prioritize growth stocks with potentially higher yields and higher risk. This approach is suitable for investors with a higher risk tolerance and longer time horizons.

Utilizing ETFs and Mutual Funds for Diversification

Exchange-Traded Funds (ETFs) and mutual funds offer a simple way to diversify your portfolio and gain exposure to a broad range of stocks.

- Examples: Many dividend-focused ETFs and mutual funds are available, providing instant diversification. Research options to find suitable funds for your strategy.

- Lower Transaction Costs: ETFs and mutual funds often have lower transaction costs compared to buying individual stocks.

- Professional Management: Mutual funds benefit from professional management, providing expertise in selecting and managing a diverse portfolio.

Long-Term Approach and Patience for Success

The Importance of Long-Term Investing

A long-term perspective is essential for weathering market fluctuations. Dividend investing is a marathon, not a sprint.

- Time and Compounding: The longer your money is invested, the more significant the compounding effect becomes.

- Psychological Benefits: A long-term approach reduces emotional decision-making during market downturns, helping you avoid impulsive actions.

- Historical Recoveries: History demonstrates that markets recover from downturns. Patience allows you to benefit from these recoveries.

Regular Portfolio Review and Rebalancing

Periodically review and rebalance your portfolio to maintain your desired asset allocation.

- Review Schedule: Aim for at least an annual or semi-annual review.

- Rebalancing Process: Sell some of your higher-performing assets and reinvest in underperforming ones to maintain your target asset allocation.

- Tax Implications: Be aware of the potential tax implications of rebalancing your portfolio.

Adapting to Market Conditions

Stay informed about economic conditions and adapt your strategy accordingly.

- Economic Awareness: Understanding economic cycles and market trends enables you to make informed decisions about your portfolio.

- Market Downturns: During downturns, you might consider increasing your allocation to defensive sectors.

- Market Upturns: During upturns, you might consider rebalancing to capture growth opportunities.

Conclusion

The most profitable dividend strategy relies on simplicity, diversification, and a long-term perspective. By focusing on high-quality dividend stocks, consistently reinvesting dividends, and maintaining a well-diversified portfolio, you can build a robust and rewarding income stream. Remember to regularly review and rebalance your portfolio, adapting to market conditions while sticking to your long-term plan. Start building your profitable dividend strategy today!

Featured Posts

-

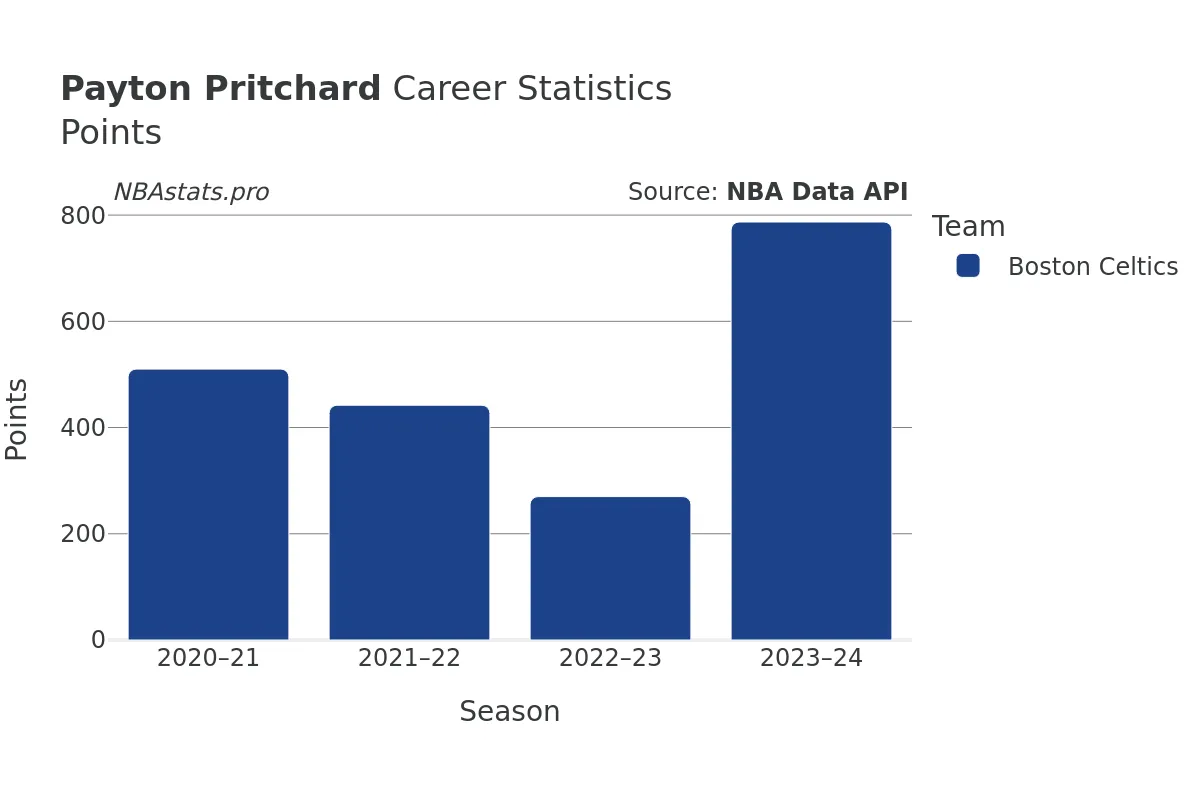

The Impact Of Payton Pritchards Childhood On His Career Achievements

May 11, 2025

The Impact Of Payton Pritchards Childhood On His Career Achievements

May 11, 2025 -

Chto Delali Boris Dzhonson I Ego Zhena V Tekhase Novye Foto

May 11, 2025

Chto Delali Boris Dzhonson I Ego Zhena V Tekhase Novye Foto

May 11, 2025 -

Spot The Easter Egg A Look At Adam Sandlers Filmmaking

May 11, 2025

Spot The Easter Egg A Look At Adam Sandlers Filmmaking

May 11, 2025 -

Analyzing Farrah Abrahams Life Before During And After Teen Mom

May 11, 2025

Analyzing Farrah Abrahams Life Before During And After Teen Mom

May 11, 2025 -

O Tzortz Kloynei Kai O Antam Santler Sto Jay Kelly Toy Netflix Mia Ypopsifia Gia Oskar Tainia

May 11, 2025

O Tzortz Kloynei Kai O Antam Santler Sto Jay Kelly Toy Netflix Mia Ypopsifia Gia Oskar Tainia

May 11, 2025