The Numbers Don't Lie: A Deficit Analysis Of The GOP Tax Plan

Table of Contents

Projected Revenue Losses from the GOP Tax Plan

The GOP tax plan's core component is a substantial reduction in tax rates for corporations and individuals. This section examines the projected revenue losses stemming from these changes.

Corporate Tax Rate Cuts and Their Impact

The proposed reduction in the corporate tax rate is a central feature of the plan. This decrease, while potentially stimulating economic growth (a point we will address later), is projected to significantly reduce government revenue.

- Projected Revenue Loss: The Congressional Budget Office (CBO) estimates a revenue loss of [Insert CBO figure here] over [Insert timeframe, e.g., 10 years] due to corporate tax rate cuts alone. The Tax Policy Center offers a similar projection of [Insert TPC figure here] over the same period. These figures don't account for potential loopholes.

- Tax Loopholes: The complexity of the tax code creates opportunities for loopholes that further reduce the tax base and government revenue. These often favor specific industries or corporations, exacerbating income inequality and potentially undermining the intended economic benefits of the tax cuts. Examples include [mention specific loopholes if applicable, citing sources].

- Keywords: corporate tax cuts, revenue projections, fiscal impact, tax loopholes, CBO, Tax Policy Center.

Individual Income Tax Changes and Their Effects

Changes to individual income tax brackets and deductions are another key aspect of the GOP tax plan. These modifications will impact various income groups differently, further impacting overall revenue.

- Tax Bracket Changes: The proposed changes [explain the specific changes to tax brackets]. This will result in [quantify the projected revenue loss for each bracket using data from reliable sources].

- Deduction Modifications: Alterations to deductions such as [mention specific deductions and their impact, e.g., state and local tax (SALT) deduction] will reduce tax revenue by [quantify the loss, citing sources].

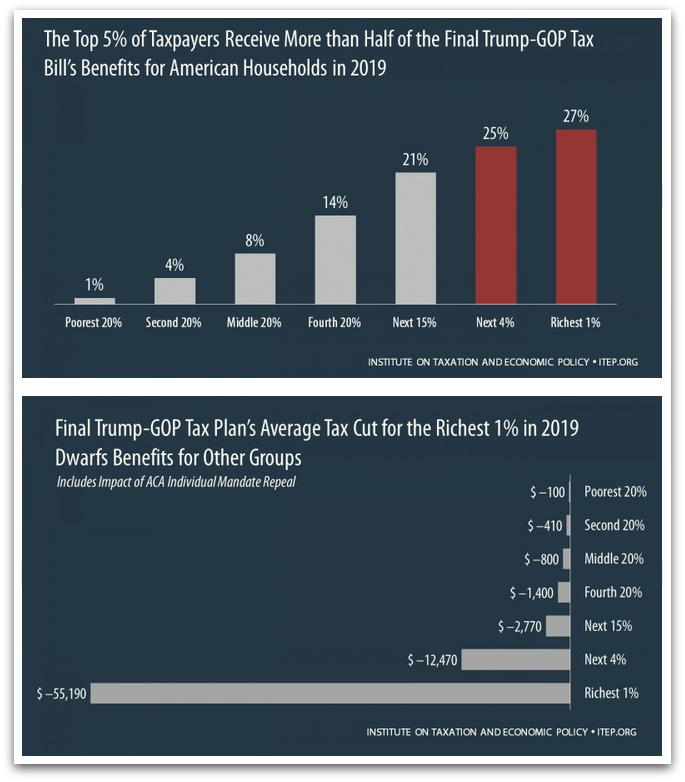

- Impact on Income Inequality: The combination of corporate and individual tax changes may exacerbate existing income inequality, as lower- and middle-income groups may see smaller tax benefits compared to higher-income earners.

- Keywords: individual income tax, tax brackets, deductions, tax revenue, income inequality, SALT deduction.

Increased National Debt Under the GOP Tax Plan

The significant revenue losses projected from the GOP tax plan will inevitably lead to an increase in the national debt and deficit spending.

Long-Term Debt Projections

The projected increase in the national debt over the next decade and beyond is substantial. Various economic models predict different outcomes, but most indicate a significant worsening of the fiscal outlook.

- 10-Year Projection: The CBO estimates an increase in the national debt of [Insert CBO projection here] over 10 years due to the tax plan. [Include a chart or graph visually representing this projection, clearly labeled and sourced].

- Comparison to Alternative Scenarios: A comparison with a scenario where no tax cuts were implemented shows a stark difference in the projected debt trajectory. [Include a chart or graph comparing the two scenarios].

- Keywords: national debt, deficit spending, long-term fiscal outlook, budget deficit, CBO projections.

Impact on Government Spending and Programs

The increased national debt resulting from the GOP tax plan will necessitate difficult choices regarding government spending and programs.

- Reduced Spending on Social Programs: Increased debt could lead to cuts in essential government programs such as Social Security, Medicare, and Medicaid, potentially impacting vulnerable populations.

- Lower Infrastructure Investment: The need to service the increased debt could also constrain government investment in vital infrastructure projects, hindering long-term economic growth.

- Keywords: government spending, social programs, infrastructure investment, fiscal responsibility, Medicare, Medicaid, Social Security.

Alternative Economic Analyses and Criticisms of the GOP Tax Plan

While proponents argue that the tax cuts will stimulate economic growth, offsetting revenue losses, this claim needs thorough examination.

Counterarguments and Rebuttals

The assertion that the tax cuts will stimulate sufficient economic growth to offset revenue losses is not universally accepted. Many economists argue that:

- Trickle-down Economics: The "trickle-down" effect, where tax cuts for corporations translate into higher wages and investment, has not consistently been demonstrated historically.

- Increased Inequality: The plan might disproportionately benefit corporations and wealthy individuals, leading to increased income inequality, not widespread economic benefit.

- Alternative Economic Models: Other economic models suggest significantly less optimistic scenarios for economic growth than those presented by proponents of the tax plan. [Cite sources for differing economic analyses].

- Keywords: economic growth, tax plan analysis, economic stimulus, fiscal policy, trickle-down economics.

The Role of Economic Modeling and its Limitations

It's crucial to acknowledge the inherent limitations of economic modeling.

- Uncertainty and Inaccuracies: Economic models rely on numerous assumptions, and slight changes in those assumptions can lead to dramatically different outcomes. The projections presented above are estimates, not certainties.

- Unforeseen Circumstances: Unforeseen economic shocks or policy changes can significantly alter the projected effects of the tax plan.

- Keywords: economic modeling, prediction uncertainty, fiscal forecasting.

The Numbers Don't Lie: A Final Look at the GOP Tax Plan's Deficit

This analysis has demonstrated that the GOP tax plan is projected to significantly increase the national debt and deficit through substantial revenue losses from both corporate and individual tax cuts. While proponents argue for economic growth as a counterpoint, the economic models and historical data offer mixed support for this claim. Further, the inherent limitations of economic modeling highlight the uncertainty surrounding these projections. Understanding the full impact of the GOP tax plan on the national debt is crucial. Continue researching this important fiscal issue and engage in informed discussions about responsible fiscal policy. A thorough understanding of the potential long-term fiscal consequences is critical for making informed decisions about the future of the American economy.

Featured Posts

-

Wwe Backstage Report Tony Hinchcliffes Segment Flops

May 20, 2025

Wwe Backstage Report Tony Hinchcliffes Segment Flops

May 20, 2025 -

Complete Nyt Crossword Answers For April 25 2025

May 20, 2025

Complete Nyt Crossword Answers For April 25 2025

May 20, 2025 -

Exploring The World Of Agatha Christies Hercule Poirot

May 20, 2025

Exploring The World Of Agatha Christies Hercule Poirot

May 20, 2025 -

Biarritz Budget Locations Saisonnieres Et Sainte Eugenie Au Conseil Municipal

May 20, 2025

Biarritz Budget Locations Saisonnieres Et Sainte Eugenie Au Conseil Municipal

May 20, 2025 -

Nagelsmann Names Goretzka To Germanys Nations League Team

May 20, 2025

Nagelsmann Names Goretzka To Germanys Nations League Team

May 20, 2025