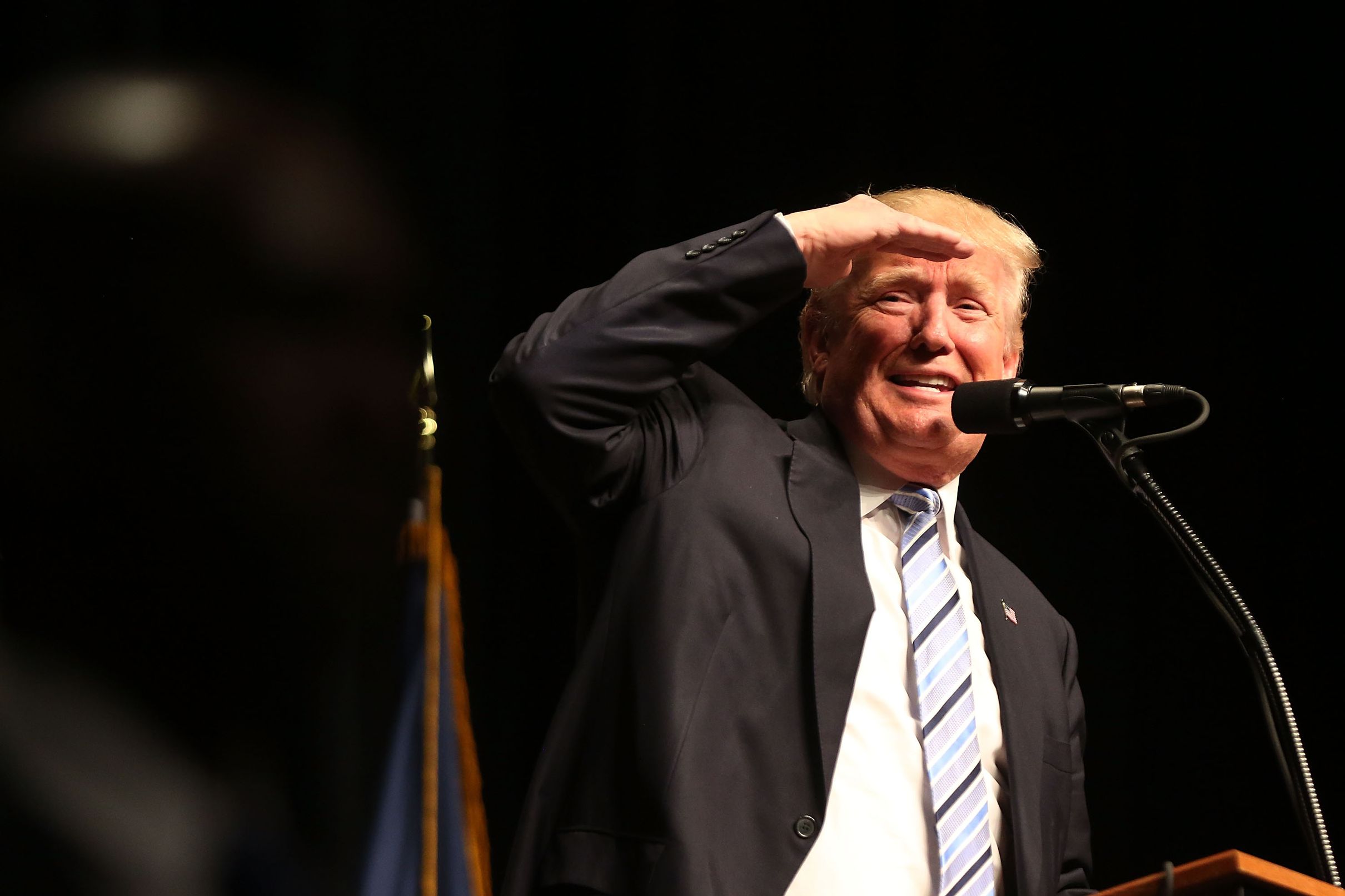

The Paradox Of Trump's Energy Policy: Cheap Oil And Industry Relations

Table of Contents

The "Energy Dominance" Strategy and its Impact on Oil Prices

Trump's stated goal of "energy dominance" aimed to make the US the world's leading energy producer, prioritizing domestic fossil fuel production through deregulation. This strategy involved a significant reduction in environmental regulations affecting drilling and extraction, a withdrawal from the Paris Agreement on climate change, and increased investment in fossil fuel infrastructure. The administration actively sought to dismantle perceived barriers to energy production, aiming for increased energy independence.

This aggressive approach led to a substantial increase in domestic oil and gas production. For example, US crude oil production rose from approximately 9 million barrels per day in 2016 to over 12 million barrels per day by 2019. This surge in supply, coupled with fluctuating global demand, contributed to periods of significantly lower oil prices. The price per barrel of West Texas Intermediate (WTI) crude oil, a benchmark for US oil, saw considerable drops during Trump's presidency, impacting both domestic and international markets.

- Deregulation of drilling and extraction: Relaxed environmental rules facilitated faster and cheaper oil extraction.

- Withdrawal from international climate agreements: Removed the pressure to transition to renewable energy sources.

- Increased investment in fossil fuel infrastructure: Improved transportation and processing capabilities.

- Impact on OPEC and global oil markets: Increased US production exerted downward pressure on global oil prices, affecting the Organization of the Petroleum Exporting Countries (OPEC) and other oil-producing nations.

The Benefits and Drawbacks of Cheap Oil for Different Industry Segments

Cheap oil, a direct consequence of Trump's energy policy, brought clear benefits to consumers. Lower gas prices reduced transportation costs, impacting both household budgets and the broader economy. Reduced energy costs also translated into lower energy bills for businesses and households.

However, the same cheap oil presented significant drawbacks for the oil and gas industry itself. Lower prices squeezed profit margins, leading to reduced investment in exploration and development. Some companies experienced job losses, particularly in sectors less efficient at extracting oil in the new price environment.

The impact extended to related industries. Refineries, for example, faced fluctuating demand and profitability linked to the price volatility of crude oil. The transportation sector benefited from lower fuel costs, but heavy industries dependent on oil-derived products felt the pressure of price fluctuations.

- Consumer benefits: Lower transportation costs, reduced energy bills, increased disposable income.

- Industry drawbacks: Lower profit margins for oil and gas companies, potential job losses in some sectors, decreased investment in exploration and production.

- Impact on renewable energy: The relative cheapness of fossil fuels slowed investment in renewable energy technologies.

- Geopolitical implications: The US achieved greater energy independence, but price volatility and the shifting global energy landscape created instability in other oil-producing regions.

Navigating Complex Industry Relations: Conflicts and Collaborations

The relationship between the Trump administration and the oil and gas industry was characterized by a complex interplay of lobbying, regulation, and cooperation. The industry heavily lobbied for deregulation and policies that favored fossil fuel production. This led to criticisms from environmental groups and others concerned about climate change, highlighting potential conflicts of interest. The administration's approach faced strong opposition from those advocating for a transition to cleaner energy.

Despite the controversies, there were instances of collaboration between the administration and industry stakeholders, particularly on infrastructure projects aimed at enhancing oil and gas transportation and processing capabilities. However, the long-term sustainability of an energy strategy so heavily reliant on fossil fuels remained a subject of intense debate.

- Industry lobbying efforts and their influence on policy: The oil and gas industry exerted considerable influence on the shaping of energy policy.

- Criticism of environmental deregulation and its impact: The relaxation of environmental regulations drew significant criticism for its potential impact on air and water quality.

- Examples of cooperation on infrastructure projects: Government and industry worked together on projects to improve oil and gas infrastructure.

- Debate surrounding the long-term sustainability of the approach: The environmental and economic implications of a fossil fuel-centric energy policy were widely debated.

The Role of Shale Oil and its Volatility

Shale oil played a crucial role in achieving "energy dominance." The rapid expansion of shale oil production, enabled by technological advancements like hydraulic fracturing ("fracking"), significantly boosted domestic oil output. However, shale oil production is inherently volatile. Production costs can fluctuate, and the ease with which production can be ramped up or down often contributes to price instability in the market. This volatility introduces a degree of uncertainty into long-term energy planning and raises questions about the sustainability of relying heavily on this resource.

Conclusion

Trump's energy policy successfully boosted domestic fossil fuel production, leading to periods of cheap oil. However, this success created a paradox, impacting various industry segments differently and generating complex relationships between the administration and the energy sector. The long-term consequences, particularly regarding environmental sustainability and the inherent volatility of shale oil, remain a matter of ongoing debate.

Understanding the complexities of Trump's energy policy, its impact on cheap oil prices, and its influence on industry relations is crucial for informed discussion on future energy strategies. Further research into the long-term effects of this "energy dominance" approach is needed to achieve a sustainable and balanced energy future. Continue learning about the lasting effects of Trump's energy policy and the intricacies of cheap oil's impact on industry relations.

Featured Posts

-

Pritchards Historic Win Boston Celtics Guard Claims Sixth Man Award

May 12, 2025

Pritchards Historic Win Boston Celtics Guard Claims Sixth Man Award

May 12, 2025 -

Norfolk Catholics District Final Loss To Archbishop Bergan

May 12, 2025

Norfolk Catholics District Final Loss To Archbishop Bergan

May 12, 2025 -

Boston Celtics Clinch Division After Blowout Victory

May 12, 2025

Boston Celtics Clinch Division After Blowout Victory

May 12, 2025 -

Stellantis Nears Ceo Decision American Executive A Leading Candidate

May 12, 2025

Stellantis Nears Ceo Decision American Executive A Leading Candidate

May 12, 2025 -

Identifying Emerging Business Hubs A Countrywide Overview

May 12, 2025

Identifying Emerging Business Hubs A Countrywide Overview

May 12, 2025

Latest Posts

-

Championship Play Offs A Newcastle United Fan Perspective

May 13, 2025

Championship Play Offs A Newcastle United Fan Perspective

May 13, 2025 -

Newcastle United Supporters Championship Play Off Picks

May 13, 2025

Newcastle United Supporters Championship Play Off Picks

May 13, 2025 -

Newcastle United Fans Predict Championship Play Off Winner

May 13, 2025

Newcastle United Fans Predict Championship Play Off Winner

May 13, 2025 -

School Stabbing Funeral Arrangements For 15 Year Old

May 13, 2025

School Stabbing Funeral Arrangements For 15 Year Old

May 13, 2025 -

Newcastle Fans Championship Play Off Predictions Who Will They Back

May 13, 2025

Newcastle Fans Championship Play Off Predictions Who Will They Back

May 13, 2025