The Posthaste Reality: High Down Payments And The Canadian Dream

Table of Contents

The Soaring Cost of Housing in Canada and its Impact on Down Payments

Several interconnected factors contribute to the ever-increasing cost of housing in Canada, making high down payments a significant barrier to entry for many aspiring homeowners. The fundamental imbalance between supply and demand plays a crucial role. Rapid population growth in major cities like Toronto, Vancouver, and Montreal, coupled with relatively slow construction rates, creates a competitive market where prices are driven upwards.

Inflation further exacerbates the issue, pushing up the cost of building materials and land. Recent interest rate hikes by the Bank of Canada have also significantly impacted mortgage affordability, meaning buyers need even larger down payments to qualify for a loan.

The average down payment required varies drastically across Canada. In Vancouver, for example, a substantial down payment might represent 30% or more of a home's value, while in smaller cities, it might be slightly lower. However, even these lower percentages represent a significant financial hurdle for many Canadians.

- Rising property prices in major Canadian cities: Annual price increases consistently outpace wage growth, widening the affordability gap.

- Impact of interest rate hikes on mortgage affordability: Higher interest rates increase the cost of borrowing, requiring larger down payments to qualify for a mortgage.

- Limited supply of affordable housing: A shortage of affordable housing options intensifies competition and drives up prices.

- Increasing competition among buyers: Multiple offers on single properties are common, pushing prices even higher.

Strategies for Saving for a High Down Payment in Canada

Saving for a substantial down payment requires dedication, planning, and a realistic approach. Consistency is key. Develop a detailed budget, tracking your income and expenses meticulously. Automate your savings by setting up regular transfers from your checking account to your savings accounts.

Several savings vehicles can help you reach your goal:

- High-interest savings accounts: Offer a relatively safe way to grow your savings, though returns may be modest compared to other options.

- Tax-Free Savings Accounts (TFSAs): Allow you to contribute a set amount annually and withdraw your funds tax-free, making them an attractive option for long-term savings.

- Registered Retirement Savings Plans (RRSPs): Offer tax deductions on contributions, but withdrawals are taxed in retirement. Consider using the Home Buyers' Plan (HBP) to access your RRSP savings for a down payment, which requires repayment with interest.

Financial literacy is crucial. Understand your spending habits, identify areas where you can cut back, and seek professional financial advice if needed.

- Create a detailed budget: Track income and expenses to identify areas for savings.

- Automate savings: Set up regular transfers to your savings accounts.

- Explore government programs assisting first-time homebuyers: Research federal and provincial initiatives that offer grants or incentives.

- Seek professional financial advice: Consult a financial advisor for personalized guidance.

Alternatives to Traditional High Down Payments in Canada

While saving a large down payment is ideal, several alternatives exist for those struggling to meet the traditional requirements. Government-backed programs like those offered by the Canada Mortgage and Housing Corporation (CMHC) allow for lower down payments (as low as 5% for insured mortgages), but typically come with higher interest rates.

- CMHC insured mortgages: These mortgages protect lenders against losses, allowing them to approve loans with smaller down payments.

- Shared equity mortgages: Involve a lender or another investor sharing the equity in your home, reducing the down payment you need.

- Rent-to-own programs: Allow you to rent a property with the option to purchase it later, often with a portion of your rent contributing towards the down payment.

- Other innovative home financing solutions: Explore options like co-ownership, where you share ownership and the associated costs with another individual or family.

Each of these alternatives has its own set of advantages and drawbacks, so careful consideration and research are essential before committing.

The Emotional Toll of the High Down Payment Hurdle

The pressure of saving for a substantial down payment can take a significant emotional toll. The financial strain can lead to stress, anxiety, and feelings of hopelessness. The ongoing struggle can impact mental well-being and even widen social inequalities.

- Stress management techniques: Employ mindfulness, exercise, and healthy coping mechanisms.

- Seeking support from family and friends: Don't hesitate to lean on your support network for emotional and practical assistance.

- Utilizing mental health resources: Access professional support if needed to help manage stress and anxiety.

Conclusion: Navigating the Reality of High Down Payments and Achieving the Canadian Dream

The challenge of high down payments significantly impacts the accessibility of the Canadian dream of homeownership. However, with careful planning, realistic expectations, and exploration of available options, achieving this dream remains within reach. By implementing sound saving strategies, understanding alternative financing options, and prioritizing mental well-being, prospective homebuyers can navigate the complexities of the current market and find a path toward homeownership. Start planning today. Use online resources to calculate your affordability and explore government programs designed to assist first-time homebuyers. The Canadian dream is achievable with diligent planning and a proactive approach to managing high down payments.

Featured Posts

-

Vu Bao Hanh Tien Giang De Xuat Cai Thien He Thong Cham Soc Tre Em

May 09, 2025

Vu Bao Hanh Tien Giang De Xuat Cai Thien He Thong Cham Soc Tre Em

May 09, 2025 -

Celebrity Stylist Elizabeth Stewart Designs Exclusive Line For Lilysilk

May 09, 2025

Celebrity Stylist Elizabeth Stewart Designs Exclusive Line For Lilysilk

May 09, 2025 -

Match Dijon Concarneau 0 1 Analyse De La 28e Journee De National 2

May 09, 2025

Match Dijon Concarneau 0 1 Analyse De La 28e Journee De National 2

May 09, 2025 -

Legal Battle Over Banned Chemicals E Bays Section 230 Defense Fails

May 09, 2025

Legal Battle Over Banned Chemicals E Bays Section 230 Defense Fails

May 09, 2025 -

Pogoda V Permskom Krae I Permi V Kontse Aprelya 2025 Goda Podrobniy Prognoz

May 09, 2025

Pogoda V Permskom Krae I Permi V Kontse Aprelya 2025 Goda Podrobniy Prognoz

May 09, 2025

Latest Posts

-

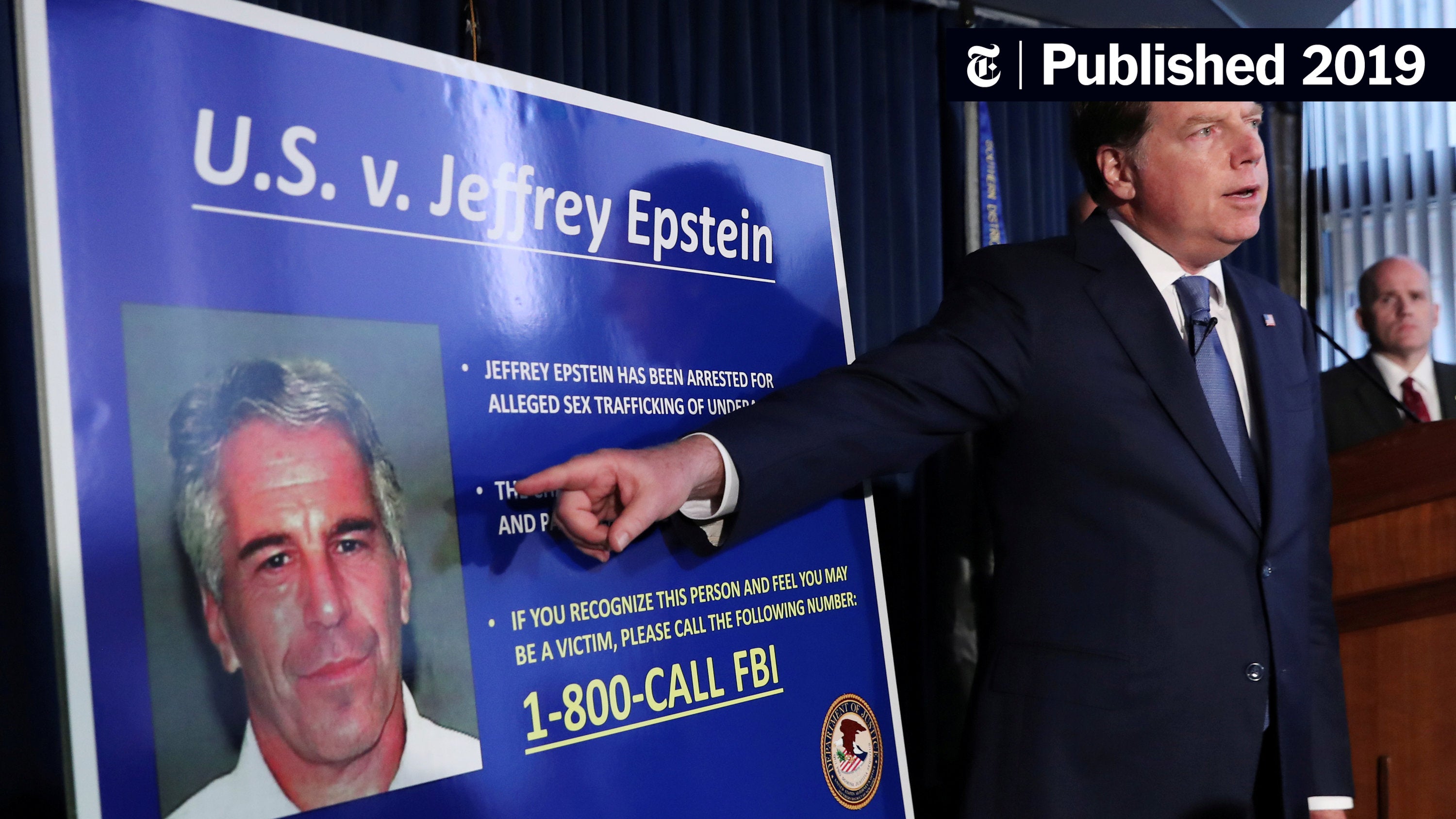

Beyond The Epstein Case Analyzing The Us Attorney Generals Media Strategy

May 10, 2025

Beyond The Epstein Case Analyzing The Us Attorney Generals Media Strategy

May 10, 2025 -

Focusing On The Bigger Picture Why The Us Attorney Generals Fox News Appearances Matter

May 10, 2025

Focusing On The Bigger Picture Why The Us Attorney Generals Fox News Appearances Matter

May 10, 2025 -

The Us Attorney General And Fox News A Question Of Priorities

May 10, 2025

The Us Attorney General And Fox News A Question Of Priorities

May 10, 2025 -

The Daily Fox News Appearances Of The Us Attorney General A Deeper Look

May 10, 2025

The Daily Fox News Appearances Of The Us Attorney General A Deeper Look

May 10, 2025 -

Why Is The Us Attorney General On Fox News Daily A More Important Question Than Epstein

May 10, 2025

Why Is The Us Attorney General On Fox News Daily A More Important Question Than Epstein

May 10, 2025