The Posthaste Report: Assessing The Risk Of A Canadian Housing Price Correction

Table of Contents

Current State of the Canadian Housing Market

High Home Prices and Affordability Challenges

Canadian home prices have reached record highs in many major cities, creating a significant affordability crisis. The dream of homeownership is increasingly out of reach for first-time buyers.

- Toronto: Average home prices consistently exceed $1 million, far exceeding the average income.

- Vancouver: Similar to Toronto, Vancouver sees exceptionally high prices, further exacerbated by limited housing supply.

- Calgary: While slightly more affordable than Toronto and Vancouver, Calgary still faces affordability challenges, particularly for those seeking detached homes.

- Montreal: While relatively more affordable than the west coast, Montreal's market is experiencing upward pressure.

The rising cost of mortgages, driven by increasing interest rates, further exacerbates the affordability crisis. Higher interest rates translate directly into larger monthly mortgage payments, making homeownership even more challenging for prospective buyers. Keywords: Canadian housing market, home prices, affordability crisis, mortgage rates, interest rates, housing affordability.

Inventory Levels and Market Dynamics

The Canadian housing market is characterized by a persistent imbalance between supply and demand. A significant shortage of available homes fuels competition and drives prices higher.

- Low Housing Inventory: Many major cities experience extremely low housing inventory, resulting in a seller's market.

- High Sales-to-List Ratio: Sales-to-list ratios consistently remain above 1 in most markets, indicating strong demand.

- Low Days on Market: Homes are selling quickly, often within days or weeks of listing.

- Impact of New Construction and Immigration: While new home construction is increasing in some areas, it's often insufficient to meet the growing demand fueled by immigration and population growth.

This intense competition contributes to the overheated nature of the market, increasing the vulnerability to a potential correction. Keywords: Housing inventory, supply and demand, sales-to-list ratio, days on market, new home construction, immigration.

Factors Contributing to Correction Risk

Rising Interest Rates

The Bank of Canada's aggressive interest rate hikes aim to curb inflation. However, these hikes directly impact borrowing costs, making mortgages more expensive and potentially cooling the market.

- Bank of Canada Monetary Policy: The Bank of Canada's actions significantly influence mortgage rates and consumer borrowing.

- Future Rate Hike Predictions: Further interest rate increases are anticipated, potentially pushing borrowing costs even higher.

- Effect on Mortgage Payments: Higher interest rates translate to substantially higher monthly mortgage payments, reducing affordability for many.

The impact of these rising rates on the already strained affordability is a major factor contributing to the risk of a correction. Keywords: Interest rate hikes, Bank of Canada, monetary policy, mortgage payments, borrowing costs.

Economic Uncertainty

Global economic uncertainty and potential recessionary pressures pose significant risks to the Canadian housing market.

- Inflation: High inflation erodes purchasing power and impacts consumer confidence.

- Unemployment Rates: Rising unemployment could lead to decreased demand for housing.

- Consumer Confidence: Weaker consumer confidence can dampen housing market activity.

Economic downturns typically lead to decreased demand and potentially lower housing prices. Keywords: Economic recession, inflation, unemployment, consumer confidence, economic uncertainty.

Government Regulations and Policies

Government regulations and policies, such as stress tests and foreign buyer taxes, play a crucial role in influencing the housing market.

- Stress Tests: Stress tests aim to ensure borrowers can withstand higher interest rates, but their effectiveness in preventing a correction is debated.

- Foreign Buyer Taxes: Foreign buyer taxes aim to reduce foreign investment in the housing market, but their impact varies across regions.

- Policy Impact: The overall impact of government policies on mitigating the risks of a price correction is complex and subject to ongoing discussion.

The effectiveness of these measures in preventing a significant correction remains to be seen. Keywords: Government regulations, housing policies, stress tests, foreign buyer taxes, policy impact.

Potential Scenarios and Their Implications

A Soft Landing vs. a Sharp Correction

Two main scenarios are possible: a soft landing or a sharp correction.

- Soft Landing: A gradual slowdown in price growth, with a relatively moderate decrease in home values. This scenario would likely involve a reduction in sales volume and a stabilization of prices.

- Sharp Correction: A significant and rapid decline in home prices, potentially leading to widespread financial distress for some homeowners and investors.

The outcome will depend on the interplay of factors discussed above. Keywords: Soft landing, housing market correction, price decline, market slowdown, economic impact.

Regional Variations

The impact of a potential correction will likely vary across different Canadian regions.

- Overheated Markets: Regions with the most overheated markets (e.g., Toronto, Vancouver) are generally considered to be at higher risk of a more significant price correction.

- More Affordable Markets: Regions with more affordable housing markets may experience a less dramatic impact.

- Market-Specific Factors: Local economic conditions, supply and demand dynamics, and government policies all contribute to regional variations in market performance.

A nuanced understanding of regional differences is crucial for assessing the overall risk. Keywords: Regional housing markets, price variations, market differences, geographic analysis.

Conclusion: Understanding the Risk of a Canadian Housing Price Correction

Several key factors contribute to the risk of a Canadian housing price correction: rising interest rates, economic uncertainty, and the impact of government policies. The potential outcomes range from a soft landing to a sharper correction, with significant regional variations likely. The implications for homeowners, investors, and the broader Canadian economy are substantial.

Key takeaways highlight the need for careful consideration of these factors when making investment decisions in the Canadian housing market. Understanding the potential for a Canadian housing price correction is critical for both buyers and sellers.

Stay updated on the latest developments in the Canadian housing market by conducting your own thorough research, consulting financial professionals, and monitoring market trends through credible sources for comprehensive Canadian housing market analysis and housing price prediction to gain a better Canadian housing market outlook.

Featured Posts

-

Pittsburgh Steelers 2025 Season A Look At The Upcoming Schedule

May 22, 2025

Pittsburgh Steelers 2025 Season A Look At The Upcoming Schedule

May 22, 2025 -

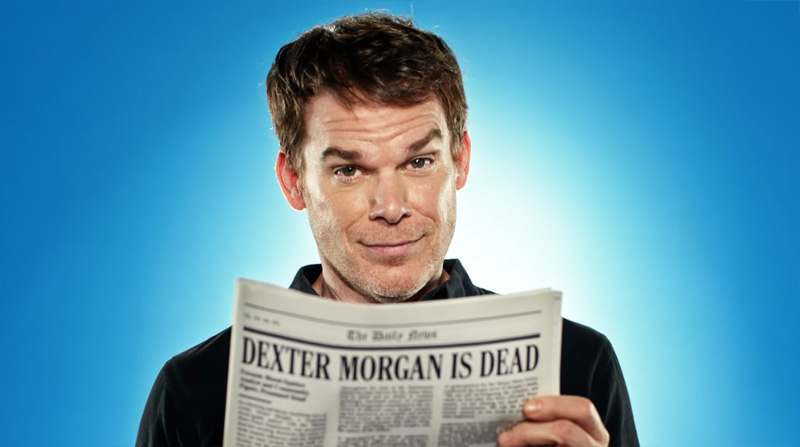

Die Rueckkehr Von Lithgow Und Smits In Dexter Resurrection

May 22, 2025

Die Rueckkehr Von Lithgow Und Smits In Dexter Resurrection

May 22, 2025 -

Dialogue On Tariffs A Joint Call From Switzerland And China

May 22, 2025

Dialogue On Tariffs A Joint Call From Switzerland And China

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Dies By Suicide At 31 Go Fund Me Launched

May 22, 2025

Adam Ramey Dropout Kings Vocalist Dies By Suicide At 31 Go Fund Me Launched

May 22, 2025 -

Evolution Du Metier De Cordiste A Nantes Avec Le Developpement Urbain

May 22, 2025

Evolution Du Metier De Cordiste A Nantes Avec Le Developpement Urbain

May 22, 2025

Latest Posts

-

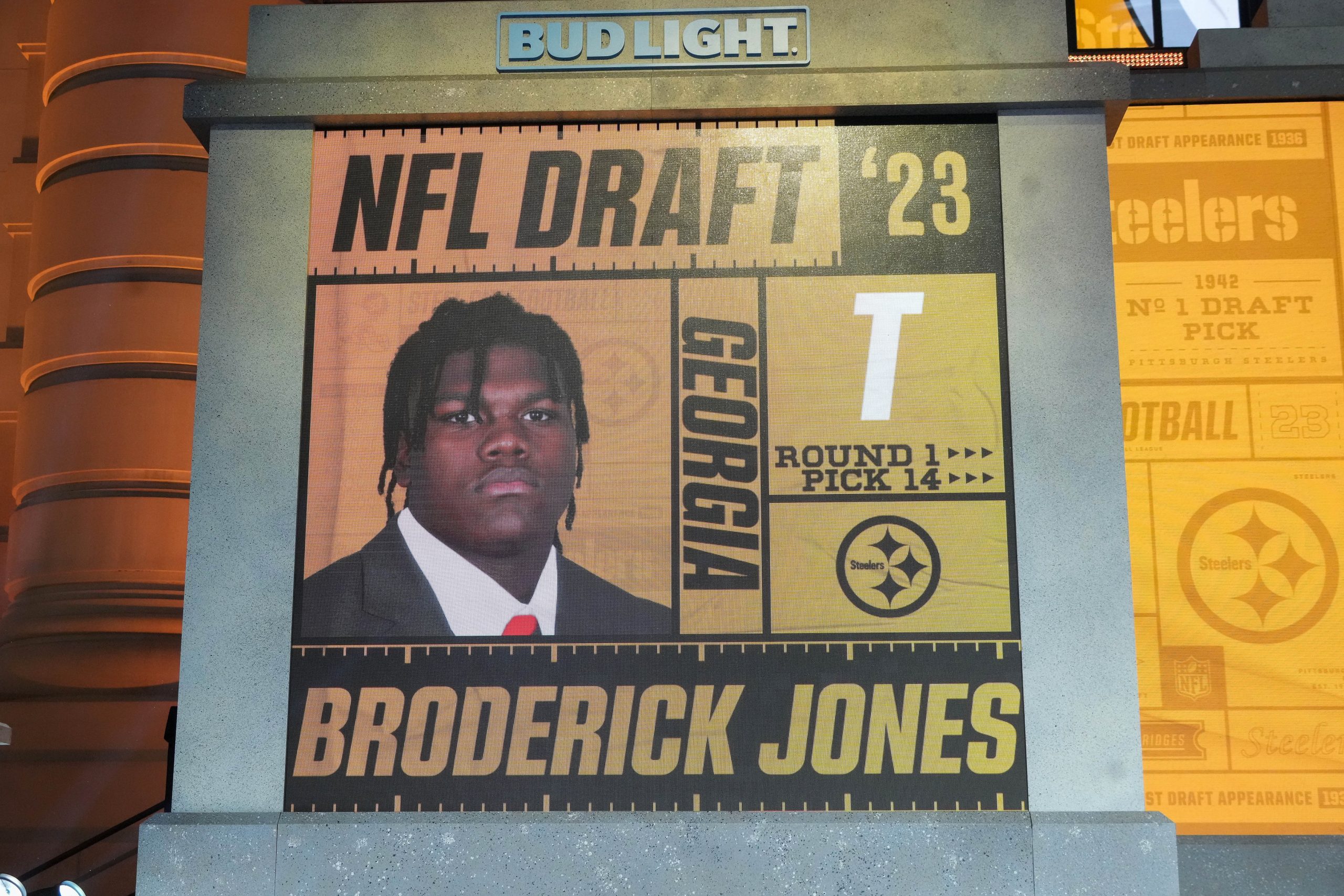

Pittsburgh Steelers 2024 Draft Strategy Will They Draft A Quarterback

May 22, 2025

Pittsburgh Steelers 2024 Draft Strategy Will They Draft A Quarterback

May 22, 2025 -

Steelers Intense Interest In Nfl Draft Quarterbacks A Deep Dive

May 22, 2025

Steelers Intense Interest In Nfl Draft Quarterbacks A Deep Dive

May 22, 2025 -

Pittsburgh Steelers And The 2024 Nfl Draft Quarterback Focus

May 22, 2025

Pittsburgh Steelers And The 2024 Nfl Draft Quarterback Focus

May 22, 2025 -

Steelers Draft Outlook Kipers Aaron Rodgers Truth Bomb For 2025

May 22, 2025

Steelers Draft Outlook Kipers Aaron Rodgers Truth Bomb For 2025

May 22, 2025 -

2025 Nfl Draft Kipers Honest Assessment Of Steelers And Aaron Rodgers

May 22, 2025

2025 Nfl Draft Kipers Honest Assessment Of Steelers And Aaron Rodgers

May 22, 2025