The Posthaste Threat: Unrest In The Global Bond Market

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

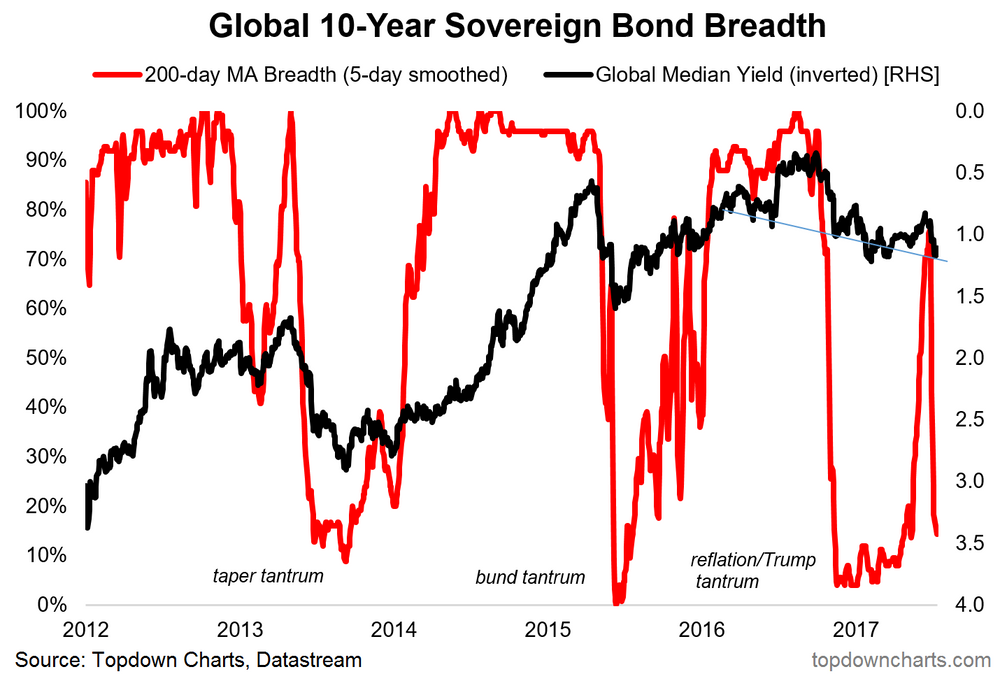

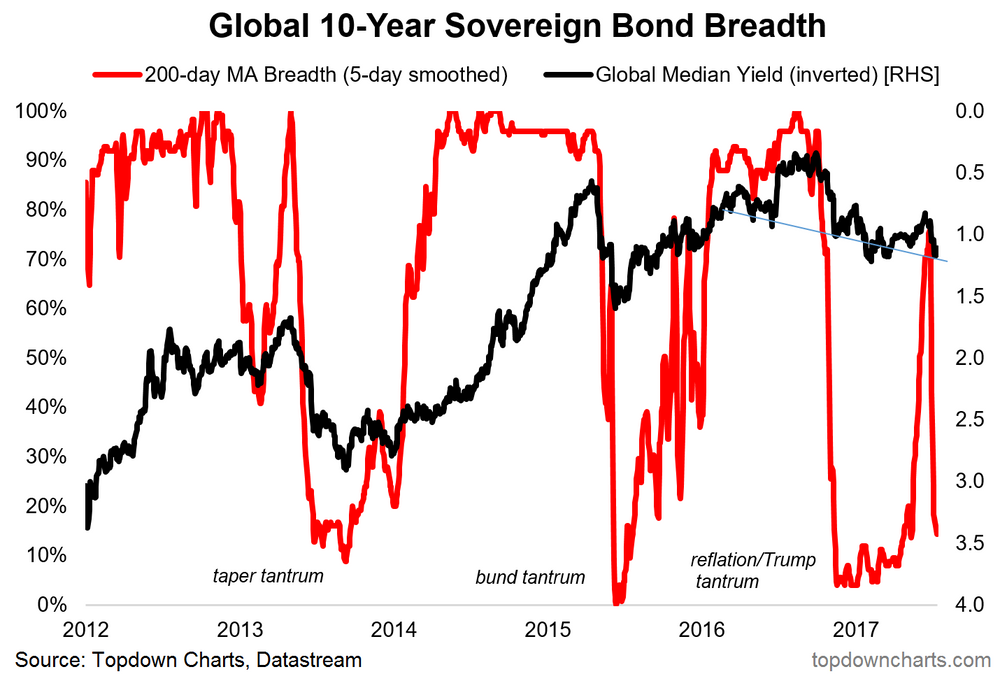

The inverse relationship between interest rates and bond prices is a fundamental principle of finance. When central banks raise interest rates, like the Federal Reserve or the European Central Bank, newly issued bonds offer higher yields, making existing bonds with lower coupon rates less attractive. This increased competition reduces the demand for existing bonds, causing their prices to fall. This dynamic is significantly impacting the current bond market unrest. The resulting "bond price volatility" is causing significant concern amongst investors.

The impact of central bank policies on bond yields is profound. Aggressive interest rate hikes, intended to combat inflation, directly impact the bond yield curve, which charts the yields of bonds with different maturities. A steeper yield curve indicates a greater difference in yields between short-term and long-term bonds, often reflecting expectations of future interest rate increases.

- Increased borrowing costs for governments and corporations: Higher interest rates make it more expensive for governments and companies to borrow money, potentially hindering economic growth.

- Reduced demand for existing bonds: Investors are less inclined to hold bonds offering lower yields than those available in the market.

- Potential for capital losses for bondholders: Falling bond prices translate directly into capital losses for those holding bonds in their portfolios. This "bond market unrest" is causing significant portfolio adjustments.

Inflationary Pressures and their Role in Bond Market Instability

High inflation erodes the purchasing power of fixed-income assets like bonds. When inflation rises, the real return on a bond (the return after adjusting for inflation) decreases. This "inflation risk" is a major concern for bond investors, leading to a reassessment of the attractiveness of bond investments. Inflation expectations also significantly influence bond yields. If investors anticipate higher inflation in the future, they will demand higher yields on bonds to compensate for the erosion of their purchasing power, increasing the "bond price volatility."

- Central banks' struggle to control inflation: Central banks' efforts to tame inflation through interest rate hikes contribute directly to bond market instability.

- Increased uncertainty about future inflation: Unpredictable inflation makes it challenging for investors to assess the true return on their bond investments, further fueling the "global bond market volatility."

- Investor flight to safer assets: In times of high inflation and uncertainty, investors often seek refuge in assets perceived as safer, like government bonds of stable economies, causing shifts in demand and price fluctuations. This creates additional challenges for understanding and managing the "posthaste threat."

Geopolitical Risks and their Influence on Global Bond Markets

Geopolitical events, such as wars, political instability, and trade disputes, significantly impact investor sentiment and bond markets. These events often lead to increased uncertainty about the global economic outlook, triggering capital flight and heightened risk aversion. Investors often flee to "safe-haven assets," such as US Treasury bonds, pushing their yields down and prices up while impacting other bond markets negatively. This creates "global bond market contagion," where instability in one market quickly spreads to others.

- Uncertainty surrounding the global economic outlook: Geopolitical risks cloud the economic forecast, making it difficult for investors to assess the long-term prospects of different countries and their bonds.

- Increased demand for safe-haven assets: Investors seek refuge in perceived safe assets during times of geopolitical uncertainty.

- Potential for contagion effects across different bond markets: Instability in one market can rapidly spread to others, exacerbating the global bond market volatility. This contributes to the overall "posthaste threat."

Potential Consequences of the Posthaste Threat

The unrest in the global bond market carries significant consequences for the broader economy. The "posthaste threat" can lead to a ripple effect throughout the financial system and broader economy.

- Increased borrowing costs for governments and businesses: Higher interest rates make it more difficult and expensive for governments and businesses to borrow money, potentially leading to reduced investments and economic slowdown.

- Slowdown in economic growth: Increased borrowing costs and reduced investments can significantly dampen economic activity, potentially leading to a recession.

- Potential for financial market instability: The interconnectedness of financial markets means that bond market unrest can trigger instability in other markets, such as the stock market, creating a systemic risk.

Navigating the Posthaste Threat in the Global Bond Market

The current unrest in the global bond market presents a significant "posthaste threat" driven by rising interest rates, inflationary pressures, and geopolitical risks. These factors combine to create considerable uncertainty and volatility. The potential consequences, including increased borrowing costs, slower economic growth, and potential financial market instability, are significant. Understanding these underlying forces is crucial for effective risk management.

Investors need to consider diversification strategies, carefully assess their risk tolerance, and potentially consult with financial advisors. Policymakers need to address the root causes of inflation and geopolitical instability while carefully managing monetary policy to mitigate the impact on the bond market and broader economy. Stay informed about developments in the global bond market and seek professional financial advice to manage your investments effectively in light of this significant "posthaste threat" and the potential for continued bond market volatility.

Featured Posts

-

Tracking The Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025 -

Is Everything Closed On Memorial Day 2025 In Michigan What To Expect

May 24, 2025

Is Everything Closed On Memorial Day 2025 In Michigan What To Expect

May 24, 2025 -

Are Memorial Day Gas Prices The Lowest In Years

May 24, 2025

Are Memorial Day Gas Prices The Lowest In Years

May 24, 2025 -

Teatr Mossoveta Proschanie S Sergeem Yurskim

May 24, 2025

Teatr Mossoveta Proschanie S Sergeem Yurskim

May 24, 2025 -

Today Show Walt Frazier And Dylan Dreyers Championship Ring Moment

May 24, 2025

Today Show Walt Frazier And Dylan Dreyers Championship Ring Moment

May 24, 2025

Latest Posts

-

Protest Der Essener Taxifahrer Die Neuesten Entwicklungen Und Reaktionen

May 24, 2025

Protest Der Essener Taxifahrer Die Neuesten Entwicklungen Und Reaktionen

May 24, 2025 -

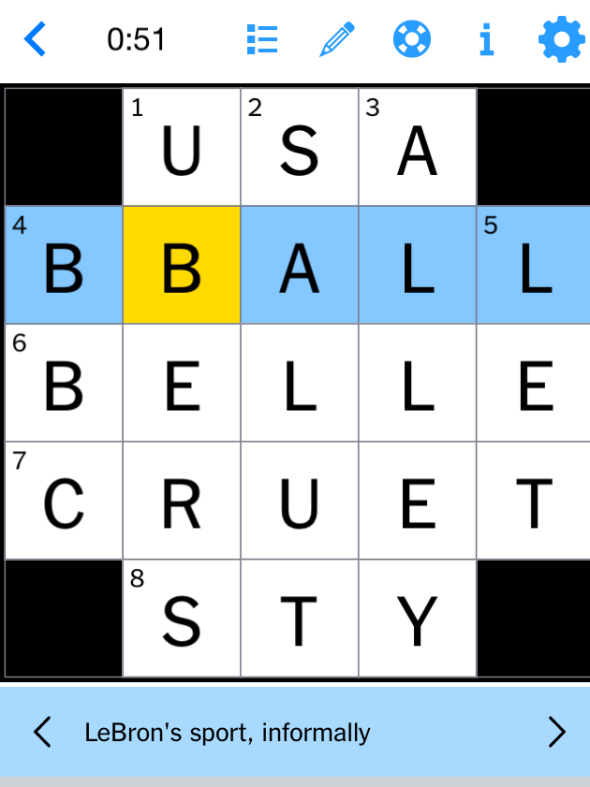

Nyt Mini Crossword Help Hints And Answers For Sunday April 19

May 24, 2025

Nyt Mini Crossword Help Hints And Answers For Sunday April 19

May 24, 2025 -

Essen Shajee Traders An Der Schuetzenbahn Wegen Hygienemaengeln Geschlossen

May 24, 2025

Essen Shajee Traders An Der Schuetzenbahn Wegen Hygienemaengeln Geschlossen

May 24, 2025 -

Get The Answers Nyt Mini Crossword March 16 2025

May 24, 2025

Get The Answers Nyt Mini Crossword March 16 2025

May 24, 2025 -

Complete Guide To Nyt Mini Crossword March 26 2025

May 24, 2025

Complete Guide To Nyt Mini Crossword March 26 2025

May 24, 2025