The Price Of Anonymity: A Look At Trump's Memecoin Gathering

Table of Contents

The Allure of Anonymous Memecoins

Memecoins, by their nature, possess an undeniable appeal. Their prices often experience rapid, dramatic increases, driven by community sentiment and social media hype. This inherent volatility is a double-edged sword, attracting investors seeking quick profits while simultaneously increasing the risk of substantial losses. The allure is amplified when memecoins become associated with prominent figures like Donald Trump, leveraging existing political sentiment and creating a fertile ground for speculative investment.

The appeal of Trump-related memecoins stems from several factors:

- High potential for profit (but also high risk): The volatile nature of memecoins means potential for massive gains, but equally significant losses.

- Community-driven price movements: Social media chatter and online communities directly influence the price, leading to unpredictable swings.

- Lack of regulation and oversight: The decentralized nature of cryptocurrencies means less regulatory control, increasing risk.

- Influence of social media hype: Viral trends and influencer marketing can rapidly inflate the price, creating speculative bubbles.

Risks Associated with Anonymity

Investing in anonymous cryptocurrencies, especially those tied to political figures, carries inherent dangers. The lack of transparency surrounding their creation and management significantly increases the risk of scams, rug pulls (where developers abandon a project and abscond with investor funds), and market manipulation. Anonymity also facilitates illicit activities:

- Higher chance of scams and fraud: The lack of identifiable creators makes it easier for scammers to operate with impunity.

- Difficulty in tracing investments and recovering losses: Tracking down perpetrators of fraud in the anonymous crypto market is challenging.

- Regulatory uncertainty and potential legal ramifications: The legal landscape surrounding anonymous cryptocurrencies is constantly evolving, and investors may face unforeseen consequences.

- Lack of transparency and accountability: Without clear ownership and management, investors lack recourse if things go wrong.

Analyzing the Trump Memecoin Phenomenon

Several Trump-related memecoins have emerged, each with its own trajectory and level of community engagement. While it's crucial to avoid promoting specific coins due to the inherent risks, analyzing publicly available data on reputable cryptocurrency tracking websites can provide insights into their price fluctuations and market trends. It's important to note that the correlation between Trump's public statements and actions, and the price movements of these memecoins, is often significant. A positive news cycle might lead to a price surge, while negative news could trigger a sharp decline.

Consider these factors when analyzing Trump memecoins:

- Examples of specific coins and their performance: Research individual coins' performance, using caution and only consulting trustworthy sources.

- Correlation between Trump's news and coin prices: Track news cycles and observe the impact on the coin's price.

- Analysis of market capitalization and trading volume: Assess the overall market health of the coin.

- Mention of relevant influencers and their impact: Identify key influencers promoting the coin and gauge their impact on its price.

Due Diligence and Smart Investing in the Memecoin Space

Before investing in any cryptocurrency, thorough research is paramount. The memecoin market is particularly volatile and prone to manipulation, requiring a cautious and informed approach. Avoid investing more than you can afford to lose.

To protect yourself:

- Check the project's whitepaper and team background: Scrutinize the project's documentation for legitimacy and transparency.

- Analyze the coin's tokenomics and utility: Understand how the coin works and its potential applications.

- Assess the community's engagement and reputation: Look for healthy community discussion and avoid projects with toxic or manipulative communities.

- Diversify your portfolio and only invest what you can afford to lose: Never put all your eggs in one basket, especially in the high-risk memecoin market.

Navigating the Uncertain Waters of Trump's Memecoin Gathering

The appeal of Trump's memecoins lies in the potential for high returns, fueled by speculation and social media trends. However, this potential is counterbalanced by the significant risks associated with their anonymity and the lack of regulatory oversight. Remember, understanding the price of anonymity is crucial before investing. Carefully assess the risks of Trump's memecoin gathering before committing any funds.

Conduct thorough research, diversify your portfolio, and only invest what you can comfortably afford to lose. Make informed decisions about your investments. Don't be swayed by hype, and remember that the allure of quick profits often masks substantial risks. Proceed with caution and always prioritize the preservation of your capital.

Featured Posts

-

Revealed Antonys Near Transfer To A Man Utd Rival

May 23, 2025

Revealed Antonys Near Transfer To A Man Utd Rival

May 23, 2025 -

James Wiltshires Photographic Legacy 10 Years With The Border Mail

May 23, 2025

James Wiltshires Photographic Legacy 10 Years With The Border Mail

May 23, 2025 -

Sistema Frontal Y Vaguada Provocaran Precipitaciones Este Sabado

May 23, 2025

Sistema Frontal Y Vaguada Provocaran Precipitaciones Este Sabado

May 23, 2025 -

Intikamci Burclar Ihanet Edildiginde Ne Yaparlar

May 23, 2025

Intikamci Burclar Ihanet Edildiginde Ne Yaparlar

May 23, 2025 -

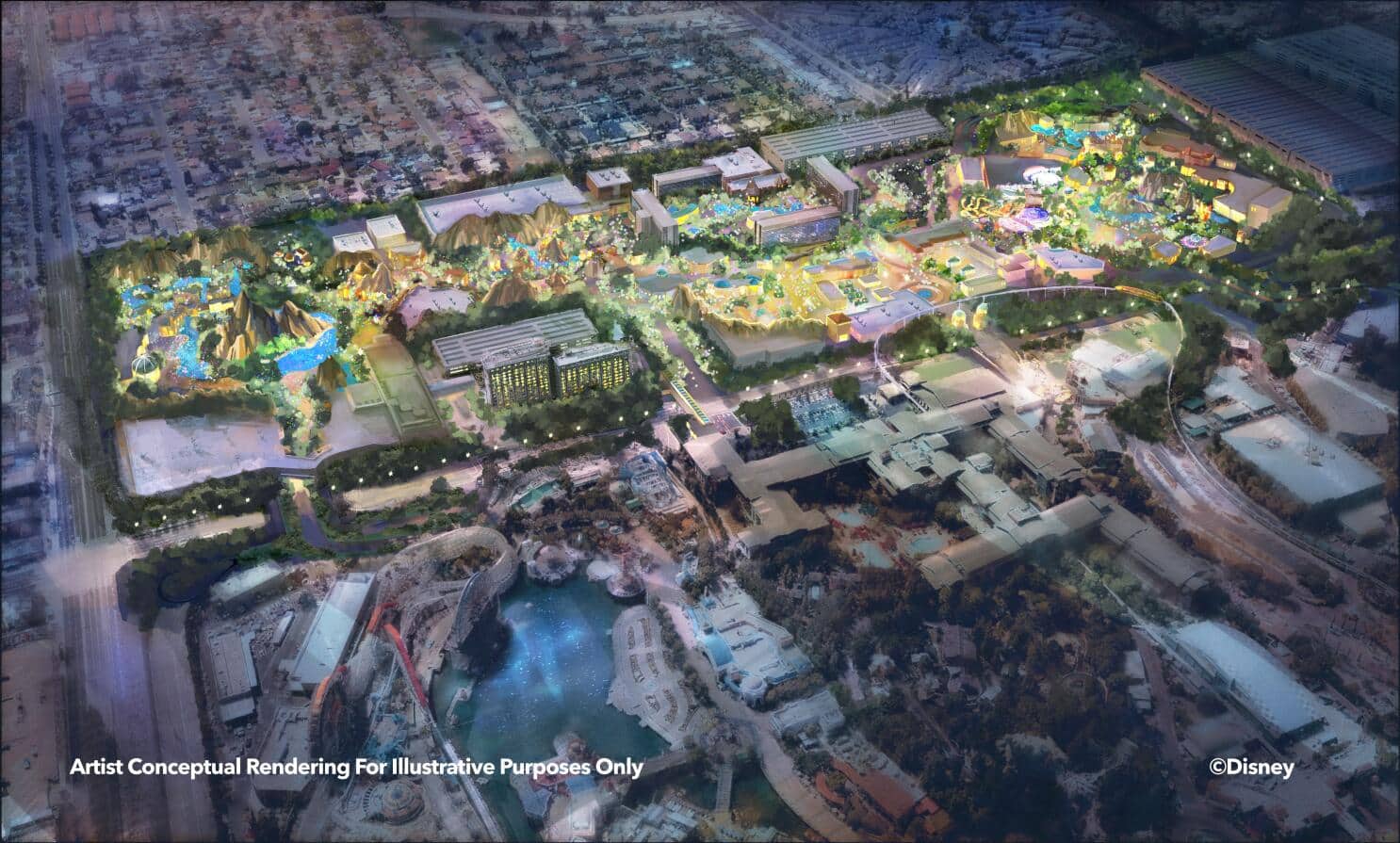

7 Billion Theme Park Universals Aggressive Play To Challenge Disneys Dominance

May 23, 2025

7 Billion Theme Park Universals Aggressive Play To Challenge Disneys Dominance

May 23, 2025

Latest Posts

-

Unexpected Joe Jonas Concert Thrills Fort Worth Stockyards Crowd

May 23, 2025

Unexpected Joe Jonas Concert Thrills Fort Worth Stockyards Crowd

May 23, 2025 -

Fort Worth Stockyards An Unforgettable Night With Joe Jonas

May 23, 2025

Fort Worth Stockyards An Unforgettable Night With Joe Jonas

May 23, 2025 -

Dc Legends Of Tomorrow Frequently Asked Questions And Answers

May 23, 2025

Dc Legends Of Tomorrow Frequently Asked Questions And Answers

May 23, 2025 -

The Last Rodeo Exploring Neal Mc Donoughs Character

May 23, 2025

The Last Rodeo Exploring Neal Mc Donoughs Character

May 23, 2025 -

A Deep Dive Into Dc Legends Of Tomorrow

May 23, 2025

A Deep Dive Into Dc Legends Of Tomorrow

May 23, 2025