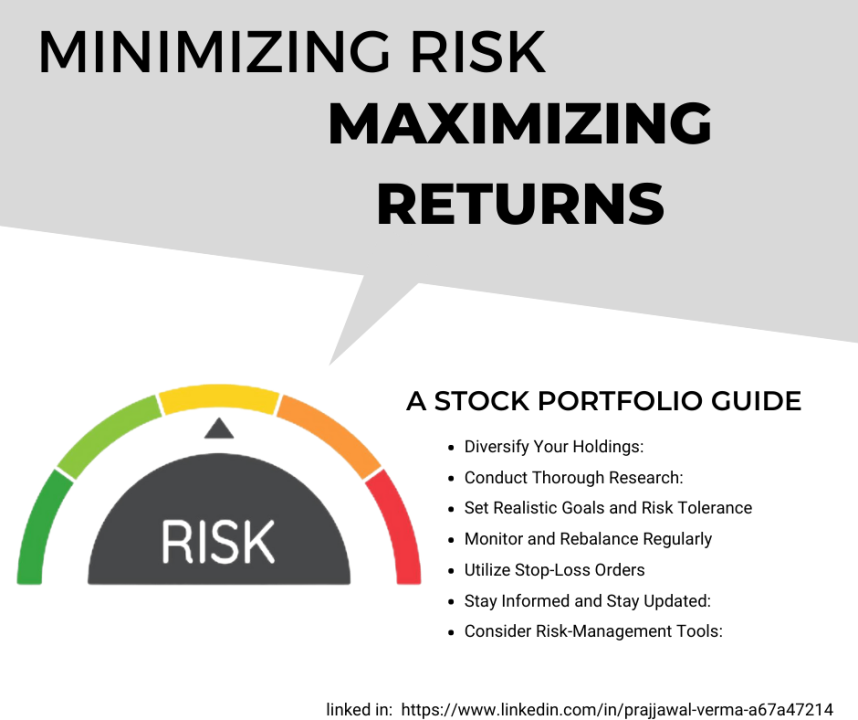

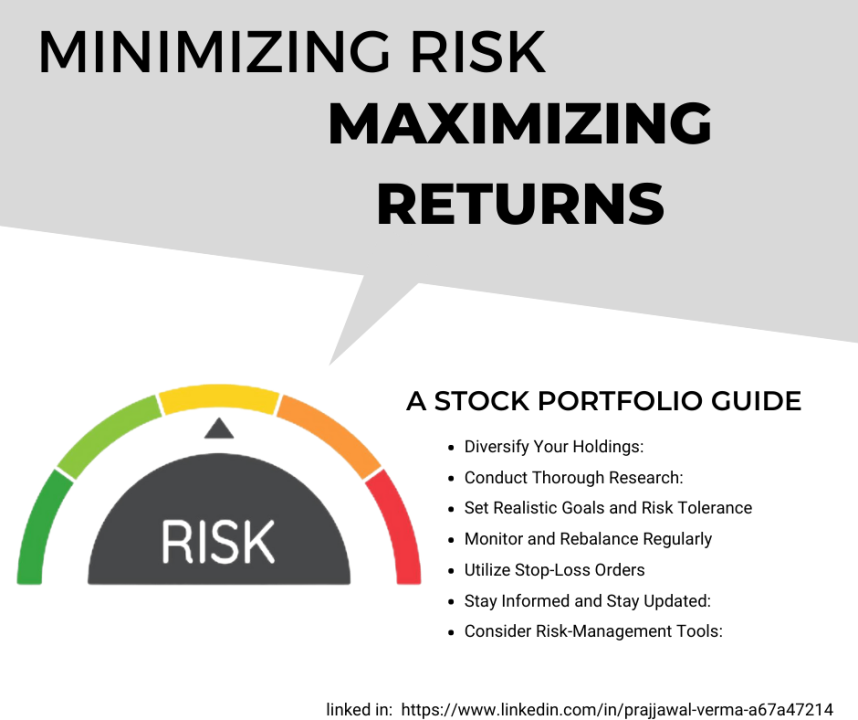

The Real Safe Bet: Strategies For Minimizing Risk And Maximizing Returns

Table of Contents

Diversification: Spreading Your Investments for Stability

Diversification is the cornerstone of any robust investment strategy. It involves spreading your investments across different asset classes, reducing your overall risk and improving the stability of your portfolio. A diversified portfolio reduces your exposure to single-point failures; if one investment performs poorly, others can offset those losses. This mitigation of losses is achieved through careful consideration of asset class correlation – understanding how different asset types tend to perform relative to one another.

- Reduce exposure to single-point failures: Don't put all your eggs in one basket. Investing heavily in a single stock or asset class leaves you vulnerable to significant losses if that specific investment underperforms.

- Mitigate losses through asset class correlation: Different asset classes often behave differently during market fluctuations. For example, while stocks might decline during a recession, bonds may perform relatively better. This negative correlation helps to cushion the impact of market downturns.

- Examples of diversified portfolios: A balanced portfolio typically includes a mix of stocks and bonds. A growth portfolio leans more heavily towards stocks, while a conservative portfolio emphasizes bonds and other lower-risk investments. Consider your risk tolerance and investment goals when selecting an appropriate portfolio composition.

- The benefits of global diversification: Expanding your investments beyond your domestic market can further reduce risk. Global diversification allows you to tap into different economic cycles and market trends, smoothing out potential volatility.

Keywords: Diversification strategy, portfolio diversification, asset allocation, risk mitigation, global investment

Due Diligence: Research and Understanding Your Investments

Thorough research is paramount before investing in any asset. Due diligence involves carefully analyzing the potential risks and rewards associated with each investment. Failing to conduct proper due diligence can lead to significant financial losses.

- Analyze company financials (for stocks): Examine key financial statements like balance sheets, income statements, and cash flow statements to assess a company's financial health and growth prospects. Pay close attention to key metrics such as debt levels, profitability, and revenue growth.

- Understand property values and market trends (for real estate): Research property values in the target area, consider factors such as location, condition, and rental potential. Keep up to date with market trends to assess property appreciation potential.

- Assess bond ratings and creditworthiness: Before investing in bonds, check their credit ratings from reputable agencies like Moody's, S&P, and Fitch. Higher credit ratings indicate lower default risk.

- Importance of understanding risk tolerance and investment goals: Before making any investment decisions, clearly define your personal risk tolerance – how much risk you are comfortable taking – and your investment goals, such as retirement planning or a down payment on a house. These will guide your investment choices.

Keywords: Investment research, financial analysis, risk assessment, due diligence process, informed investing

Risk Management Techniques: Controlling Your Exposure

Effective risk management is crucial for protecting your investments and achieving long-term financial success. Several strategies can help you control your exposure to risk.

- Setting stop-loss orders (for stocks): A stop-loss order automatically sells a stock when it reaches a predetermined price, limiting potential losses.

- Diversifying across geographies and sectors: Don't concentrate your investments in a single geographic region or industry sector. Diversify to reduce the impact of localized economic downturns or industry-specific challenges.

- Hedging strategies to mitigate potential losses: Hedging involves using financial instruments to offset potential losses from an investment. For example, you might buy put options to protect against a decline in the value of a stock you own.

- Regular portfolio rebalancing: Regularly review and adjust your portfolio to maintain your desired asset allocation. Rebalancing involves selling some assets that have performed well and buying those that have underperformed, bringing your portfolio back to its target allocation.

- Understanding leverage and its impact: Leverage involves using borrowed money to increase your investment potential. While it can amplify returns, it also significantly increases risk. Use leverage cautiously and only if you fully understand its implications.

Keywords: Risk management strategies, loss mitigation, hedging, portfolio rebalancing, financial risk control

Seeking Professional Advice: Partnering for Success

While you can learn a great deal about investing independently, seeking guidance from a qualified financial advisor offers numerous benefits. A professional advisor can provide personalized advice tailored to your specific circumstances and goals.

- Personalized investment plans tailored to individual needs: A financial advisor will work with you to develop a customized investment strategy that aligns with your risk tolerance, time horizon, and financial objectives.

- Access to expert knowledge and market insights: Advisors possess extensive knowledge of the financial markets and can offer valuable insights that may be difficult to obtain independently.

- Objective assessment of risk tolerance: They can help you objectively assess your risk tolerance and make investment decisions that are appropriate for your personality and financial situation.

- Guidance on tax optimization strategies: Advisors can help you structure your investments to minimize your tax liability and maximize your after-tax returns.

Keywords: Financial advisor, investment planning, wealth management, personalized investment strategy, financial consulting

Conclusion

Building a truly "safe bet" portfolio involves a strategic approach encompassing diversification, thorough due diligence, proactive risk management, and potentially, seeking professional financial advice. It's not about avoiding risk entirely, but about intelligently managing it to achieve your financial goals. Remember, balancing risk and return is key to long-term success. Start building your own "real safe bet" portfolio today! Learn more about effective diversification and risk management strategies by [link to relevant resource, e.g., a free guide, consultation].

Featured Posts

-

Donner Ses Cheveux A Dijon Un Geste Solidaire

May 09, 2025

Donner Ses Cheveux A Dijon Un Geste Solidaire

May 09, 2025 -

Solve The Nyt Crossword Hints And Solutions For April 6 2025

May 09, 2025

Solve The Nyt Crossword Hints And Solutions For April 6 2025

May 09, 2025 -

Apples Ai Challenge Maintaining Its Competitive Edge

May 09, 2025

Apples Ai Challenge Maintaining Its Competitive Edge

May 09, 2025 -

Former Becker Sentencing Judge Heads Nottingham Attack Investigation

May 09, 2025

Former Becker Sentencing Judge Heads Nottingham Attack Investigation

May 09, 2025 -

Selling Sunset Star Calls Out Landlord Price Gouging Following Devastating La Fires

May 09, 2025

Selling Sunset Star Calls Out Landlord Price Gouging Following Devastating La Fires

May 09, 2025

Latest Posts

-

French Minister Highlights Importance Of Shared Nuclear Power For Europe

May 09, 2025

French Minister Highlights Importance Of Shared Nuclear Power For Europe

May 09, 2025 -

French Minister Demands Further Eu Action Against Us Tariffs

May 09, 2025

French Minister Demands Further Eu Action Against Us Tariffs

May 09, 2025 -

European Nuclear Energy Partnership Frances Vision

May 09, 2025

European Nuclear Energy Partnership Frances Vision

May 09, 2025 -

Us Tariffs French Minister Pushes For More Aggressive Eu Response

May 09, 2025

Us Tariffs French Minister Pushes For More Aggressive Eu Response

May 09, 2025 -

Strengthening Europes Nuclear Security A French Ministers Plan

May 09, 2025

Strengthening Europes Nuclear Security A French Ministers Plan

May 09, 2025