The Rise Of Chinese Stocks: A Post-Negotiation And Data Analysis

Table of Contents

Post-Negotiation Economic Impacts on Chinese Stocks

The economic fallout and subsequent recovery following various international negotiations have profoundly impacted Chinese stocks. Understanding these impacts is crucial for informed investment decisions in the China stock market.

Impact of Trade Agreements

Recent trade agreements have had a mixed impact on specific sectors within the Chinese stock market. For instance:

- Positive Impacts: Agreements easing trade tensions have led to increased foreign investment in certain sectors, boosting stock prices. The technology sector, particularly companies involved in 5G infrastructure, saw a surge following certain agreements. Consumer goods companies also benefited from increased exports.

- Negative Impacts: Some sectors, initially perceived as targets of trade disputes, experienced short-term dips in stock prices. However, many companies adapted and found new markets, mitigating the long-term effects.

- Sector-Specific Analysis: The technology sector shows a strong correlation between positive trade agreements and stock price increases. Meanwhile, the agricultural sector's performance is more sensitive to specific tariff adjustments within agreements.

Data Points: [Insert chart/graph illustrating stock performance in technology and consumer goods sectors before and after specific trade agreements. Clearly label axes and source data.]

Regulatory Changes and their Influence

New regulations in China, concerning data privacy, antitrust, and environmental protection, are significantly shaping investment decisions and market behavior.

- Specific Regulations and Impact: The implementation of stricter data privacy laws, for example, has increased compliance costs for companies, but also fostered trust among consumers. Antitrust regulations have led to greater scrutiny of tech giants, impacting their stock valuations.

- Investor Confidence Shifts: Regulatory uncertainty can create volatility. However, clear and consistent regulations can, in the long run, improve investor confidence and attract more foreign investment.

- Potential Long-Term Implications: Increased regulatory transparency and consistent enforcement could boost the long-term stability and attractiveness of the Chinese stock market.

Data Points: [Insert statistics on compliance costs for data privacy regulations, number of antitrust fines issued, and a graph illustrating investor confidence indices before and after significant regulatory changes.]

Data Analysis: Key Trends in Chinese Stock Performance

Analyzing key trends in Chinese stock performance reveals both opportunities and challenges for investors.

Sector-Specific Growth

Certain sectors within the Chinese stock market have demonstrated exceptional growth.

- Thriving Sectors: Renewable energy companies are experiencing significant growth, driven by government support for clean energy initiatives and technological advancements. Fintech companies, leveraging China's massive mobile payment market, also show promising growth trajectories.

- Contributing Factors: Government subsidies, technological innovation, and a burgeoning domestic consumer market are key factors driving growth in these sectors.

Data Points: [Insert a table comparing the growth rates and market capitalization of renewable energy and fintech sectors against other sectors in the Chinese stock market. Source the data.]

Valuation Metrics and Investment Opportunities

Identifying undervalued stocks requires a thorough examination of valuation metrics.

- Relevant Valuation Metrics: The Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and dividend yield are crucial metrics for evaluating the value of Chinese stocks.

- Undervalued Sectors: Comparing valuation metrics across sectors helps identify potentially undervalued opportunities. Thorough due diligence is crucial, considering the complexities of the Chinese market.

- Strategies for Risk Mitigation: Diversification across sectors and companies is key to mitigating risk in the Chinese stock market.

Data Points: [Insert a table comparing P/E ratios, P/B ratios, and dividend yields across different sectors and companies within the Chinese stock market. Include sources.]

Assessing the Risks and Rewards of Investing in Chinese Stocks

While the Chinese stock market offers significant opportunities, investors must carefully assess the inherent risks.

Geopolitical Risks

Geopolitical tensions and international relations can significantly impact the Chinese stock market's stability.

- Examples of Geopolitical Risks: Trade disputes, political instability, and territorial conflicts can cause market volatility.

- Strategies for Managing Risk Exposure: Diversification, hedging strategies, and staying informed about geopolitical developments are essential for managing risks.

Data Points: [Insert a chart illustrating historical stock market reactions to major geopolitical events affecting China.]

Currency Fluctuations and Their Impact

Fluctuations in the Chinese Yuan (CNY) can significantly impact investment returns for foreign investors.

- Explanation of Currency Risk: Changes in exchange rates can either amplify or diminish investment gains or losses.

- Hedging Strategies: Investors can use hedging strategies, such as forward contracts or options, to mitigate currency risk.

- Historical Examples: Past periods of CNY volatility provide valuable insights into the impact of currency fluctuations on stock performance.

Data Points: [Insert a chart illustrating CNY fluctuations against major currencies and their correlation with the performance of Chinese stock indices over a specific period.]

Conclusion

The rise of Chinese stocks in the post-negotiation environment presents both compelling opportunities and significant challenges. Our analysis highlights the impact of trade agreements, regulatory changes, and geopolitical risks on the Chinese stock market. Identifying undervalued sectors and employing effective risk management strategies are crucial for successful investment. Thorough due diligence, diversification, and staying informed about the evolving regulatory landscape are paramount.

Call to Action: Stay informed on the evolving landscape of Chinese stocks and make well-informed investment decisions. Consider diversifying your portfolio with promising Chinese stocks. Learn more about navigating the complexities of this dynamic market and unlock the potential of Chinese stock investments. Remember that this analysis is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consider seeking professional financial guidance before making any investment decisions.

Featured Posts

-

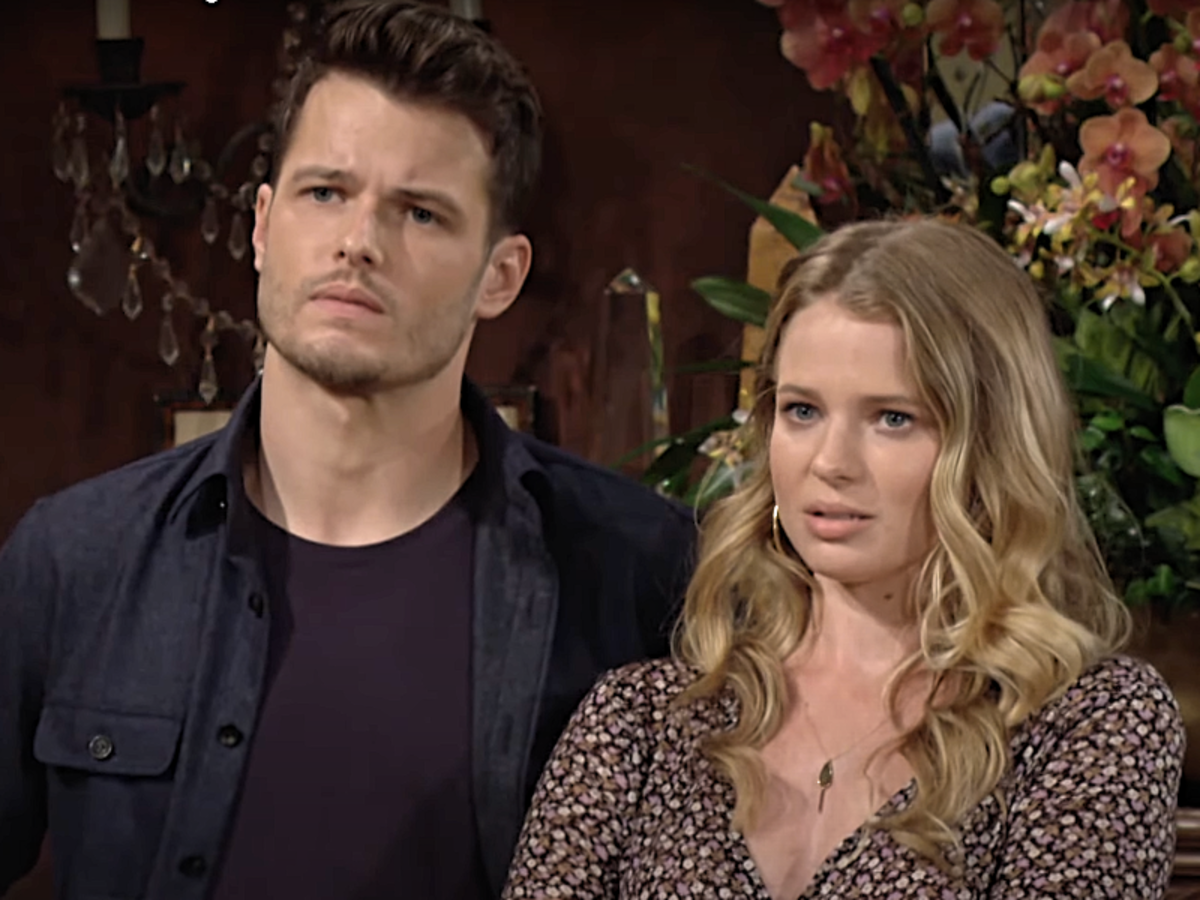

The Young And The Restless Summers Shocking Apartment Scheme

May 07, 2025

The Young And The Restless Summers Shocking Apartment Scheme

May 07, 2025 -

Cj

May 07, 2025

Cj

May 07, 2025 -

Former Notre Dame Basketball Stars In Wnba Preseason Showdown

May 07, 2025

Former Notre Dame Basketball Stars In Wnba Preseason Showdown

May 07, 2025 -

The Papal Conclave A Detailed Explanation Of The Pope Selection Process

May 07, 2025

The Papal Conclave A Detailed Explanation Of The Pope Selection Process

May 07, 2025 -

The Price Of A Suspension Anthony Edwards And The Minnesota Timberwolves Financial Loss

May 07, 2025

The Price Of A Suspension Anthony Edwards And The Minnesota Timberwolves Financial Loss

May 07, 2025