The Scale Of The Bond Crisis: An Investor's Guide

Table of Contents

Understanding the Current Bond Market Volatility

The current bond market volatility is largely driven by two interconnected factors: rising interest rates and persistent inflation. Understanding their impact is vital for navigating the bond crisis.

Rising Interest Rates and their Impact

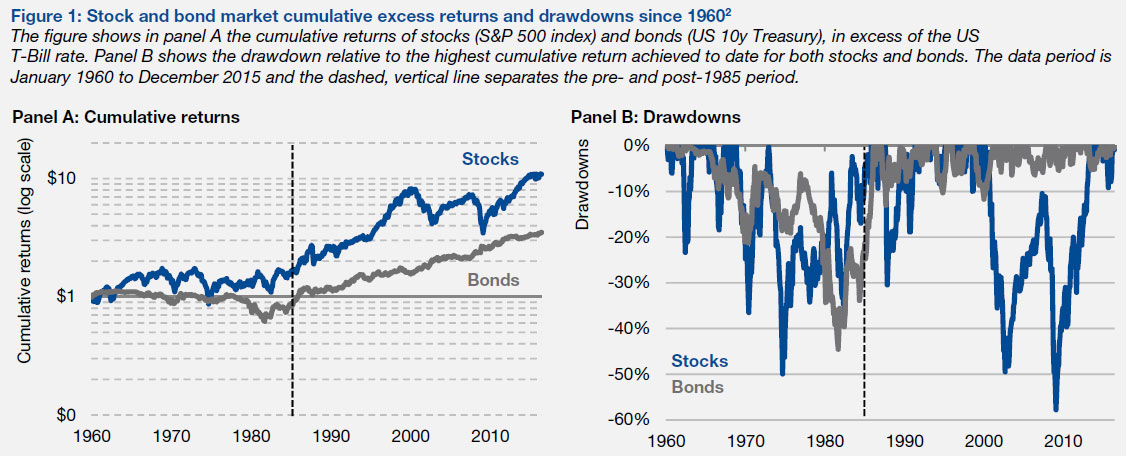

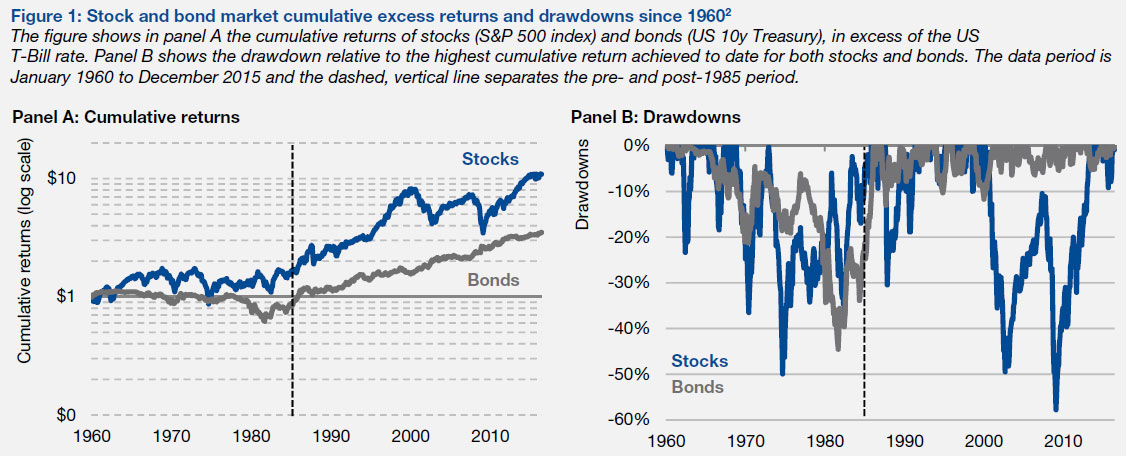

Rising interest rates have a direct and inverse relationship with bond prices. As central banks increase interest rates to combat inflation, newly issued bonds offer higher yields. This makes existing bonds with lower yields less attractive, causing their prices to fall.

- Increased borrowing costs for governments and corporations: Higher rates make it more expensive for governments and companies to borrow money, impacting their ability to service existing debt and potentially leading to defaults.

- Reduced demand for existing bonds: Investors shift their focus towards newer, higher-yielding bonds, reducing the demand for older ones, thereby lowering their price. This is particularly true for long-term bonds, which are more sensitive to interest rate changes.

- Potential for defaults: As borrowing costs rise, companies with high debt burdens face increased pressure, increasing the risk of defaults on their corporate bonds. The recent increase in corporate bond spreads reflects this growing concern. For example, the yield spread between high-yield corporate bonds and US Treasuries has widened significantly in the past year, a clear indicator of increased risk aversion.

Inflation's Role in the Bond Crisis

High inflation erodes the purchasing power of fixed-income investments like bonds. This forces investors to demand higher yields to compensate for the loss of value due to inflation. Central banks' responses to inflation, often involving interest rate hikes, further exacerbate the situation.

- Central bank responses to inflation: Aggressive monetary tightening by central banks globally to curb inflation is a primary driver of the current bond market volatility. This creates a challenging environment for bond investors.

- The impact of inflation expectations on bond prices: If investors expect inflation to remain high, they will demand even higher yields on bonds, putting downward pressure on prices. This creates a self-fulfilling prophecy, potentially deepening the crisis.

- The search for yield in a high-inflation environment: Investors are constantly searching for assets that can provide returns that outpace inflation. This has led to increased interest in alternative investments and higher-risk bonds, further impacting the bond crisis. Recent research from the Bank for International Settlements (BIS) highlights this trend.

Assessing the Risk Levels Across Different Bond Types

Different types of bonds carry varying levels of risk during a bond crisis. Understanding these differences is crucial for effective portfolio management.

Government Bonds vs. Corporate Bonds

Government bonds, particularly those issued by developed nations with strong credit ratings, are generally considered less risky than corporate bonds. However, even government bonds are not immune to the effects of rising interest rates and inflation.

| Feature | Government Bonds | Corporate Bonds |

|---|---|---|

| Credit Rating | Typically high (AAA, AA) | Varies widely, from AAA to high-yield (junk) bonds |

| Default Risk | Low | Higher, depending on the issuer's creditworthiness |

| Liquidity | Generally high | Can be lower, especially for smaller issuers |

| Interest Rate Sensitivity | Moderate to High | High |

Emerging Market Bonds and the Increased Vulnerability

Emerging market bonds present significantly higher risks during a bond crisis. These risks are amplified by factors such as currency fluctuations and political instability.

- Currency fluctuations: Changes in exchange rates can significantly impact the returns of bonds denominated in foreign currencies. A weakening domestic currency can reduce the value of bond holdings for investors in other countries.

- Political instability: Political uncertainty and potential policy shifts can negatively affect investor confidence and lead to capital flight, causing bond prices to plummet.

- Sovereign debt concerns: Countries with high levels of sovereign debt are particularly vulnerable during a bond crisis, as investors may lose confidence in their ability to repay their obligations. Several countries in Latin America and parts of Asia are currently experiencing bond market stress, highlighting this risk.

Strategies for Investors During a Bond Crisis

Navigating a bond crisis requires a proactive and informed approach. Investors should focus on diversification and professional advice.

Diversification and Portfolio Restructuring

A well-diversified portfolio is crucial to mitigate risks during a bond crisis. This involves spreading investments across different asset classes, sectors, and geographies.

- Asset allocation strategies: Rebalancing your portfolio to reduce exposure to fixed-income assets and increase exposure to assets less correlated with bonds (like equities or real estate) can be a prudent step.

- Exploring alternative investments: Considering alternative investment strategies, such as infrastructure or private equity, can help to diversify risk further.

- Reducing exposure to high-risk bonds: Investors should carefully evaluate their holdings of high-yield corporate bonds and emerging market bonds, potentially reducing their exposure to these riskier segments of the market.

Seeking Professional Financial Advice

Consulting with a qualified financial advisor is essential, particularly during times of market uncertainty.

- Personalized portfolio management: An advisor can help create a tailored investment strategy aligned with your risk tolerance and financial goals.

- Risk assessment: A professional can perform a comprehensive risk assessment to identify potential vulnerabilities in your portfolio and develop mitigation strategies.

- Navigating complex market conditions: Financial advisors possess the expertise and resources to navigate the complexities of a bond crisis, providing valuable insights and guidance.

Conclusion

This article explored the significant challenges posed by the current bond crisis, examining the impact of rising interest rates and inflation, the varying risk levels across bond types, and crucial strategies for investors to navigate this uncertain market. The bond crisis presents substantial risks, requiring careful assessment and proactive management. Understanding the scale of the bond crisis is paramount for protecting your investments. Seek professional financial advice and carefully review your bond portfolio to mitigate potential losses. Stay informed about market developments and consider diversifying your holdings to navigate the complexities of the current bond crisis.

Featured Posts

-

Netflixs Stranger Things Tales From 1985 Release Date And Story Details

May 29, 2025

Netflixs Stranger Things Tales From 1985 Release Date And Story Details

May 29, 2025 -

Forgotten Arsenal Player Could Be Alonsos Next Target

May 29, 2025

Forgotten Arsenal Player Could Be Alonsos Next Target

May 29, 2025 -

Brisbane Councils Funding Pull Fallout From Queensland Music Awards Jazz Winner

May 29, 2025

Brisbane Councils Funding Pull Fallout From Queensland Music Awards Jazz Winner

May 29, 2025 -

Frances New Crackdown Confiscating Phones From Drug Users And Dealers

May 29, 2025

Frances New Crackdown Confiscating Phones From Drug Users And Dealers

May 29, 2025 -

Hondas Le Mans Challenge Can The Under The Radar Star Overcome Yamahas Dominance

May 29, 2025

Hondas Le Mans Challenge Can The Under The Radar Star Overcome Yamahas Dominance

May 29, 2025

Latest Posts

-

Grigor Dimitrov Vliyanieto Na Kontuziyata Vrkhu Karierata Mu

May 31, 2025

Grigor Dimitrov Vliyanieto Na Kontuziyata Vrkhu Karierata Mu

May 31, 2025 -

Kontuziyata Na Grigor Dimitrov Aktualna Informatsiya I Analiz

May 31, 2025

Kontuziyata Na Grigor Dimitrov Aktualna Informatsiya I Analiz

May 31, 2025 -

Trumps Uncertainty What Made Him Question Elon Musk

May 31, 2025

Trumps Uncertainty What Made Him Question Elon Musk

May 31, 2025 -

Uncertainty And The End Trumps Doubts About Elon Before The Break

May 31, 2025

Uncertainty And The End Trumps Doubts About Elon Before The Break

May 31, 2025 -

Everything Revealed In The Star Trek Strange New Worlds Season 3 Teaser

May 31, 2025

Everything Revealed In The Star Trek Strange New Worlds Season 3 Teaser

May 31, 2025