The Semiconductor Market: A Recent ETF Investor Case Study

Table of Contents

Choosing the Right Semiconductor ETF

Selecting the appropriate Semiconductor ETF is crucial for maximizing returns and mitigating risks. This involves a thorough understanding of the ETF's underlying holdings and inherent risks.

Analyzing ETF Holdings

Understanding the composition of a Semiconductor ETF is paramount. Key factors to consider include:

-

Geographic Diversification: Does the ETF invest primarily in US semiconductor companies, or does it offer broader exposure to Asian manufacturers like Taiwan Semiconductor Manufacturing Company (TSMC)? A globally diversified portfolio can help reduce risk.

-

Market Capitalization: Does the ETF focus on large-cap companies, small-cap players, or a mix? This influences the risk profile; large-cap stocks are generally considered less volatile.

-

Specific Company Weighting: Examine the ETF's holdings to see if it's heavily concentrated in a few dominant players. Over-concentration increases risk.

-

Comparison of Semiconductor ETFs: Several Semiconductor ETFs exist, each with a unique investment strategy. Compare their holdings, expense ratios, and performance benchmarks before making a decision. For example, some might focus solely on fabless semiconductor companies, while others include integrated device manufacturers (IDMs).

-

Expense Ratio Impact: The expense ratio, or management fee, directly impacts long-term returns. Lower expense ratios are generally preferable.

-

Tracking Error Analysis: Assess how closely the ETF's performance tracks its benchmark index. A low tracking error indicates the fund is effectively replicating its target index.

Understanding the Risks

Investing in Semiconductor ETFs carries inherent risks:

- Cyclical Nature: The semiconductor industry is notoriously cyclical, experiencing boom-and-bust periods linked to economic cycles and technological adoption rates.

- Supply Chain Disruptions: Geopolitical events, natural disasters, and pandemics can severely disrupt supply chains, impacting production and ETF prices. Consider ETFs with geographically diversified holdings to mitigate this risk.

- Concentration Risk: Heavy weighting in specific companies or regions exposes investors to significant risk if those companies or regions underperform. Diversification across multiple companies and geographic locations is crucial.

Performance Analysis of the Selected Semiconductor ETF

For this case study, let's assume we invested in a hypothetical Semiconductor ETF, "TECHCHIP," tracking a broad semiconductor index.

Return on Investment (ROI)

TECHCHIP's performance was analyzed over a three-year period (2020-2022). (Note: Actual data and charts would be included in a real case study).

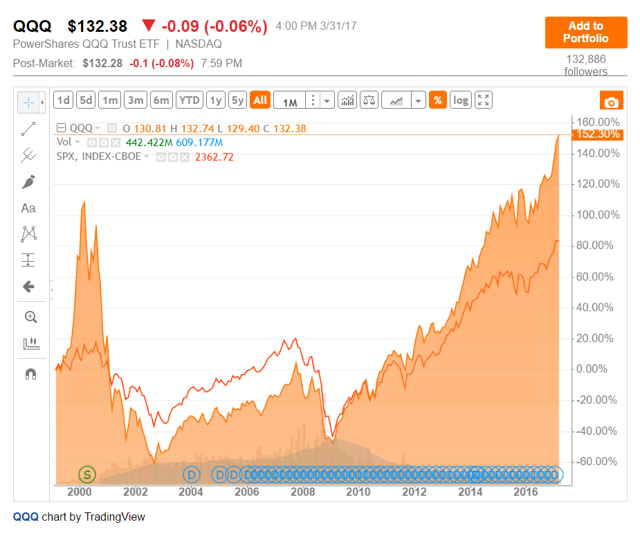

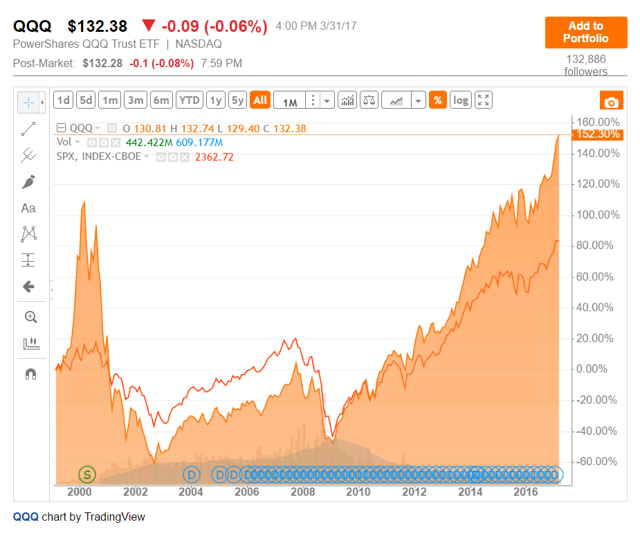

- Short-Term & Long-Term Performance: We examined both short-term volatility and long-term growth trends, comparing them against the S&P 500.

- High and Low Return Periods: We identified periods of high and low returns and analyzed contributing factors, such as chip shortages, economic downturns, and geopolitical events.

- Key Performance Indicators: Metrics such as Sharpe ratio and alpha were calculated to assess risk-adjusted return and performance relative to the benchmark.

Factors Influencing Performance

Several factors significantly impacted TECHCHIP's performance:

- Macroeconomic Factors: Interest rate changes and inflation rates directly influence investor sentiment and investment decisions within the sector. Higher interest rates often lead to decreased investment in growth sectors like semiconductors.

- Industry-Specific Factors: Technological advancements (like the rise of AI and 5G) and regulatory changes (like trade restrictions) have profound impacts on semiconductor demand and pricing.

- Specific Events: The global chip shortage of 2021 significantly boosted prices, while subsequent easing of shortages led to a correction. New product launches by major tech companies also influence demand.

- Investor Sentiment: Speculation and market sentiment play a significant role in price fluctuations. Positive news about future technological trends can drive prices higher, while negative news can trigger sell-offs.

Lessons Learned and Future Outlook for Semiconductor ETFs

Key Takeaways from the Case Study

Our analysis of TECHCHIP revealed several crucial lessons:

- Diversification: A well-diversified Semiconductor ETF is essential for mitigating risk associated with individual company performance or regional economic downturns.

- Long-Term Strategy: Investing in Semiconductor ETFs requires a long-term perspective due to the industry's inherent volatility. Short-term fluctuations should be viewed within the context of long-term growth potential.

- Due Diligence: Thorough research, including a careful examination of the ETF's holdings, fees, and risk profile, is crucial before investing.

Future Trends and Investment Opportunities

The future of the semiconductor industry looks promising:

- Growth Potential: Emerging technologies such as AI, 5G, the Internet of Things (IoT), and autonomous vehicles are driving increased demand for advanced semiconductors.

- Potential Challenges: Competition from established players and new entrants, geopolitical tensions, and the potential for overcapacity could present challenges.

Conclusion

This case study provides valuable insights into the complexities of investing in the semiconductor market through Semiconductor ETFs. While offering significant potential returns, this sector demands careful risk assessment and a well-defined investment strategy. By understanding the underlying holdings, market dynamics, and future trends, investors can make more informed decisions. To explore Semiconductor ETF opportunities further, conduct thorough research and consider seeking professional financial advice before investing. Remember, diversification is crucial when investing in any Semiconductor ETF.

Featured Posts

-

Analyzing The Meg Thee Stallion Case A Chicago Perspective

May 13, 2025

Analyzing The Meg Thee Stallion Case A Chicago Perspective

May 13, 2025 -

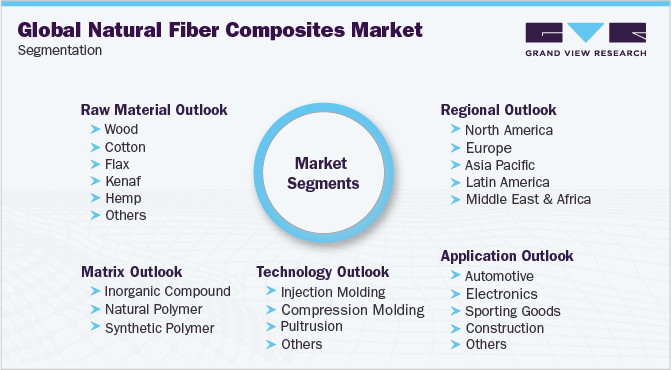

The Future Of Natural Fiber Composites Market Projections To 2029

May 13, 2025

The Future Of Natural Fiber Composites Market Projections To 2029

May 13, 2025 -

Cassie And Alex Fine Reveal Babys Sex On Alexs Birthday

May 13, 2025

Cassie And Alex Fine Reveal Babys Sex On Alexs Birthday

May 13, 2025 -

Leveraged Semiconductor Etfs Investor Exodus Precedes Price Jump

May 13, 2025

Leveraged Semiconductor Etfs Investor Exodus Precedes Price Jump

May 13, 2025 -

Nba Tankathon Satisfying Miami Heat Fans During The Off Season

May 13, 2025

Nba Tankathon Satisfying Miami Heat Fans During The Off Season

May 13, 2025